what can be claimed under section 80ddb Who can claim a deduction under Section 80DDB of the Income Tax Act The deduction u s 80DDB for the expenditure on the medical treatment of the specified diseases can be claimed by Deductions under Section 80DDB can be claimed only by individuals and HUFs Section 80DDB deduction can not be claimed by corporates or

Details of Deduction Allowed under Section 80DDB Deduction made under Section 80DDB is allowed for medical treatment of a dependent who is suffering from a particular disease which are mentioned below It can be claimed by an individual or HUF He or she should be an Indian resident Section 80DDB provides for a deduction to Individuals and HUFs for medical expenses incurred for treatment of specified diseases or ailments and should be deducted from the Gross Total Income while computing the taxable income of the assessee Who Can Claim the Deduction under Section 80DDB

what can be claimed under section 80ddb

what can be claimed under section 80ddb

https://i.ytimg.com/vi/MZuLtZk9SSE/maxresdefault.jpg

Section 80U Tax Deductions For Disabled Individuals Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80u.jpg

Know About Health Insurance Tax Benefits Under Section 80D

https://www.taxhelpdesk.in/wp-content/uploads/2022/04/Know-About-Health-Insurance-Tax-Benefits-Under-Section-80D.png

Deduction under section 80DDB can be claimed by an individual or a HUF who is resident in India Deduction is available in respect of amount actually paid by the taxpayer on medical treatment of specified disease or ailment prescribed by the Board see rule 11DD for prescribed disease or ailment For the assessment year of 2022 23 the amount allowed under Section 80DDB income tax deductions is discussed below Rs 40000 or the amount paid which of the two is less Senior citizens can claim a deduction up to Rs 100000 or

Who Can Claim the Deduction under Section 80DDB Individuals and Hindu Undivided Families HUF can claim a deduction under section 80DDB Additionally the individual or HUF must be a resident Indian in the previous financial year to claim the deduction Non resident Indians corporates or any other entity cannot claim deduction A taxpayer can claim an 80DDB deduction only if the following eligibility parameters are fulfilled The taxpayer is an individual or a Hindu Undivided Family The taxpayer is a resident Indian The dependent on whose treatment the money has been spent is the spouse child parent or sibling

More picture related to what can be claimed under section 80ddb

Section 80DDB Diseases Covered Certificate Deductions Masters India

https://www.mastersindia.co/_next/image/?url=https:%2F%2Fcdn.mastersindia.co%2Fwebsite%2Fauthors%2FWhatsApp_Image_2022-01-21_at_12.21.18_PM.jpeg&w=828&q=75

Learn How To Claim Tax Deduction On Cancer Treatment Expenses Under

https://media.assettype.com/bloombergquint/2022-09/3d3132d5-2425-4927-b2f6-fcdabfc6be7d/Tax_Deduction_on_Medical_Expense_Image_by_atlascompanya_on_Freepik.jpg?w=1200&auto=format%2Ccompress&ogImage=true

Deduction Under Section 80DD 80DDB And 80U

https://1.bp.blogspot.com/-W76ENVY8FC0/XyZXxMW9aKI/AAAAAAAANf4/bIg5ox4TLFQBxxOSNULkGYSJlrFHCcPjgCLcBGAsYHQ/w1200-h630-p-k-no-nu/saying-cover-saying-quote-wording-beak-art-1-5f03ecaba5416.png

Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions are satisfied a The medical expenditure must be incurred either on self spouse or dependent children or and parents 1 Tax deduction is available to individuals and HUFs under Section 80DDB of the IT Act on expenses incurred for the treatment of specific diseases or ailments 2 One can claim deductions either for himself or dependents which can be one s spouse parents children or dependent siblings or members of Hindu undivided family in case of HUFs 3

Under the Section 80DDB an individual can claim for deduction up to Rs 40 000 If an individual on behalf of whom such medical expenditure is incurred is a senior citizen then one can Specified Illness or Ailment for Which Deduction Can be Claimed under Section 80DDB The deduction under section 80DDB is allowed only for the expenses incurred to treat a major illness or ailment as specified in the Act The diseases are specified in Rule 11DD of the Income Tax Act

