how do i claim 80ccd 2 A complete guide on Section 80CCD 2 of income tax act Also find out the deduction under Section 80CCD 2 for FY 2024 25 AY 2025 26 from Goodreturns

How to Claim a Deduction on both Employee and Employer s Contributions A resounding yes If your employer contributes to your NPS account you can claim a deduction under section 80CCD 2 There is no How do I make a claim for 80CCD 2 on my tax return To claim the deduction under Section 80CCD 2 employees need to provide details of the employer s contribution to

how do i claim 80ccd 2

how do i claim 80ccd 2

https://i.ytimg.com/vi/LrCY2AM_KQY/maxresdefault.jpg

NPS 80CCD 2 NPS Taxation YouTube

https://i.ytimg.com/vi/0MPd5o8WLNE/maxresdefault.jpg

National Pension Scheme 80CCD 1B How To Claim Onlineideation

https://www.onlineideation.in/files/How-to-Claim-National-Pension-Scheme-80CCD1B-Onlineideation.jpg

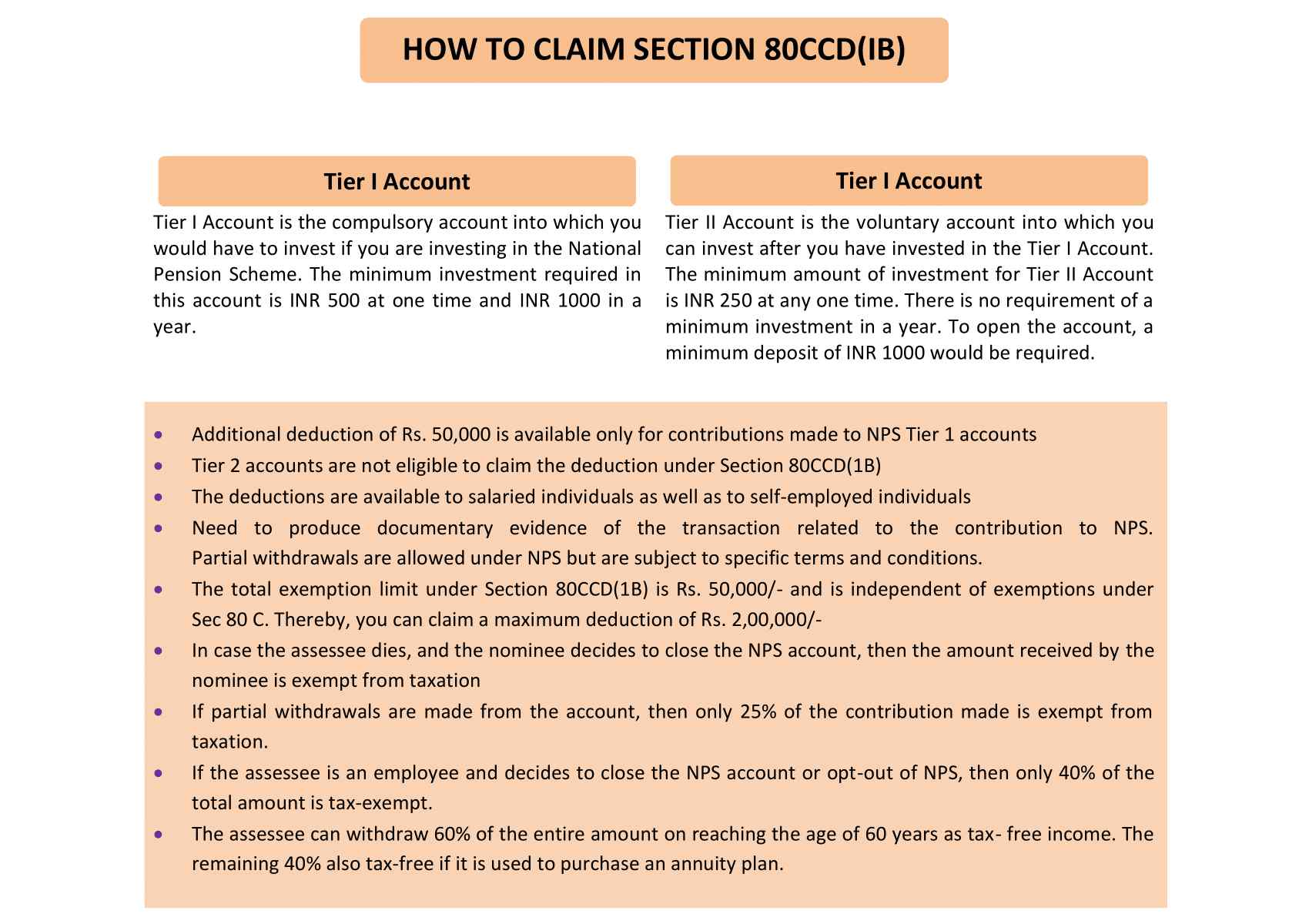

Under Section 80CCD deductions can be claimed by both salaried as well as self employed people While on the one hand it is obligatory for government employees on the other hand it To claim deduction u s 80CCD 2 follow 2 steps i First add that contribution in salary income ii and then claim deduction under Chapter VI A upto maximum of 10 of salary Remember in case of Government

