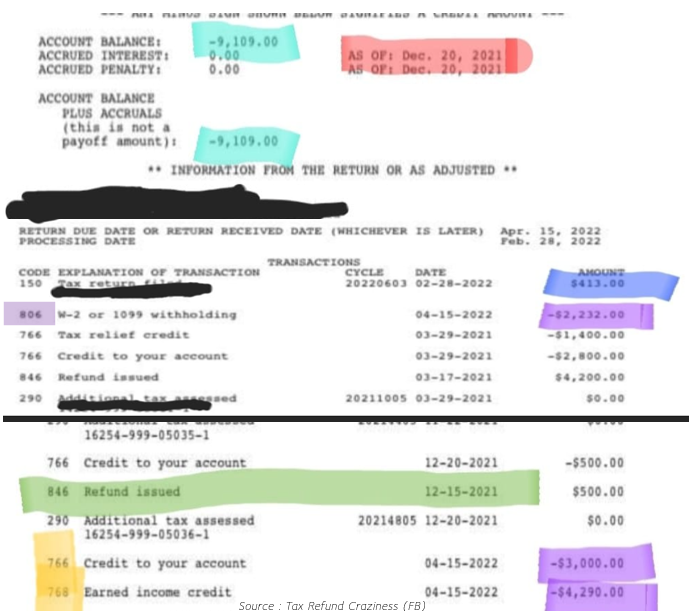

what does 806 mean on tax transcript irs TC 806 Reflects any credit the taxpayer is given for tax withheld as shown on the tax return and the taxpayer s information statements such as Forms W 2

Code 806 on an IRS Transcript signifies an adjustment made by the IRS to the taxpayer s account It indicates that the IRS has made changes to the taxpayer s Understanding IRS Code 806 is easier than you think This guide breaks down why the code exists what it means and most importantly how it impacts your

