section 89 of income tax An employee can claim Section 89 relief if during the year he is liable to pay tax in respect of the following receipts a Advance Salary b Arrears of salary c Family Pension d Withdrawal from a PF account before completing 5 years of service

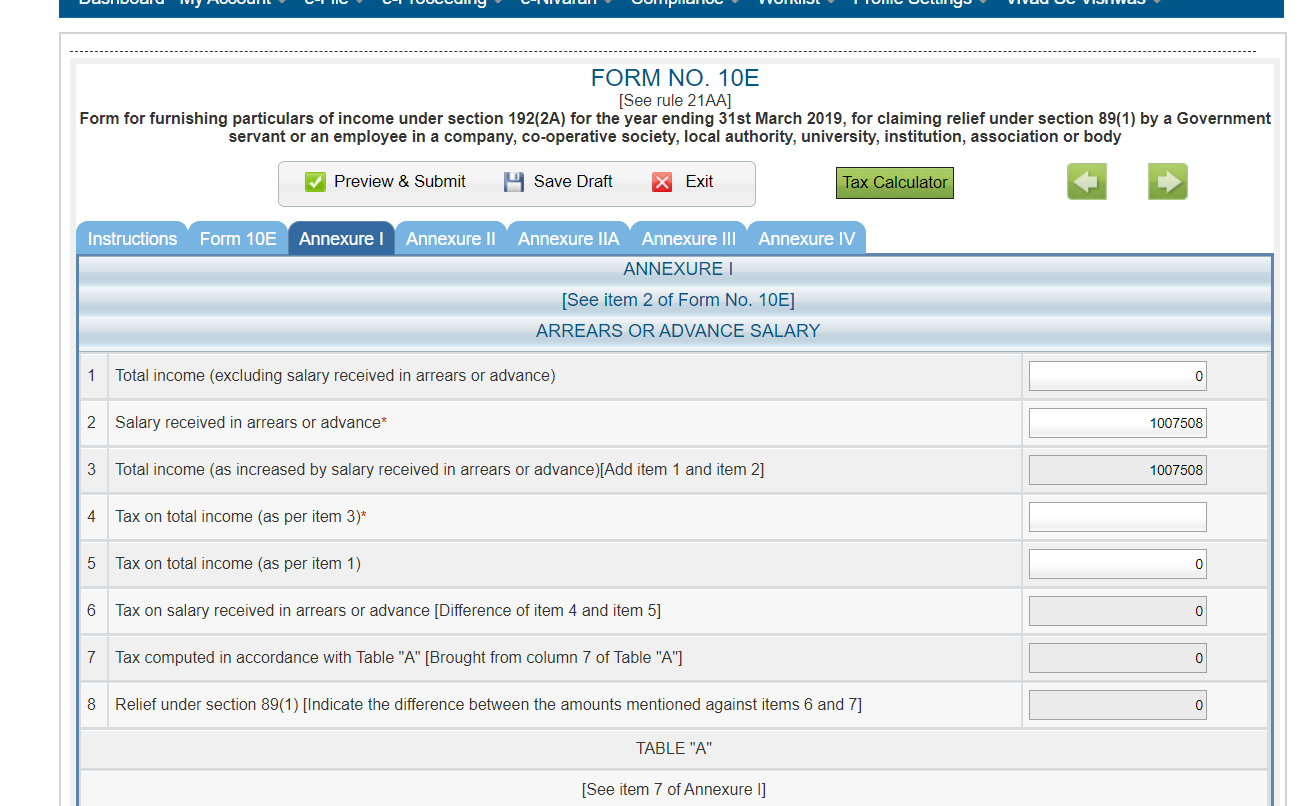

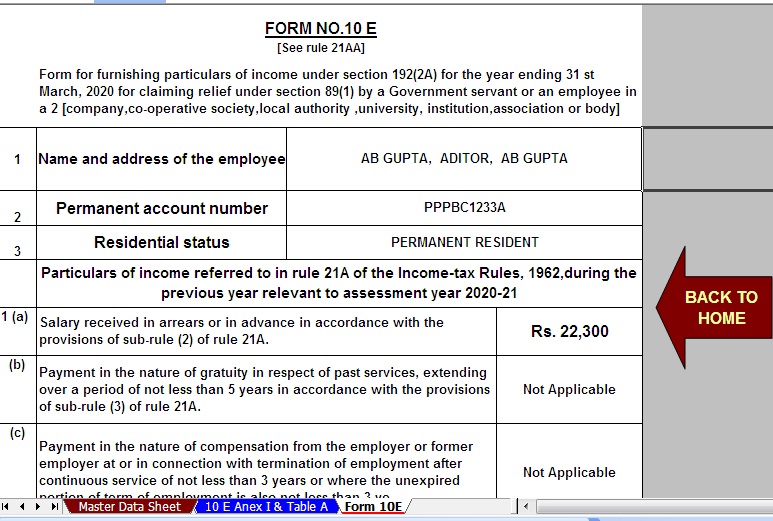

It is mandatory to fill out Form 10E when an individual wants to claim tax relief under Section 89 1 of the Income Tax Act 1961 Section 89 1 provides tax relief for delayed salary received in the form of arrears or received a family pension in arrears Relief under Section 89 1 A taxpayer receiving any portion of the salary in arrears or in advance or receiving profits in lieu of salary can claim relief under Sec 89 1 of the Income Tax Act

section 89 of income tax

section 89 of income tax

https://i.ytimg.com/vi/KegK6LnTCNQ/maxresdefault.jpg

Salary Received In Arrears Or In Advance Don t Forget To File Form 10E

https://splan.in/wp-content/uploads/2020/07/Capture1.png

Section 194A Of Income Tax Act Sorting Tax

https://sortingtax.com/wp-content/uploads/2022/08/blogimg2.png

What is Section 89 For the purpose of the Income Tax Act income tax is levied on the total income earned or received during the previous year by the assessee There are cases where in the past dues are paid off If your current Taxable Income is increased due to arrears relating to Preceding Previous Years or Past Years received in current years that s why your tax liability is increased So Income Tax Act 1961 allows a relief under section 89 1 to the assessee to claim relief if any made

