how does mpaa work How does the Money Purchase Annual Allowance work The MPAA is applied in different ways depending on the tax year In the first tax year in which you draw your pension MPAA is applied only to contributions you make into

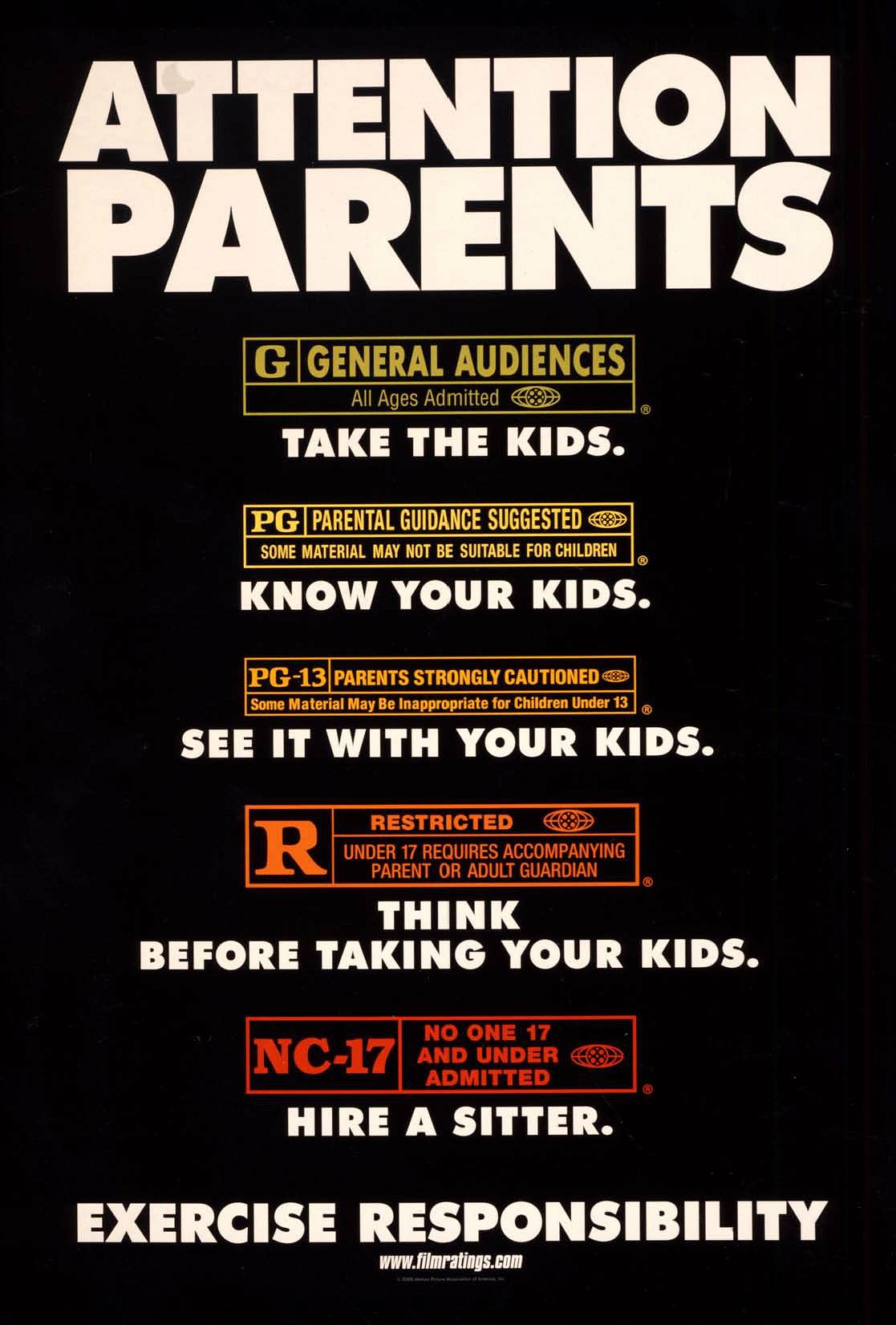

MPAA and Movie Ratings The ratings system established by the Motion Picture Association of America MPAA is ubiquitous in American entertainment although few moviegoers understand how those ratings are assigned or enforced The first thing to understand is that movie ratings are voluntary Once you ve flexibly accessed your pension you ll have trigged the Money Purchase Annual Allowance MPAA This means your future contributions into money purchase pension schemes such as

