operating lease cash flow statement example For operating leases with a term greater than 12 months lessees must show a right of use asset and a lease liability on their balance sheets initially recorded at the present value of the lease payments calculated the same way as

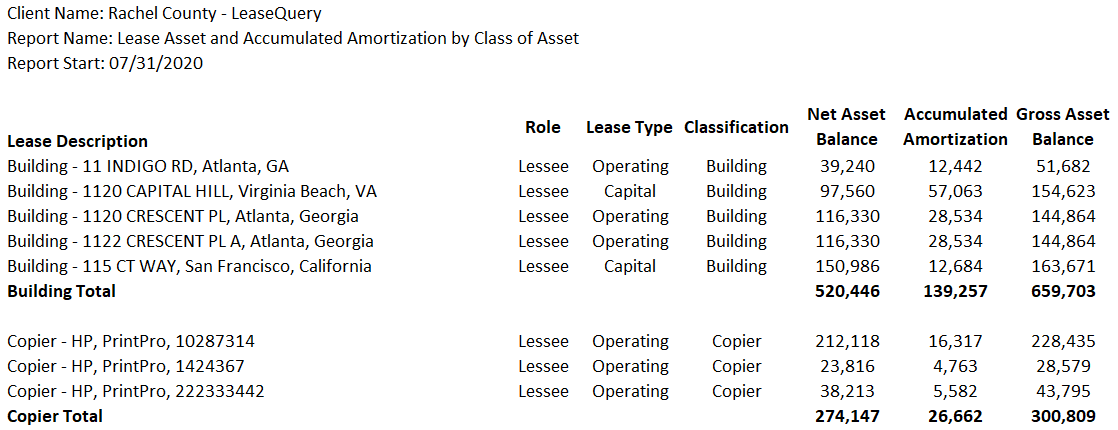

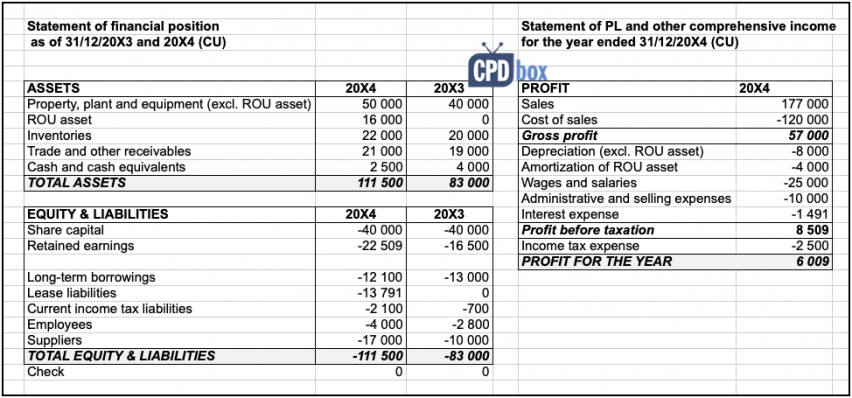

In order to measure the ROU asset you ll want to amortize based on the difference between the periodic straight line lease cost and the interest The straight line expense is included in the income statement and helps show a lease s direct impact on cash flow in a given period Disclose maturity analysis of undiscounted lease liabilities i e 5 year table separately for finance leases and operating leases Provide reconciliation of undiscounted cash flows to the finance lease liabilities and operating lease liabilities recognized in the statement of financial position

operating lease cash flow statement example

operating lease cash flow statement example

https://mergersandinquisitions.com/wp-content/uploads/2021/06/Lease-Accounting-07.jpg

