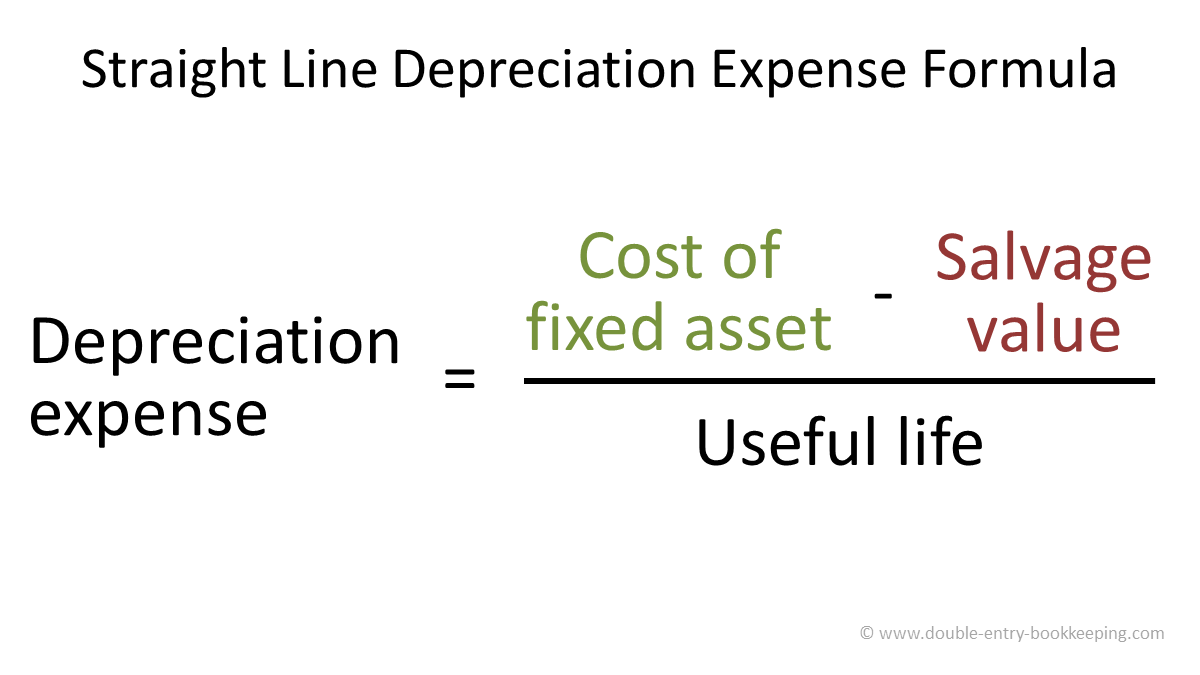

how to calculate depreciation on fixed assets Learn how to calculate depreciation here Fixed Installment or Equal Installment or Original Cost or Straight line Method Under this method we deduct a fixed amount every year from the original cost of the asset and charge it to the profit and loss A c Formula Depreciation frac Cost of asset Residual value Useful life Rate of

What is Depreciation accounting Information on accounting and hot to calculate the depreciation of the fixed assets within your company Depreciation is the reduction in the value of a fixed asset due to usage wear and tear the passage of time or obsolescence The loss on an asset that arises from depreciation is a direct consequence of the services that the asset gives to its owner

how to calculate depreciation on fixed assets

how to calculate depreciation on fixed assets

https://www.wikihow.com/images_en/thumb/e/e1/Calculate-Depreciation-on-Fixed-Assets-Step-17-Version-3.jpg/v4-1200px-Calculate-Depreciation-on-Fixed-Assets-Step-17-Version-3.jpg

How To Calculate Depreciation On Fixed Assets Fixed Asset Math

https://i.pinimg.com/736x/44/85/04/448504e702ccbb9b3a518d4335d16e95--fixed-asset-accounting.jpg

How To Calculate Depreciation Maths Haiper

https://i.pinimg.com/736x/24/e5/e0/24e5e01a09e8f453415b726c34938b32--fixed-asset-accounting.jpg

Depreciation is an indirect expense systematically charged on tangible fixed assets to provide the actual cost of an asset over its useful life is proportional to benefits derived from such assets The calculation of the depreciation equation requires knowledge of some factors Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes Here are the different depreciation methods and how they work

What is the Depreciation Rate for Fixed Assets 3 Methods of Depreciating Fixed Assets Straight Line Depreciation Declining Balance Depreciation Double Declining Balance Depreciation How to Depreciate Fixed Asset in 5 Steps Step 1 Determine the Depreciation Period of the Asset Step 2 Set the Depreciation Rate Depreciation is a non cash expense that allocates the purchase of fixed assets or capital expenditures Capex over its estimated useful life The depreciation expense reduces the carrying value of a fixed asset PP E recorded on a company s balance sheet based on its useful life and salvage value assumption

More picture related to how to calculate depreciation on fixed assets

How To Calculate Depreciation Expense Per Year Haiper

https://www.wikihow.com/images/thumb/6/63/Calculate-Depreciation-on-Fixed-Assets-Step-14-Version-4.jpg/aid1410799-v4-728px-Calculate-Depreciation-on-Fixed-Assets-Step-14-Version-4.jpg

4 Ways To Calculate Depreciation On Fixed Assets WikiHow

https://www.wikihow.com/images/thumb/0/02/Calculate-Depreciation-on-Fixed-Assets-Step-10-Version-3.jpg/aid1410799-v4-728px-Calculate-Depreciation-on-Fixed-Assets-Step-10-Version-3.jpg

Practical Of Straight Line Depreciation In Excel 2020 YouTube

https://i.ytimg.com/vi/jf5JhKFh0Zg/maxresdefault.jpg

Now that you know how to calculate the depreciation of fixed assets take a look at our comprehensive step by step approach From determining asset cost to selecting the depreciation method we ll walk you through each crucial stage Depreciation is the allocation of the cost of a fixed asset over a specific period of time The Ascent explains depreciation basics and how does it affect your business

[desc-10] [desc-11]

Calculation Of Depreciation On Rental Property InnesLockie

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/07/20042010/OFFSET.jpg

D Is For Depreciation Simply Taxes CPA PLLC

https://simplytaxesaz.com/wp-content/uploads/2020/08/straight-line-depreciation-formula.png

how to calculate depreciation on fixed assets - [desc-12]