how much is percentage tax in the philippines Learn how to compute and file your percentage tax as a small business or non VAT entity in the Philippines Find out the tax rates categories

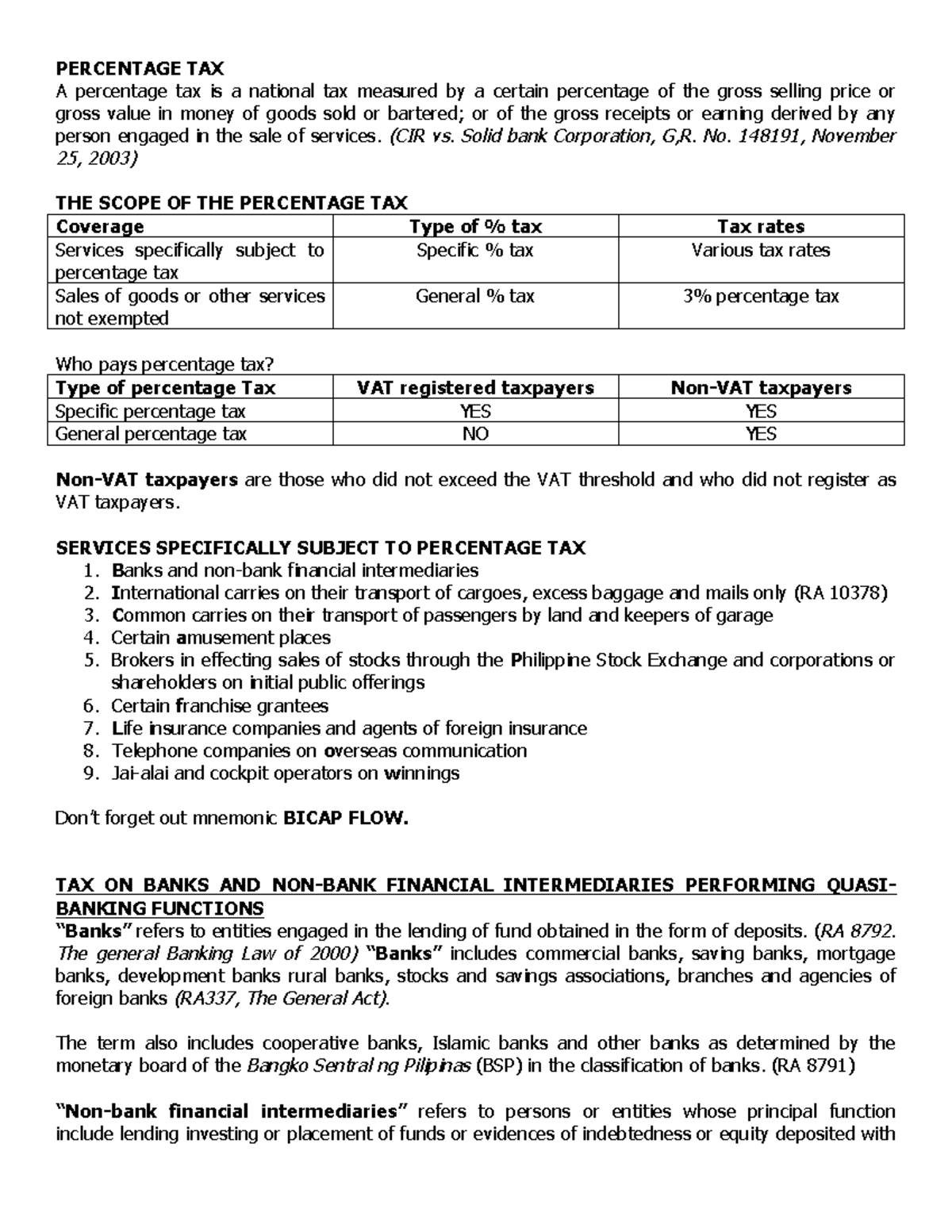

Learn about the Philippine percentage tax a 3 flat rate imposed on certain transactions or industries by the BIR Find out who pays who is exempted and how to file and pay this tax online or manually What is Percentage Tax Percentage Tax in the Philippines is a form of sales tax The Percentage Tax computation is based on gross sales receipts or earnings except for insurance

