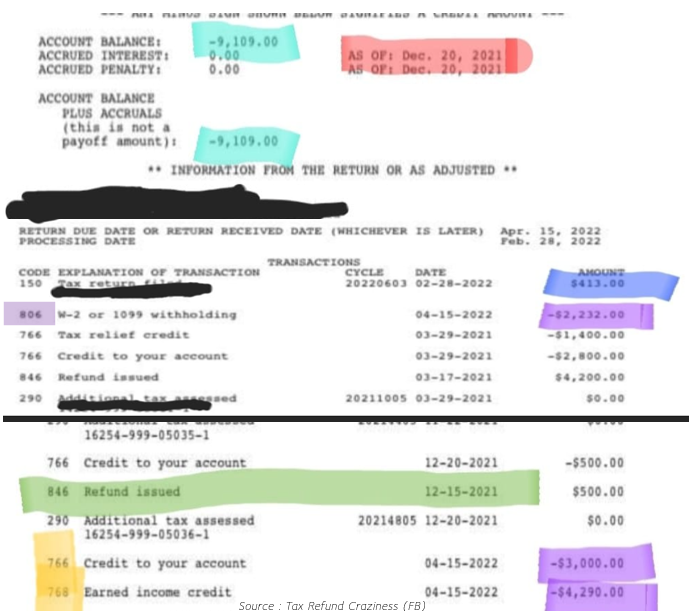

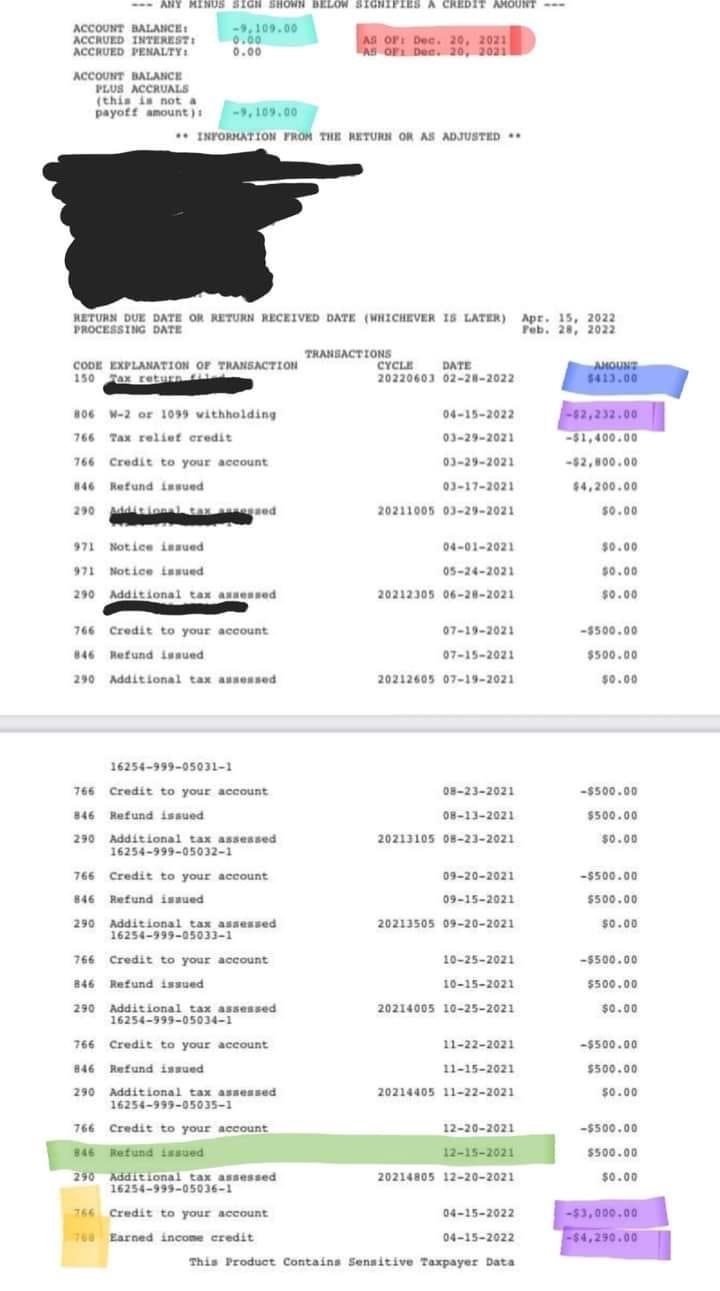

what does 806 mean on tax transcript Code 806 on an IRS Transcript signifies an adjustment made by the IRS to the taxpayer s account It indicates that the IRS has made changes to the

New Tax Transcript Format and Utilizing a Customer File Number In July 2021 IRS updated a webpage on IRS gov to educate taxpayers regarding the new Code 806 indicates your return has a credit for income taxes and possibly excess FICA taxes withheld Code 766 indicates your return has a refundable credit that could have

what does 806 mean on tax transcript

what does 806 mean on tax transcript

https://thebusinessalert.com/wp-content/uploads/2021/09/IRS-Code-806-2048x1152.jpg

