how to file a 1099 k from uber Your 1099 K is an official IRS tax document that includes a breakdown of your annual on trip gross earnings Who gets it We ll send you a 1099 K if You earned more than

How to use your Uber 1099s taxes for Uber drivers Form 1099 K decoded for the self employed Key tax reform changes that could affect you next year Understanding your 1099 K An official IRS tax document that includes all on trip gross earnings Not all drivers and delivery people will receive a 1099 K Only drivers and couriers who made more

how to file a 1099 k from uber

how to file a 1099 k from uber

https://i.ytimg.com/vi/Szljpdrngts/maxresdefault.jpg

Lost Your 1099 Form FundsNet

https://fundsnetservices.com/wp-content/uploads/Lost-your-1099-Form.png

How To File Your Uber Driver Tax With Or Without 1099

https://uploads-ssl.webflow.com/60b7736b59f1400cad97bd5f/617fcbe45891d5023e1b097c_sample form 1099-NEC for uber driver tax.png

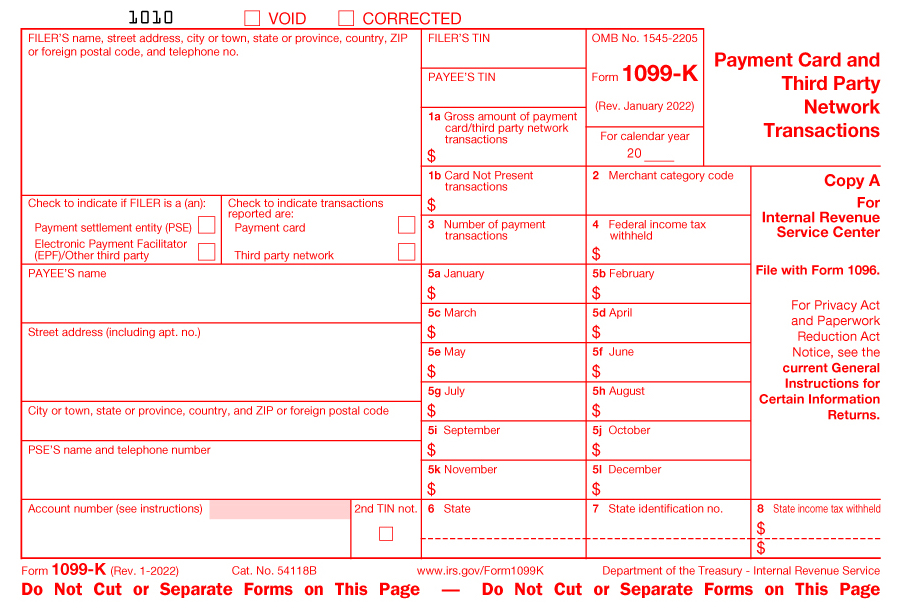

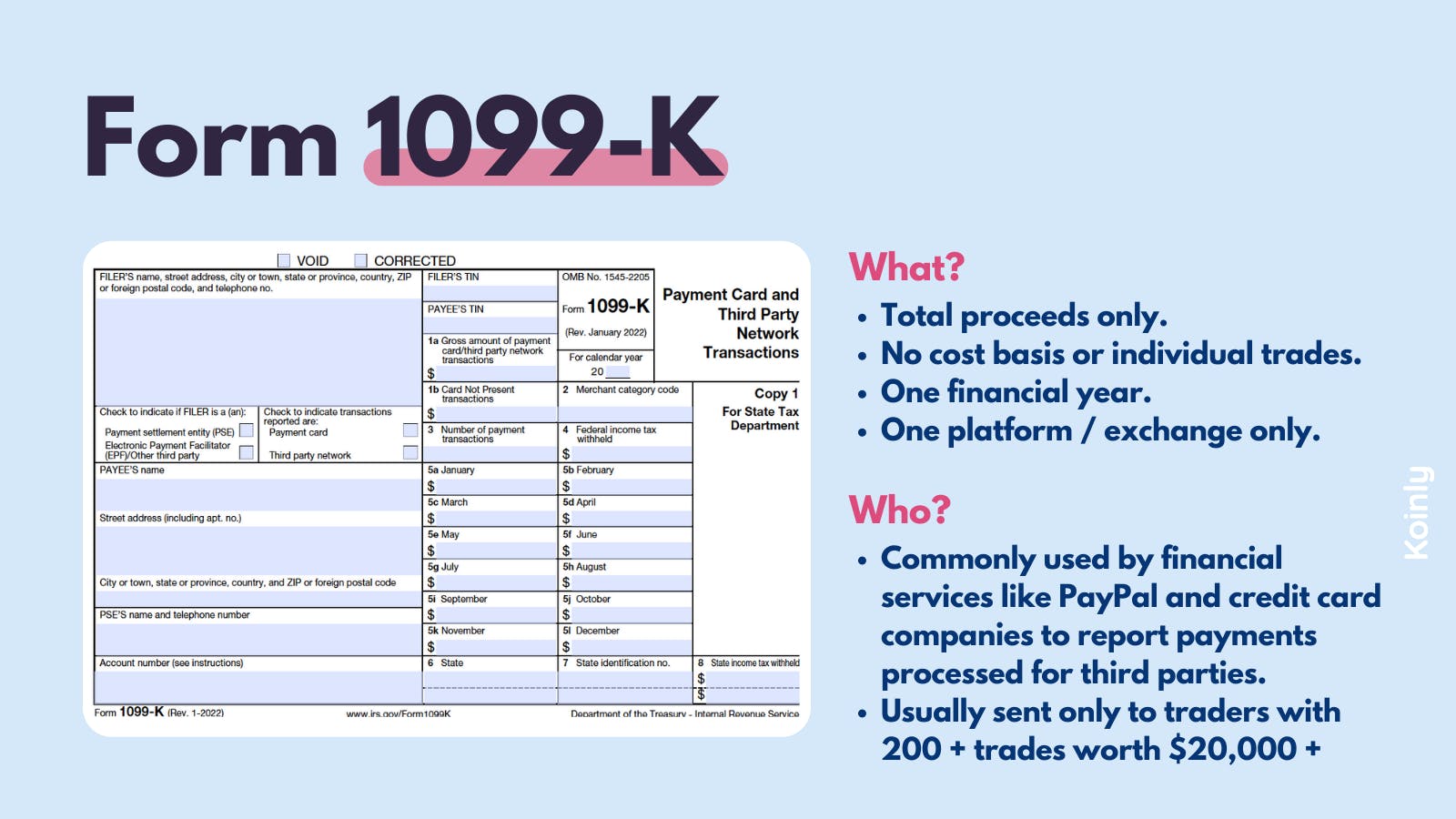

1099 K This form reports your earnings from third party network transactions such as payments from customers Qualifying for 1099 K You ll receive this form if your annual gross earnings As an Uber driver you may receive the following documents for tax purposes 1099 K For drivers who meet certain earning thresholds 1099 NEC If you ve received non employee

Explaining the 1099 K Form The 1099 K form is a tax document you ll receive if you ve earned over 600 from rides with Uber It reports all transactions between riders and drivers You can Instead of using a W 2 to report income self employed professionals must use a 1099 when filing taxes Uber drivers fall under the rules for a 1099 K for their driving services and a 1099 MISC for any other payouts

More picture related to how to file a 1099 k from uber