what does 806 mean on tax transcript irs

what does 806 mean on tax transcript irs

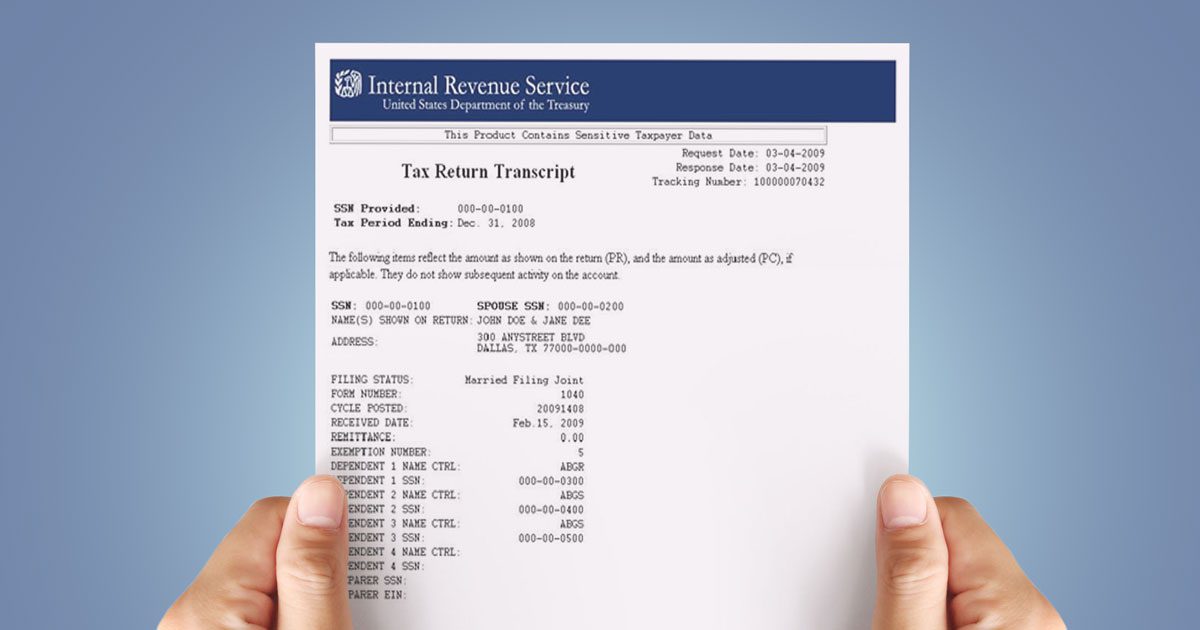

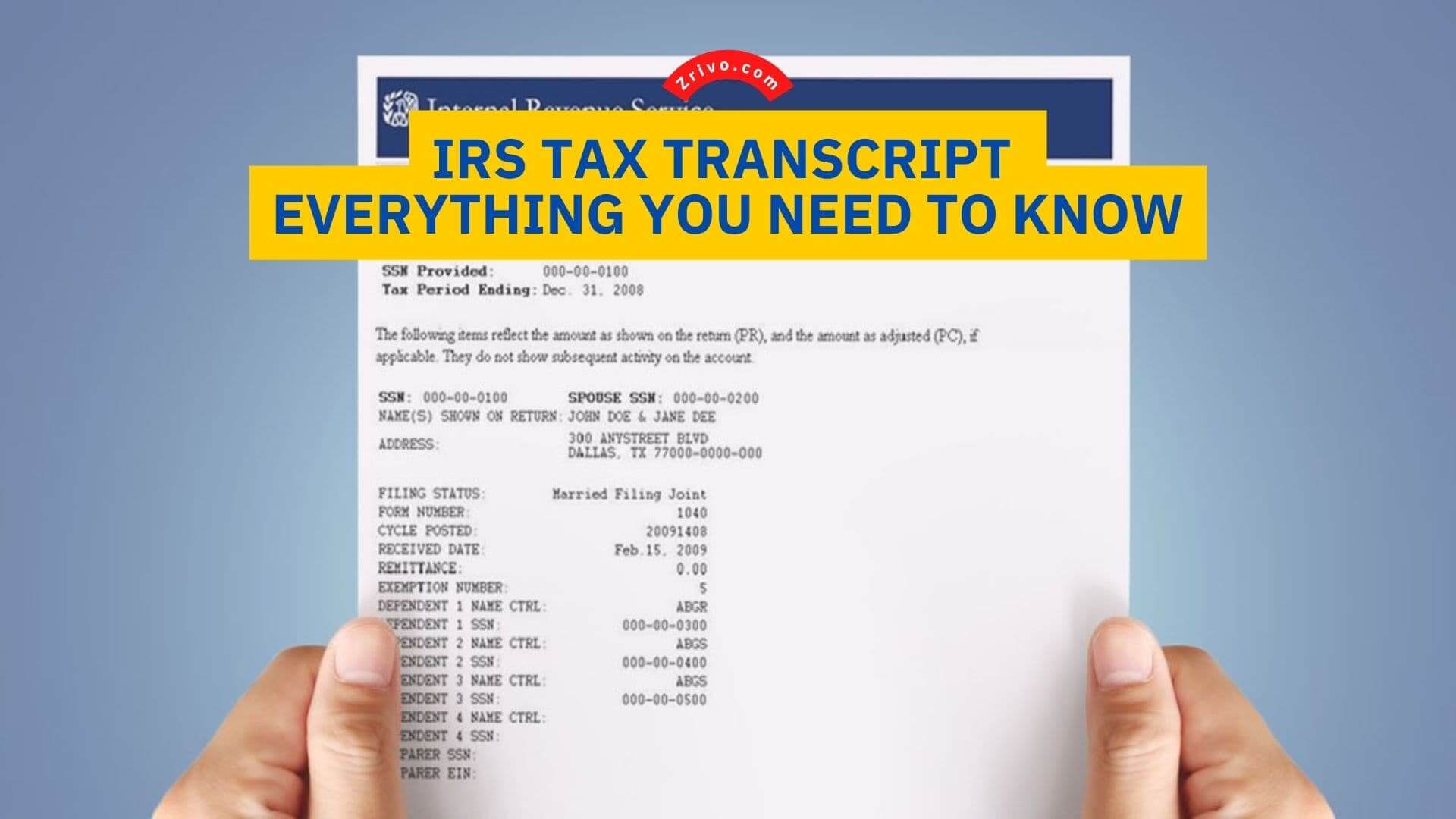

https://www.wiztax.com/wp-content/uploads/2022/06/tax-return-transcript.jpeg

IRS Tax Transcript Everything You Need To Know

https://www.zrivo.com/wp-content/uploads/2022/08/IRS-tax-transcript-Zrivo-Cover-1.jpg