The Income Tax Act u s 89 provides relief to an assessee for any salary or profit in lieu of salary or family pension received by an assessee in advance or arrears in a Financial Year This relief is granted as the total income assessed is at a rate higher than that at which it would otherwise have been assessed Detailed insights into Section 89 of the Income Tax Act 1961 which offers tax relief on arrears or advance salary pension or compensation Learn about eligibility conditions and more

More picture related to section 89 of income tax

Claim Income Tax Relief Under Section 89 1 On Salary Arrears

https://assets1.cleartax-cdn.com/s/img/2016/07/23142805/Step-14.png

Income Tax Relief Under Section 89 I Arrear Of Salary I Relief Under

https://i.ytimg.com/vi/3BJaBFEYZUc/maxresdefault.jpg

Section 13 OF THE INCOME TAX ACT

https://www.legalmantra.net/admin/assets/upload_image/blog/INCOME_TAX2.jpg

According to Section 89 of income tax act an assessee is given relief for any pay profit instead of salary or family pension that they receive in advance or arrears within a financial year The total amount of income assessed is higher than it would otherwise be thus this relief is given As per the Income Tax Act 1961 the Income Tax Section 89 1 a taxpayer can receive relief of salary relevant to the previous year s earning Section 89 1 is prominent since the 6th Pay Commission of the Central Government Previously this section was applicable only for relief of salary arising from gratuity income Gratuity

[desc-10] [desc-11]

Income Tax 20p Rate Will Form Part Of Review Guernsey Press

https://guernseypress.com/resizer/s4jAXy0imak1dcPMplbgeCoSUYM=/1200x0/cloudfront-us-east-1.images.arcpublishing.com/mna/ODNPXKST5ZGKTFV2BHWXRFB7VY.jpg

Relief Under Section 89 1 For Arrears Of Salary Itaxsoftware

https://1.bp.blogspot.com/-tZFrTAS5gvo/XhUd-5p6j3I/AAAAAAAALfQ/Bb1lpmHCvMk08MD2EPLY5qHVFx-Gt0TlgCNcBGAsYHQ/s1600/Picture%2B5%2Bof%2BArrears%2BRelief%2BCalculator%2B%2B19-20.jpg

section 89 of income tax - [desc-14]