ois swap rate An overnight indexed swap OIS is an interest rate swap IRS over some given term e g 10Y where the periodic fixed payments are tied to a given fixed rate while the periodic floating payments are tied to a floating rate calculated from a daily compounded overnight rate over the floating coupon period

An Overnight Index Swap OIS is a derivative contract in which two parties agree to exchange or swap interest rates over a specified period One party will pay a fixed interest rate and receive a floating interest rate which is pegged to an overnight rate such as the Fed funds rate in the US OIS Wholesale Weighted average rate 1 month bucket Euro area Member States and Institutions of the Euro Area changing composition Daily businessweek Not allocated unspecified Euro money market Overnight Index Swap All sectors other than households and NP

ois swap rate

ois swap rate

https://www.clarusft.com/wp-content/upLoads/2015/04/sdrview_ois_swap_volumes_2015_03_11-e1428238247299.png

OIS Discount Rate Curves Computed From Swap Rates As Of May 31st 2013

https://www.researchgate.net/profile/Areski-Cousin/publication/261289089/figure/fig4/AS:669430149312527@1536615993956/OIS-discount-factor-curves-computed-from-swap-rates-as-of-May-31st-2013_Q640.jpg

Mohamed El Erian On LinkedIn economy markets EconTwitter 25 Comments

https://media-exp1.licdn.com/dms/image/C4E22AQEMD6ofaEPfmg/feedshare-shrink_1280/0/1659449411661?e=2147483647&v=beta&t=6NX5dTT_VXrbrQOmOF4xvlMyS9qwWIwM-aX6I5ZK_wA

Overnight Index Swaps OIS are instruments that allow financial institutions to swap the interest rates they are paying without having to refinance or change the terms of the loans they have taken from other financial institutions An overnight index swap OIS is a type of interest rate swap where overnight interest rates are exchanged for fixed interest rates The OIS rate in the market reflects the fixed rate within the swap agreement

One way to arrive at the correct discount rate is to look to the overnight swaps market OIS Key Takeaways When contemplating an investment opportunity research analysts rely on the An overnight index swap OIS is a sophisticated financial derivative used in hedging strategies It involves the exchange of cash flows between two parties based on a predetermined index such as the federal funds rate or LIBOR over a specified period

More picture related to ois swap rate

Reading The OIS Curve Signal

https://www.crisil.com/content/dam/crisil/our-analysis/reports/Research/documents/2022/07/reading-the-ois-curve-signal/narrowing-alley.JPG

U S Dollar LIBOR OIS Spreads And Major Events Download

https://www.researchgate.net/profile/Francis_In/publication/252127658/figure/download/fig8/AS:668427513516044@1536376946301/US-dollar-LIBOR-OIS-spreads-and-major-events.png

Bloomberg Interpolating The Swap Curve Quantitative Finance Stack

https://i.stack.imgur.com/bcGvV.jpg

The LIBOR OIS spread represents the difference between an interest rate with some credit risk built in and one that is virtually free of such hazards An Overnight Index Swap OIS is a financial contract between two parties which agree to exchange a payment at the end of the contract based on the difference between a fixed rate and the

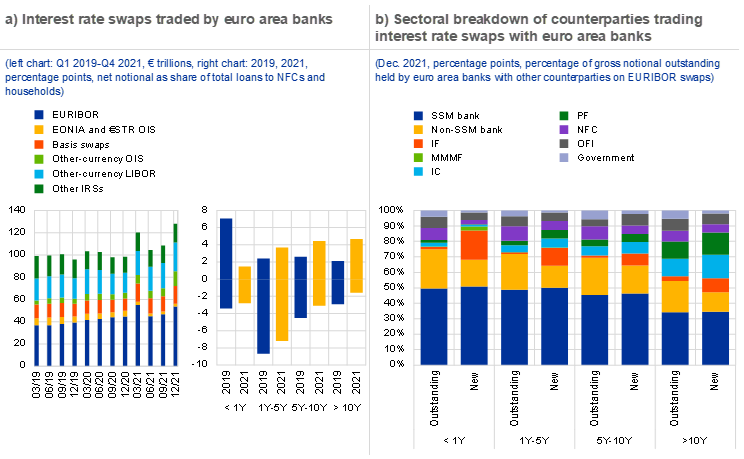

[desc-10] [desc-11]

Ecb Interest Rate Hike 2022

https://www.ecb.europa.eu/pub/financial-stability/fsr/focus/2022/html/fsrbox202205_05/ecb.fsrbox202205_05.en_img1.png?d4b48d91b77a100a3e6a5e3f63a30f66

Swaps How Bloomberg Calculates Discount Rates For Zero Rate Curves

https://i.stack.imgur.com/9FaH6.png

ois swap rate - One way to arrive at the correct discount rate is to look to the overnight swaps market OIS Key Takeaways When contemplating an investment opportunity research analysts rely on the