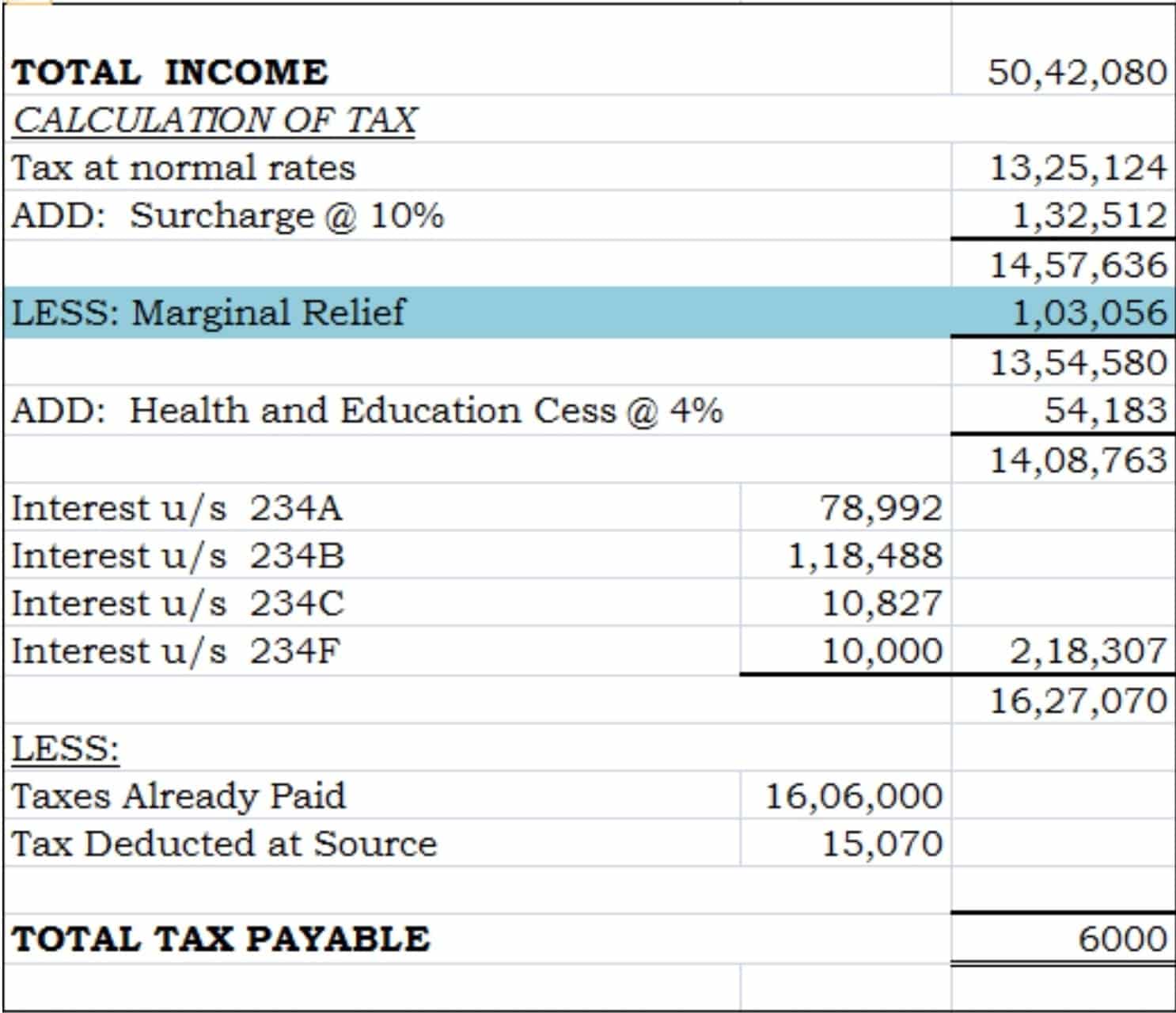

how do you calculate relief under section 89 with example How to Calculate Tax Relief Under Section 89 1 on Salary Arrears Below are the detailed steps to calculate the relief under section 89 Step 1 We need to calculate the tax payable on the total

How do I calculate tax relief under Section 89 for salary arrears A Tax relief under Section 89 is computed by multiplying the average tax difference for each relevant year by How to calculate relief under Section 89 1 for salary arrears Step 1 First calculate the tax due in the current year i e the year of receipt of salary by including

how do you calculate relief under section 89 with example

how do you calculate relief under section 89 with example

https://themarketmentality.com/wp-content/uploads/2021/08/smartselect_20210811-140447_docs3606267742280610203.jpg

Relief Under Section 89 1 Income Under The Head Salaries

https://1.bp.blogspot.com/-QyfjTlwqo4c/YHaVGkR9nHI/AAAAAAAAIFk/P1cVPtiNzo4oOoVdIz8eOGwRd6DPQPD-ACLcBGAsYHQ/s600/relief%2Bunder%2Bsection%2B89%2B%25281%2529-min.png

