restaurant 5 gst hsn code 47 rowsigst 5 cgst 2 5 sgst utgst 2 5

121 rowsSearch and Find HSN Codes SAC codes GST Rates of goods and There has been a lowering of tax from 12 to 5 non ac restaurants by the GST council Also the GST rate on air conditioned restaurants has been fixed at

restaurant 5 gst hsn code

restaurant 5 gst hsn code

https://www.aubsp.com/wp-content/uploads/gst-rates-goods-5-percent.jpg

How Does GST HSN Code Works And HSN Code List

https://ebizfiling.com/wp-content/uploads/2022/02/Information-on-GST-HSN-code.png

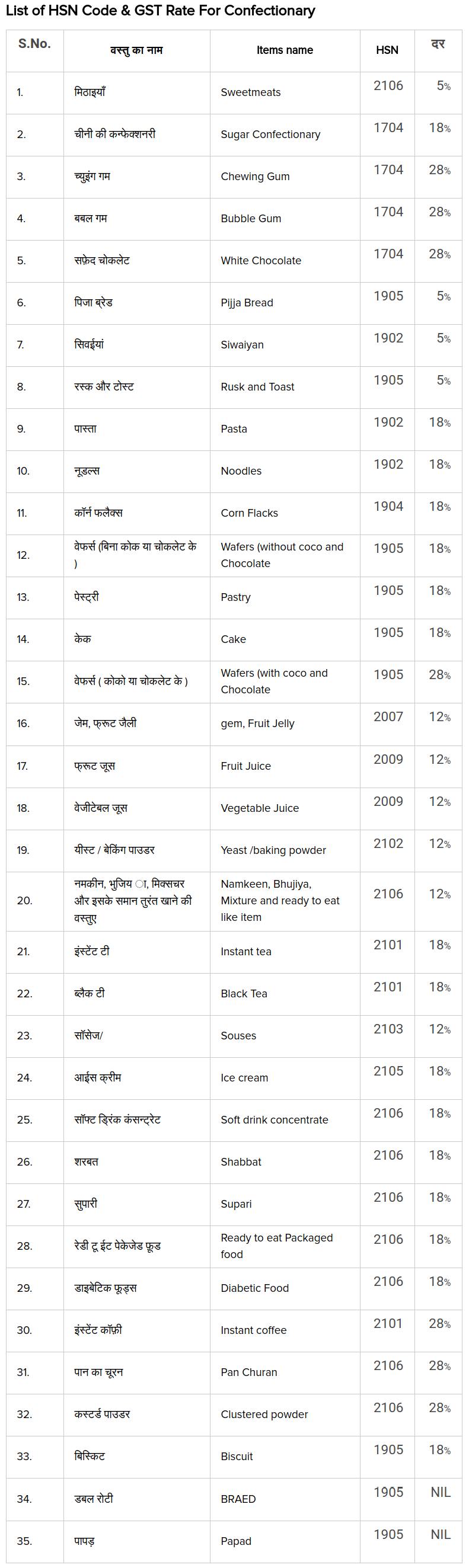

List Of HSN Code With Tax Rates GST E Startup India

https://www.e-startupindia.com/learn/wp-content/uploads/2021/04/List-of-HSN-Code.png

Type of Restaurants GST Rate 1 Food supplied or catering services by Indian Railways IRCTC 5 without ITC 2 Standalone restaurants including takeaway 5 Restaurants are required to pay GST at a concessional rate of 5 on the turnover under the composition scheme subject to the following restrictions Turnover not to exceed Rs 1 5 Crores Rs 1 Crore

With GST set to be implemented in India from 1st July 2017 GST registration process has started and GST Portal is now available for use by taxpayers In this article let us look at the GST rate applicable to Find the restaurants related HSN and SAC codes for India Also see the GST rates and special GST rates applicable to restaurants SAC code GST rates of

More picture related to restaurant 5 gst hsn code

GST Rates HSN Codes On Flours Meals Pellets Oil Cakes Chapter 23

https://khatabook-assets.s3.amazonaws.com/media/post/2022-06-28_154002.6300410000.webp

Find HSN Code With GST Rate In India GST BLOG

http://gstpartnership.weebly.com/uploads/1/1/2/7/112780291/confectionary_orig.png

Definition And Uses Of HSN Codes Stenn

https://5065780.fs1.hubspotusercontent-na1.net/hubfs/5065780/HSN-CODE-no-logo.jpg?7dad72c2-6ff1-42c9-8f66-1b0ab368d6a6

Find all HS Codes or HSN Codes for restaurant and its GST rate with Drip Capital s HSN Code finder SAC Code is 9963 which will be mentioned while issuing the tax invoice to the recipient of services Value of Supply Place of Supply and Time of Supply as per Section 13 15 of CGST Act 2017 Value of

