gstr 2a means GSTR 2A means a purchase related document that the GST portal provides to each business registered with it The GSTR 2A has generated automatically when a business s

GSTR 2A is a GSTR 1 return that is automatically generated by the seller s GSTR 1 for the GST registered buyer GSTR 2A captures the information filed by the GSTR 2A is an auto generated monthly statement that contains the information of goods or services that have been purchased in a given month from the sellers GSTR 1 GSTR 2A won t generate until the

gstr 2a means

gstr 2a means

https://www.saralgst.com/wp-content/uploads/2019/02/GSTR-2A-Meaning-difference-due-date-and-reconcilation-1.jpg

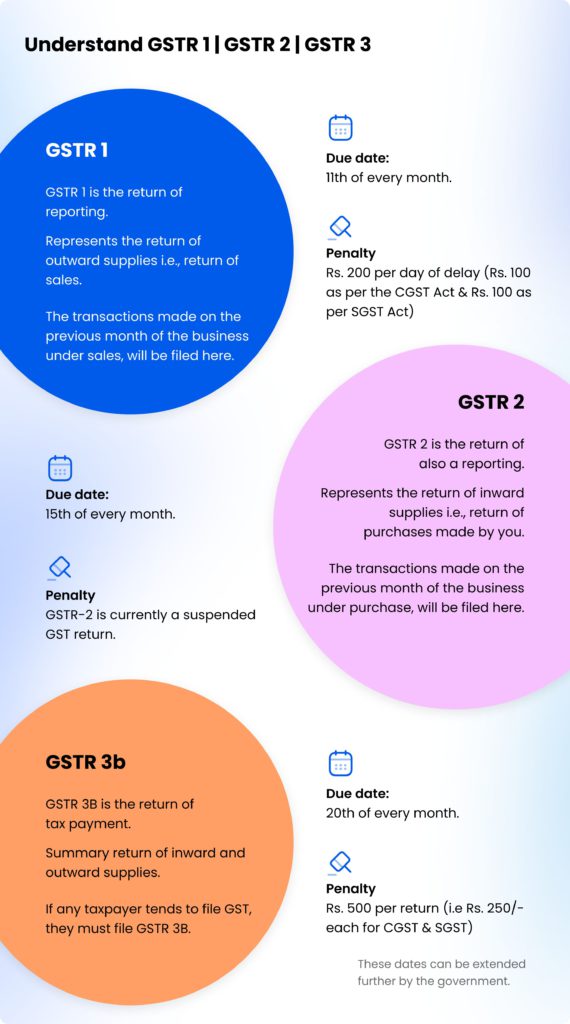

GST Reports GSTR 1 GSTR 2 And GSTR 3B Explained Zetran

https://zetran.com/wp-content/uploads/2018/10/draw-a-table-for-gstr-1-gstr-2-gstr-3b-compressed-570x1024.jpg

GSTR 2A VS GSTR 2B L Gstr 2b L What Is Gstr 2a L Gst 2a L

https://manthanexperts.com/wp-content/uploads/2021/03/GSTR-2A.png

GSTR 2A means a statement of Input Tax credit and you need not have to file GSTR 2A legally Thereby there is no such thing as GSTR 2A due date of filing GSTR 2A means a list of all the purchases made by an entity in a month detailing the Input Tax Credit ITC for that period It is automatically updated once a business s seller uploads the GSTR 1 and 5 forms Since it is an

What Is GSTR 2A GSTR 2A Table of Contents What is Form 49B What is Form 26Q What is Form 15CB What is Form 15CA What is Form 10F What is Form The GSTR 2A is a purchase related tax return that is automatically generated for each business by the GSTN portal It s based on the information contained in the GSTR 1

More picture related to gstr 2a means

What Is Form GSTR 2A And 2B And What Exactly Is Their Difference

https://static.wixstatic.com/media/31c268_97fc2cbbbb084ccea8877e9ce71e92f2~mv2.png/v1/fill/w_916,h_512,al_c,q_90,enc_auto/31c268_97fc2cbbbb084ccea8877e9ce71e92f2~mv2.png

Difference Between GSTR 2A And GSTR 2B Finaxis

https://finaxis.in/wp-content/uploads/2022/04/Difference-Between-GSTR-2A-And-GSTR-2B.jpg

GSTR2B Guide Download GSTR2A Vs GSTR2B And Reconciliation

https://gsthero.com/wp-content/uploads/2022/02/GSTR-2B-Return.jpg

What is GSTR 2A The GSTR 2A is automatically generated when a business s seller or partner supplier uploads the GSTR 1 and 5 Forms Every business registered with the GST porta l receives this purchase Form GSTR 2A is a system generated auto populated return reflecting inward supplies purchase related transactions Form GSTR 2A gets auto generated

GSTR 2A is an auto populated return that contains details of the input tax credit on purchases TDS credits and TCS credits of a buyer It is auto populated based Form GSTR 2A is an auto generated monthly return that summarizes the details of inward supplies of taxable goods and services received by a registered

GSTR 1 Meaning Due Dates Checklist And Format In PDF And Excel

https://i2.wp.com/www.gsthelplineindia.com/blog/wp-content/uploads/2017/09/Filing-GSTR-1-1200x650.jpg?fit=1200%2C650&ssl=1

Difference Between GSTR1A And GSTR 2A

https://howtoexportimport.com/UserFiles/Windows-Live-Writer/Difference-between-GSTR1A-and-GSTR-2A_8322/Difference between GSTR1A and GSTR 2A_2.jpg

gstr 2a means - GSTR 2A is an automatically generated return from the seller s GSTR 1 for each business by the portal of GST Any information filed in GSTR 1 by the seller is