Capital Lease Definition Examples And Forms

https://www.nysscpa.org/cpaj-images/CPA.2017.87.9.054.t005.jpg

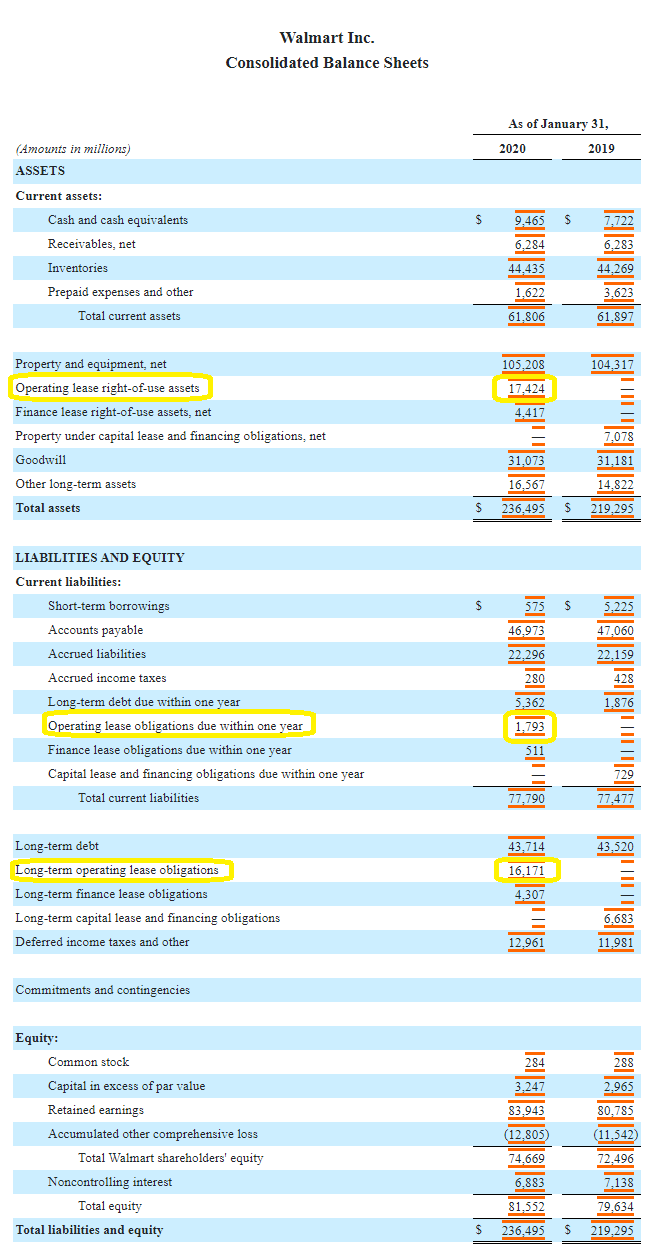

Operating Leases Now In The Balance Sheet GAAP Accounting Made Simple

https://einvestingforbeginners.com/wp-content/uploads/2020/07/image-5.png

There are two methods to capitalize operating leases the full adjustment method and the approximation method 1 Full Adjustment Method Step 1 Collect input data Find the operating lease expenses operating income reported debt cost of debt and reported interest expenses Cost of debt can be found using the firm s bond rating STATEMENT OF CASH FLOWS The requirements for presenting cash outflows in the statement of cash flows are linked to the presentation of expenses arising from a lease in the statement of comprehensive income and are generally consistent with prior GAAP Example 1 Statement of cash flow presentation Lessees

The legacy lease accounting requirements in IAS 17 Leases were criticised for failing to meet the needs of users of the financial statements particularly because IAS 17 did not require lessees to recognise assets and liabilities arising from operating leases Operating lease accounting under ASC 842 and examples Finance lease accounting under ASC 842 and examples 7 Lessor accounting 8 Sale leaseback accounting 9 Leveraged lease accounting 10 Practical expedients 11 Disclosure requirements 12 ASC 842 vs IFRS 16 What are the differences between the two 13

More picture related to operating lease cash flow statement example

ASC 842 And The Impact On Business Valuation Stout

https://www.stout.com/-/media/images/insights/articles/fj19_gandre-asc-842_f7.jpg

GASB 87 Disclosure Requirements For Lessees Explained Examples

https://leasequery.com/wp-content/uploads/2021/05/lessee-lease-asset-quantitative-disclosure.png

Capital Lease Vs Operating Lease U S GAAP Lease Accounting

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/09/14130148/Capital-Lease-Calculator.jpg

For an operating lease the full lease payment is shown as an operating cash outflow on the lessee s statement of cash flows Cash flows from financing activities Proceeds from issue of share capital 250 Proceeds from long term borrowings 250 Payment of lease liabilities 90 Dividends paid 2 1 200 2 This could also be shown as an operating cash flow Net cash used in financing activities 790 Effect of exchange rate changes 40 Net increase in cash

Operating lease accounting example and journal entries Details on the example lease agreement Step 1 Determine the lease term under ASC 840 Step 2 Determine the total lease payments under GAAP Step 3 Prepare the straight line amortization schedule under ASC 840 Step 4 On the ASC 842 effective date determine The sum of the undiscounted cash flows for all years thereafter A reconciliation of the undiscounted cash flows to the discounted finance lease liabilities and operating lease liabilities recognized in the statement of financial position ASC 842 20 55 53 provides an example of this disclosure requirement

How To Present Leases Under IFRS 16 In The Statement Of Cash Flows IAS

https://www.cpdbox.com/wp-content/uploads/00_IFRS16IAS7_Task-e1635952607650.png

2 An Example Of The Cash Flow Statement With Indirect Method

https://www.researchgate.net/profile/Hadri-Kusuma/publication/45118300/figure/download/tbl2/AS:640637841977345@1529751372549/2-An-Example-of-the-Cash-Flow-Statement-with-Indirect-Method.png

operating lease cash flow statement example - In this report we will cover the guidance in FASB ASC 842 related to presentation in the balance sheet income statement and statement of cash flows