what all can be claimed in 80d Story outline Section 80D of the Income tax Act 1961 allows an individual to claim deduction from gross taxable income The deduction can be claimed if an individual has paid medical insurance premium during the year for self spouse and dependent children

The total tax deduction that can be claimed under Section 80D is based on members insured and their age criterion which ranges from INR 25 000 up to INR one lakh According to section 80D of the Income Tax Act a person can claim a tax deduction on medical expenditures in the same year But what is a Section 80D Who are eligible and how to claim it

what all can be claimed in 80d

what all can be claimed in 80d

https://www.playmissouri.com/wp-content/uploads/2022/04/Unclaimed-Missouri-Lottery-Prize.jpg

Your Petrol Diesel Expenses Can Help You Save Tax In Just Few Clicks

https://cdn.zeebiz.com/sites/default/files/2019/05/29/88810-fuel-pumps-pixabay.jpg

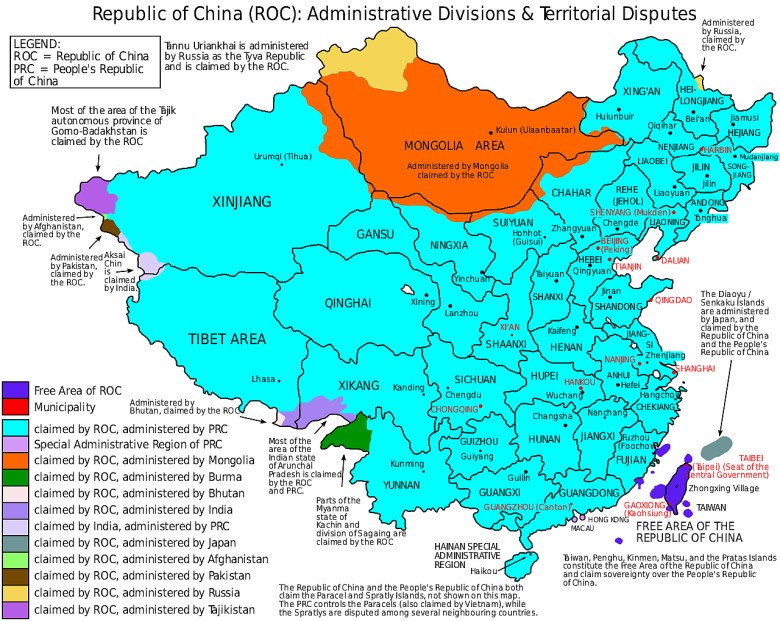

Roszczenia Terytorialne Tajwanu

https://www.techpedia.pl/app/public/files/34712.jpg

Under Section 80D you can claim deductions for the following expenses incurred on healthcare Medical insurance premium paid for self spouse dependent children and parents Expenses incurred on preventive health Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions are satisfied a The medical expenditure must be incurred either on self spouse or dependent children or and parents

Who is eligible for deduction under Section 80D Deduction for medical insurance premiums and medical expenses for senior citizens is allowed to the Individual or HUF category of taxpayers only For individual or HUF taxpayers insurance can be availed for Self Spouse Dependent children Dependent Parents Dependent Parent Who can claim deduction under section 80D Every individual or HUF can claim a deduction under section 80D of the income tax act for the medical insurance done by them Sec 80D of Income Tax Act also offers the benefit in case the health insurance is taken to cover their spouse dependent children or parents

More picture related to what all can be claimed in 80d

Whether Section 80C 80D Deduction Can Be Claimed By Filing

https://thetaxtalk.com/wp-content/uploads/2023/09/Slide4.jpg

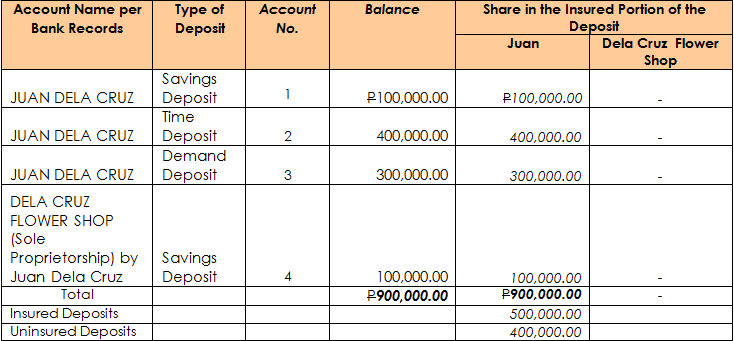

Philippine Deposit Insurance Corporation Official Website

https://www.pdic.gov.ph/images/claims/case2.png

Preventive Check Up 80d Wkcn

https://emailer.tax2win.in/assets/guides/all_images/Section-80D-Summary.jpg

Deduction under Section 80D can be claimed for premiums paid through approved modes of payment such as debit cards credit cards or net banking However it s important to note that cash payments are not eligible for deductions under this section Residential Status There are a wide range of deductions that you can claim Apart from Section 80C tax deductions you could claim deductions up to INR 25 000 INR 50 000 for Senior Citizens buying Mediclaim u s 80D You can claim a deduction of INR 50 000 on home loan interest under Section 80EE

Deduction Under Section 80D Assessment Year Status Assessee Spouse dependent Children Assesee s parents Payment for medical insurance premium mode other than cash contribution to CGHS Payment of medical insurance premium for resident Sr Citizen mode other than cash Payment made for preventive health check up Deduction under section 80D of the Income Tax Act is available in addition to the deduction of INR 1 50 Lakhs available collectively under section 80C section 80CCC and section 80CCD 1 Deduction under section 80D is available basically for two types of payment namely 1 Medical insurance premium including preventive health check up

Section 80D Deduction In Respect Of Health Or Medical Insurance

https://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GTI/Tax-Deductions/Maximum Deduction Amount under Section 80D.jpg

Sec 80D Deduction For A Y 21 22 Medical Expense Claim U s 80d How Much

https://i.ytimg.com/vi/BGRnR1duO_k/maxresdefault.jpg

what all can be claimed in 80d - Who can claim deduction under section 80D Every individual or HUF can claim a deduction under section 80D of the income tax act for the medical insurance done by them Sec 80D of Income Tax Act also offers the benefit in case the health insurance is taken to cover their spouse dependent children or parents