how much is percentage tax in the philippines

how much is percentage tax in the philippines

http://business.inquirer.net/files/2016/08/tax-rates.jpg

Percentage Tax In The Philippines Explained YouTube

https://i.ytimg.com/vi/HXhc3T2nSis/maxresdefault.jpg

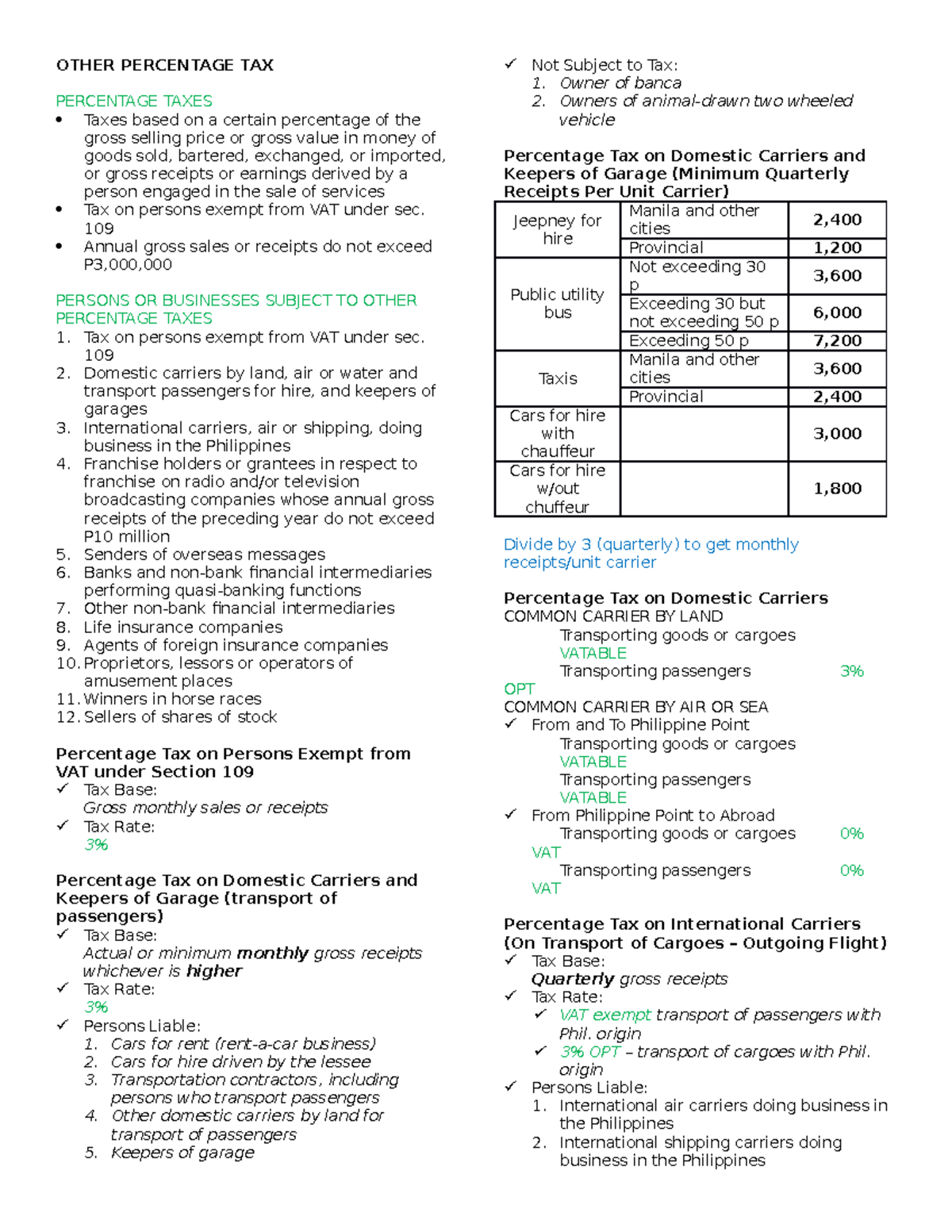

Other Percentage Taxes OTHER PERCENTAGE TAX PERCENTAGE TAXES Taxes

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/f4fc38fbab9fc9c13ed44937b246246c/thumb_1200_1553.png

The 1 percentage tax shall only be applied from 1 July 2020 until 30 June 2023 Starting 1 July 2023 the rate shall revert to 3 Individual Significant developments Under Section 127 A of the Tax Code as amended by the Tax Reform for Acceleration and Inclusion TRAIN Law the STT rate is 6 10 of 1 based on the gross selling price or gross value in money of the shares of stock sold bartered exchanged or otherwise disposed

