how to calculate 80ccd 2 Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this section you can claim a deduction of

A complete guide on Section 80CCD 2 of income tax act Also find out the deduction under Section 80CCD 2 for FY 2024 25 AY 2025 26 from Goodreturns Understand Section 80CCD 1 and 80CCD 2 of the Income Tax Act covering tax deductions for contributions to the National Pension System NPS Learn

how to calculate 80ccd 2

how to calculate 80ccd 2

https://c.pxhere.com/photos/5a/04/calculator_solar_calculator_count_how_to_calculate_business_black_white_b_w-1349034.jpg!d

HOW TO PAY NPS ONLINE II NPS CONTRIBUTION ONLINE PAYMENT II TAX SAVING

https://i.ytimg.com/vi/LrCY2AM_KQY/maxresdefault.jpg

How To Calculate Rpm Lupon gov ph

https://www.deif.com/media/444lcvww/xl-front.png

Section 80CCD offers income tax deductions on contributions to the National Pension Scheme NPS and the Atal Pension Yojana APY The section covers NPS A salaried person is eligible to claim the following deduction under Section 80CCD 2 a maximum contribution from the Central Government or State Government

Section 80CCD 2 of the Income Tax Act Learn how to maximise your tax deductions Our expert guide provides clear insights into eligibility benefits and how this Rs 2 lakhs is the 80CCD 2 maximum limit that can be claimed under the section It contains the additional deduction of Rs 50 000 that is available under 80CCD 1B

More picture related to how to calculate 80ccd 2

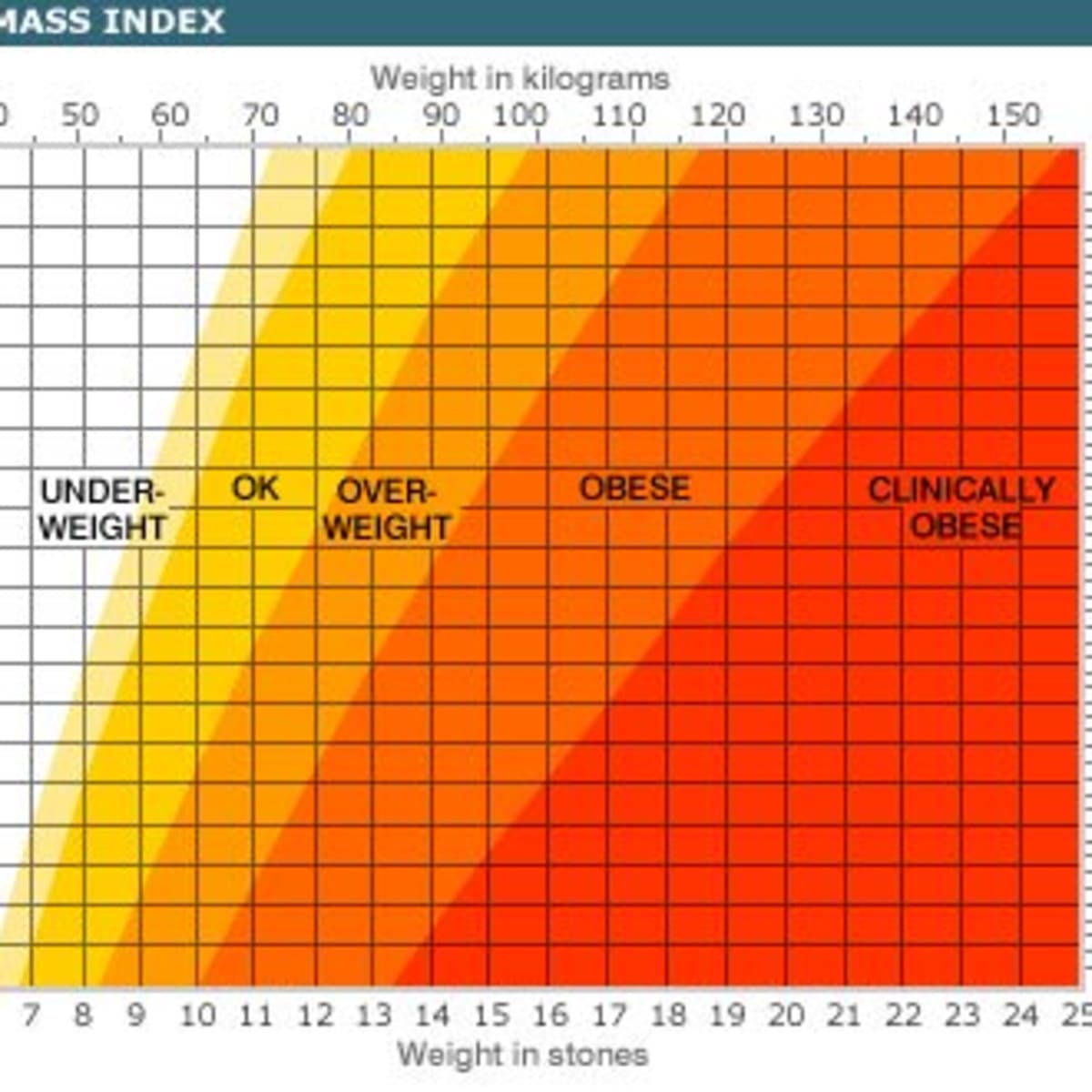

How To Calculate Bmi Manually How To Calculate Bmi Manually Tuko Co

https://images.saymedia-content.com/.image/ar_1:1%2Cc_fill%2Ccs_srgb%2Cfl_progressive%2Cq_auto:good%2Cw_1200/MTczOTUzMzMxOTc3NTI5MjEx/how-do-i-calculate-my-bmi-and-how-do-i-know-if-i-am-overweight.jpg

Free Stock Photo Of Calculate Calculator Close up

https://static.pexels.com/photos/221174/pexels-photo-221174.png

Audio Not Available In Your Location

https://i.pinimg.com/videos/thumbnails/originals/90/9b/48/909b48f962e9dccdad0088492b1c7f19.0000000.jpg

A Govt employee Corporate employee can claim a deduction of your employer s contribution towards NPS under Section 80CCD 2 up to a limit of 10 of your salary i e Basic Salary What you need to know If your employer is contributing to your NPS account then as a salaried employee you are eligible to claim a deduction for the contribution made from gross income This deduction

Section 80CCD 2 Employer Contribution to NPS of the Income Tax Act is the ONLY tax saving investment allowed under the new income tax regime and the old Suppose Mr Sharma is an employee and earns a salary of Rs 10 lakh per year His employer contributes 8 of his salary Rs 80 000 to the NPS on his behalf

Calculating Clipart Clipground

http://clipground.com/images/calculate-clipart-1.jpg

Section 80CCD 1B Deduction NPS Scheme Tax Benefits Alankit

https://www.alankit.com/blog/blogimage/NPS-80CCD.jpg

how to calculate 80ccd 2 - Section 80CCD 2 of the Income Tax Act Learn how to maximise your tax deductions Our expert guide provides clear insights into eligibility benefits and how this