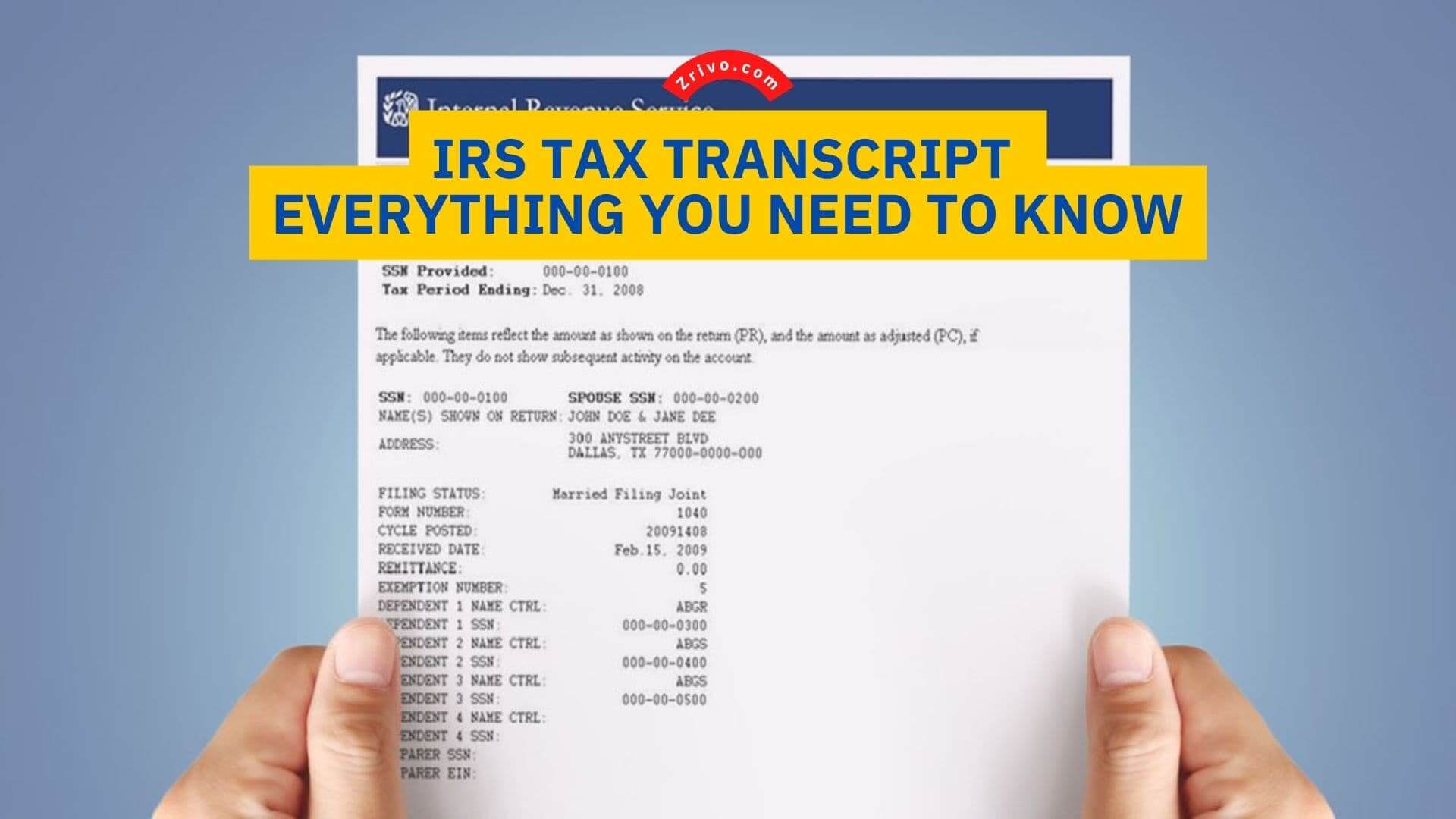

IRS Tax Transcript Everything You Need To Know

https://www.zrivo.com/wp-content/uploads/2022/08/IRS-tax-transcript-Zrivo-Cover-1.jpg

Is Vitamin B12 806 Normal High Or Low What Does Vitamin B12 Level 806

https://www.medchunk.com/images/english/Vitamin-B12-jpg/Vitamin-B12-806.jpg

Code 806 documents the accumulated amount reported and paid for a given tax year It serves as the IRS s confirmation showing your employer handled withholding Code 806 usually resides on your Form 1040 specifically on Line 64 for federal income tax withheld and Line 59 for FICA tax withheld It also appears on your