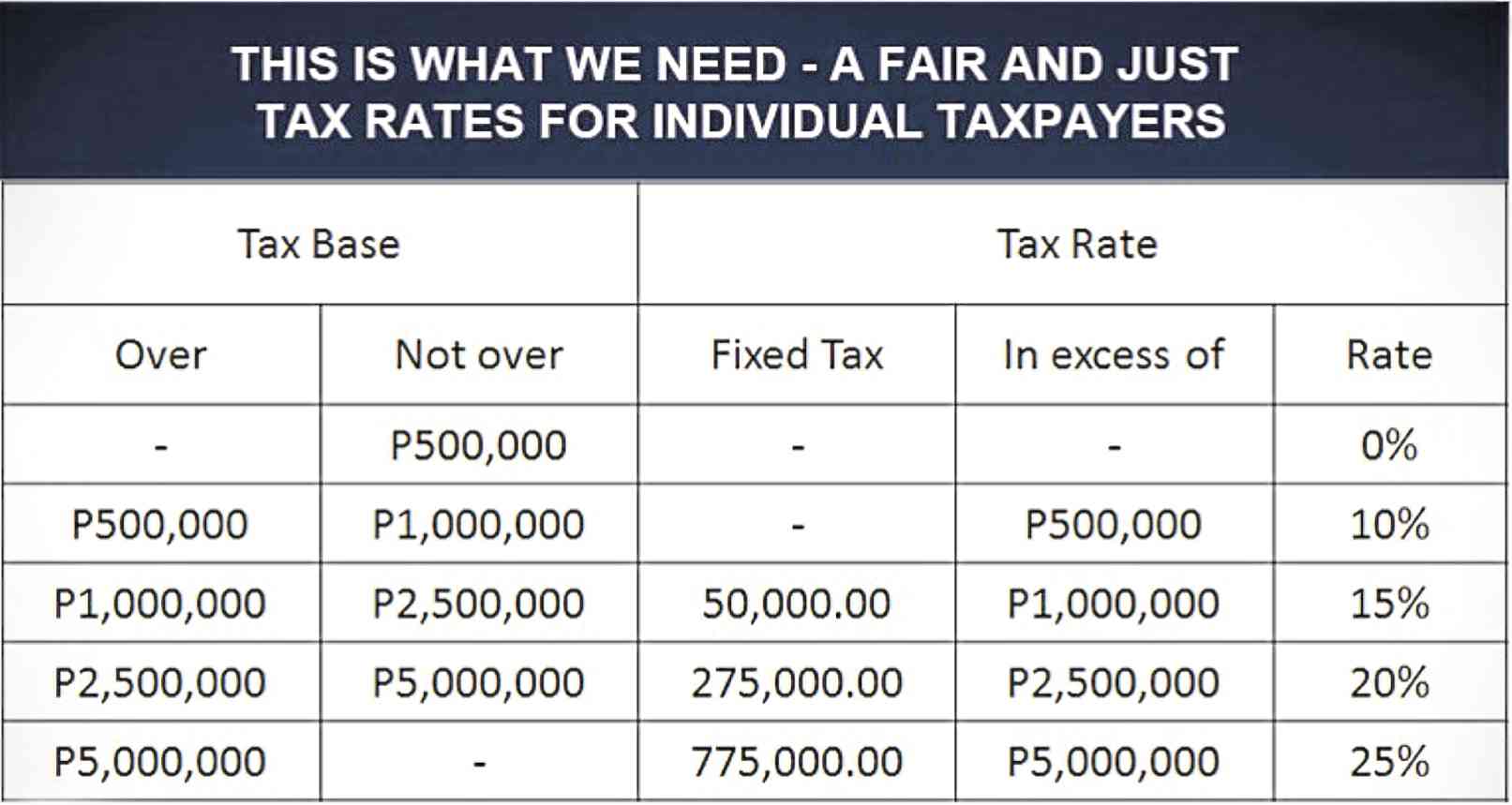

1 Itemized deduction 2 Optional standard deduction TRAIN Law Tax Table 2023 Graduated income tax rates for January 1 2023 and onwards How To Compute Your Income Tax Based on 1 How to Compute Your Income Tax Using the New BIR Tax Rate Table 2 How To Compute Your Income Tax Based on an 8 Preferential Tax Rate Sample income tax computation for the taxable year 2020 3 How To Compute Tax on Passive Income 4 How to Compute Your Income Tax Using an Online Tax Calculator Frequently Asked

More picture related to how much is percentage tax in the philippines

Complete Guide To Quarterly Percentage Tax BIR Form 2551Q

https://mpm.ph/wp-content/uploads/2020/09/percentage-tax-2551q.jpg

CHAP 5 Tax PERCENTAGE TAX A Percentage Tax Is A National Tax

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/ef5f2b76e828b062521813797c6d21c3/thumb_1200_1553.png

Understanding Percentage Tax In The Philippines A Comprehensive Guide

https://imgv2-1-f.scribdassets.com/img/document/259635611/original/62c2e59b17/1704078946?v=1

Percentage Tax is a business tax regulated in the Philippines that is imposed on individuals or businesses that sell lease goods and services with annual sales not exceeding PHP 3 Million and is not VAT Percentage Tax Starting July 1 2023 percentage tax returns to its original rate of 3 from the previously lowered 1 Minimum Corporate Income Tax MCIT Starting July 1 2023 MCIT will be back

