what are the two types of opportunity cost There are two types of Opportunity Cost Explicit costs and implicit costs The equation is FO return on the best forgone choice CO return on the chosen option They are beneficial tools while evaluating

Types of opportunity cost When looking at opportunity costs economists consider two types explicit and implicit Explicit opportunity cost The Production Possibilities Curve PPC is a model that captures scarcity and the opportunity costs of choices when faced with the possibility of producing two goods or services Points on the interior of the PPC are inefficient points on the PPC are efficient and points beyond the PPC are unattainable

what are the two types of opportunity cost

what are the two types of opportunity cost

https://commerceaspirant.com/wp-content/uploads/2022/11/Opportunity-Cost-in-Economics-Marginal-Opportunity-Cost-Class-11-Notes.png

What Is Opportunity Cost Definition Formula And Calculation Glossary

https://chisellabs.com/glossary/wp-content/uploads/2021/06/Opportunity-Cost.png

3 Types Of Opportunity Cost For Your Investment Portfolio Go Trading Asia

https://www.gotradingasia.com/wp-content/uploads/2020/01/shutterstock_418646125.jpg

In accounting it is common practice to refer to the opportunity cost of a decision option as a cost The discounted cash flow method has surpassed all others as the primary method of making investment decisions and opportunity cost has surpassed all others as an essential metric of cash outflow in making investment decisions The two types of opportunity costs are explicit opportunity cost and implicit opportunity cost Explicit opportunity cost has a direct monetary value For instance if a restaurant buys 1 000 worth of ground beef the cost is the other things that it could have purchased with that money like chicken wings or hamburger buns

Each curve has a different shape which represents different opportunity costs The bowed out concave curve represents an increasing opportunity cost the bowed in convex curve represents a decreasing opportunity cost and the straight line curve represents a constant opportunity cost Opportunity cost is the trade off that one makes when deciding between two options The example of choosing between catching rabbits and gathering berries illustrates how opportunity cost works The related concept of marginal cost is the cost of producing one extra unit of something

More picture related to what are the two types of opportunity cost

/opportunitycost-d6d8905019464b27be241653d3366a54.png)

What Is Opportunity Cost

https://www.thebalance.com/thmb/jxSVw6JHZqtLXyG8iBTKFFlnZvc=/1500x1000/filters:fill(auto,1)/opportunitycost-d6d8905019464b27be241653d3366a54.png

:max_bytes(150000):strip_icc()/Term-Definitions_Opportunity-cost2-614cfb37567040879073c5ed1d03b25c.png)

Opportunity Cost Formula Calculation And What It Can Tell You 2023

https://i0.wp.com/www.investopedia.com/thmb/piKnbh1RQsRV9VfvRqXtXjrmg7k=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Term-Definitions_Opportunity-cost2-614cfb37567040879073c5ed1d03b25c.png

10 Opportunity Cost Examples 2024

https://helpfulprofessor.com/wp-content/uploads/2023/01/opportunity-cost-example-and-definition.jpg