5 or 18 GST Rate Under GST restaurants are subject to either a 5 GST rate without the option to claim Input Tax Credit ITC or an 18 GST rate with ITC GST Rates on Restaurants Under the GST regime restaurants are divided into two categories AC and Non AC The GST rates on these two categories

HSN And SAC Code In GST Archives Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/09/HSN-Vs-SAC.png

HSN Codes For GST Enrolment PDF Rolling Metalworking Gear

https://imgv2-1-f.scribdassets.com/img/document/360184026/original/e3e8c32585/1688933466?v=1

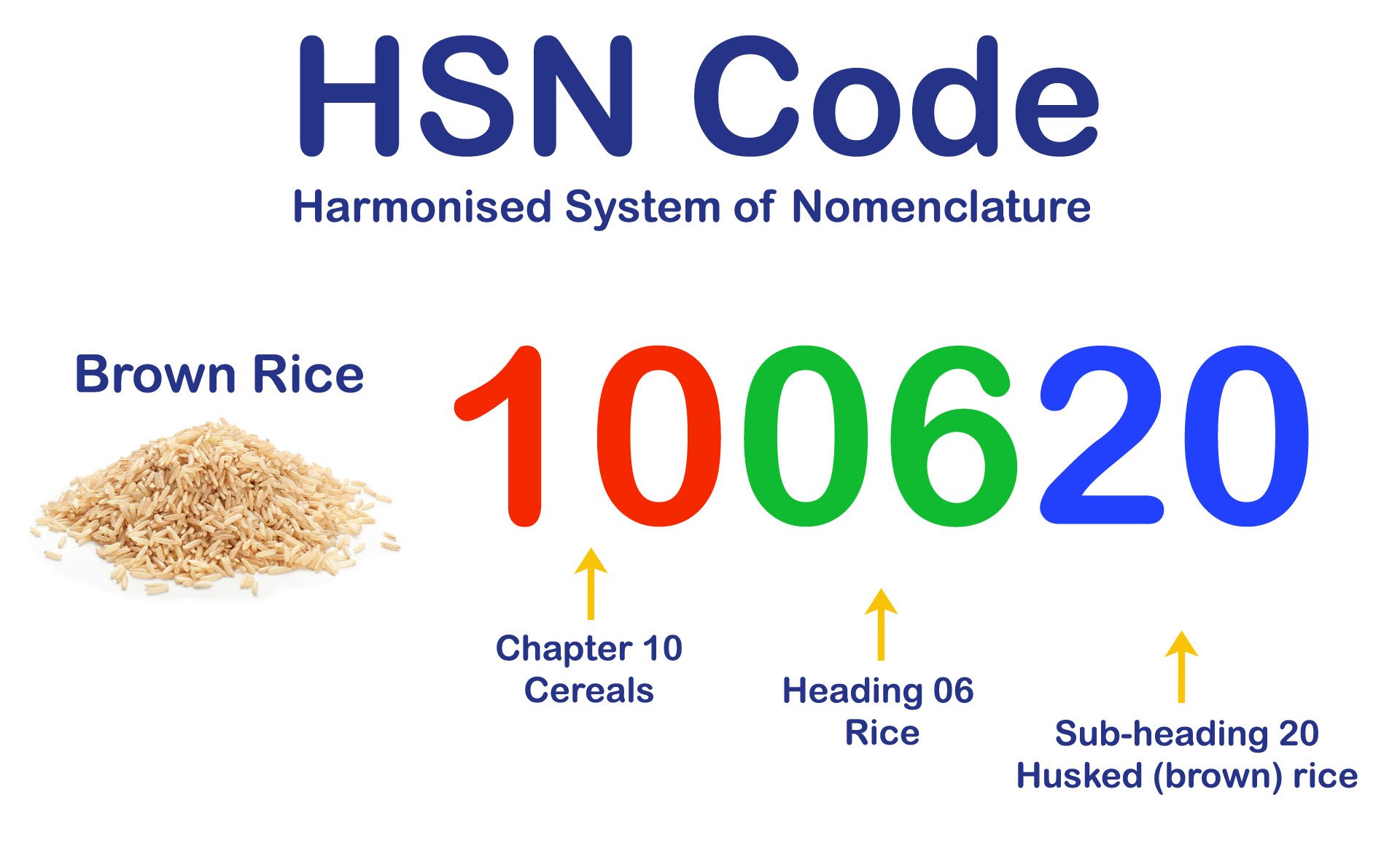

restaurant 5 gst hsn code - Explore the list of HSN codes for goods and services under India s GST Discover the GST rates the specifics of the HSN code its functionality and additional