is indirect materials a fixed cost Indirect costs may be either fixed or variable costs An example of a fixed cost is the salary of a project supervisor assigned to a specific project An example of a variable indirect cost would be utilities expense

The cost of indirect materials used is added to the entity s manufacturing overhead cost and thus ultimately made part of the total product cost However if the amount is significantly minor the cost of these materials can be directly charged to expense as incurred during a period Indirect costs on the opposite hand have a tendency to be fixed costs so the expense amount is independent of the manufacturing volume For example if the cost of the legal fee is 5 000 the amount charged remains

is indirect materials a fixed cost

is indirect materials a fixed cost

https://wise.com/imaginary/e167c360aeb98b31c8a93061c9815c10.jpg

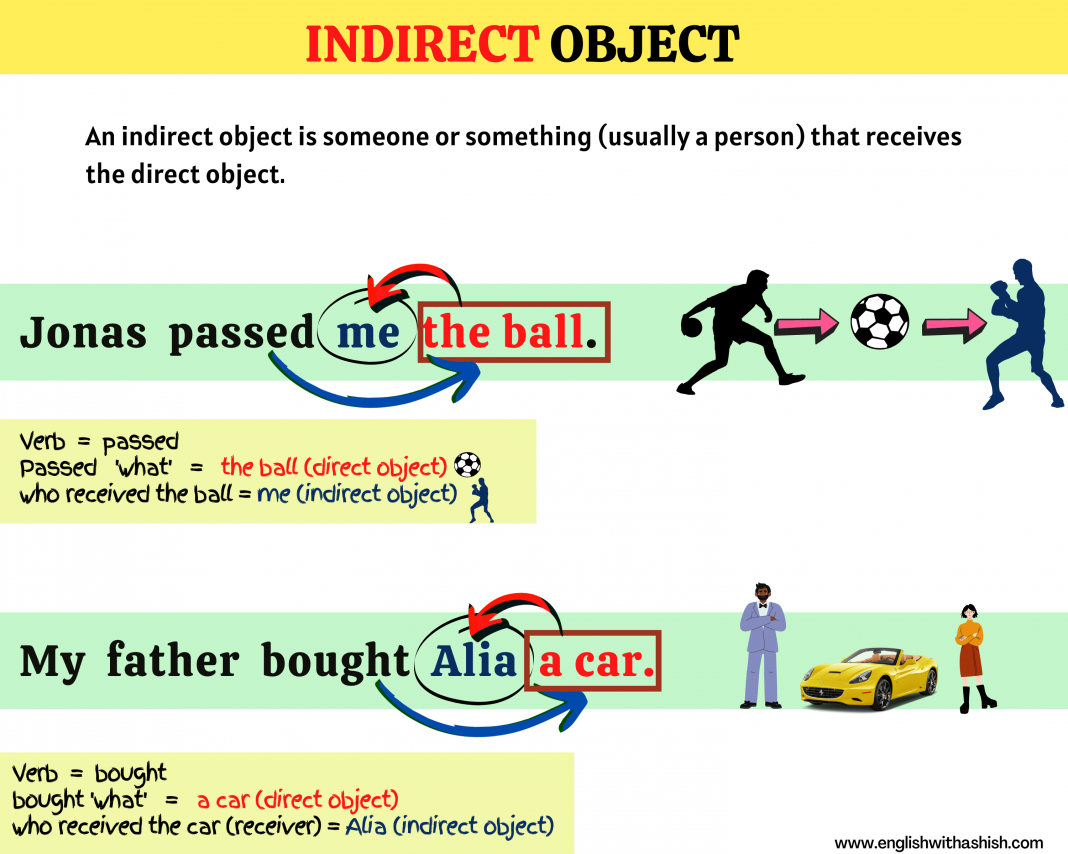

Indirect Object Masterclass A Free Detailed Guide

https://www.englishwithashish.com/wp-content/uploads/2022/02/INDIRECT-OBJECT-2-1068x854.png

