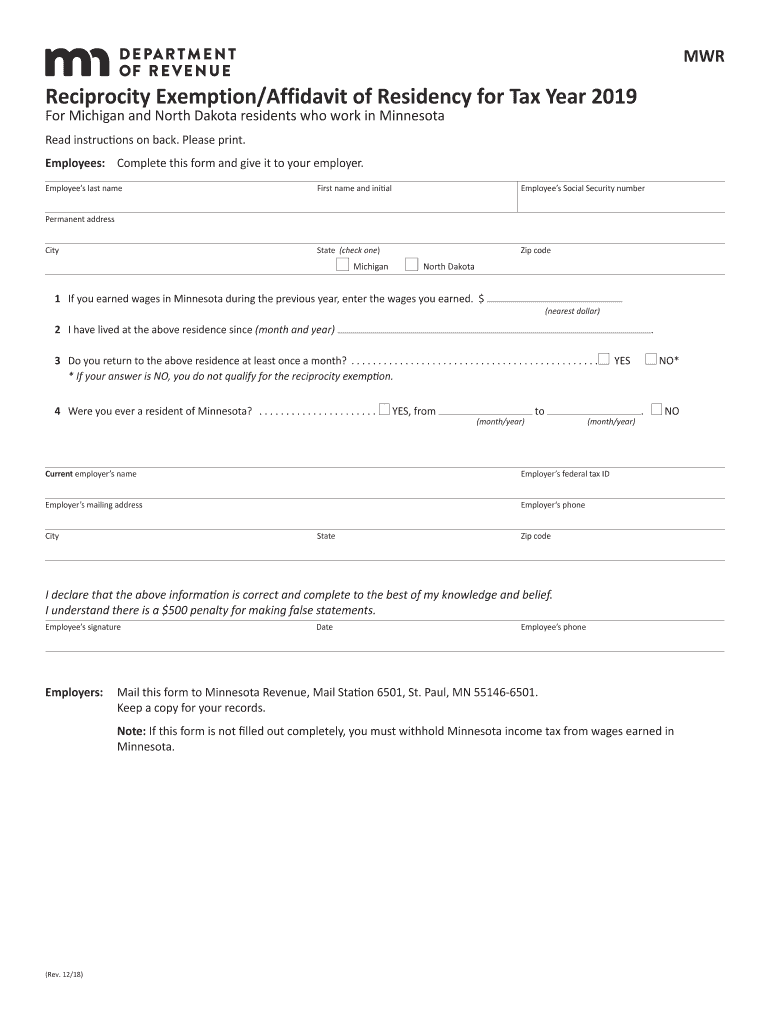

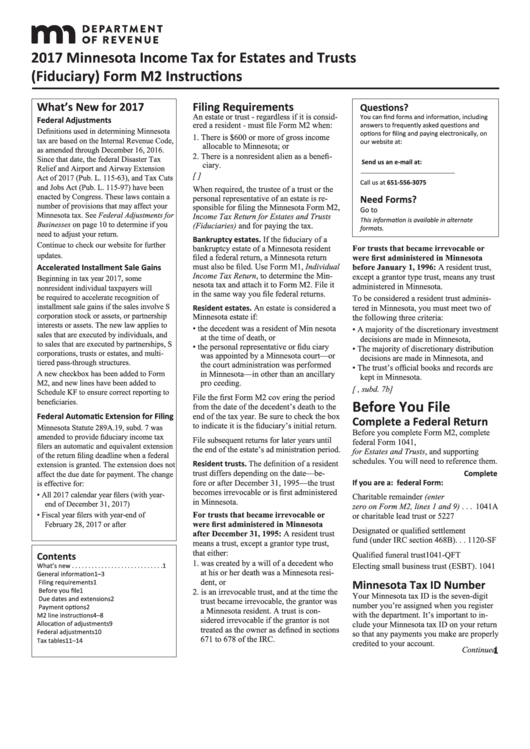

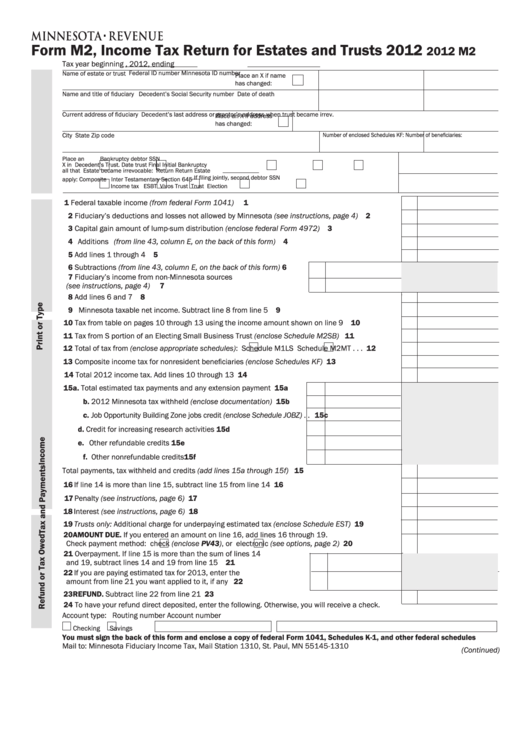

mn form m2 instructions Filing Requirements An estate or trust regardless of whether it is considered a resident must file Minnesota Form M2 Income Tax Return for Estates and Trusts Fiduciaries when it has

Filing Requirements An estate or trust regardless of whether it is considered a resident must file Minnesota Form M2 Income Tax Return for Estates and Trusts Fiduciaries when it has 600 I authorize the Minnesota Department of Revenue to discuss this tax return with the preparer I do not want my paid preparer to file my return electronically Enclose a copy of federal Form

mn form m2 instructions

mn form m2 instructions

https://pbs.twimg.com/media/FxwAy5JaMAAU64-.jpg

Mn M1pr Table 2019 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/463/100/463100184/large.png

Instructions For Form M2 Minnesota Income Tax For Estates And Trusts

https://data.formsbank.com/pdf_docs_html/360/3605/360524/page_1_thumb_big.png

I authorize the Minnesota Department of Revenue to discuss this tax return with the preparer I do not want my paid preparer to file my return electronically Enclose a copy of federal Form Enclose a copy of federal Form 1041 Schedules K 1 and other federal schedules Mail to Minnesota Fiduciary Income Tax Mail Station 1310 600 N Robert St St Paul MN 55145 1310

Easily file your Form M2 Income Tax Return for Estates and Trusts in Minnesota Fill the form online and download as a PDF or Word document Free fast and simple An estate or trust regardless of whether it is considered a resident must file Minnesota Form M2 Income Tax Return for Estates and Trusts Fiduciaries when it has