For instance if 5 000 in federal income tax was withheld from your paycheck for 2021 code 806 on your 2021 transcript would show 5 000 The IRS official title for transaction code 806 is Credit for Withheld Taxes and Excess FICA If you see IRS Code 806 on your tax transcript the amount you see along with

More picture related to what does 806 mean on tax transcript

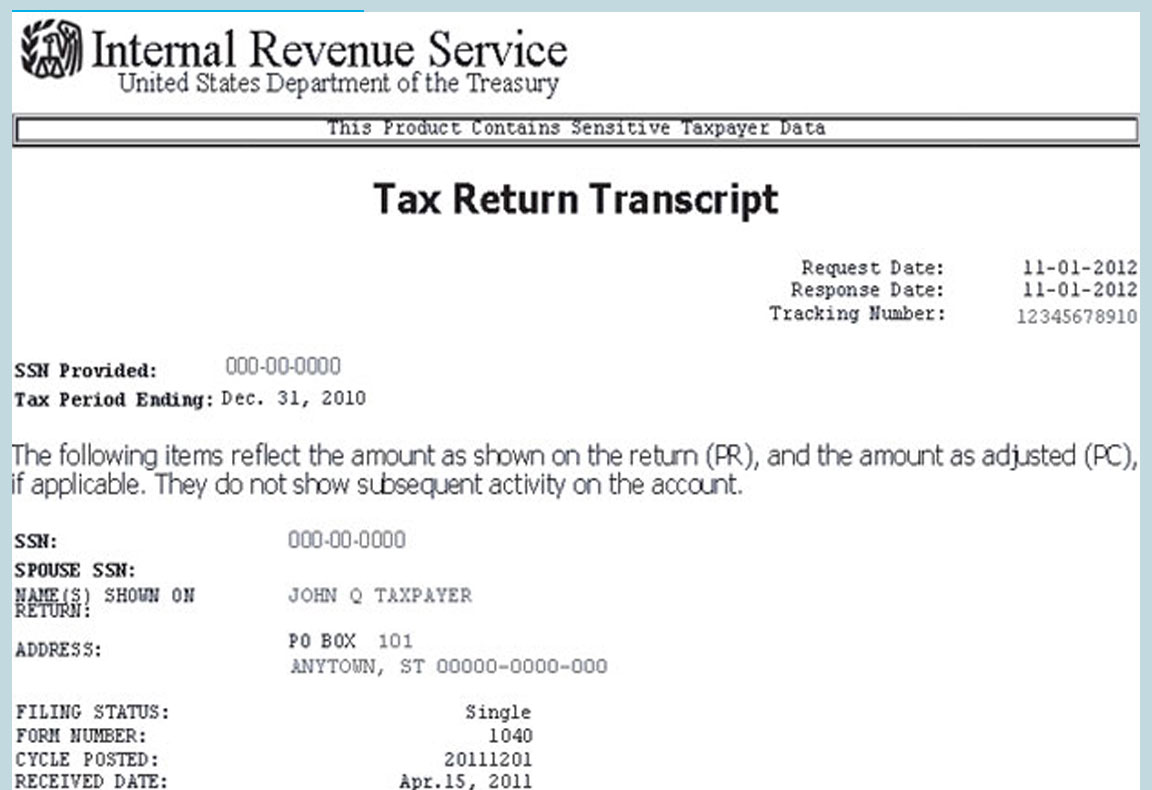

IRS Redesigns Tax Transcript To Protect Taxpayer Data CPA Practice

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/07/31212/Tax_Return_Transcript_M_1_.5b7dc4cc39e04.png

What Your IRS Transcript Can Tell You About Your 2022 IRS Tax Return

https://savingtoinvest.com/wp-content/uploads/2022/02/image-14.png

IRS Code 806 2023 2024 What Does Code 806 Mean On Tax Transcript

https://thetransfercode.com/wp-content/uploads/2021/05/IRS-Code-806-Claimyr.jpg

Taxpayers and tax professionals with a properly executed Form 2848 Power of Attorney or Form 8821 Tax Information Authorization can request a As a tax return is processed there are transaction codes added to it to indicate changes These transaction codes are three digits long They are used to identify a transaction

5 A verification of nonfiling letter is a transcript that is automatically produced when the IRS doesn t have your return on file or hasn t yet processed your filed return Many 3 Match the same description on the transcript Since your tax return transcript doesn t include the line numbers for the data you have to use the description

Is ALT SGPT 806 High Normal Or Dangerous What Does Alanine

https://www.medchunk.com/images/english/ALT-SGPT-jpg/ALT-SGPT-806.jpg

Angel Number 806 Meaning Explained Angel Number Meanings Number

https://i.pinimg.com/originals/7b/67/7f/7b677f7e9311fb34d0c57a0376ddb86d.png

what does 806 mean on tax transcript - For instance if 5 000 in federal income tax was withheld from your paycheck for 2021 code 806 on your 2021 transcript would show 5 000