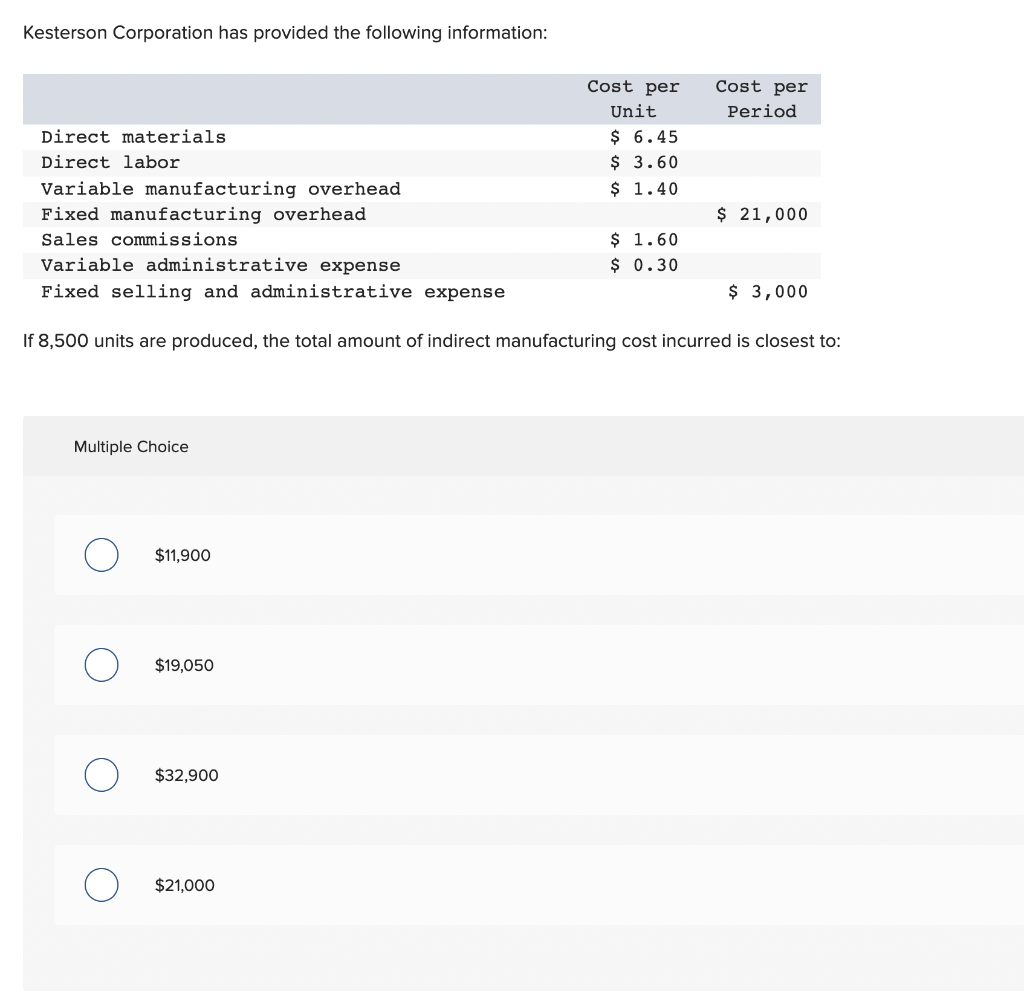

Solved Kesterson Corporation Has Provided The Following Chegg

https://media.cheggcdn.com/media/505/5059ee2c-2d1d-4c0c-a8a8-393c1143a60f/phpIeQtrA

Indirect Materials Cost An indirect material is a material that indirectly forms part of the finished product it cannot be directly charged to the unit or the order Glue nails rivets and other such items are examples of indirect materials To calculate the unit cost of indirect materials the total cost is divided by the number of units How Are Indirect Materials Accounted for Indirect materials are necessary for production costs in a company s financial records They are typically classified as an overhead manufacturing cost and included in the indirect cost pool These costs are allocated to specific production runs or periods based on a predetermined rate

Indirect materials are materials that a company uses in the production process However it cannot link them to a specific job or product They belong to a category of indirect costs In accounting we treat indirect materials as overhead costs or operating expenses and treat them accordingly Since fixed costs are unrelated to a company s production of goods or services they are generally indirect Shutdown points tend to be applied to reduce fixed costs These costs are