A Tax Rate in General on taxable income from all sources within the Philippines same manner as individual citizen and resident alien individual B Certain Passive Income Tax Rates 1 Interest from currency deposits trust funds and deposit substitutes 20 2 Royalties on books as well as literary musical compositions 10 In As a responsible citizen of the country a Filipino individual earning at least 1 000 monthly is mandated to pay tax to the government amounting to a percentage of their taxable income an amount calculated by deducting an individual s benefits contributions from their gross monthly income

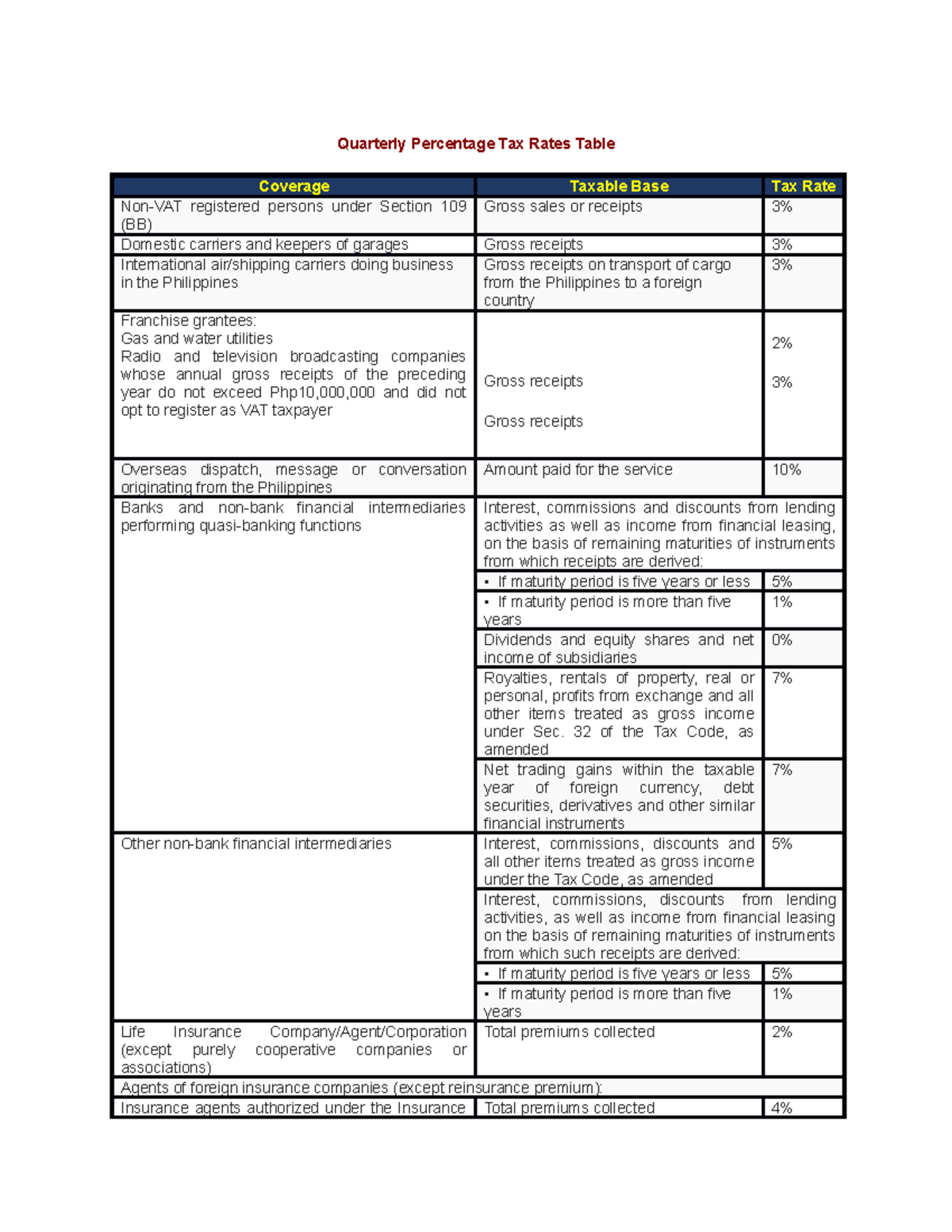

Quarterly Percentage Tax Rates Table Quarterly Percentage Tax Rates

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/d8fcf3d22304c4f44236faadd5b55edd/thumb_1200_1553.png

How To Compute And File Percentage Tax In The Philippines An Ultimate

https://filipiknow.net/wp-content/uploads/2022/05/percentage-tax-philippines-3-1024x576.png

how much is percentage tax in the philippines - 1 How to Compute Your Income Tax Using the New BIR Tax Rate Table 2 How To Compute Your Income Tax Based on an 8 Preferential Tax Rate Sample income tax computation for the taxable year 2020 3 How To Compute Tax on Passive Income 4 How to Compute Your Income Tax Using an Online Tax Calculator Frequently Asked