More picture related to mn form m2 instructions

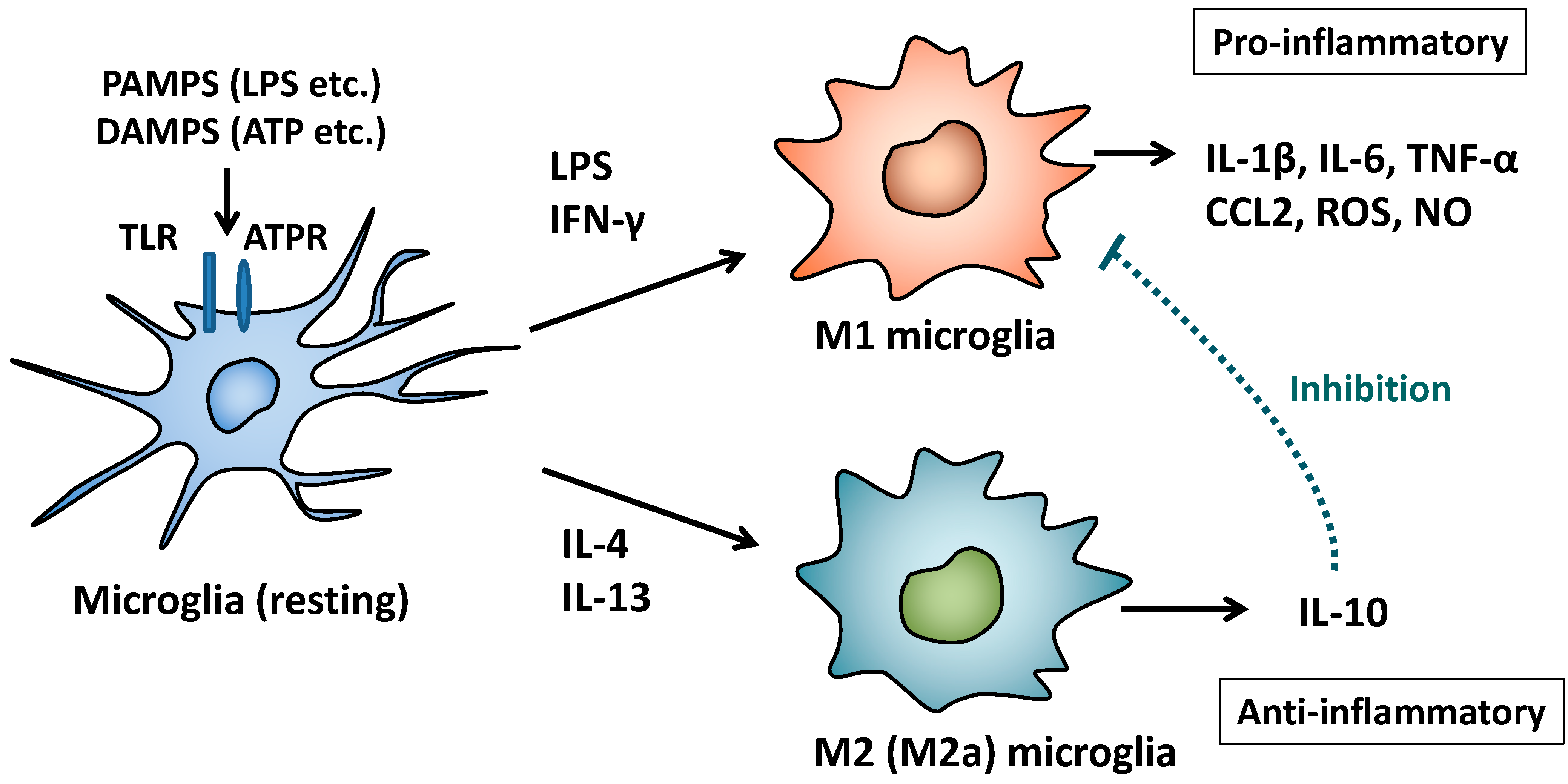

M1 M2 Kujira

https://www.mdpi.com/pharmaceuticals/pharmaceuticals-07-01028/article_deploy/html/images/pharmaceuticals-07-01028-g001.png

Fillable Form M2 Income Tax Return For Estates And Trusts 2012

https://data.formsbank.com/pdf_docs_html/331/3314/331468/page_1_thumb_big.png

MN DoR M4 2020 2022 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/536/51/536051726/large.png

An estate or trust with 600 or more of gross income assignable to Min nesota or that has a nonresident alien as a beneficiary must file Form M2 regardless if it is consid ered a resident An estate or trust with 600 or more of gross income assignable to Minnesota or that has a nonresi dent alien as a beneficiary must file Form M2 regardless if it is consid ered a

The new Schedule M2NM is filed with Form M2 Form M2X or Schedule M2SB if your estate or trust had in come from non Minnesota sources or deductions and losses not allowed by The beneficiaries need this information to complete a Form M1 Minnesota Individual Income Tax Return or Form M2 Income Tax Return for Estates and Trusts The schedule shows each

Instructions Flickr

https://live.staticflickr.com/65535/51842054551_f05abd9074_h.jpg

3290 Installation Instructions Store

https://www.megapacific.com.au/client_images/2410518.jpg

mn form m2 instructions - Enclose a copy of federal Form 1041 Schedules K 1 and other federal schedules Mail to Minnesota Fiduciary Income Tax Mail Station 1310 600 N Robert St St Paul MN 55145 1310