form 1120 h deadline Information about Form 1120 H U S Income Tax Return for Homeowners Associations including recent updates related forms and instructions on how to file A homeowners association files

Filing Form 1120 H correctly is critical for homeowners associations to maintain compliance and fully utilize available tax benefits Here are some key takeaways File by the 15th day of the 3rd month after the end The due date for filing Form 1120 H is generally the 15th day of the 3rd month following the end of your association s taxable year with an automatic extension available until the 15th day of 4th month if you file Form

form 1120 h deadline

form 1120 h deadline

https://cookco.us/news/wp-content/uploads/2021/03/tax-deadline-680x455.jpg

How Do I Fill Out Form 1120S Gusto

https://gusto.com/wp-content/uploads/2019/06/Form-1120S-instructions-Schedule-K.png

IRS 1120 Schedule D 2020 2022 Fill Out Tax Template Online US

https://www.pdffiller.com/preview/535/781/535781017/large.png

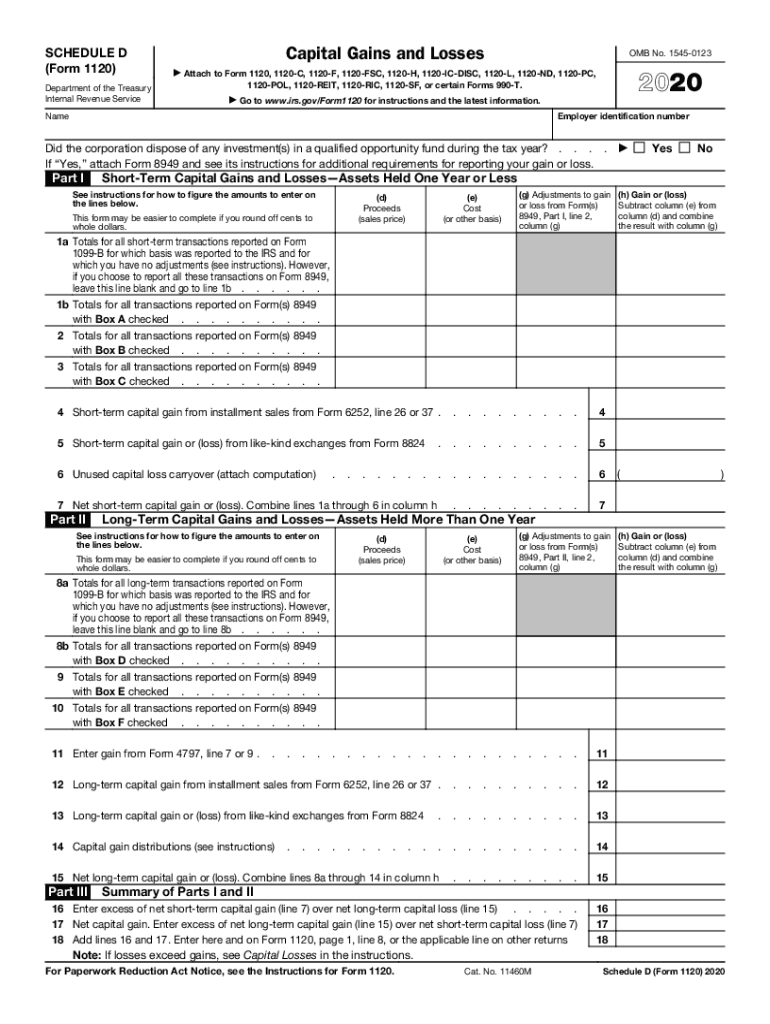

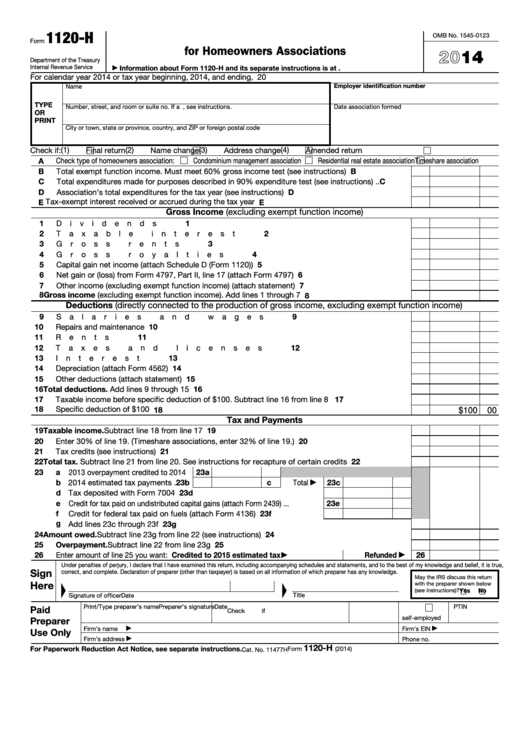

Form 1120 H Tax Filing Deadlines and Due Dates Form 1120 H must be filed by the 15th day of the 4th month after the end of the association s tax year Any tax due must be A homeowners association elects to take advantage of the tax benefits provided by section 528 by filing a properly completed Form 1120 H The election is made separately for each tax year

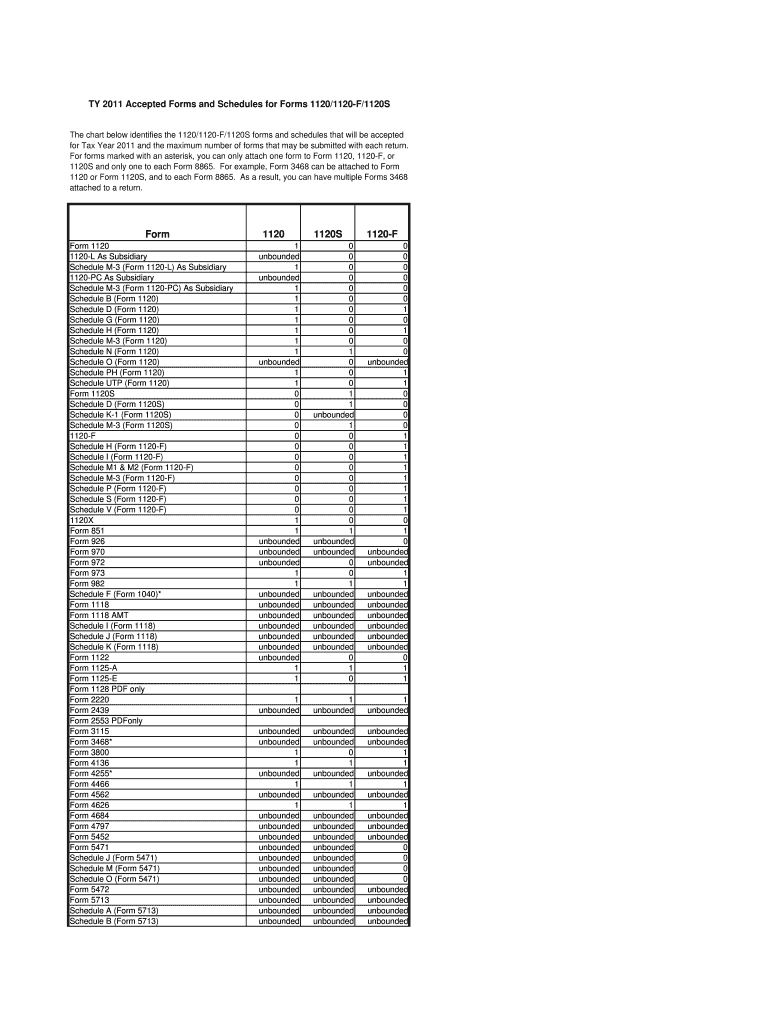

IRS begins accepting 1120 electronic tax returns There s no final date for the transmission of electronic 1120 returns You can continue to use 2022 and 2021 UltraTax CS There are two different forms that can be filed Form 1120 and Form 1120 H Read the instructions carefully There are a few things you can do to make filing an HOA tax return easier First separate the member fees and assessments