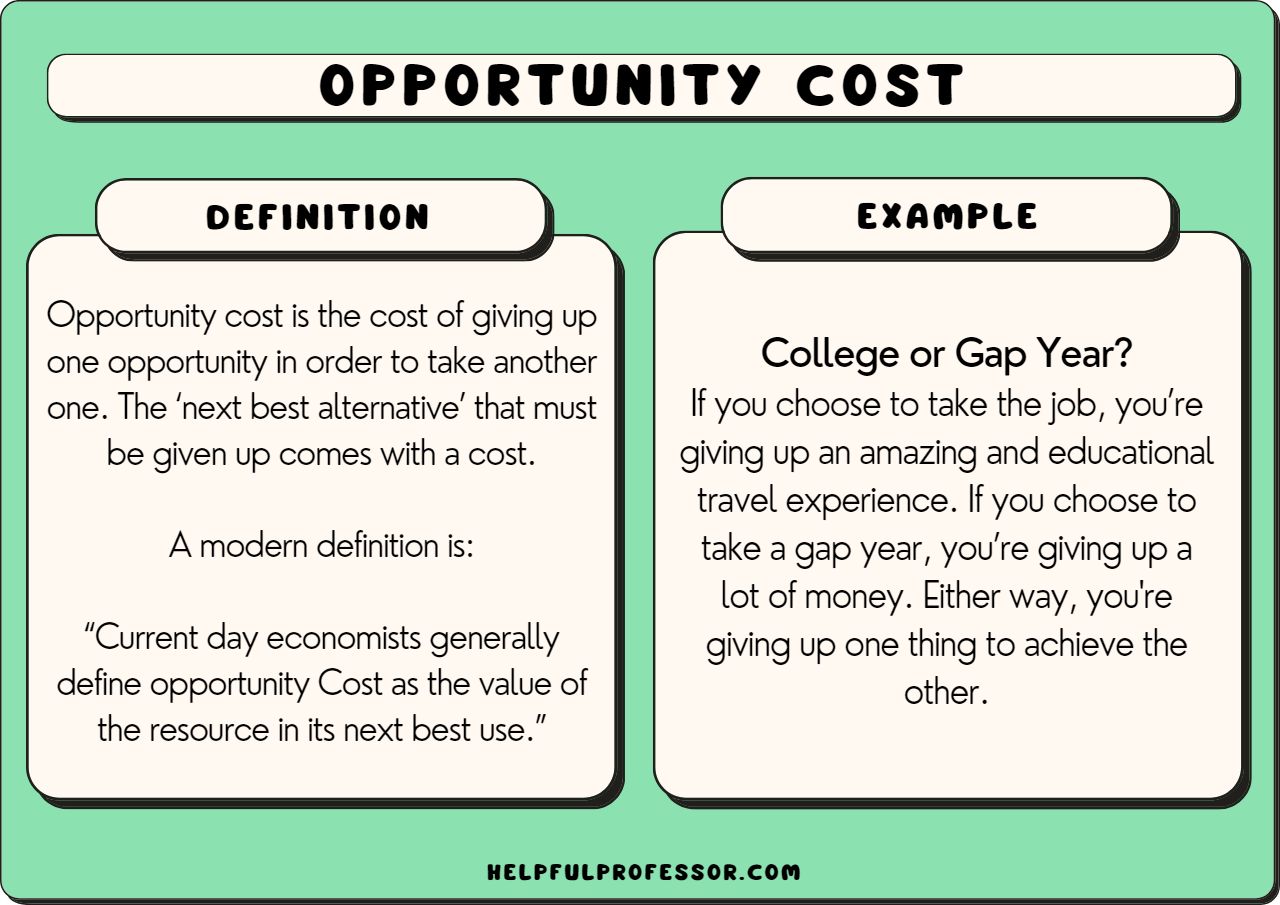

Opportunity cost can be applied to any situation where you need to make a choice between two or more alternatives Here s how opportunity cost works in investing plus the differences There are two main types of opportunity costs Implicit opportunity cost This type of opportunity cost is an intangible cost for which people can t easily account Explicit opportunity cost Explicit costs are typical costs you count such as a dollar amount or tangible costs

There are two types of opportunity costs implicit and explicit There are various advantages and disadvantages to opportunity cost varying from awareness of losses knowing the relative price and time investment Opportunity cost is the comparison of one economic choice to the next best choice These comparisons often arise in finance and economics when trying to decide between investment options The opportunity cost attempts to quantify the impact of choosing one investment over another

What Is Opportunity Cost Definition Meaning And Calculations

https://www.marketing91.com/wp-content/uploads/2019/04/How-To-Calculate-Opportunity-Cost-1.jpg

Opportunity Cost Explanation With Example Tutor s Tips

https://i0.wp.com/tutorstips.com/wp-content/uploads/2020/09/Opportunity-Cost-min.png?resize=1080%2C606&ssl=1

what are the two types of opportunity cost - In accounting it is common practice to refer to the opportunity cost of a decision option as a cost The discounted cash flow method has surpassed all others as the primary method of making investment decisions and opportunity cost has surpassed all others as an essential metric of cash outflow in making investment decisions