More picture related to is indirect materials a fixed cost

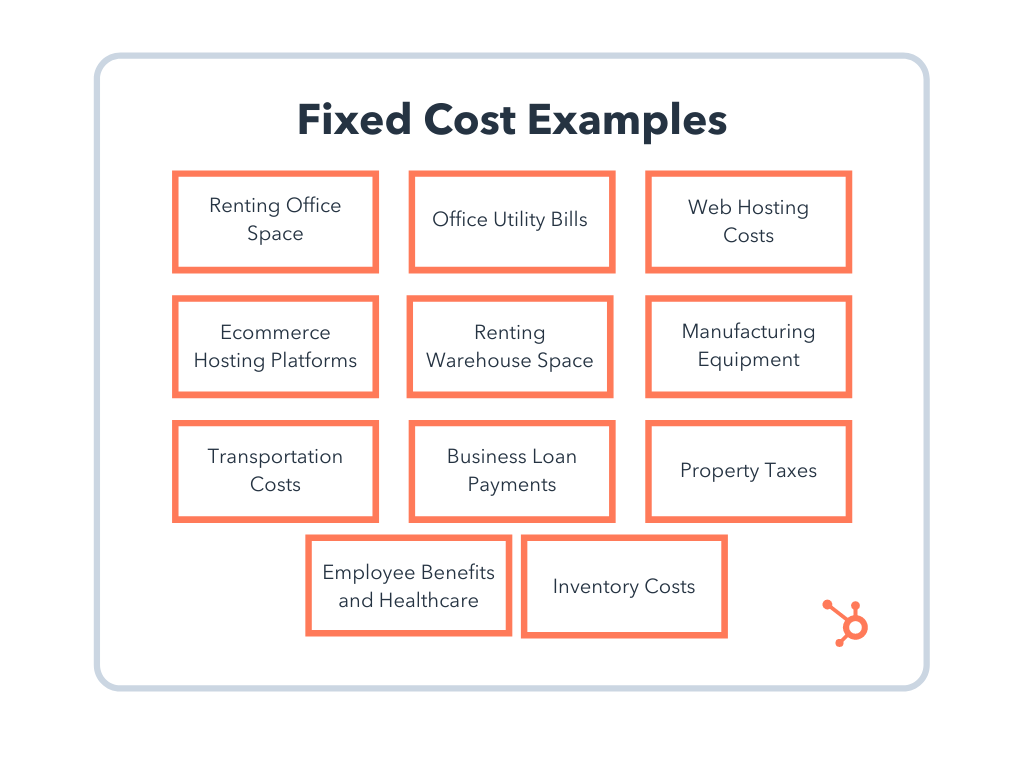

Fixed Cost What It Is How To Calculate It Amplitude Marketing

https://blog.hubspot.com/hs-fs/hubfs/Fixed-Cost-Examples.png?width=1024&name=Fixed-Cost-Examples.png

