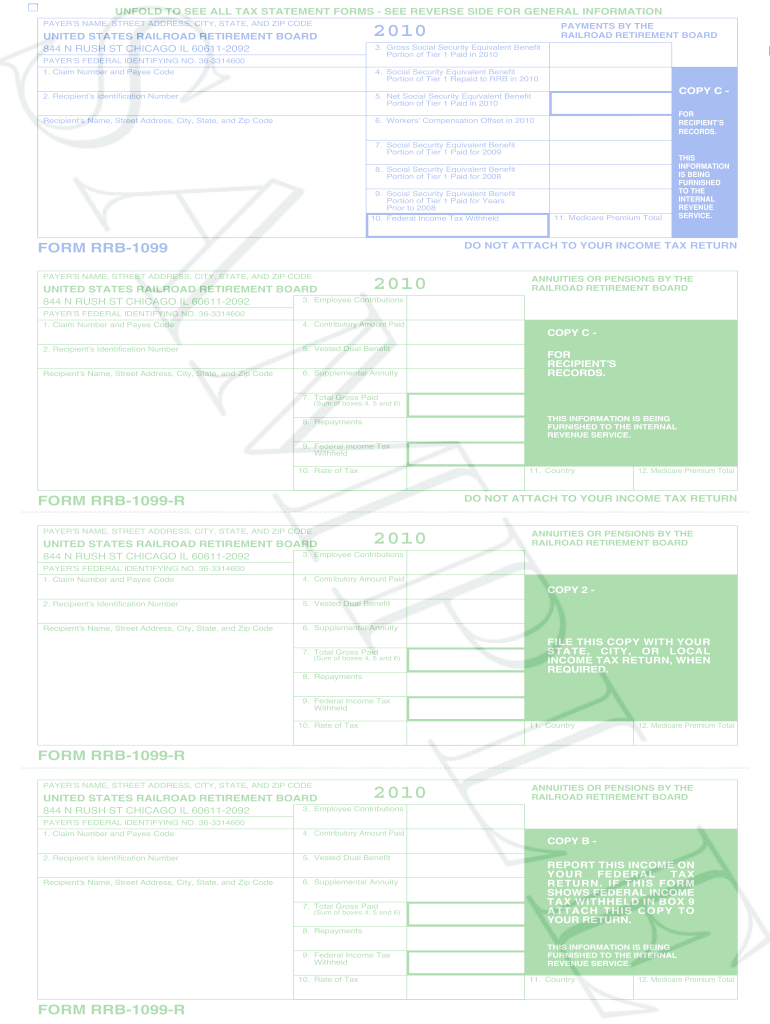

form rrb 1099 r explained Forms RRB 1099 and RRB 1099 R are tax statements specifically for railroad employees working in jobs covered by the Railroad Retirement Act RRA If you got one or

Form RRB 1099 R Annuities or Pensions by the Railroad Retirement Board is a green form and reports non Social Security equivalent benefits payments which are entered in Learn how to read and use Form RRB 1099 R which reports your railroad retirement payments and tax withholding for the year indicated Find out what items are taxable how to correct or

form rrb 1099 r explained

form rrb 1099 r explained

https://www.uc.pa.gov/faq/claimant/PublishingImages/UC-1099G-OnlineForm.jpg

Types Of 1099 Form What You Need To Know About Tax Filings

https://mycountsolutions.com/wp-content/uploads/2019/06/Types-of-1099-Form-min.jpeg

