how to make a personal budget plan Step 1 Calculate your net income The foundation of an effective budget is your net income That s your take home pay total wages or salary minus deductions for taxes and employer provided programs such as retirement plans and health insurance

1 Calculate your net income The first step is to find out how much money you make each month You ll want to calculate your net income which is the amount of money you earn less taxes If SEE YOUR SPENDING Create a budget plan that works for you Before choosing a budget planner you want to decide on a budgeting system As mentioned you could get started with the

how to make a personal budget plan

how to make a personal budget plan

https://images.template.net/wp-content/uploads/2016/11/18110654/Personal-Budget-Weekly-Expenses-Worksheet1.jpg

Budget Strategy Guide How To Calculate Your Finances And Budget Plan

http://www.letsbegamechangers.com/wp-content/uploads/2019/09/load-image-1-2.jpg

6 Steps To Create An Effective Personal Budget Plan Dig This Design

https://digthisdesign.net/wp-content/uploads/2020/02/Personal-Budget.jpg

Whichever method you choose personal budgeting involves three basic routines Track what you earn and what you spend Work to keep the second number lower than the first Lather rinse How to budget money Calculate your monthly income pick a budgeting method and monitor your progress Try the 50 30 20 rule as a simple budgeting framework Allow up to 50 of your income

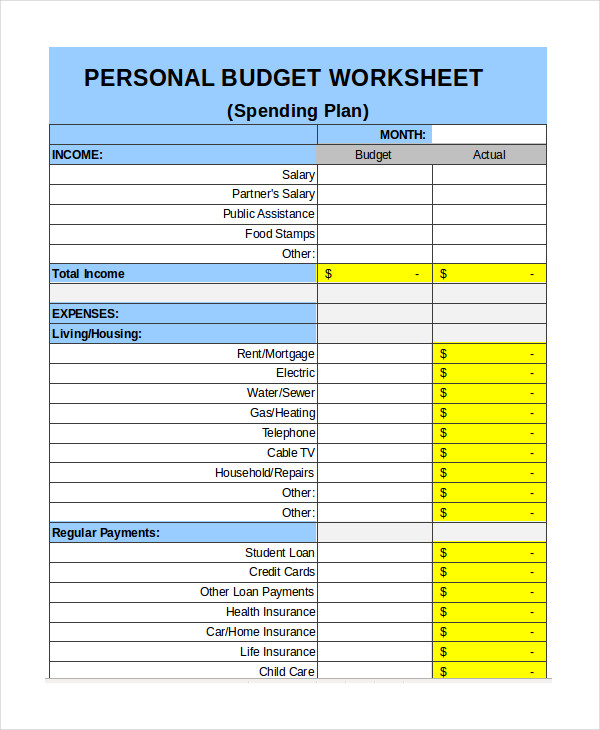

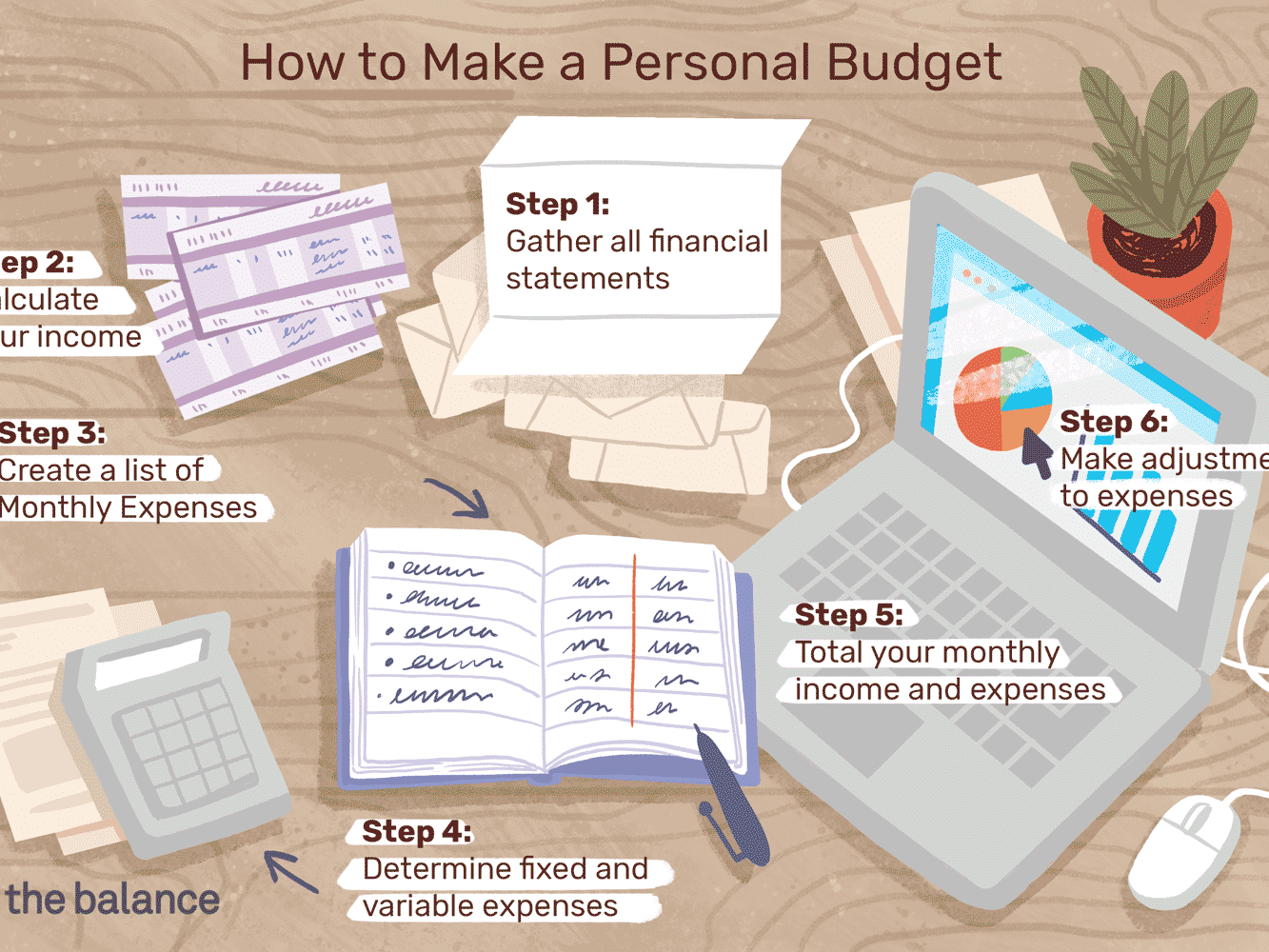

1 Gather bank statements household bills and receipts Lay the groundwork by compiling these financial records as well as info on credit card debt pension contributions and one off spends See our six tips before starting your budget 2 Fill in the free BUDGET PLANNER spreadsheet 1 Add up your income The first step to making a budget is to total your income so that you know how much money you have to work with Everyone s personal finance situation is different but

More picture related to how to make a personal budget plan

Get Our Example Of Easy Household Budget Template For Free Family

https://i.pinimg.com/originals/da/0e/ad/da0ead22d228e8da16addd7a673b6806.jpg

