how long do you have to file an amended 1120s To correct a previously filed Form 1120 S file an amended Form 1120 S and check box H 4 on page 1 Attach a statement that identifies the line number of each amended item the corrected

Information about Form 1120 X Amended U S Corporation Income Tax Return including recent updates related forms and instructions on how to file Corporations use Form Amendments and timing The ERC applies for periods during calendar years 2020 and 2021 The statute of limitation for 2020 income tax returns such as Forms 1120 U S Corporation Income Tax Return will

how long do you have to file an amended 1120s

how long do you have to file an amended 1120s

https://blog.incparadise.net/app/uploads/2023/04/Filing-Your-Annual-Report-A-Step-by-Step-Guide.png

Filing An Amended Tax Return Wheeler Accountants

https://wheelercpa.com/wp-content/uploads/blog3.jpg

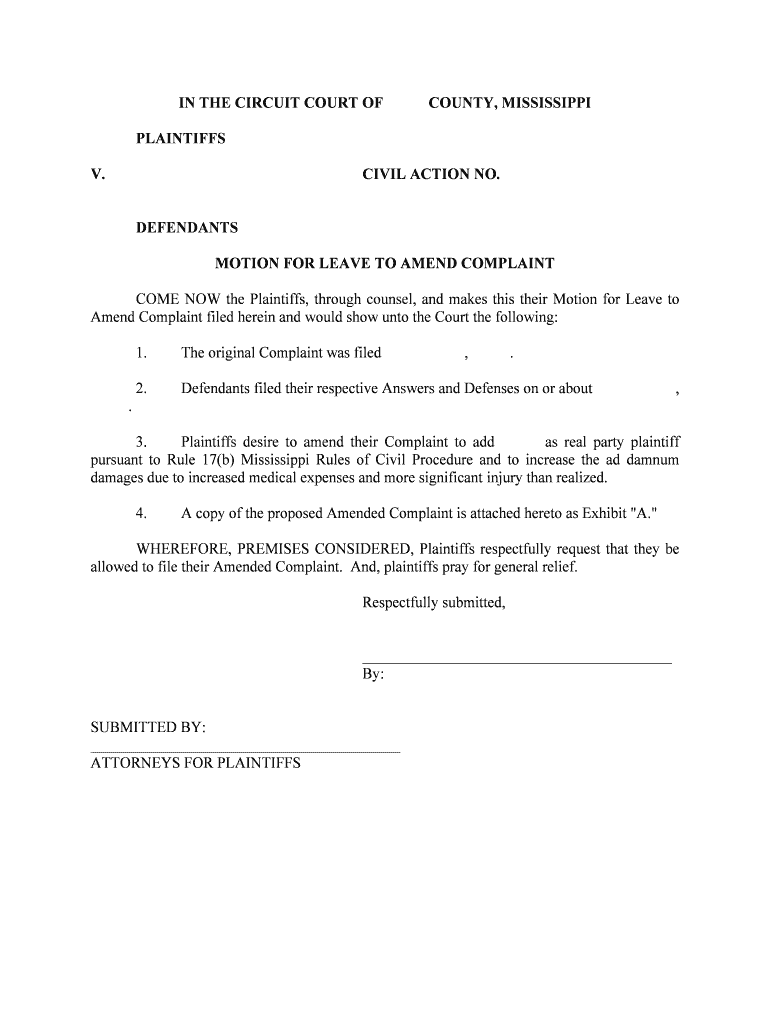

Amend Complaint Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/497/329/497329553/large.png

By Intuit 2 Updated 3 months ago This article will help you create and file an amended 1120S in Intuit ProSeries If you are looking for how to amend a different return For 1120S returns make all necessary changes to the return and then complete the amended return changes detail under Organizer Amended Return Amended Changes Add new Amended Changes For 1065 and

Typically you have up to three years after you first filed a return to file an amendment for it You ll need to file a separate amendment for each year you re amending How long do you have to file an amended business tax return You typically have two or three years to file your amended return depending on when or if you paid taxes on the year in question How do you submit an

More picture related to how long do you have to file an amended 1120s

How To File An Amended Tax Return WTOP News

https://wtop.com/wp-content/uploads/2020/07/GettyImages-897291366.jpg

Ask Dr Pane How Long Do You Have To Wear The Faja After A 360 Lipo

https://acplasticsurg.com/wp-content/uploads/2021/12/bigstock-Q-And-A-Letters-Questions-And-433178216.jpg

Amendment To Amended And Restated Management Agreement Dated IStar

https://resources.contracts.justia.com/contract-images/ea8ac5e6df02ae2e7a9fc02f01c9de55f2ce63e3.jpg

You can only file Form 1120X after your corporation has filed its original return Generally you must file Form 1120X within three years after the date your corporation filed its original return or within two years after the date Information about Form 1120 S U S Income Tax Return for an S Corporation including recent updates related forms and instructions on how to file Form 1120 S is used by corporations

The deadline for filing Form 1120S is March 15 2024 unless you ve applied for an extension You can apply for an extension up to March 15 2024 using Form 7004 Successfully applying If you needed to file the original return electronically you also need to file the amended or superseding return electronically This applies to the current and 2 prior tax years

Motion To Amend Order PDF

https://imgv2-2-f.scribdassets.com/img/document/535153225/original/cabdd174af/1658652833?v=1

Consent Motion For Leave To File Fourth Amended Complaint Form Fill

https://www.signnow.com/preview/490/176/490176610/large.png

how long do you have to file an amended 1120s - How long do you have to file an amended business tax return You typically have two or three years to file your amended return depending on when or if you paid taxes on the year in question How do you submit an