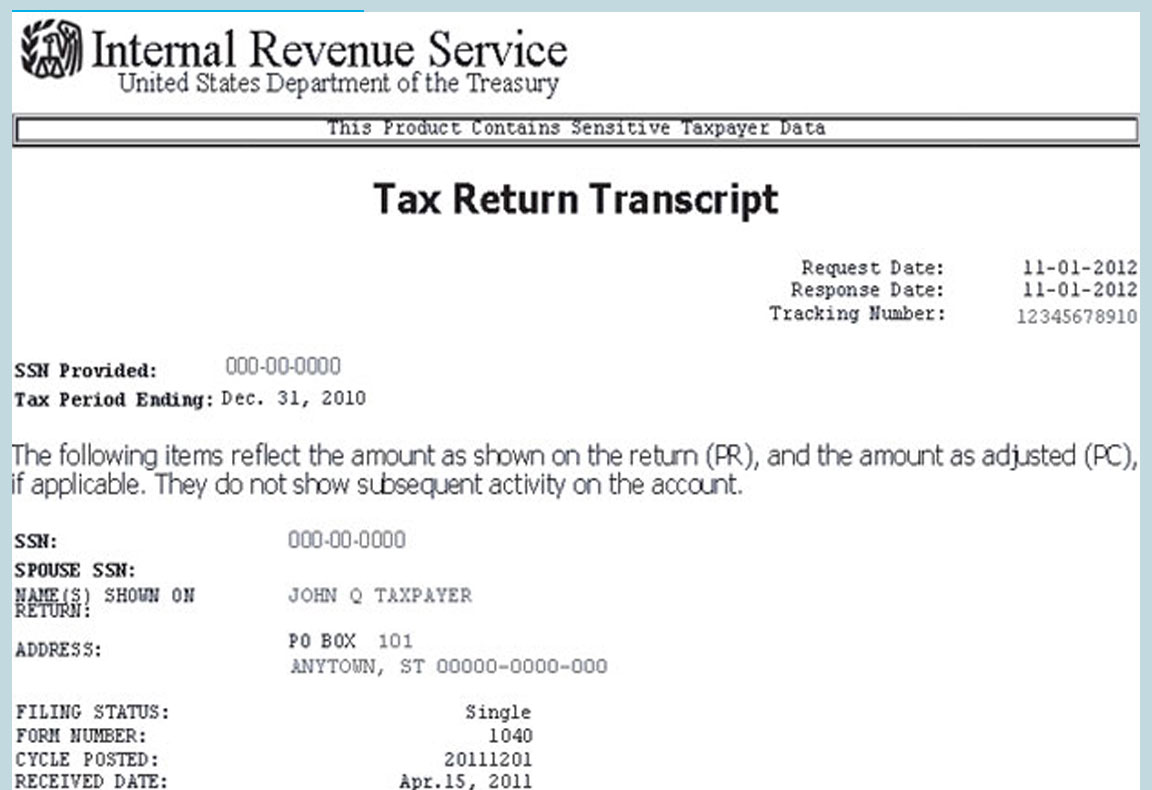

IRS Redesigns Tax Transcript To Protect Taxpayer Data CPA Practice

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/07/31212/Tax_Return_Transcript_M_1_.5b7dc4cc39e04.png

For instance if 5 000 in federal income tax was withheld from your paycheck for 2021 code 806 on your 2021 transcript would show 5 000 Officially known as Credit for Withheld Taxes and Excess FICA code 806 signifies the sum of federal income taxes and FICA Social Security and Medicare

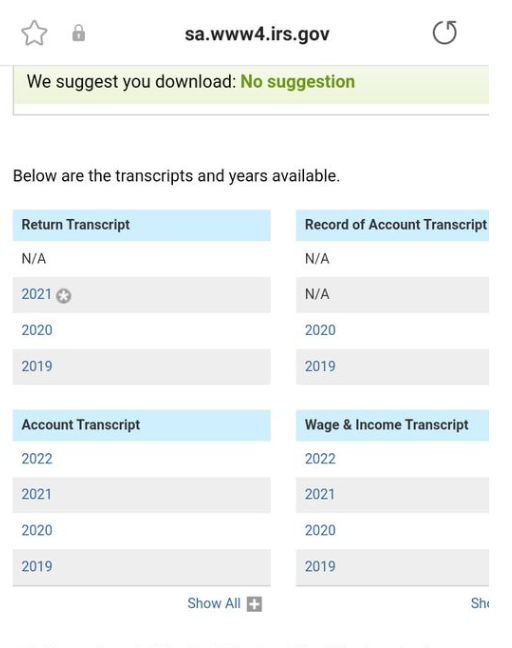

Wage and Income Transcript This provides data from the third party information statements the IRS has received for a specific taxpayer such as Forms W Tax account transcript shows basic data such as filing status taxable income and payment types It also shows changes made after you filed your original

More picture related to what does 806 mean on tax transcript irs

What To Do If IRS Code 806 Was Issued On Your 2021 Transcript The

https://thebusinessalert.com/wp-content/uploads/2021/09/IRS-Code-806-1024x576.jpg

