is 10 apr good on a credit card Banks typically offer credit card APRs in the range of 19 to 28 According to the Federal Reserve s most recently available data as of November 2023 the average interest rate for U S

A good APR for a credit card is around 17 or below A credit card APR in this range is on par with the interest rates charged by credit cards for people with excellent credit which tend to have the lowest regular APRs The average credit card APR overall is around 23 right now according to WalletHub s latest Credit Card Landscape Report A good credit card APR is a rate that s at or below the national average which currently sits above 20 percent While there are credit cards with APRs below 10 percent they are most often

is 10 apr good on a credit card

:max_bytes(150000):strip_icc()/what-does-apr-mean-315004-v3-jl-442b370734d44759ac43d09edcc3fb26.png)

is 10 apr good on a credit card

https://www.thebalancemoney.com/thmb/Zv904594BnlqOHBGatBEgNSCHc8=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/what-does-apr-mean-315004-v3-jl-442b370734d44759ac43d09edcc3fb26.png

What Is Credit Card APR How Yours Affects You Hanover Mortgages

https://blog.mint.com/wp-content/uploads/2020/05/common-kinds-of-credit-card-aprs-1.png?w=2880

What Does APR Mean On A Credit Card

https://m.foolcdn.com/media/affiliates/images/Credit_card_APR_RYhyIj6.2e16d0ba.fill-1080x1080.jpg

Anything below the average credit card interest rate 23 55 for new offers as of February 2023 according to a LendingTree study is generally considered a good APR and anything above that rate is considered high However the criteria for a good APR varies widely depending on the card category A card s APR is the annual cost of borrowing money using the card For instance say you make a 1 000 purchase using your credit card but can t pay the balance in full If your credit card has

The annual percentage rate APR on a credit card is the annual interest you ll pay if you carry a balance This is a cost that s charged to credit card customers by card issuers for the privilege of borrowing money APR has a slightly different meaning for credit cards than it does for other financial products including personal loans According to creditcards s weekly rate report here are the average APRs currently being offered per card type as of July 21 2021 Low interest cards 12 98 Cash back cards 16 10

More picture related to is 10 apr good on a credit card

What Is Credit Card Apr Discovery Credit

https://discoverycredit.com.au/wp-content/uploads/2023/07/istockphoto-547169082-612x612-1.jpg

What Is A Credit Card Apr Login Pages Info

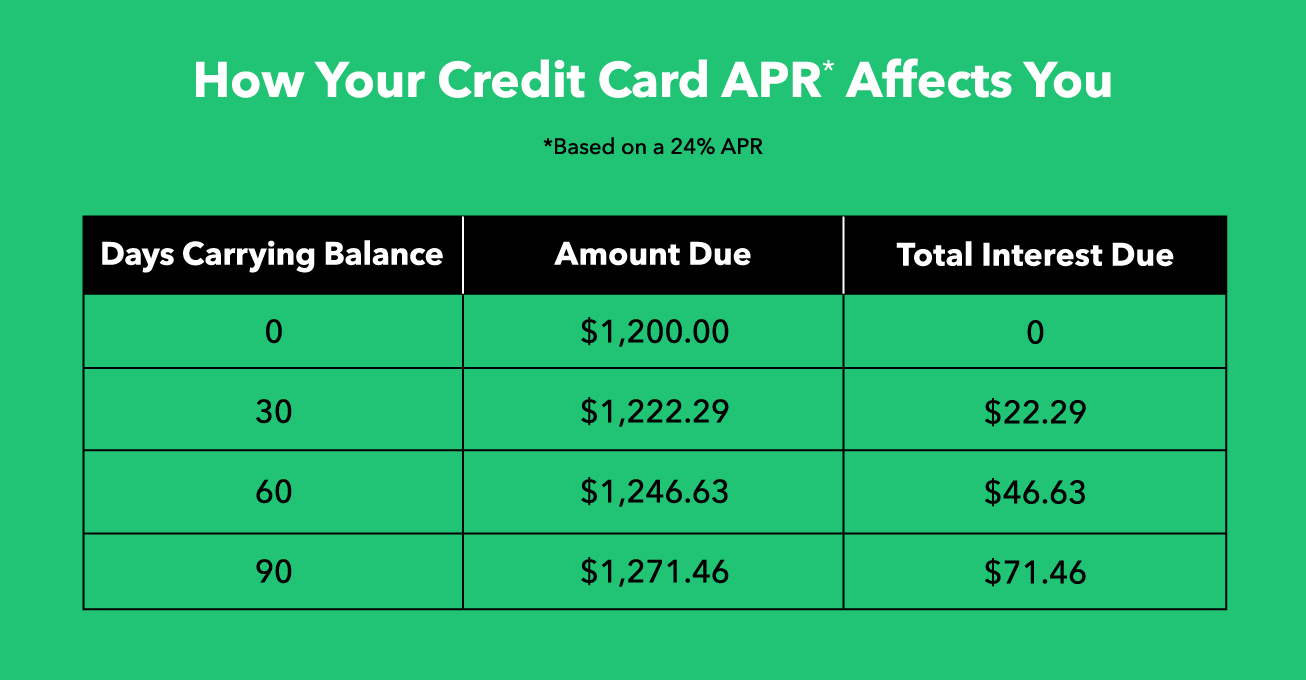

https://blog.mint.com/wp-content/uploads/2020/05/how-your-credit-card-apr-affects-you-1.png?w=2880

Why You Shouldn t Make Small Purchases On A Credit Card To Keep It Open

https://m.foolcdn.com/media/affiliates/original_images/woman_buying_produce_at_grocery_store.jpg?width=1460

Having said that as of mid 2023 you could consider a good APR for a credit card to be anything below the average of 24 24 if you have good credit If you have excellent credit you could What is credit card APR Written by Heather Swick Updated January 31 2023 4 min read Leer en espa ol In a Nutshell An annual percentage rate or APR is the price you pay for borrowing money stated as a yearly interest rate For credit cards interest rate and APR for purchases are essentially the same thing

An annual percentage rate or APR is a financial term that shows the cost to borrow money over one year Credit card companies determine your APR based on your credit score and the APR range for the particular card Updated Sep 01 2023 4 min read Discover it Cash Back CNET Rating CNET rates credit cards by comparing their offers to those of their categorical competitors Each card is individually

What Is APR On A Credit Card And How Does It Work

https://images.inkl.com/s3/article/lead_image/18091088/Recommends_what_is_apr_on_a_credit_card.jpg

What Is Apr On A Credit Card Hanfincal

https://hanfincal.com/wp-content/uploads/2022/05/what-is-apr-on-a-credit-card.jpg

is 10 apr good on a credit card - A card s APR is the annual cost of borrowing money using the card For instance say you make a 1 000 purchase using your credit card but can t pay the balance in full If your credit card has