Relief Under Section 89 1 On Arrears Of Salary FY 2020 21 Excel

https://i0.wp.com/www.commerceangadi.com/wp-content/uploads/2021/03/Relief-under-Section-89-1-on-Arrears-of-Salary-FY-2020-21-e1615102418105.png

How to Calculate Tax Relief under Section 89 1 on Salary Arrears 1 Calculate tax payable on the total income including additional salary arrears or compensations in the Let us understand the steps to calculate tax relief u s 89 1 with an example Arjun s salary is INR 4 80 000 40 000 per month for FY 2019 20 His employer raised the salary to INR 7 80 000 65 000 per

Steps to calculate the relief u s 89 1 Step 1 Calculate the tax payable on total income including arrears of relevant previous year in which salary should have Calculation of relief under Section 89 Step 1 Calculate the tax liability for the current year by adding the liabilities to the gross income Step 2 Calculate the

More picture related to how do you calculate relief under section 89 with example

Relief Under Section 89 1 Hindi relief U s 89 1 How To Calculate

https://i.ytimg.com/vi/EIwMEfBtAtM/maxresdefault.jpg

How To Calculate Relief U s 89 1 Of The Income Tax Act

https://www.caclubindia.com/editor_upload/685154_20210823174644_e.png

Relief Under Section 89 1 On Salary Arrears YouTube

https://i.ytimg.com/vi/gykgwim-a4M/maxresdefault.jpg

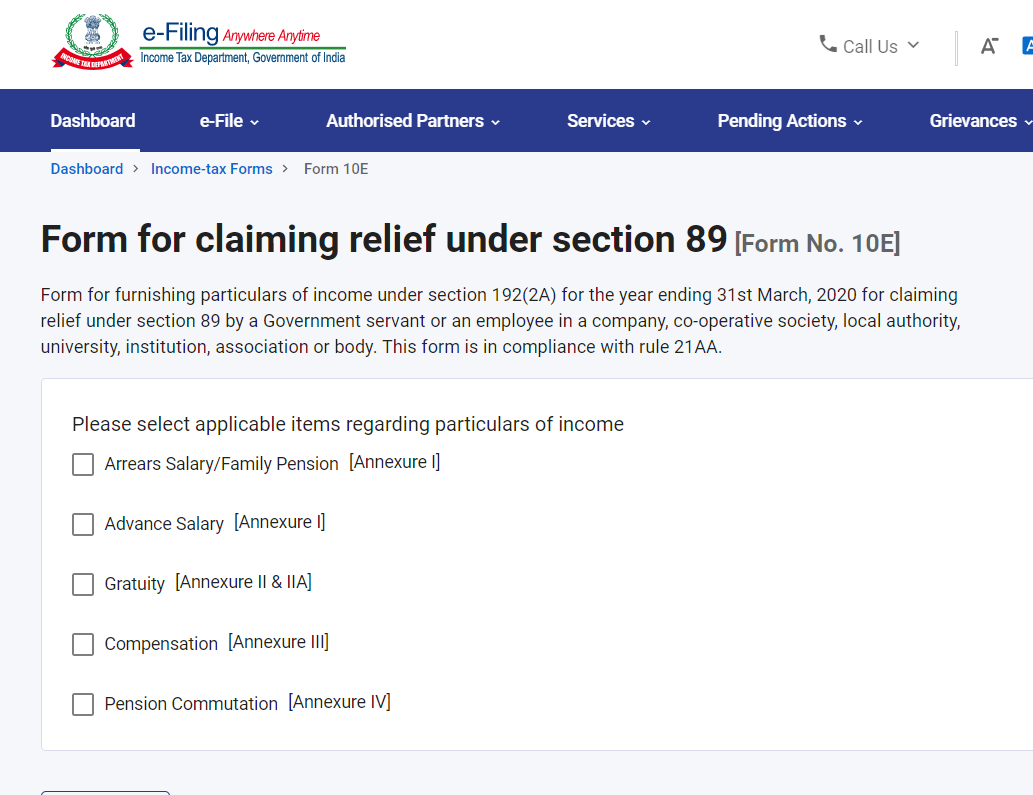

It is mandatory to fill out Form 10E when an individual wants to claim tax relief under Section 89 1 of the Income Tax Act 1961 Section 89 1 provides tax relief for delayed salary received in the form of However you can claim some tax benefits under Section 89 of the Income Tax Act You must fill up F orm 10E to claim the tax relief for salary arrears on leave

How is tax relief calculated under Section 89 1 Tax relief is calculated by finding the difference in tax liability with and without arrears and then spreading the arrears income How to Calculate Tax Relief under Section 89 on Salary Arrears Section 89 of the Income Tax Act 1961 provides a special rule for adjusting tax burden in cases

How Do You Calculate Revenue The Tech Edvocate

https://www.thetechedvocate.org/wp-content/uploads/2023/09/How-To-Calculate-Monthly-Revenue.png

ITR Filing How To Calculate Relief For Salary Arrears And Claim It

https://images.news18.com/webstories/2023/02/cropped-shutterstock_1985338904.jpg

how do you calculate relief under section 89 with example - Learn how to calculate tax relief under Sections 89 and 89A for arrears gratuity and foreign retirement benefits Understand the steps and eligibility criteria