what does withheld mean on paycheck Withholding is the portion of an employee s wages that is not included in their paycheck but is instead remitted directly to federal tax authorities and where

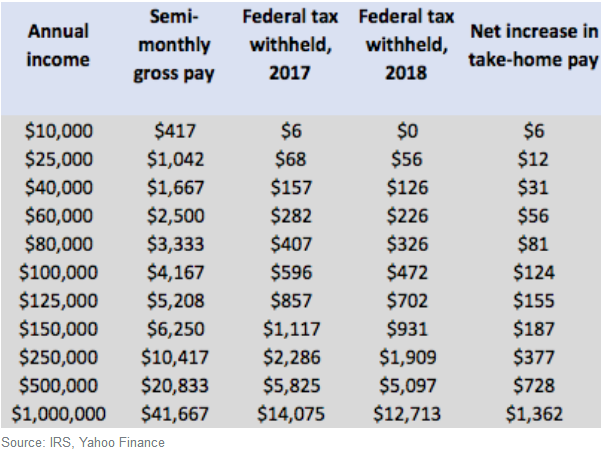

Your tax withholding can have a big impact on your paycheck and whether you ll get a tax refund Learn how withholding tax works and how to adjust it Withholding tax is tax your employer withholds from your paycheck and sends to the IRS on your behalf If too much money is withheld throughout the year you ll receive a tax refund

what does withheld mean on paycheck

what does withheld mean on paycheck

https://www.paycom.com/cms-content/2014/09/paycheck.jpg

What Does FIT Mean On My Paycheck Exploring The Meaning Of Federal

https://www.tffn.net/wp-content/uploads/2023/01/what-does-fit-mean-on-my-paycheck.jpg

No Federal Income Tax Withheld On Paycheck 2020 HeatherHira

https://media.cheggcdn.com/media/6b3/6b30960f-6fd1-4fa6-9255-09468d7e5683/phpw8Emss

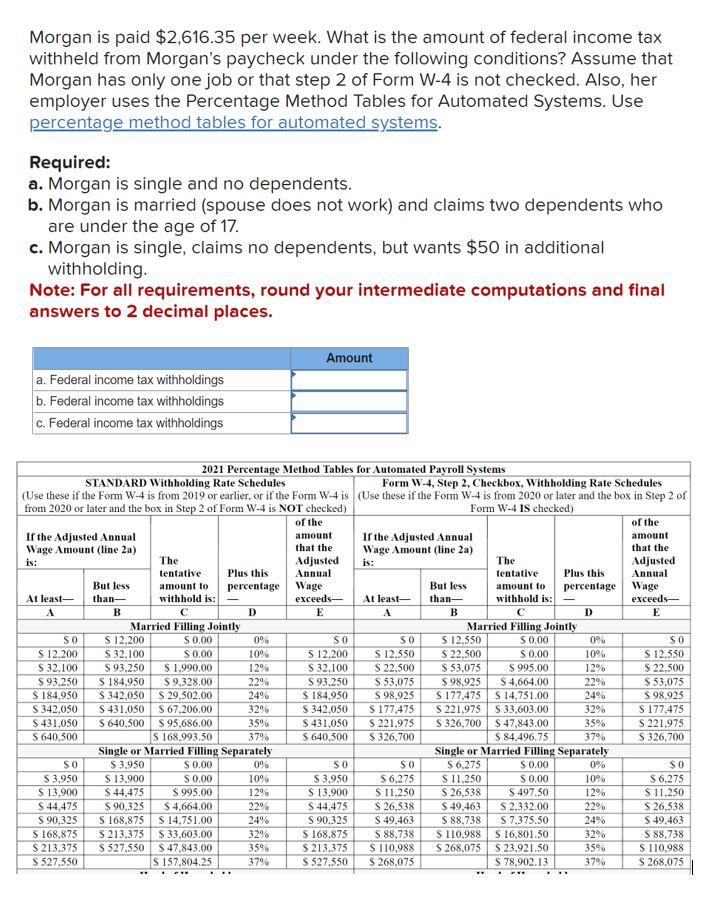

Understand tax withholding An employer generally withholds income tax from their employee s paycheck and pays it to the IRS on their behalf Wages paid along with any Tax withholding is the amount that gets held back from a paycheck or other type of payment for tax purposes The amount of tax withheld doesn t always line up exactly with the amount of tax owed but

For employees withholding is the amount of federal income tax withheld from your paycheck The amount of income tax your employer withholds from your Tax withholding or withholding tax is how much your company takes out of your paycheck to cover what it expects you ll owe in income taxes Withholding

More picture related to what does withheld mean on paycheck

Percentage Taken Out Of Paycheck DeonneWishe

https://img.money.com/2016/03/decoding_paycheck_30daymoneychallenge.png

IRS Withholding Chart Federal Withholding Tables 2021

https://federal-withholding-tables.net/wp-content/uploads/2021/07/new-irs-tax-withholding-tables-mean-your-paycheck-might-be-2.png

2021 Tax Brackets Irs Calculator Orientierungsreiten

https://i2.wp.com/federalwithholdingtables.net/wp-content/uploads/2021/07/federal-income-tax-brackets-released-for-2021-has-yours-1024x724.png

Payroll deductions are withheld from an employee s gross earnings for income taxes benefit payments or other permissible reasons Some payroll deductions are mandatory while other payroll Tax withholding is a process where an employer deducts a portion of an employee s paycheck and sends it directly to the government This prepayment helps the employee pay their annual tax liabilities

What is tax withholding If you re an employee your employer probably withholds income tax from your paycheck and pays it to the IRS in your name What is estimated tax If Key Takeaways IRS Form W 4 which you file with your employer when you start a job is used by your employer to calculate how much to withhold from your

Calculate Income Tax Per Paycheck JaimeMunmair

https://i.ytimg.com/vi/jlFuMlwIff4/sddefault.jpg

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FMENQYIIVBCKDIIIWAAPXQI5RM.png)

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

https://morningstar-morningstar-prod.web.arc-cdn.net/resizer/19dNYwi1w-_rM1Bxh8GRMsOYa6I=/960x0/filters:no_upscale():quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FMENQYIIVBCKDIIIWAAPXQI5RM.png

what does withheld mean on paycheck - Withholding refers to the money that your employer is required to take out of your paycheck on your behalf This includes federal and state income tax payments Social