9 KEYS TO CREATING A PERSONAL BUDGET California Business Journal

https://calbizjournal.com/wp-content/uploads/2022/01/how-to-make-a-budget.png

Online Personal Budget Template

https://dremelmicro.com/wp-content/uploads/2020/09/free-10-free-budget-templates-that-will-change-your-life-online-personal-budget-template-pdf.png

1 Use a 50 30 20 calculator A budget calculator will do the math so you don t have to divide dollars and cents Try out the one below for yourself Input your monthly after tax income to get The basic process for making a budget goes like this Add up the monthly income you expect from all sources Categorize and add up the monthly expenses you expect to pay Subtract expenses from income Your goal should be to see how much you have coming in and to set a plan for what goes out Step 1 Add Up Monthly Income

How to Create a Personal Budget Money Many companies featured on Money advertise with us Opinions are our own but compensation and in depth research may determine where and how companies appear Learn more about how we make money Personal Finance Budgeting How to Create a Personal Budget By Peter Burns So how can you make a personal budget for yourself By following the below steps you can build a perfect personal budget and make informed decisions about your money 1 Find the objective It is impossible to predict the future but a few basic questions need to be answered early on in life For example when do you want to retire

How To Make A Household Budget That WORKS the EASY Way Great Tips

https://i.pinimg.com/originals/0a/26/7f/0a267f40a347b7e3730db0f7eb2d7071.jpg

Simple Monthly Budget Template Things That Make You Love And Hate

https://www.ah-studio.com/wp-content/uploads/2020/04/14-free-budget-templates-and-spreadsheets-gobankingrates-simple-monthly-budget-template.png

how to make a personal budget plan - How to create a personal budget in 8 easy steps Step 1 Determine your monthly expected income Step 2 List all of your fixed expenses Step 3 Total your fixed expenses Step 4 List all of your variable expenses Step 5 Total your variable expenses Step 6 Break your monthly expenses down into categories Step 7 Evaluate your