What Can Be Claimed Under 80dd - Worksheets have advanced right into functional and vital devices, accommodating diverse needs throughout education, organization, and individual administration. They supply arranged styles for numerous tasks, ranging from standard mathematics drills to complex corporate assessments, thus simplifying learning, preparation, and decision-making processes.

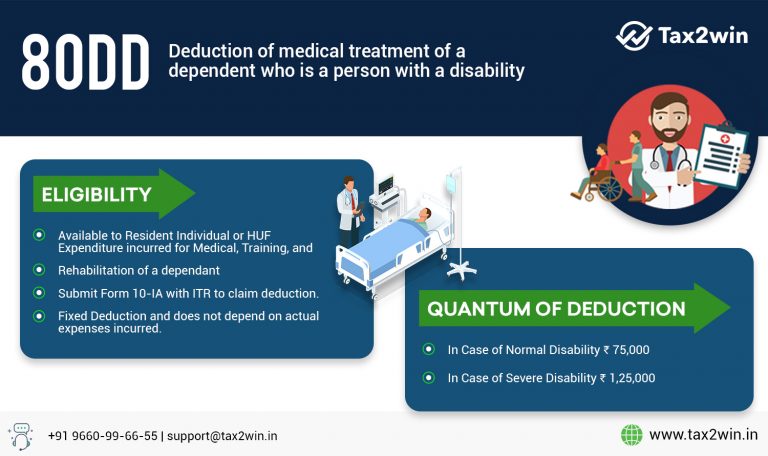

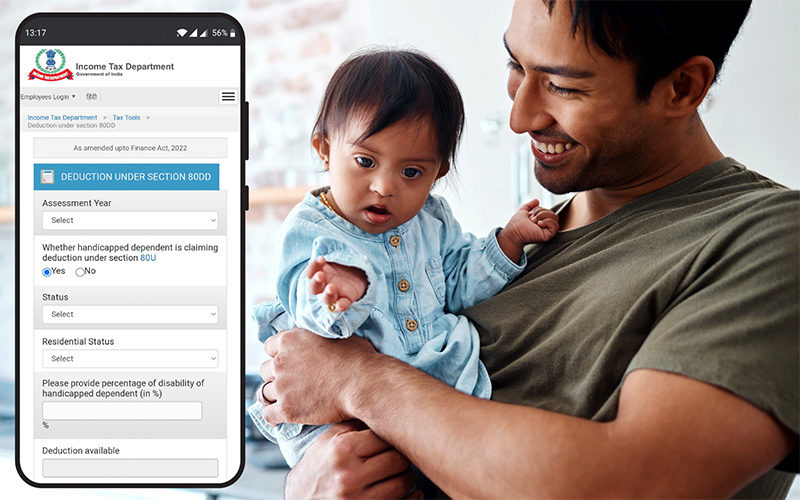

Tax Deduction Under Sec 80DD Eligibility Amount Covered Documents

Tax Deduction Under Sec 80DD Eligibility Amount Covered Documents

Worksheets are structured files used to arrange data, details, or tasks systematically. They provide a visual representation of concepts, permitting customers to input, manipulate, and assess information efficiently. Whether in the class, the conference room, or in the house, worksheets improve processes and boost efficiency.

Kinds of Worksheets

Learning Devices for Success

Worksheets are extremely helpful tools for both instructors and pupils in educational atmospheres. They include a range of tasks, such as math jobs and language jobs, that permit practice, support, and analysis.

Company Worksheets

Worksheets in the company ball have various purposes, such as budgeting, project monitoring, and examining information. They assist in educated decision-making and tracking of goal success by organizations, covering financial reports and SWOT evaluations.

Individual Worksheets

Individual worksheets can be an important device for accomplishing success in various aspects of life. They can aid people established and function in the direction of goals, handle their time successfully, and check their development in locations such as fitness and finance. By giving a clear structure and feeling of accountability, worksheets can aid people stay on track and achieve their goals.

Benefits of Using Worksheets

Worksheets provide numerous benefits. They boost involved knowing, boost understanding, and nurture logical thinking abilities. Furthermore, worksheets support framework, boost effectiveness and enable synergy in group circumstances.

Uber Driver Requirements Explained 2023 Easy How To Guide

Who Can Claim 80DD Deduction For Disabilities In India

What Tax Deductions Can I Receive As An Uber Driver SH Block Tax

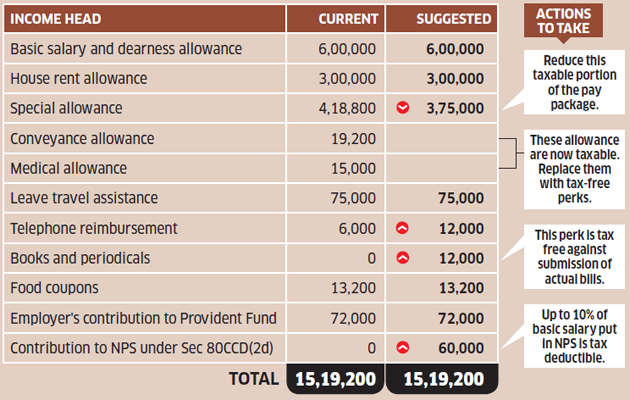

Tax Optimiser How Claiming Medical Expenses Under Section 80dd Can

Claim Deduction Under Section 80DD Learn By Quicko

Disabled Can Claim Tax Saving Deductions As Much As Rs 1 25 Lakh Under

What Are Sections 80DD 80DDB And 80U All About Rupiko

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Deductions Under The New Tax Regime Budget 2020 Quicko Blog

Tax Deduction Under Section 80DD Of Income Tax Eligibility Criteria