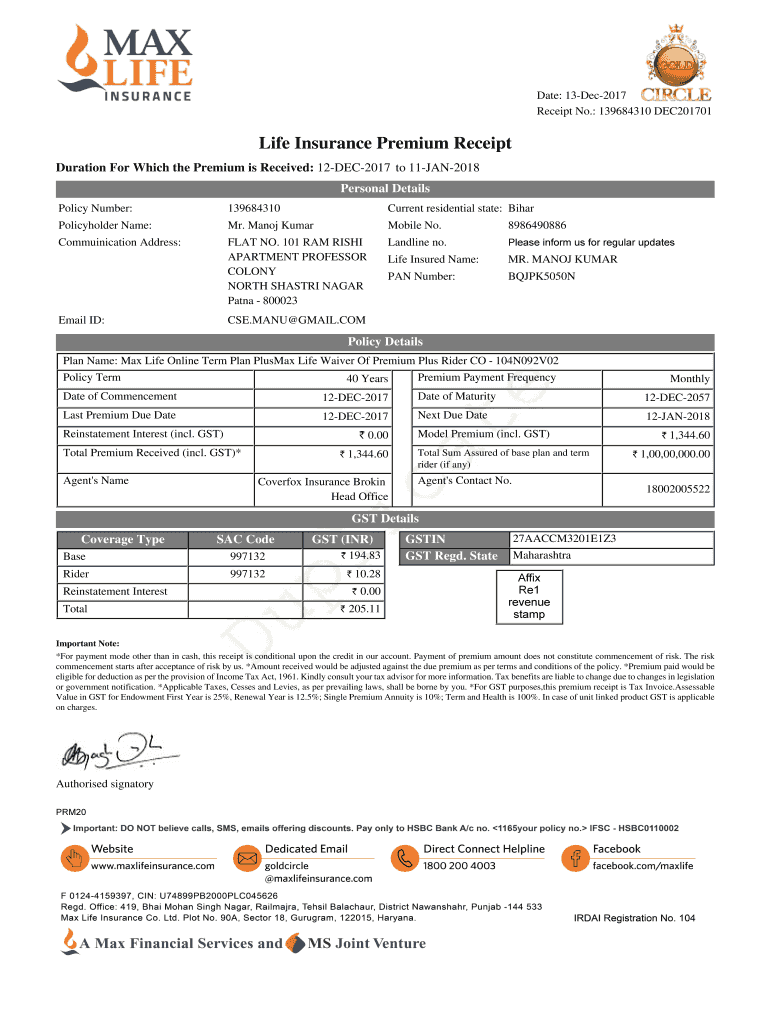

health insurance comes under 80c or 80d Does term insurance come under 80C or 80D The premium paid for a term plan is eligible for a deduction under Section 80C The premium paid for any health riders availed is eligible for a deduction under Section 80D

You as an individual or HUF can claim a deduction of Rs 25 000 under section 80D on insurance for self spouse and dependent children An additional deduction for insurance of parents is available up to Rs 25 000 if they are less than 60 years of age The cumulative deduction under sections 80C of Income Tax 80CCC and 80CCD shall be subject to the limit of 1 50 000 4 Section 80D Individuals and HUFs This section allows a deduction for premiums paid for health insurance plans 1 Premium paid for health insurance taken for self spouse and dependent children 25 000 2

health insurance comes under 80c or 80d

health insurance comes under 80c or 80d

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

Deductions U S 80C Under Schedule VI Of Income Tax India Financial

https://www.caindelhiindia.com/blog/wp-content/uploads/2021/07/80c.jpg

Medical Insurance Premium Receipt PDF Complete With Ease AirSlate

https://www.signnow.com/preview/470/590/470590793/large.png

Learn how to maximise the tax benefits and savings using health or medical insurance under section 80D of the Income Tax Act Income tax deduction and limits under section 80C 80CCD in 2024 Tax Benefit Under Section 80D Policyholders who have opted for a health related rider such as Critical Illness Surgical Care or Hospital Care Rider with their term insurance policy can also avail 80D deductions up to Rs 25 000

Section 80D allows a tax deduction of up to 25 000 per financial year on medical insurance premiums for non senior citizens and 50 000 for senior citizens This limit also includes a 5 000 deduction for any expenses paid towards preventative health check ups Under Section 80D you can claim deductions for the following expenses incurred on healthcare Medical insurance premium paid for self spouse dependent children and parents Expenses incurred on preventive

More picture related to health insurance comes under 80c or 80d

How Car Insurance Claims Process Works Forbes Advisor INDIA

https://thumbor.forbes.com/thumbor/fit-in/x/https://www.forbes.com/advisor/in/wp-content/uploads/2021/12/pexels-mikhail-nilov-7736045-Cropped-scaled.jpg

Deductions Under Section 80C Does PF Come Under 80C

https://vakilsearch.com/blog/wp-content/uploads/2022/08/PF-under-80C.jpg

Section 80C Deductions List To Save Income Tax FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/section-80C-deductions-list-to-save-income-tax-video.webp

Under Section 80D you can avail income tax saving benefits against healthcare related expenses and payment of medical insurance premium for self spouse children and senior citizen parents Section 80D also covers payment made for preventive health check ups critical illness CI and other health related riders provided under a life Section 80D includes health insurance and critical illness insurance only Maximum Tax Deduction Limit Section 80C offers a tax deduction of up to Rs 1 5 lakh The maximum tax deduction under Section 80D is Rs 1 lakh Scope of Tax Benefits Section 80C can offer a higher tax deduction than Section 80D

[desc-10] [desc-11]

Comprehensive Car Insurance OR Zero Depreciation Cover What Should You

https://i.ytimg.com/vi/qvTllJpnAM8/maxresdefault.jpg

Is Term Insurance Covered Under 80C Or 80D

https://d3h6xrw705p37u.cloudfront.net/articles/main_image_680x309/is-term-insurance-covered-under-80c-or-80d-1658815168.png

health insurance comes under 80c or 80d - Under Section 80D you can claim deductions for the following expenses incurred on healthcare Medical insurance premium paid for self spouse dependent children and parents Expenses incurred on preventive