how does mpaa work

/95742466-56a575505f9b58b7d0dd06a9.jpg)

how does mpaa work

https://fthmb.tqn.com/n2ENh43Kwq97mwk06X1OIlCMh4g=/1186x886/filters:fill(auto,1)/95742466-56a575505f9b58b7d0dd06a9.jpg

Film Ratings Explained What Are The Arbitrary Differences Between Film

https://www.hollywoodinsider.com/wp-content/uploads/2021/11/The-Hollywood-Insider-Film-Ratings-Explained.jpg

What Does MPAA Stand For YouTube

https://i.ytimg.com/vi/2SAMDnmrDU0/maxresdefault.jpg

What is the money purchase annual allowance MPAA The MPAA is a variation of the annual allowance rules which was introduced in April 2015 If you want to learn more about the annual allowance rules please read our Annual Allowance fact sheet What are the MPAA rules and how does it work The MPAA is triggered when you withdraw income from a defined contribution pension scheme not including any tax free lump sums you are entitled to It is designed to limit the amount you can benefit from tax relief after retirement

Money purchase annual allowance MPAA was introduced in 2015 as part of the Pension Freedoms It restricts the amount of tax relief you can collect on contributions you make once you start drawing benefits from your pension in certain ways as explained later in this article How does the MPAA work The Money Purchase Annual Allowance MPAA was introduced by the Taxation of Pensions Act 2014 on 6 April 2015 It is designed to discourage individuals who seek to abuse the new flexible pension rules to avoid tax and potentially National Insurance Contributions by introducing a lower annual

More picture related to how does mpaa work

MPAA What Does MPAA Mean

https://www.cyberdefinitions.com/x-images/MPAA.png

A Parent s Guide To The MPAA Ratings System Reel Life With Jane

http://www.reellifewithjane.com/wp-content/uploads/2014/09/MPAA-Ratings-Poster-1.jpg

The MPAA Film Rating System Online Presentation

https://cf2.ppt-online.org/files2/slide/z/zQsRN2DhtPLH4YAU9CquGKBI8Ook0b1rEje3dW/slide-0.jpg

How does the annual allowance test work in the year the MPAA is triggered When someone triggers the MPAA it is only contributions after the trigger event that are subject to the MPAA The full annual allowance of 60 000 still applies over the tax year in question as long as they are not impacted by the tapered annual allowance TAA Such is the Money Purchase Annual Allowance rules or MPAA Any Benefit Crystallisation Event BCE or trigger event can entail a 90 reduction in further tax relieved contributions from the current 40 000 money purchase arrangement for most to 4 000

What triggers the MPAA There are several ways it can be triggered such as Accessing income through a flexi access drawdown plan Exceeding the Government Actuary s Department GAD limit 150 on income for capped drawdown plans Converting a capped drawdown to a flexi access drawdown and taking income The MPAA was introduced alongside pension freedoms on 6 April 2015 It limits the maximum amount of pension savings an individual can make each year to money purchase pension schemes with the benefit of tax relief It only applies to people who have flexibly accessed their pension

How Does In context Learning Work A Framework For Understanding The

https://ai.stanford.edu/blog/assets/img/posts/2022-08-01-understanding-incontext/images/image11.gif

My Own MPAA Rating Screen YouTube

https://i.ytimg.com/vi/AL490ZzzOB4/maxresdefault.jpg

how does mpaa work - The Money Purchase Annual Allowance MPAA was introduced in the 2014 Pension Act to enable individuals to maximise pension contribution efficiency and to prevent tax avoidance By following the rules set down by the MPAA you can get the most out of your pension claim tax relief appropriate to you and avoid unnecessary financial penalties