What Your IRS Transcript Can Tell You About Your 2022 IRS Tax Return

https://savingtoinvest.com/wp-content/uploads/2022/02/image-14.png

Angel Number 806 Meaning Explained Angel Number Meanings Number

https://i.pinimg.com/originals/7b/67/7f/7b677f7e9311fb34d0c57a0376ddb86d.png

Return transcripts Current tax year and three prior tax years If you don t see a return transcript available for download it likely means that you didn t file a return for that year There are codes to note one action and more codes to undo that action For example TC 420 indicates that the return has been referred to the examination or appeals division It

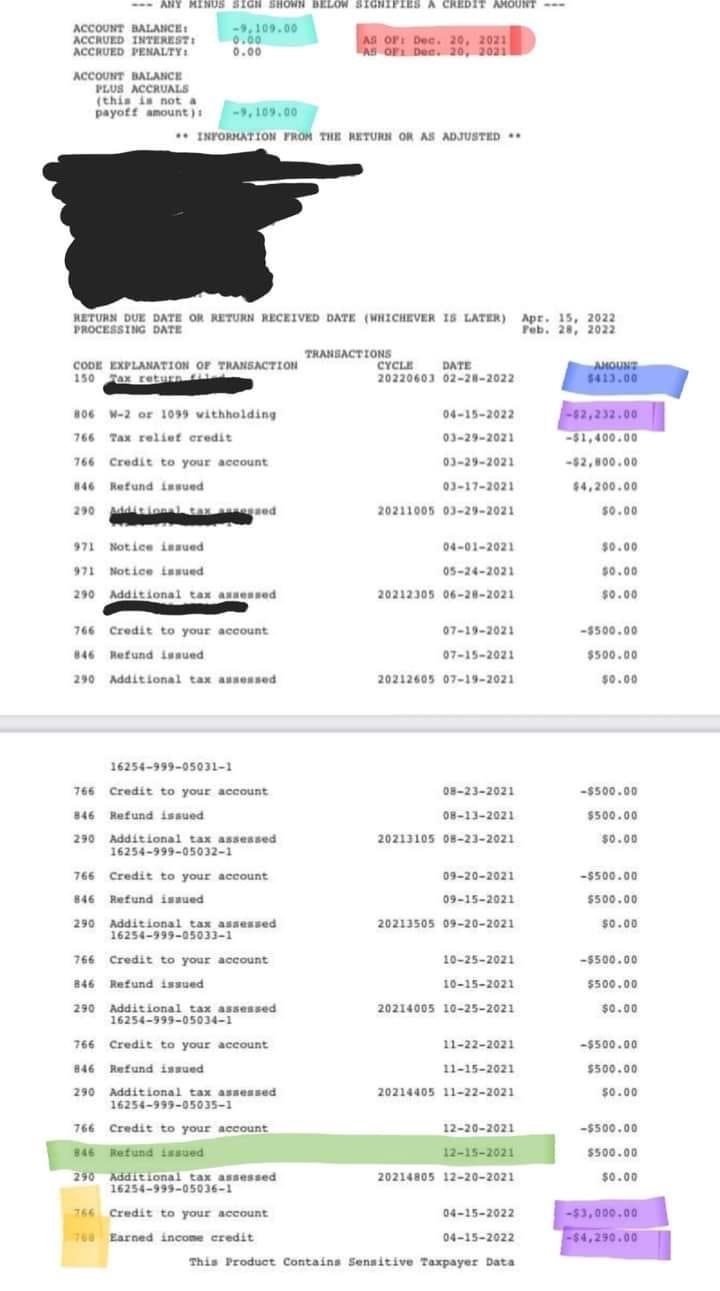

Purple Code 806 2 232 This is all of your Federal pay check withholdings you had If negative it means you withheld too much in taxes and will get Forms 4506 T and 4506 T EZ include a field where a Customer File Number can be entered to display on the transcript Individual taxpayers using Get

IRS Code 806 2023 2024 What Does Code 806 Mean On Tax Transcript

https://thetransfercode.com/wp-content/uploads/2021/05/IRS-Code-806-Claimyr.jpg

My Transcript Says N A What Does That Mean How Do I Get Information

https://savingtoinvest.com/wp-content/uploads/2023/02/image-21.png

what does 806 mean on tax transcript irs - Officially known as Credit for Withheld Taxes and Excess FICA code 806 signifies the sum of federal income taxes and FICA Social Security and Medicare