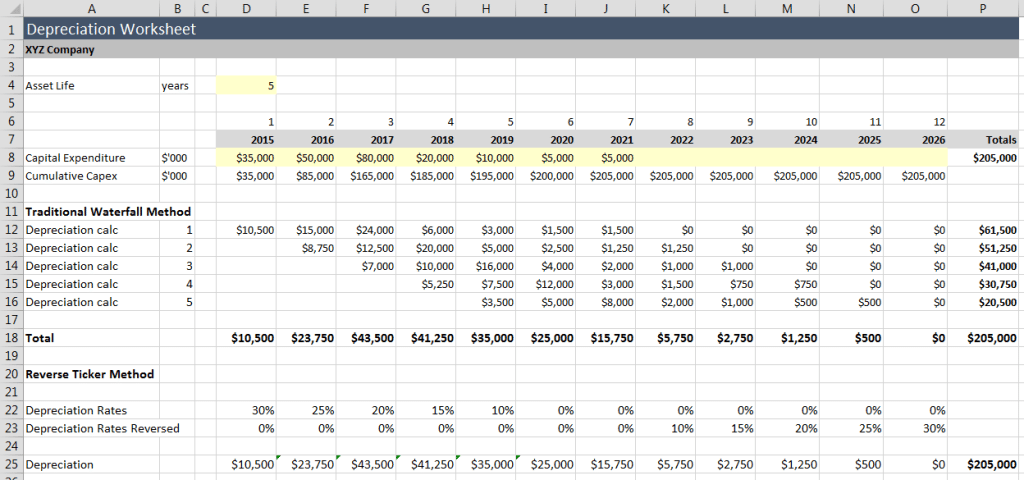

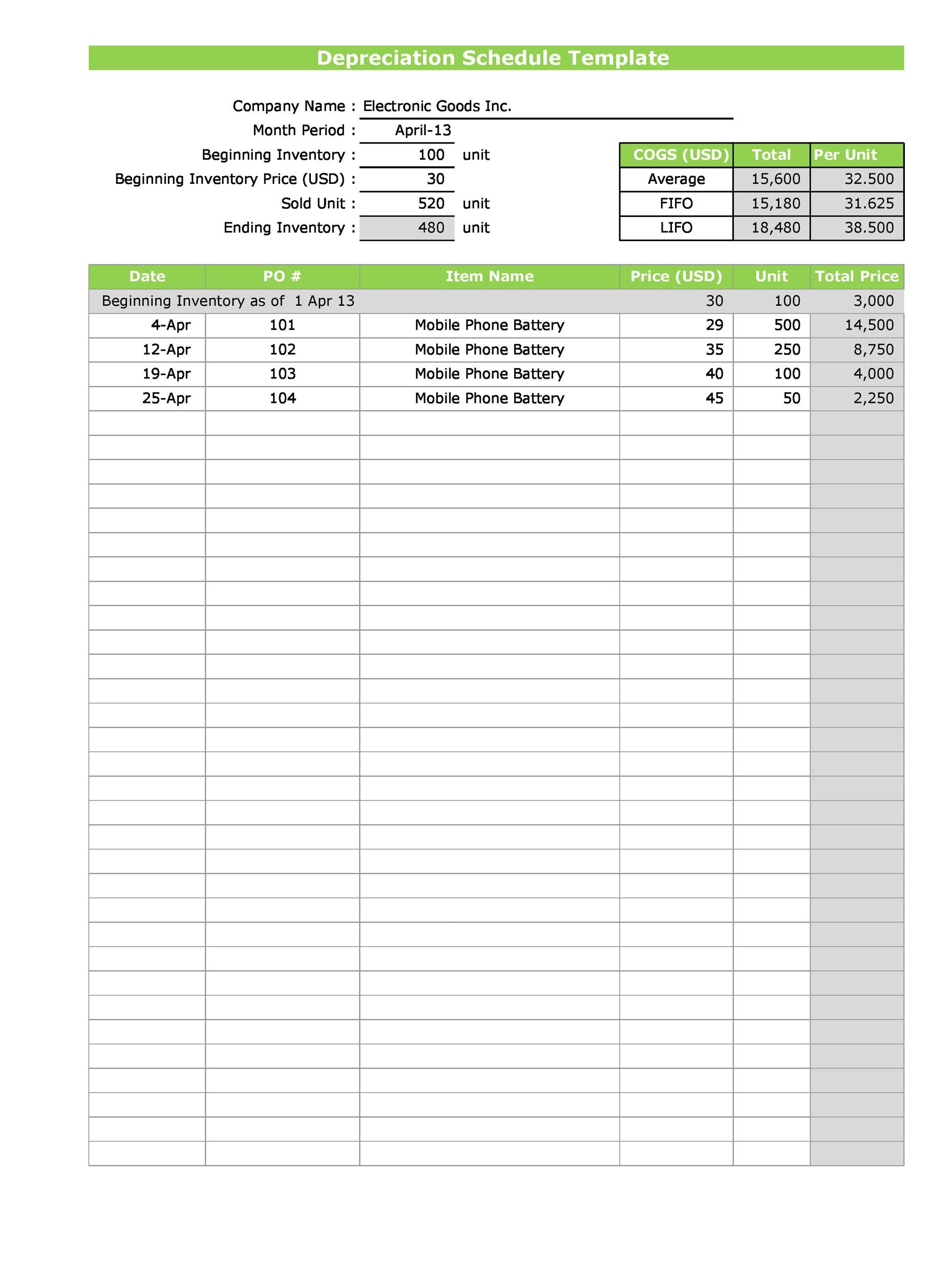

how to create a monthly depreciation schedule in excel The depreciation schedule records the depreciation expense on the income statement and calculates the asset s net book value at the end of each accounting period Our Excel spreadsheet will allow you to track and calculate depreciation for up to 25 assets using the straight line method

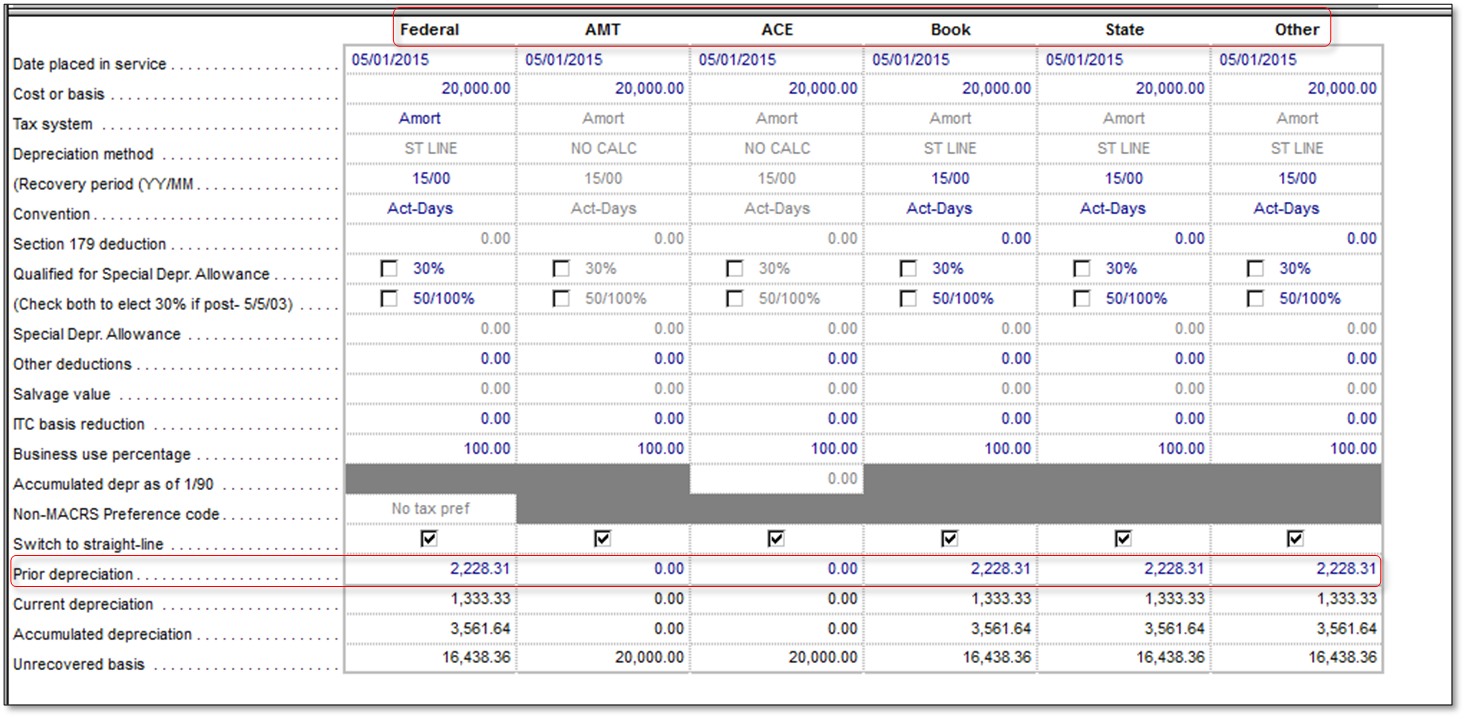

The syntax is SYD cost salvage life per with per defined as the period to calculate the depreciation The unit used for the period must be the same as the unit used for the life e g years months etc This page is the first of a 3 part series covering Depreciation in Excel Part 1 provides a Depreciation Schedule for financial reporting and explains the formulas used for the basic common depreciation methods Part 2 discusses how to calculate the MACRS depreciation Rate using Excel formulas

how to create a monthly depreciation schedule in excel

how to create a monthly depreciation schedule in excel

https://i.ytimg.com/vi/jf5JhKFh0Zg/maxresdefault.jpg

How To Calculate Depreciation Excel Haiper

https://accessanalytic.com.au/wp-content/uploads/2015/09/Deprecation-Modelling-2-1024x480.png

