irs ps 58 rate table The determination of whether the premium charges straddle the costs is based on the IRS Premium Table rates not the actual cost You can view the Premium Table in

Rates IRS Table 2001 PS 58 Rates Age Prudential Pruco Life Product Rates IRS Table 2001 PS 58 Rates Age Prudential Pruco Life Product Rates IRS Table 2001 PS 58 Rev Rul 64 328 held that the table of one year premium rates set forth in Rev Rul 55 747 1955 2 C B 228 commonly referred to as the P S 58 rates may be used to determine

irs ps 58 rate table

irs ps 58 rate table

https://www.iol.pt/multimedia/oratvi/multimedia/imagem/id/54199e700cf26c21209c58e0/

IRS 2024

https://img.cs-finance.com/img/the-basics/how-to-use-the-irs-tax-rate-table-1.jpg

New Wheels And Tires On The Old Rancher Honda ATV Forum

https://www.hondaatvforums.net/attachments/img_8115-jpg.139326/

This is referred to as a P S 58 cost The IRS has a table Table 2001 that explains how to figure out how much insurance protection you need at a certain age The following is the Issued with Notices 2001 10 and 2002 8 the Table 2001 rates replace the prior P S 58 mortality tables issued by the IRS in 1946 and measure the value of current life

Review contracts between the employer and employees for splitting the costs and benefits of life insurance policies Determine how the economic benefit being provided the If one is using the lower published premium rates instead of the PS 58 Tables or Table 2001 is the rate being used a published rate available to all persons who apply

More picture related to irs ps 58 rate table

Lo D PS 58

https://audio-heritage.jp/LO-D/player/ps-58.jpg

IRS Increases Standard Mileage Rate For The Second Half Of 2022

https://www.trans4mind.com/counterpoint/index-finance-business/irs-increases-standard-mileage-rate1.jpg

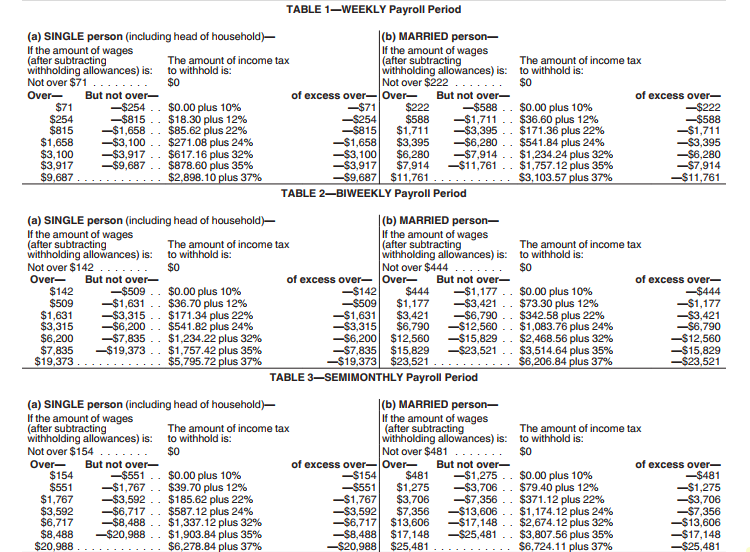

IRS Weekly Withholding Income Tax Table Federal Withholding Tables 2021

https://federalwithholdingtables.net/wp-content/uploads/2021/07/irs-releases-new-2018-withholding-tables-to-reflect-tax-1.png

Split dollar arrangements are affected by this Notice in two ways First after 2001 the Internal Revenue Service will no longer accept the PS 58 rates as a proper The plan administrator reports the taxable cost of life insurance the PS 58 cost annually on Form 1099 R Distributions From Pensions Annuities Retirement or

The plan administrator reports the taxable cost of life insurance the PS 58 cost annually on Form 1099 R Distributions From Pensions Annuities Retirement or Notice 2001 10 addresses three important issues affecting SDAs the proper income taxation for equity SDAs P S 58 rates and alternative term rates Equity SDAs

PS Insiste Na Redu o Do IRS E Do IVA Para Fazer Chegar A Retoma

https://psmadeira.pt/wp-content/uploads/2021/11/Conferencia-PS-scaled.jpg

Audio Ease 246 Digital Reverberator VST Torrent VST Crack Loop

https://looptorrent.net/wp-content/uploads/2022/01/246-735x400.jpg

irs ps 58 rate table - Issued with Notices 2001 10 and 2002 8 the Table 2001 rates replace the prior P S 58 mortality tables issued by the IRS in 1946 and measure the value of current life