what does it mean to capitalize an expense A capitalized cost is an expense added to the cost basis of a fixed asset on a company s balance sheet Capitalized costs are incurred when building or

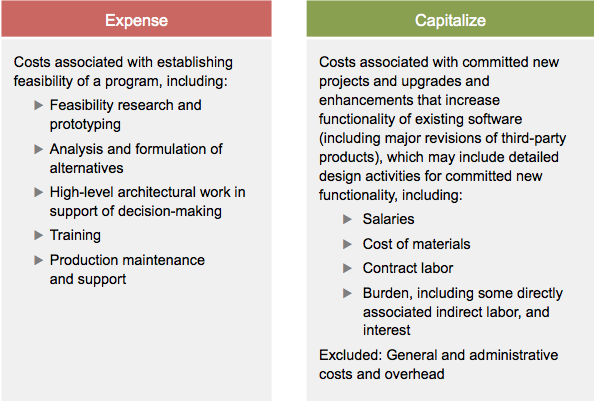

The Capitalize vs Expense accounting treatment decision is determined by an item s useful life assumption Costs expected to provide long lasting benefits 1 year are capitalized whereas costs with short lived benefits What is Capitalize in Accounting An item is capitalized when it is recorded as an asset rather than an expense This means that the expenditure will appear in the balance sheet rather than the income statement When an item is capitalized it is gradually charged to expense via depreciation or amortization and so is gradually and

what does it mean to capitalize an expense

what does it mean to capitalize an expense

https://v5.scaledagileframework.com/wp-content/uploads/2015/04/Table-1.-Categories-of-expensed-and-capitalized-costs.png

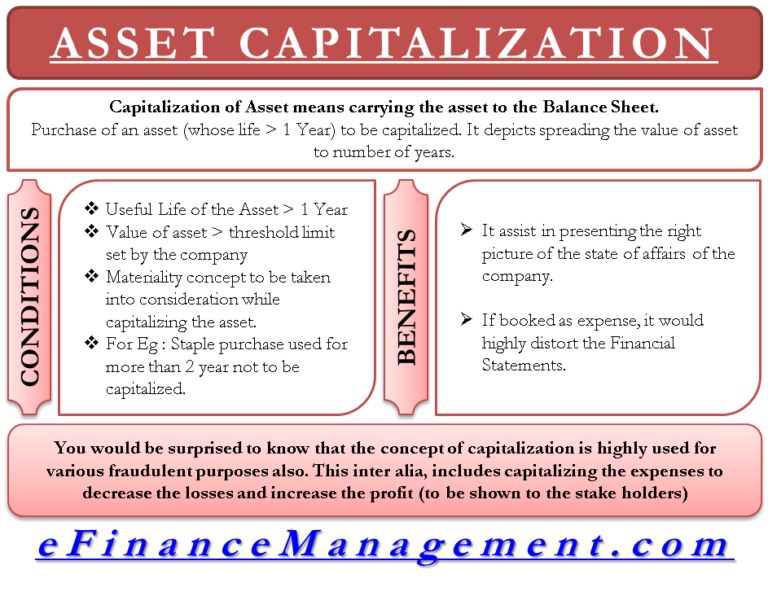

Capitalizing Assets Define Example Matching Concept Fraud Benefits

https://efinancemanagement.com/wp-content/uploads/2017/12/Capitalizing-Assets-1-768x596.png

How Do You Know Whether To Capitalize Or Expense

https://stepofweb.com/upload/1/cover/how-do-you-know-whether-to-capitalize-or-expense.jpeg

In accounting capitalization is an accounting rule used to recognize a cash outlay as an asset on the balance sheet rather than an expense on the income Definition Capitalization is recognizing the expense of a long term asset over a specified period of time which is typically defined by the useful life of the long term asset When an entity elects to capitalize an expense it s reducing the amount of expense associated with the asset in a given period by spreading recognition of the

A capitalized cost is a cost that is incurred from the purchase of a fixed asset that is expected to directly produce an economic benefit beyond one year or a company s normal operating cycle If an expenditure is expected to be consumed over a longer period of time then it can be capitalized in which case it appears as an asset on the company s balance sheet Capitalization means that the recognition of

More picture related to what does it mean to capitalize an expense

What Does It Mean To Capitalize Asset YouTube

https://i.ytimg.com/vi/FtbUU4117ZE/maxresdefault.jpg

What Does It Mean To Capitalize Something In Accounting YouTube

https://i.ytimg.com/vi/Mo0Ccy_CCFY/maxresdefault.jpg

How To Correctly Use AP and APA Style Title Case Essay School

https://i.pinimg.com/originals/d4/b1/84/d4b1843eda5343f9255db5ad7661afcd.png

A capitalized cost is recognized as part of a fixed asset rather than being charged to expense in the period incurred Capitalization is used when an item is expected to be consumed over a long period of time typically more than one year Capitalized cost refers to the expenses incurred to acquire and prepare an asset for use which are added to the asset s cost basis and recorded on the balance sheet rather than being expensed immediately

[desc-10] [desc-11]

Capitalize Vs Expense Basic Accounting YouTube

https://i.ytimg.com/vi/VKzm1mWn21w/maxresdefault.jpg

Capitalization In Book Titles Articles Headings

https://i0.wp.com/www.worthytutors.com/wp-content/uploads/2022/09/Capitalization-in-Title-or-Headings.jpg?w=1000&ssl=1

what does it mean to capitalize an expense - [desc-12]