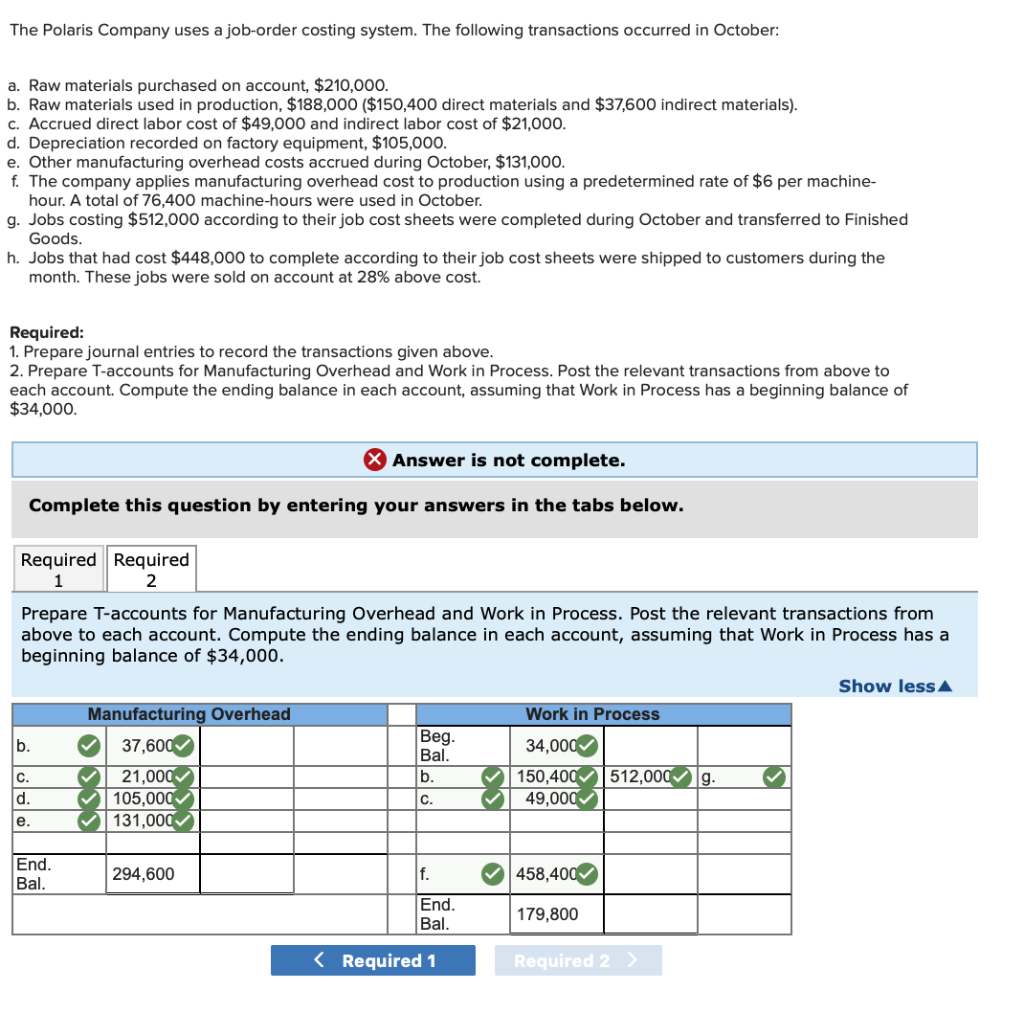

Solved A Raw Materials Purchased On Account 210 000 B Chegg

https://media.cheggcdn.com/media/975/9757e783-307b-4f7c-b4a6-1dcf33748ee5/phpgIMw8L.png