IRS Reintroduces Form 1099 NEC For Non Employees Wendroff

https://lh4.googleusercontent.com/Yqn5aOoQW5V6DMCy7QTGXTwpCLjJp40-KdNljm2hP3_1N1OQdMbyWkFsr-cyHCnApS_IOnFuwQPanmObDUp2v7z4wkB41dcn001c7GNDjbd6jocAd1Jr4wDteaQxkk-ZLydd1oTY

2023 Tax Documents From TD Ameritrade And Charles Schwab EKS Associates

https://eksassociates.com/wp-content/uploads/2024/01/form-1099-scaled.jpeg

How To File A 1099 Form For Vendors Contractors And Freelancers

https://assets-global.website-files.com/60a6b551be6130e4e5b19b98/6184e97fc0fca378123537f5_Screen Shot 2021-11-03 at 8.41.45 AM.png

The 1099 K you receive from Uber includes all fees customers paid for any drives you accepted This is your gross income but Uber sends a tax summary showing the exact amount of the direct deposits you received which Drive for Uber When it comes to tax time you are considered self employed Here s what to know about 1099 MISC 1099 K forms and how to file Uber taxes

Tax Documents Bring Forms 1099 NEC 1099 K W 2 if you had an employer and last year s tax return You will likely find your 1099 K and 1099 NEC on your driver dashboard If you did 1099 K Your driving income This includes the amounts paid by riders the gross fares for your rides as well as fees related to your driving income like tolls sales tax

1099 K Forms Reporting Requirements For 2023

https://lili.co/wp-content/uploads/2022/12/1099-K_Form_1000x1294-1.jpg

IRS Crypto 1099 Form 1099 K Vs 1099 B Vs 1099 MISC Koinly

https://images.prismic.io/koinly-marketing/a04aa430-f0f5-4c03-9dd9-3f4670d8ed2b_Form+1099-K.png?auto=compress,format

how to file a 1099 k from uber - If you qualify to receive a 1099 the easiest way to access your document is to download it directly from your Driver Dashboard To do this Log in to drivers uber and click the Tax