Is Non Earner Benefits Taxable - Worksheets are currently essential tools utilized in a variety of tasks, consisting of education, commerce, and personal management. They offer organized formats that support knowing, planning, and decision-making throughout different levels of complexity, from basic math issues to elaborate business evaluations.

Taxable Vs Nontaxable Fringe Benefits Hourly Inc

Taxable Vs Nontaxable Fringe Benefits Hourly Inc

Worksheets are arranged data that help methodically set up information or tasks. They offer a visual depiction of concepts, allowing users to input, take care of, and evaluate information successfully. Whether made use of in school, conferences, or individual settings, worksheets simplify operations and improve effectiveness.

Worksheet Varieties

Understanding Devices for Children

In educational settings, worksheets are invaluable sources for teachers and students alike. They can range from math problem sets to language understanding workouts, providing chances for practice, support, and assessment.

Work Vouchers

In the business world, worksheets serve numerous features, consisting of budgeting, task planning, and information evaluation. From financial declarations to SWOT analyses, worksheets aid companies make notified choices and track progress towards objectives.

Individual Worksheets

Personal worksheets can be a valuable device for achieving success in various facets of life. They can assist individuals established and function towards objectives, manage their time properly, and check their progress in locations such as health and fitness and financing. By offering a clear structure and feeling of accountability, worksheets can help individuals remain on track and attain their goals.

Benefits of Using Worksheets

The advantages of using worksheets are manifold. They promote active understanding, boost comprehension, and foster vital thinking skills. Additionally, worksheets motivate organization, improve performance, and facilitate cooperation when made use of in team setups.