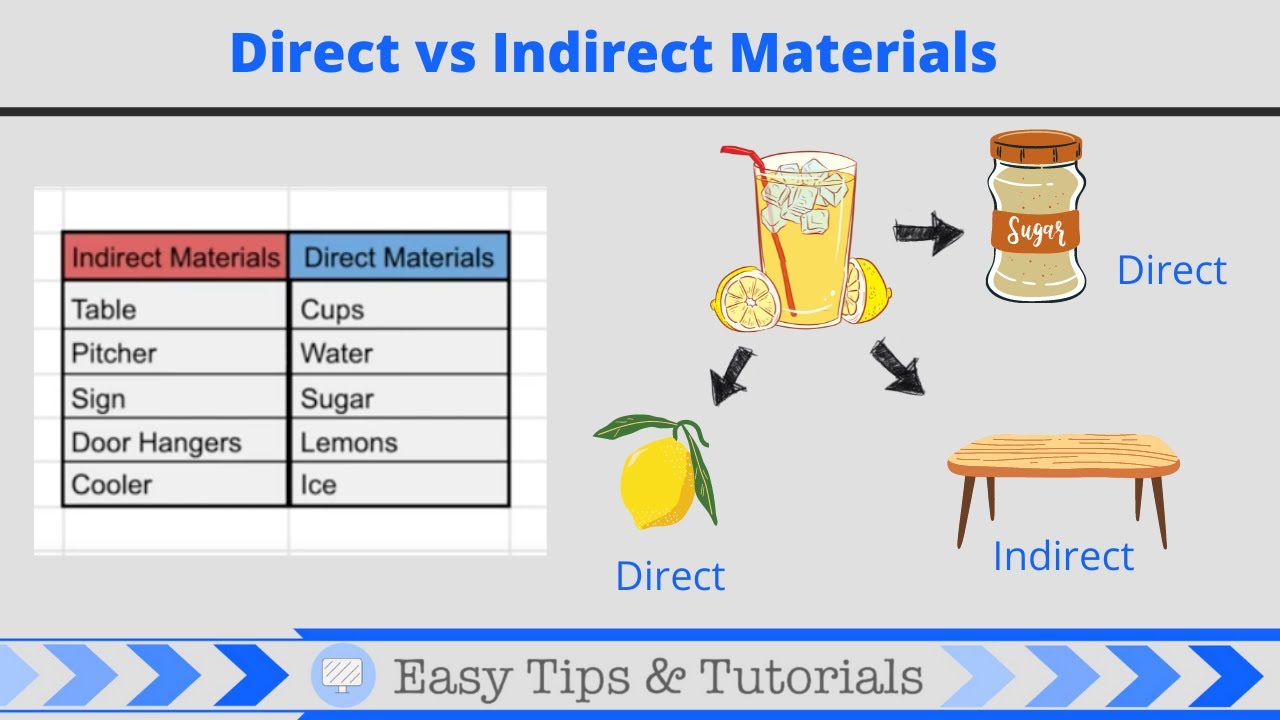

What Is Direct And Indirect Materials YouTube

https://i.ytimg.com/vi/slvNIGDecW4/maxresdefault.jpg

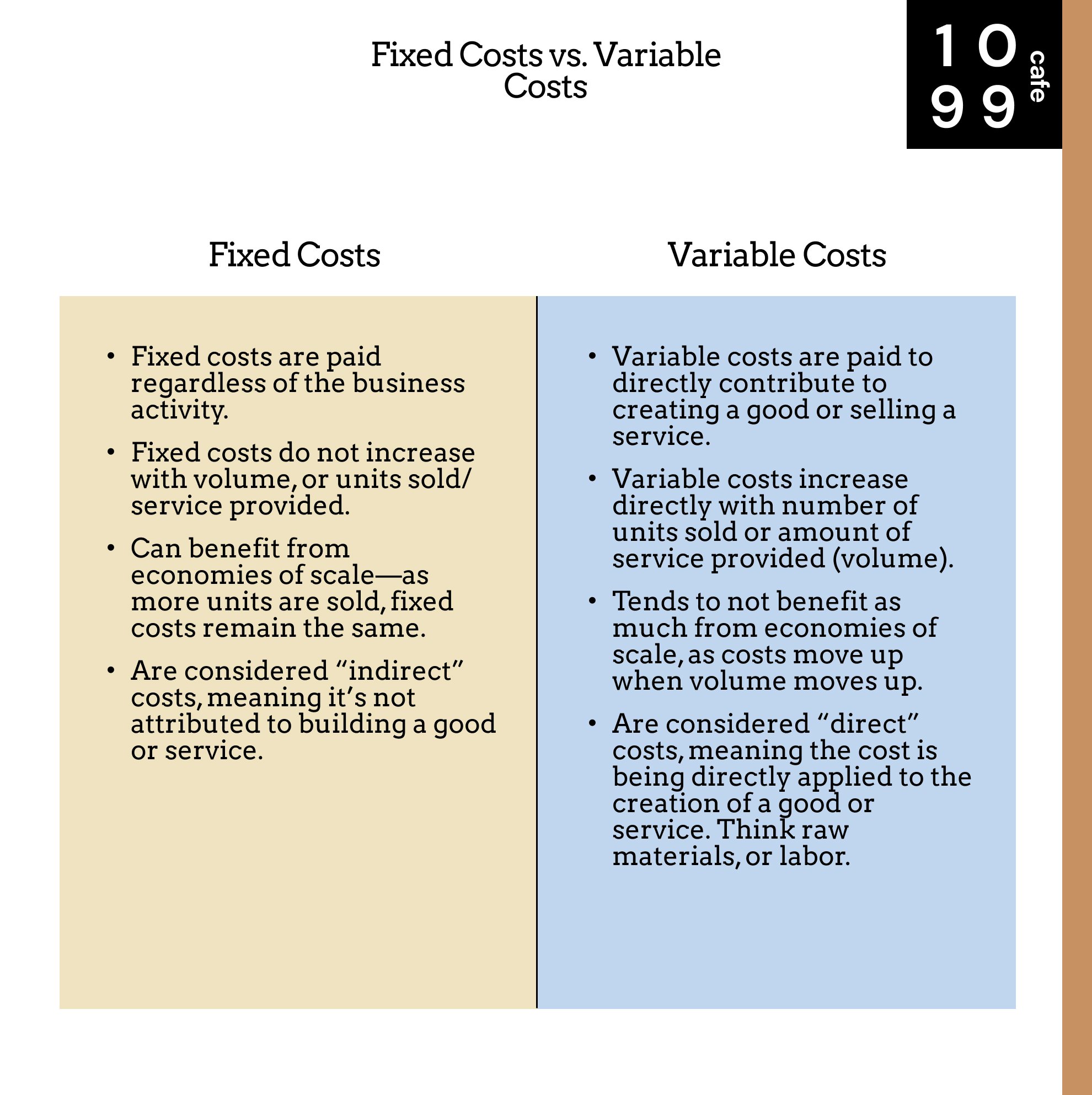

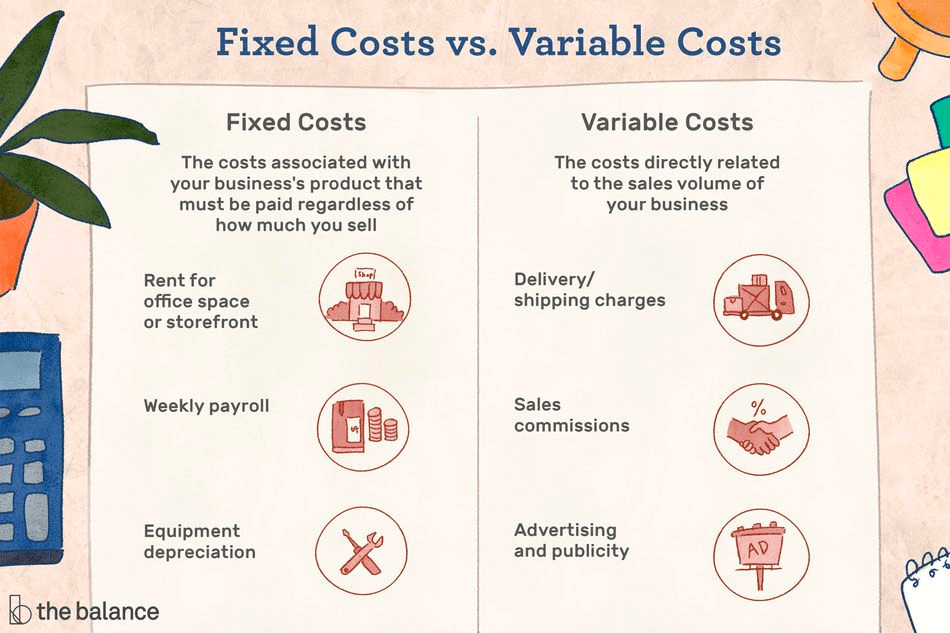

Nature costs are classified as being direct or indirect Behaviour costs are classified as being fixed variable semi variable or stepped fixed Function costs are classified as being production or non production costs Classification by element The main cost elements that you need to know about are materials labour and expenses Fixed Costs vs Variable Costs If the cost object is a product being manufactured it is likely that direct materials are a variable cost If one pound of material is used for each unit then this direct cost is variable However the product s indirect manufacturing costs are likely a combination of fixed costs and variable

[desc-10] [desc-11]

What Is A Fixed Cost Variable Vs Fixed Expenses 1099 Cafe

https://images.squarespace-cdn.com/content/v1/62bf512694446a492e067bbe/93d56c1b-ceeb-46bc-945d-ce17fc7459d6/fixed+costs+vs+variable+costs.jpg

Shortridge Oursend

https://finmark.com/wp-content/uploads/2022/01/difference-between-fixed-and-variable-costs.png

is indirect materials a fixed cost - Indirect Materials Cost An indirect material is a material that indirectly forms part of the finished product it cannot be directly charged to the unit or the order Glue nails rivets and other such items are examples of indirect materials To calculate the unit cost of indirect materials the total cost is divided by the number of units