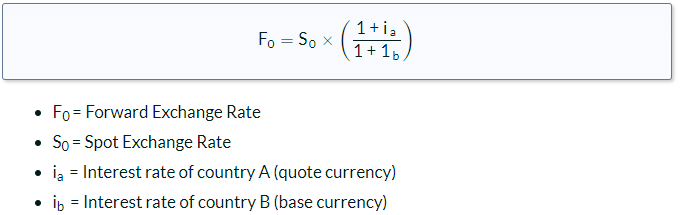

fx forward rate formula In theory the formula for converting spot rates to forward rates should provide an unbiased predictor of future spot rates This is based on the concept of covered interest rate parity

The forward exchange rate also referred to as forward rate or forward price is the exchange rate at which a bank agrees to exchange one currency for another at a future date when it enters into a forward contract with an investor We can also calculate the forward rate consistent with the spot rate and the interest rate in each currency Since the amount of forward points is proportional to the spread between the foreign and domestic interest rates i f i d we can evaluate this relationship as F f d S f d S f d frac i f i d 1 i d Example

fx forward rate formula

fx forward rate formula

https://1.bp.blogspot.com/-AzBFHWue5so/YQ-AMYhXZJI/AAAAAAAABfo/9s5LcdcIcrcKy2nXaG9vGHWDmFkOSIl_gCLcBGAsYHQ/s0/Fx_Forward_Calculation.png

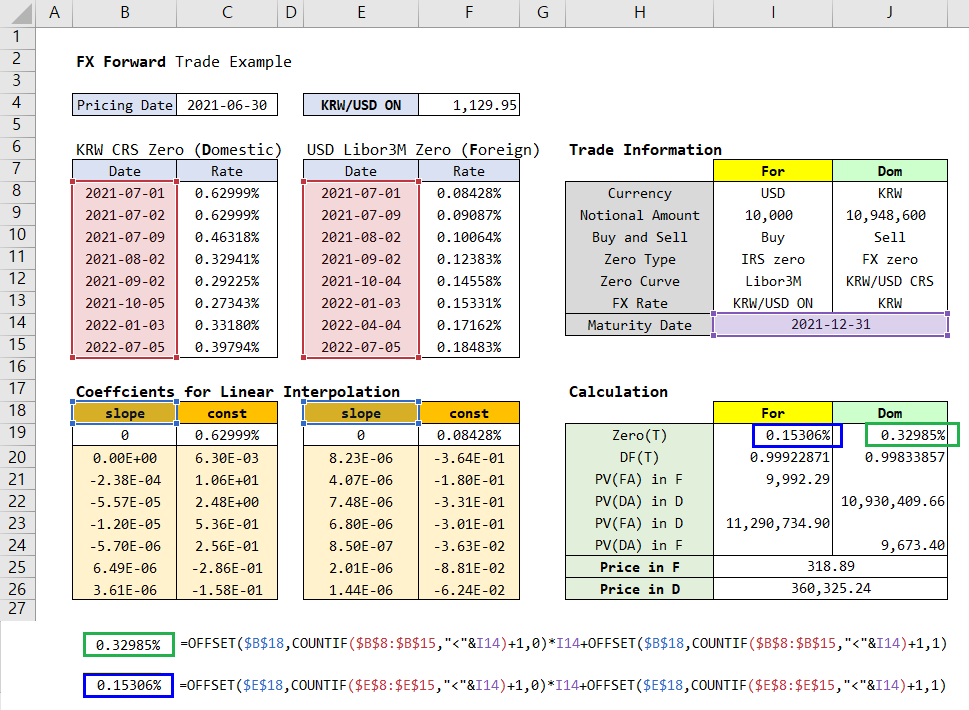

Fx Forward Rate Calculation Example Oil Futures Trading Strategy

https://financetrainingcourse.com/education/wp-content/uploads/2012/01/013112_1058_ForwardRate2.png

33 Mortgage Interest Rates Maryland GerardKamile

https://qph.cf2.quoracdn.net/main-qimg-bf531853c64c3f92ff061442e4fcb3e3-lq

We can calculate the price currency interest rate using the formula below price currency interest rate annualised price currency interest rate days 360 Hence the price currency interest rate for this currency forward interest rate is 0 8 90 360 0 2 In forex markets the forward rate can be calculated using the spot rate and the interest rates of the two currencies involved The formula for calculating the forward rate is as

The formula for calculating the forward rate is straightforward Forward Rate Spot Rate 1 Domestic Interest Rate 1 Foreign Interest Rate This formula encapsulates the essence of CIRP ensuring that the forward rate accurately reflects the cost of holding the currency over the contract period Forward exchange rate is the exchange rate at which a party is willing to enter into a contract to receive or deliver a currency at some future date Currency forwards contracts and future contracts are used to hedge the currency risk For example a company expecting to receive 20 million in 90 days can enter into a forward contract to

More picture related to fx forward rate formula

Level 1 CFA Economics Currency Exchange Rates Lecture 4 YouTube

https://i.ytimg.com/vi/Z6N0g9tk2oc/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGFYgXShlMA8=&rs=AOn4CLCzAX1brrMeCocSOKBEoXz07Mktvg

Fx Forward Rate Calculation Grower Direct Marketing Stockton California

https://financetrainingcourse.com/education/wp-content/uploads/2012/01/013112_1058_ForwardRate11.png

The Importance Of FX Futures Pricing And Basis CME Group

https://s3.amazonaws.com/cme-institute-prod-assets/rich/rich_files/rich_files/000/000/485/original/161031fx-basis-201.jpg

How to calculate Foreign Exchange Forward Points Every year thousands of readers like you benefit from this common sense approach to the calculation of foreign exchange FX forward points the time value adjustment made to the spot rate to reflect a future date What is a forward contract How to price a forward contract Oku Markets explains forward points and how to calculate forward rates Use forward contracts to hedge your currency risk and lock in exchange rates to protect against FX volatility

[desc-10] [desc-11]

Formula Forward Rate Invatatiafaceri ro

https://invatatiafaceri.ro/wp-content/uploads/Formula-Forward-Rate.jpg

Forward Exchange Rate Equation Tessshebaylo

https://media.cheggcdn.com/media/3dc/3dcd5c4d-3cef-49e3-a785-eaf15fc8abd8/phpJNlbFf.png

fx forward rate formula - The formula for calculating the forward rate is straightforward Forward Rate Spot Rate 1 Domestic Interest Rate 1 Foreign Interest Rate This formula encapsulates the essence of CIRP ensuring that the forward rate accurately reflects the cost of holding the currency over the contract period