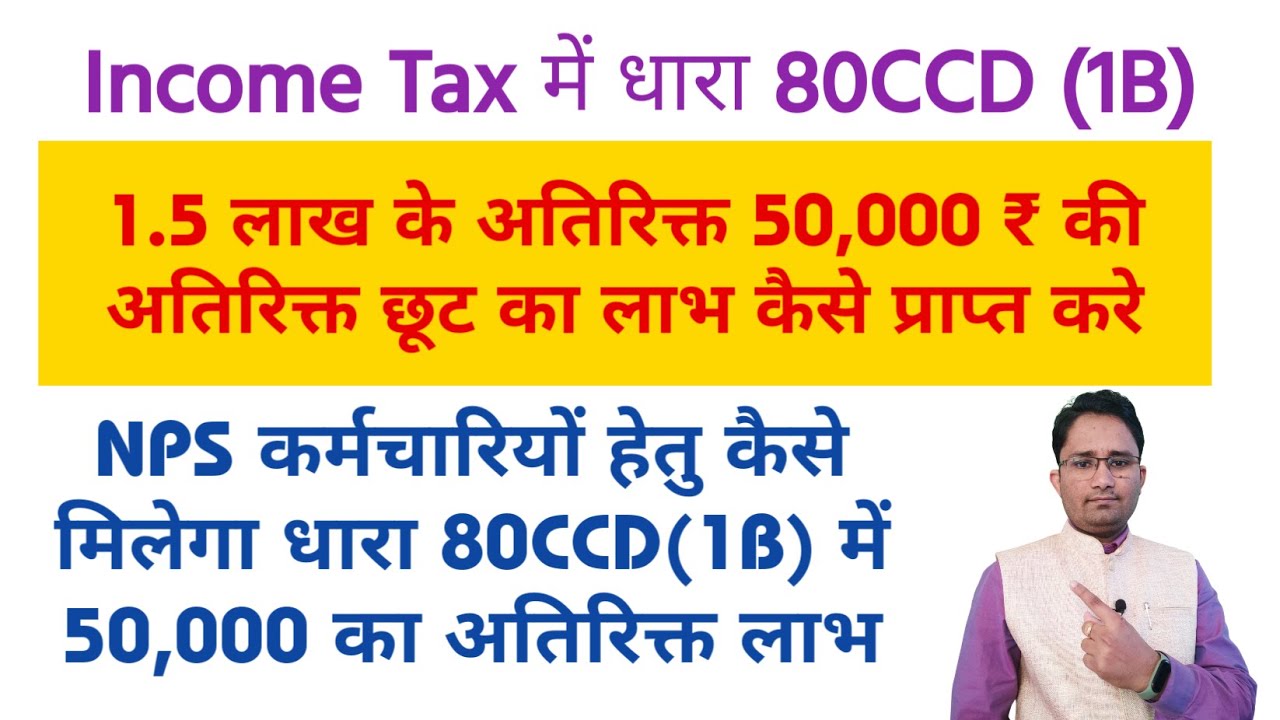

So a government employee a private sector employee self employed or an ordinary citizen can claim benefit of Rs 50 000 under Section 80CCD 1B Therefore the total tax benefits that can be claimed for NPS Section 80CCD 2 allows a salaried individual to claim the following deduction Central Government or State Government Employer Up to 14 per cent of their salary basic DA Any other

More picture related to how do i claim 80ccd 2

How To Prepare Trading Account YouTube

https://i.ytimg.com/vi/eYn9GoH10I4/maxresdefault.jpg

National Pension Scheme 80CCD 1B How To Claim Onlineideation

https://www.onlineideation.in/files/How-to-Claim-National-Pension-Scheme-80CCD1B-Know-From-Onlineideation.jpg

Section 80CCD 2 Tax 2Win Flickr

https://live.staticflickr.com/65535/49247202166_90551293ef_b.jpg

How do I claim deduction under section 80ccd 1b Deduction under section 80CCD 1B of the Income Tax Act can be claimed by paying deposited an amount to the notified pension scheme The maximum Section 80CCD 2 allows employers to claim deductions for contributions made on behalf of employees to their Tier I NPS accounts Unlike Section 80CCD 1 there is no monetary limit for the deduction under Section

Understand Section 80CCD 1 and 80CCD 2 of the Income Tax Act covering tax deductions for contributions to the National Pension System NPS Learn about eligibility limits and benefits Here is an example to understand how 80CCD 2 works Suppose Mr Sharma is an employee and earns a salary of Rs 10 lakh per year His employer contributes 8 of his

NPS Tier 1 Benefits 80CCD 1 80CCD 1B 80CCD 2 NPS Tax

https://i.ytimg.com/vi/GT73sBLn6A0/maxresdefault.jpg

NPS Employee Income Tax 80CCD 1B

https://i.ytimg.com/vi/rw6otVRjsG4/maxresdefault.jpg

how do i claim 80ccd 2 - So a government employee a private sector employee self employed or an ordinary citizen can claim benefit of Rs 50 000 under Section 80CCD 1B Therefore the total tax benefits that can be claimed for NPS