Cost For Latest Version Of Excel Fecolswap

https://www.journalofaccountancy.com/content/jofa-home/issues/2021/may/how-to-calculate-depreciation-in-excel/_jcr_content/contentSectionArticlePage/article/articleparsys/image_395166678.img.jpg

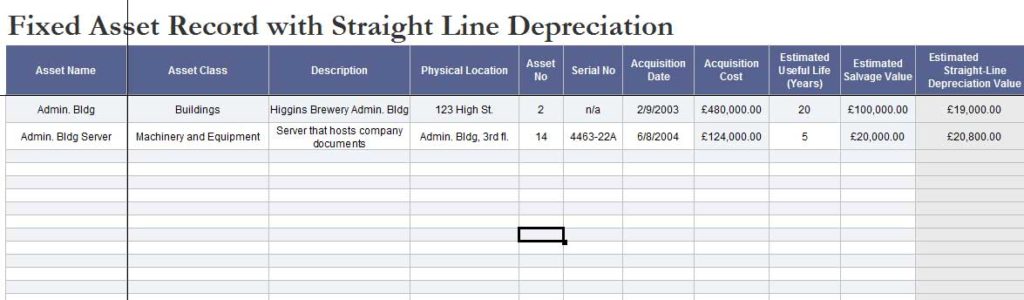

A depreciation schedule is required in financial modeling to forecast the value of a company s fixed assets balance sheet depreciation expense income statement and capital expenditures cash flow statement Depreciation occurs as an economic asset is used up Economic assets are different types of property plant and equipment PP E In this article we ll teach you how to make a depreciation worksheet in Excel from assembling column headers to entering formulas and explain the usage and arguments in each depreciation formula We ve also prepared a downloadable depreciation worksheet template that s ready to use

I demonstrate two methods for creating the depreciation schedule the first method works in any version of Excel The second method only works in Excel 365 and uses dynamic array formulas 1 Open Microsoft Excel and rename the first tab to Depreciation Schedule If several schedules are preferred for comparison sake name the tab to something like SL Depreciation Schedule Other tabs can be created for Double Declining Balance etc 2 Place a title such as Straight Line Depreciation Schedule in row one 3

More picture related to how to create a monthly depreciation schedule in excel

Fixed Asset Depreciation Excel Spreadsheet Template124

https://www.template124.com/wp-content/uploads/2017/02/Fixed-Asset-Depreciation-Excel-1024x300.jpg

Fixed Asset Depreciation Schedule Excel Excel Templates

https://km-ext.ebs-dam.intuit.com/content/dam/km/external/salesforce/7000s/7800-7999/7958_03.png

Depreciation Schedule Template Excel Free Free Printable Templates

https://soulcompas.com/wp-content/uploads/2020/09/fixed-asset-monthly-depreciation-schedule-excel-template.jpg

Excel has a small selection of functions for various ways of calculating depreciation built in SLN The straight line function is the simplest SLN cost salvage life Cost is the cost of the asset Salvage is the salvage value of the asset Life is the number of periods over which the asset will be depreciated Instructions The Excel depreciation calculator available for download below is used to produce a straight line depreciation schedule by entering details relating to the cost and salvage value of the asset and the straight line depreciation rate The straight line depreciation schedule calculator is used as follows Step 1

How to calculate depreciation in Excel by Ilker Dec 27 2021 Excel Tips Tricks Excel supports various methods and formulas to calculate depreciation There 7 built in functions dedicated to depreciation calculation In this guide we re going to show you How to calculate depreciation in Excel in 7 ways Depreciation types in this article The formula for straight line depreciation is as follows Annual Depreciation Expense Cost of the Asset Salvage Value Useful Life of the Asset Where Cost of the asset is the purchase price of the asset Salvage value is

Depreciation Schedule Samples Find Word Templates

https://i0.wp.com/www.findwordtemplates.com/wp-content/uploads/2016/09/Depreciation-Schedule-4..gif?fit=652%2C505&ssl=1

Depreciation Schedule Template

https://templatelab.com/wp-content/uploads/2017/08/depreciation-schedule-template-09.jpg

how to create a monthly depreciation schedule in excel - Type cost into cell A1 and 5 000 into B1 Next type salvage value into cell A2 and 500 into cell B2 Type useful life into cell A3 and 5 into cell B3 Type period into cell A5 and