rule 10b5 1 plan disclosure The Securities and Exchange Commission today adopted amendments to Rule 10b5 1 under the Securities Exchange Act of 1934 and new disclosure requirements to

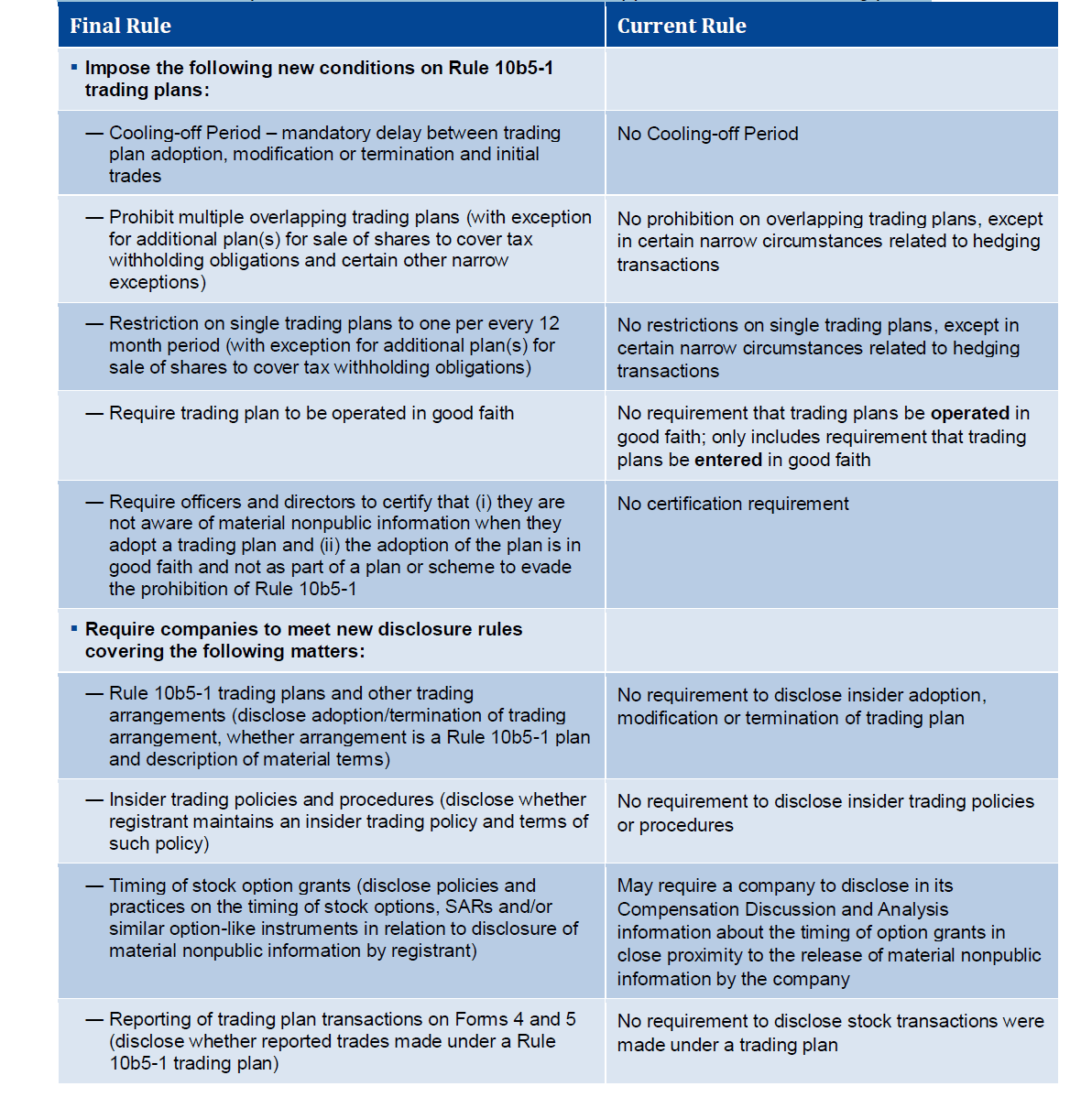

On December 14 2022 the U S Securities and Exchange Commission SEC adopted final rules 1 adding new conditions applicable to Rule 10b5 1 trading plans 2 requiring The Commission adopted Rule 10b5 1 in 2000 to provide more clarity regarding the meaning of manipulative or deceptive device s or contrivance s prohibited by Section 10 b and Rule

rule 10b5 1 plan disclosure

rule 10b5 1 plan disclosure

https://corpgov.law.harvard.edu/wp-content/uploads/2023/01/paygovernance152.png

NASPP Rule 10b5 1 Plan Disclosures And Insider Trading

https://www.naspp.com/images/default-source/blog-images/2023/january/disclosure-of-rule-10b5-1-plans-and-insider-trading-compliance.thumb.jpg?sfvrsn=3acc4dd0_1

SEC Adopts Final Rules On 10b5 1 Trading Plans Meridian LIVE

https://d2jsype5crt5mk.cloudfront.net/wp-content/uploads/2022/12/Capture.png

The Securities and Exchange Commission adopted final rules that impose new conditions on the availability of the Rule 10b5 1 affirmative defense to insider trading and require enhanced disclosures regarding the Rule 10b5 1 specifies that a sale constitutes trading on the basis of material non public information MNPI when the person making the sale was aware of MNPI at the time the sale

The Adopting Release provides transition guidance for existing Trading Plans as well as the new disclosure requirements and Section 16 reporting requirements The new On December 14 2022 the Securities and Exchange Commission unanimously adopted final rules relating to Rule 10b5 1 plans Properly structured a Rule 10b5 1 plan provides an

More picture related to rule 10b5 1 plan disclosure

Reminder Tracking Rule 10b5 1 Plans And Disclosure Timing Wilson

https://jdsupra-html-images.s3-us-west-1.amazonaws.com/be4c9632-8691-4106-bc14-bfed2f778f89-10b5-Graphic-2-2.jpg

SEC Adopts Final Rules On Rule 10b5 1 Trading Plans And Related Company

https://www.winston.com/images/content/2/8/v2/281753.jpg

SEC Adopts Restrictive Amendments To Rule 10b5 1 JONES KELLER

https://joneskeller.com/wp-content/uploads/2023/01/SEC-10b5-1-Overview.png

Enhanced scrutiny of insider trading and broader conflicts of interest compliance risk programs controls and governance should be anticipated in the near term as the rules go into effect and To provide greater detail and transparency to investors regarding the use of Rule 10b5 1 plans and insider trading policies and procedures relating to the protection of MNPI issuers will be required to make new disclosures in

As a refresher the amended rules related to Rule 10b5 1 plans impose new mandatory cooling off periods for 10b5 1 plans create new prohibitions on overlapping Rule 10b5 1 plans are passive investment schemes plan holders relinquish direct control over transactions which provide a mechanism for companies and corporate

What You Need To Know About Rule 10b5 1 Plans YouTube

https://i.ytimg.com/vi/_-AMo9PrubM/maxresdefault.jpg

SEC Adopts Amendments To Rule 10b5 1 And Adds Insider Trading Related

https://www.cravath.com/a/web/3TGCEVXUvj4tuMrTbazt4/4LB11e/sm-10b5-1-memo.jpg

rule 10b5 1 plan disclosure - Rule 10b5 1 Compliance Dates and Transition Issues 1 What does the February 27 2023 effective date mean for new trading plans Trading plans adopted on or after that date must