More picture related to form 1120 h deadline

Fillable Form 1120 H U s Income Tax Return For Homeowners

https://data.formsbank.com/pdf_docs_html/129/1291/129169/page_1_thumb_big.png

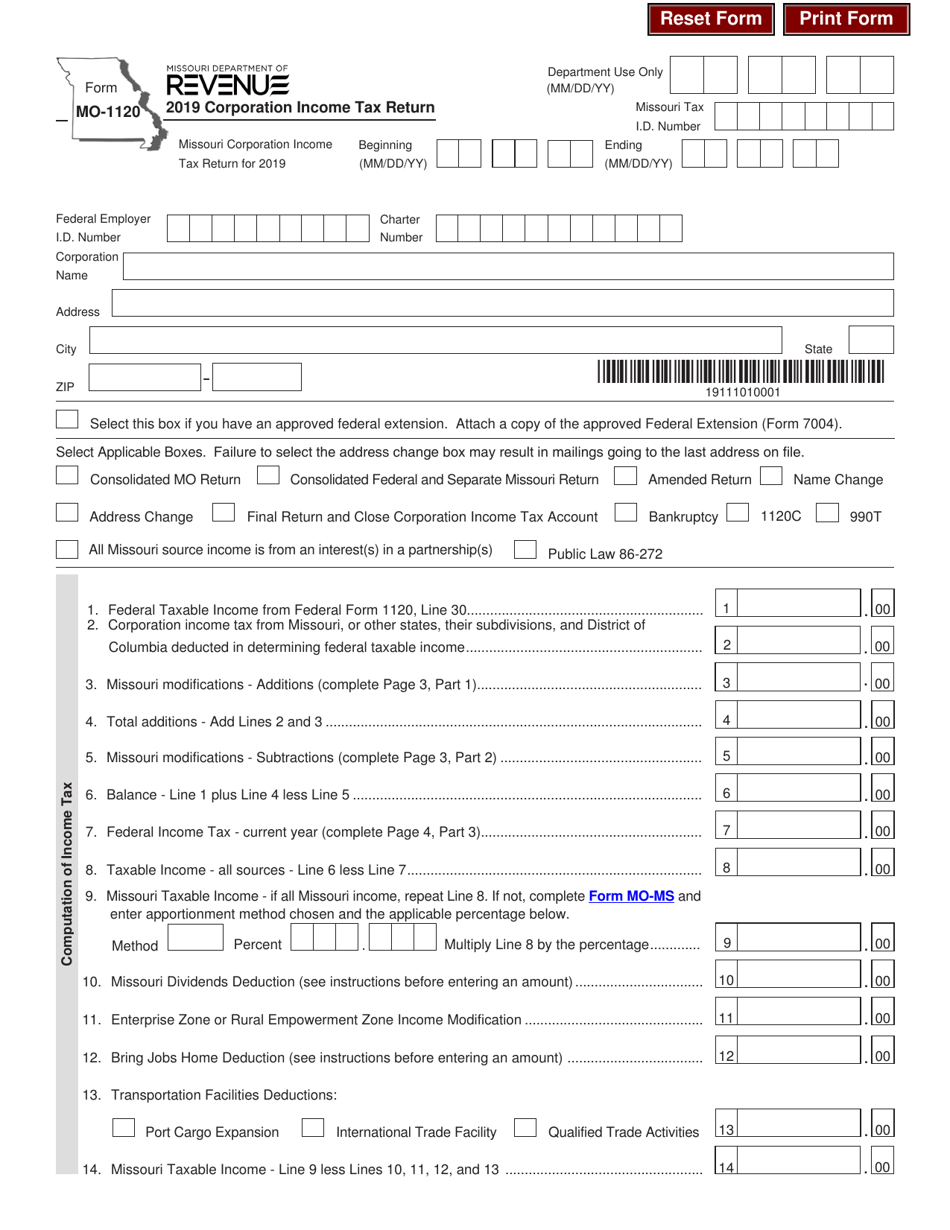

Form MO 1120 Download Fillable PDF Or Fill Online Corporation Income

https://data.templateroller.com/pdf_docs_html/2080/20803/2080340/form-mo-1120-corporation-income-tax-return-missouri_print_big.png

Form 1120 Other Deductions Worksheet Fill Out And Sign Printable PDF

https://www.signnow.com/preview/0/844/844177/large.png

Form 1120 H Department of the Treasury Internal Revenue Service U S Income Tax Return for Homeowners Associations Go to irs gov Form1120H for instructions and the latest Does My HOA Need to File Form 1120 H Every Year An HOA must qualify each year by filing an 1120 H before the 15th day of the 3rd month after the end of the HOA s tax year Qualification is not permanent

Form 1120 H must be submitted on the 15th day of the 4th month following the end of the association s fiscal year However if your fiscal year ends on June 30 Form 1120 H must be HOAs have two forms to choose from 1120 and 1120 H Form 1120 is used by C corporations while 1120 H is a tax form specifically designed for qualifying HOAs What makes HOAs

Form 1120 When And How To File

https://assets.website-files.com/6094875660e7caf817a85eb9/6372485a389c7a400ba41658_Blank.jpg