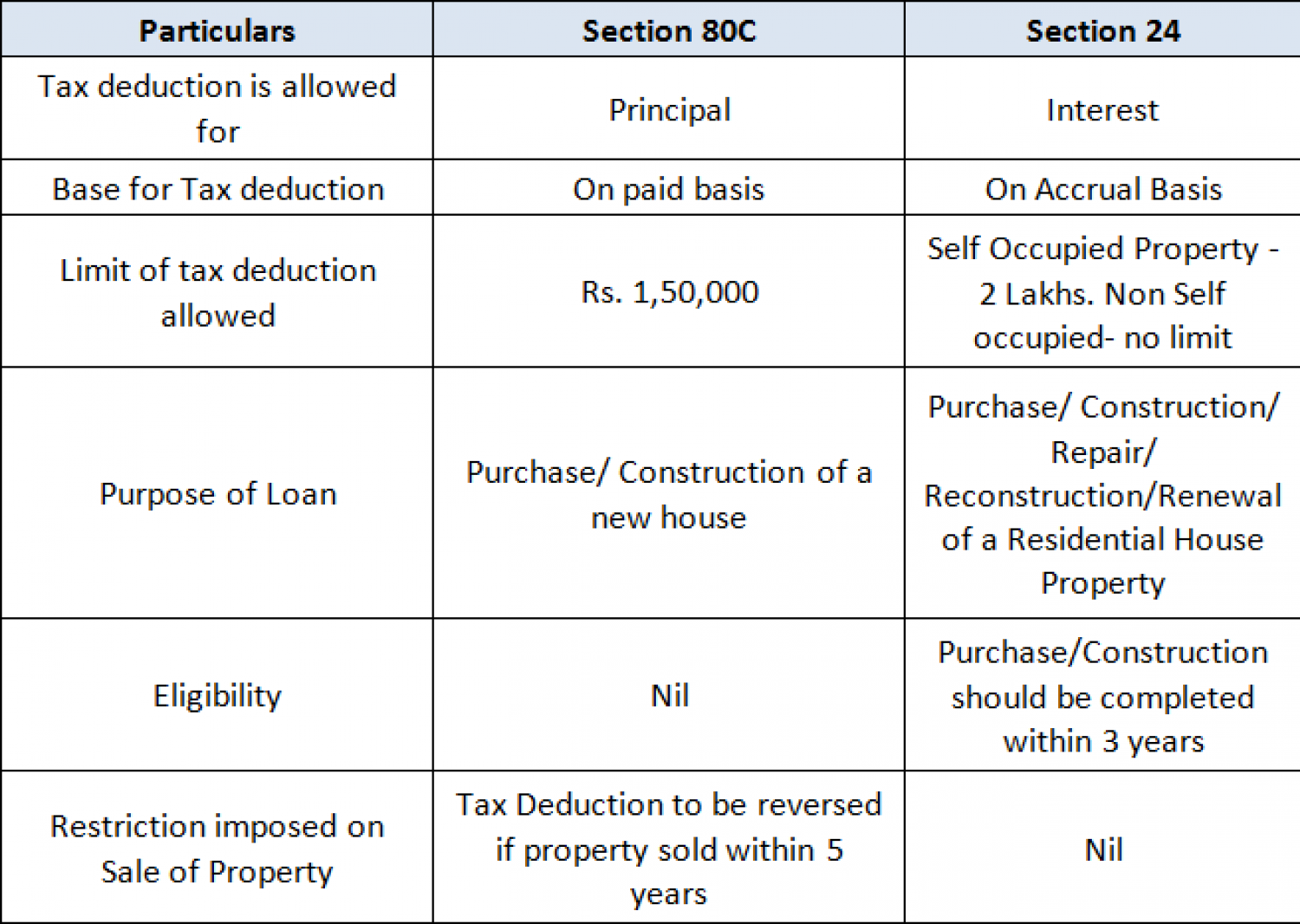

Can HRA Home Loan Benefits Be Claimed When ITR Is Filing

https://carajput.com/art_imgs/can-hra-and-home-loan-benefits-be-claimed-when-itr-is-filing.jpg

Section 80DD Of Income Tax Act Deductions For Disabled Persons Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80dd.jpg

what can be claimed under section 80ddb - Who Can Claim the Deduction under Section 80DDB Individuals and Hindu Undivided Families HUF can claim a deduction under section 80DDB Additionally the individual or HUF must be a resident Indian in the previous financial year to claim the deduction Non resident Indians corporates or any other entity cannot claim deduction