12 Non Taxable Compensation Of Government Employees 12 Non taxable

Income Replacement Benefits Vs Non Earner Benefit Badre Law PC

Benefits

Benefits Free Of Charge Creative Commons Tablet Dictionary Image

Bir Form 2316 PDF

90k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

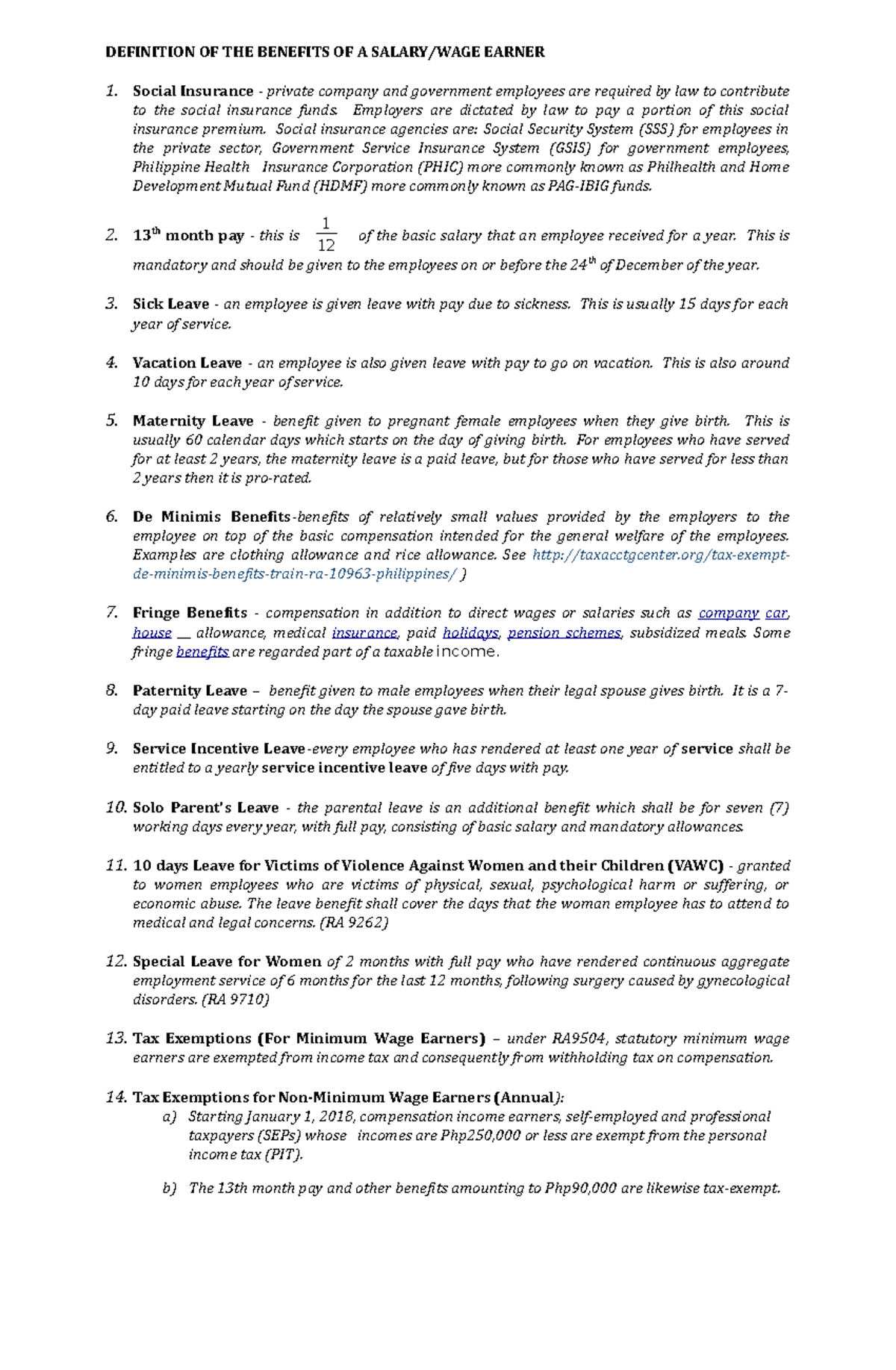

Benefits OF A Salary and WAGE Earner Copy DEFINITION OF THE

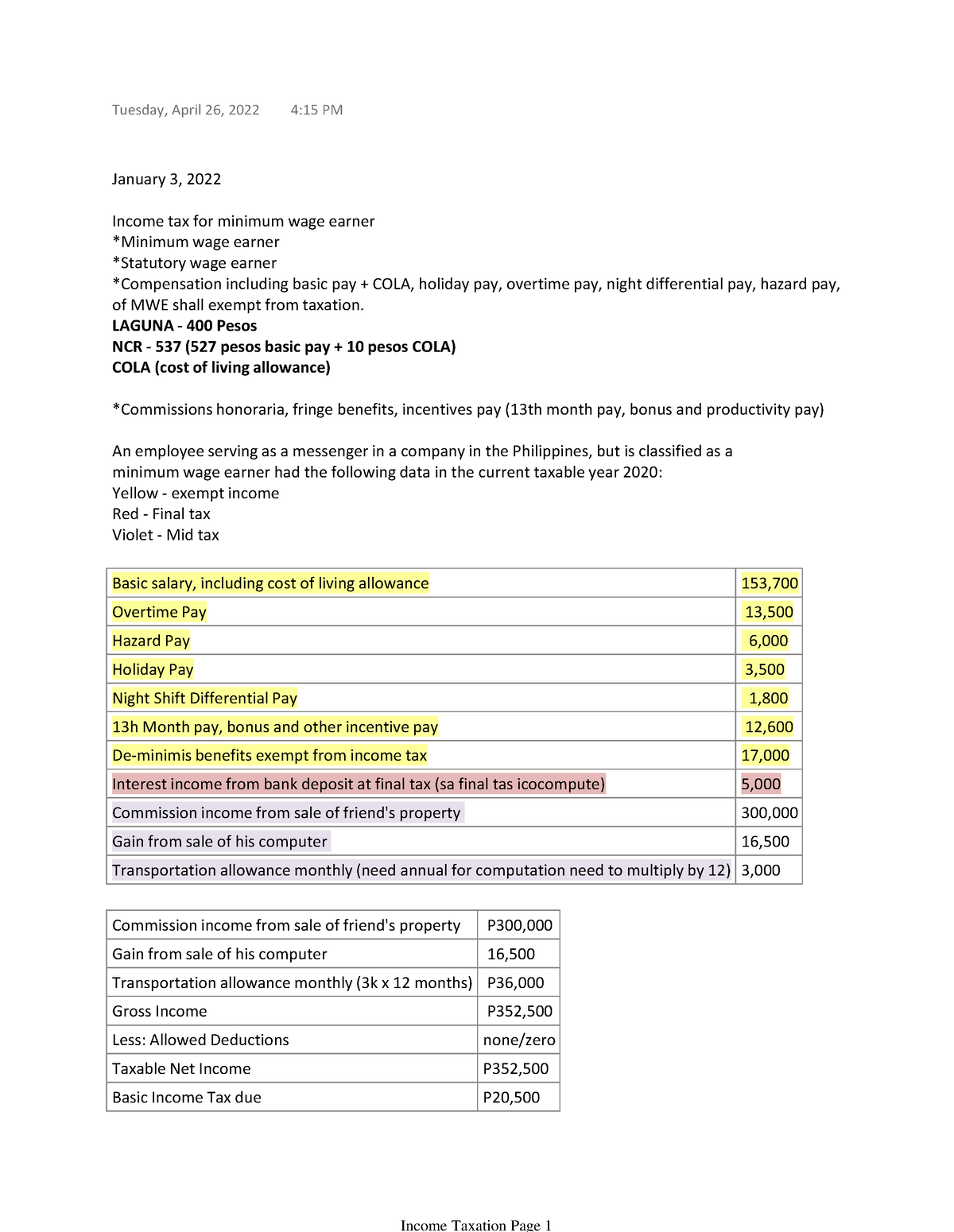

Income Tax For Minimum Wage Earners In The Philippines January 3

Benefits Of Wage Earner Taxable And Non Taxable Benefits PDF

Write Off An Employee s Loan Tax Tips Galley And Tindle