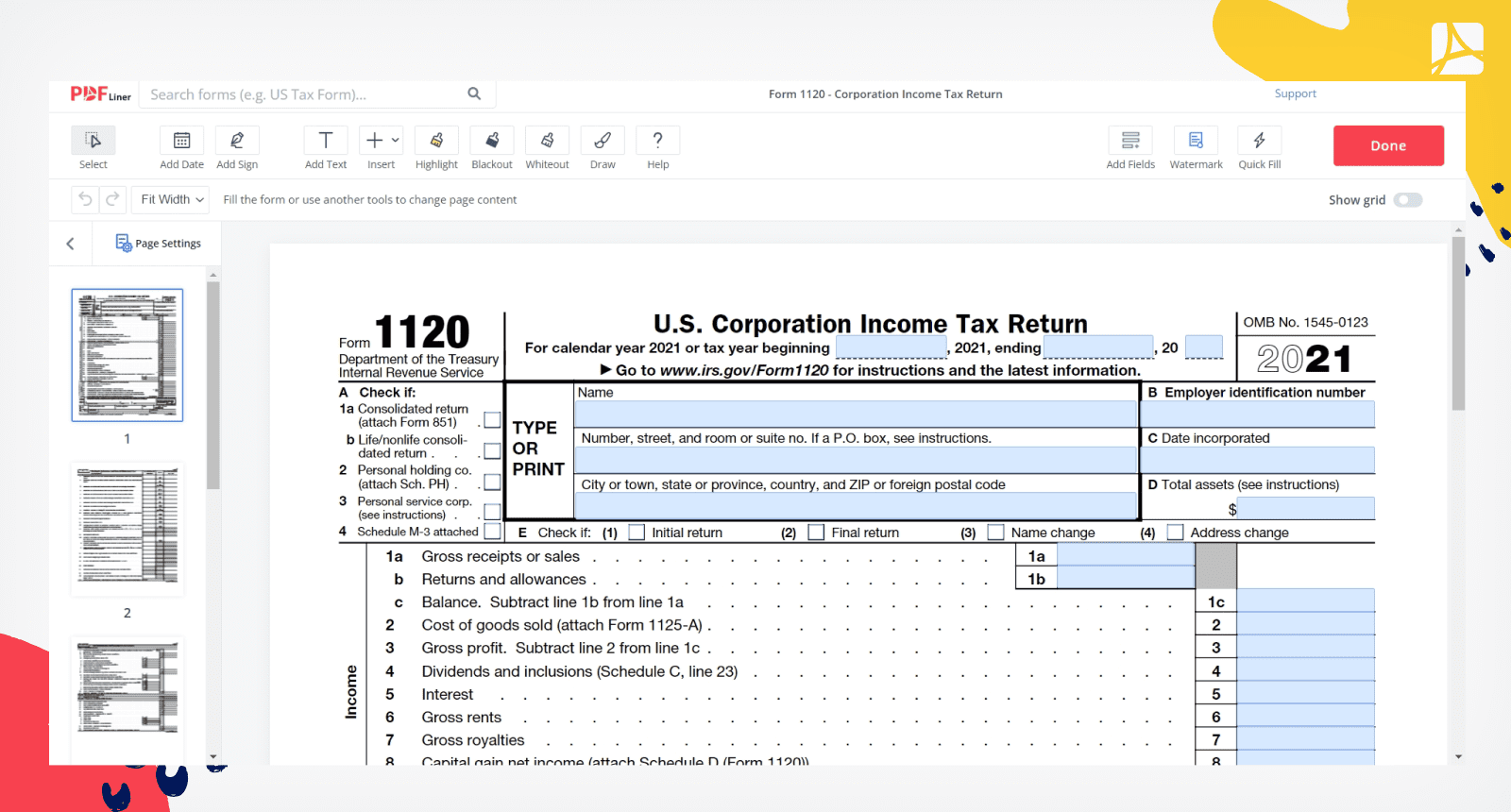

IRS Form 1120 2022 Edit Download And Send Online PDFliner

https://pdfliner.com/ckeditor/images/cA0TauUSclZedxgBe199SFOj3w9oJXv2QzmnjSXQ.png

form 1120 h deadline - Form 1120 H Tax Filing Deadlines and Due Dates Form 1120 H must be filed by the 15th day of the 4th month after the end of the association s tax year Any tax due must be