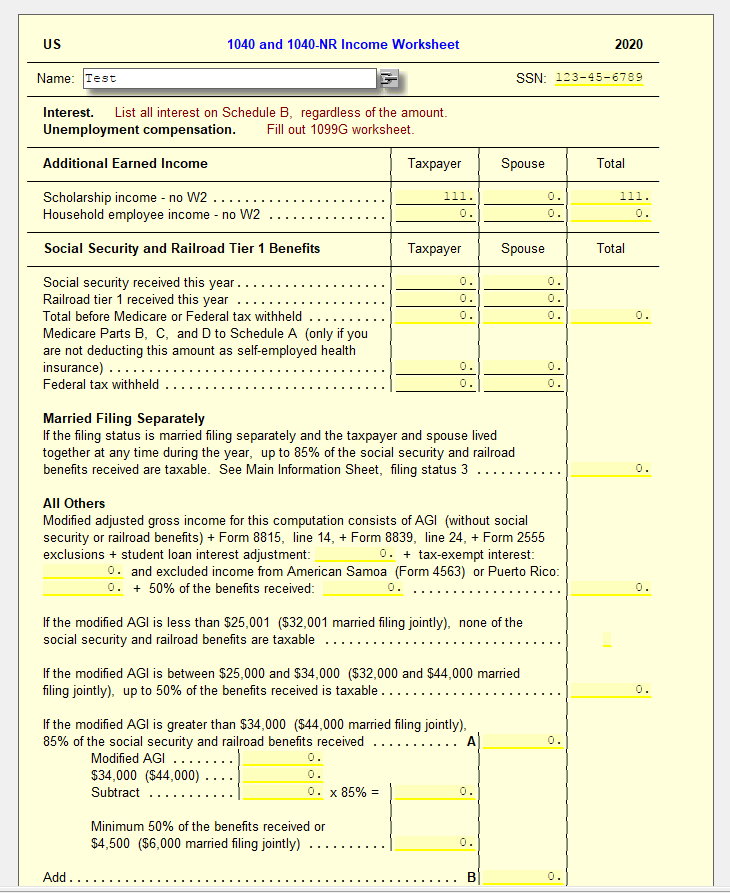

Railroad Benefits RRB 1099 UltimateTax Solution Center

https://support.ultimatetax.com/hc/article_attachments/4407091552407/mceclip0.png

These benefits are shown on the GREEN portion of the Form RRB 1099 R and are treated as an amount received from a qualified employer plan Vested dual benefits and supplemental Learn how to report Railroad Retirement Benefits RRB on Form RRB 1099 R and Form RRB 1099 R Tier 2 Find out how to calculate the taxable amount enter the information on

Railroad Retirement Benefits Form RRB 1099 R Keystone Support Center Benefits paid under the Railroad Retirement Act fall into two categories These categories are treated Form RRB 1099 R Railroad Retirement Board Benefits are non Social Security equivalent benefits NSSEB and are generally treated as an annuity For more information on Form

More picture related to form rrb 1099 r explained

Selecting The Correct IRS Form 1099 R Box Distribution 47 OFF

https://fppaco.org/images/1099R/1099-R-Example.jpg

IRS Form 1099 DIV Guide For 2024 TY2023 The Boom Post

https://blog.boomtax.com/wp-content/uploads/2022/10/joanna-kosinska-1_CMoFsPfso-unsplash.jpg

1099 R Form What Is 1099 R Form Pension Distribution

https://d2rcescxleu4fx.cloudfront.net/images/1099-R.webp

For additional information on how to report in the TaxSlayer Pro program see To Enter A Form 1099 R Entry above Penalties To discourage the use of pension funds for purposes other A 1099 R has a code that indicates disability but a RRB 1099 R does not If you retire on disability the payments you are receiving would be taxed as wages until you reach

Introduction The Form RRB 1099 tax statement is issued by the U S Railroad Retirement Board RRB and represents payments made to you in the tax year indicated on Form CSA 1099 R Civil Service Retirement Benefits The Office of Personnel Management issues Form CSA 1099 R for annuities paid or Form CSF 1099 R for survivor annuities paid

Form Rrb 1099 Sample Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/1/43/1043335/large.png

E file Form 1099 R IRS Form 1099 R Distribution Of Retirement Benefits

https://d2rcescxleu4fx.cloudfront.net/images/1099-R.jpg

form rrb 1099 r explained - Railroad Retirement Benefits Form RRB 1099 R Keystone Support Center Benefits paid under the Railroad Retirement Act fall into two categories These categories are treated