how to calculate gratuity in zambia How is employee Gratuity calculated in Zambia Gratuity calculator formula for the year 2023 consists of the Basic amount Rate devided by 100 to find percentage rate period an employee has worked

The standard gratuity percentage in Zambia is 25 The calculator will first calculate your total earnings for the period of service This is done by multiplying your basic pay by the number of months you have worked The calculation of gratuity amount by 25 in Zambia

how to calculate gratuity in zambia

how to calculate gratuity in zambia

https://i.ytimg.com/vi/JGsVsReNPBc/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AGMAoAC4AOKAgwIABABGH8gHCgwMA8=&rs=AOn4CLD_dyIDXHFDS8OMgD9s0xdBjFvGvg

How To Calculate Employee Gratuity In The UAE Caterer Middle East

https://www.caterermiddleeast.com/cloud/2022/02/16/pexels-photo-6963030-scaled.jpeg

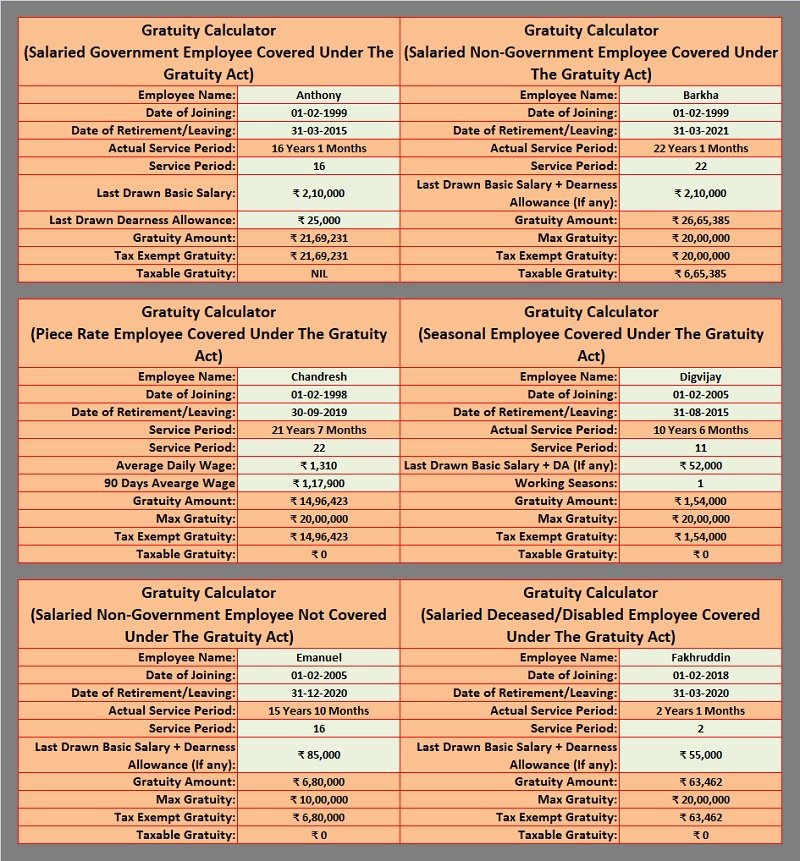

Download Gratuity Calculator India Excel Template MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2021/07/Gratuity-Calculators.jpg

Qualifying gratuity paid is taxed as follows Qualifying Gratuity Bands Rates First K12 000 000 0 Above K12 000 000 25 Non qualifying gratuity is added to the salary for the month in which it is paid and taxed with reference to the appropriate P A Y E tax According to the Zambian labor laws an employer shall at the end of a long term contract period pay an employee gratuity at a rate of not less than 25 of the employee s basic pay earned during the period of the contract

If an employee on a permanent contract is terminated before attaining retirement age they are entitled to a benefit in form of severance pay generally calculated on the same basis as gratuity Section 54 1 b Gratuity is usually at an employer s discretion the Act makes payment of gratuity mandatory for all employees on fixed term contracts at a rate of not less than 25 of an employee s basic pay

More picture related to how to calculate gratuity in zambia

Download Gratuity Calculator India Excel Template MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2021/07/Gratuity-Calculator-India.jpg

How To Calculate Gratuity Gratuity Calculation Formula

https://i0.wp.com/www.theworldbeast.com/wp-content/uploads/2021/12/gratuity.jpg?fit=1000%2C667&ssl=1

How To Calculate Your Gratuity In UAE Gratuity Calculator 2024

https://www.edarabia.com/wp-content/uploads/2018/10/how-calculate-your-gratuity-uae.jpg

The employer shall at the end of the fixed term contract pay an employee a severance pay in the form of gratuity at the rate of 25 or a retirement benefit provided by the relevant social security scheme and where a contract of fixed duration is terminated gratuity shall be Chargeable Emoluments for PAYE purposes means emoluments from an employee s employment that are chargeable to income tax but does not include any amount which is exempt from income tax

[desc-10] [desc-11]

Gratuity In The Employment Act In Zambia Musonda Speaks HR

https://musondaspeakshr.files.wordpress.com/2019/04/labour-law-1155x770.jpg?w=870&h=770&crop=1

Gratuity Payment Formula And How To Calculate The Gratuity Online

https://www.financesrule.com/wp-content/uploads/2020/04/gratuity-payment.jpg

how to calculate gratuity in zambia - Qualifying gratuity paid is taxed as follows Qualifying Gratuity Bands Rates First K12 000 000 0 Above K12 000 000 25 Non qualifying gratuity is added to the salary for the month in which it is paid and taxed with reference to the appropriate P A Y E tax