form 1120 h 2022 Information about Form 1120 H U S Income Tax Return for Homeowners Associations including recent updates related forms and instructions on how to file A homeowners association files

An HOA may elect to file Form 1120 H U S Income Tax Return for Homeowners Associations as its income tax return in order to take advantage of certain tax benefits These benefits in A homeowners association files Form 1120 H as its income tax return to take advantage of certain tax benefits These benefits in effect allow the association to exclude exempt function

form 1120 h 2022

form 1120 h 2022

https://www.pdffiller.com/preview/578/929/578929624/large.png

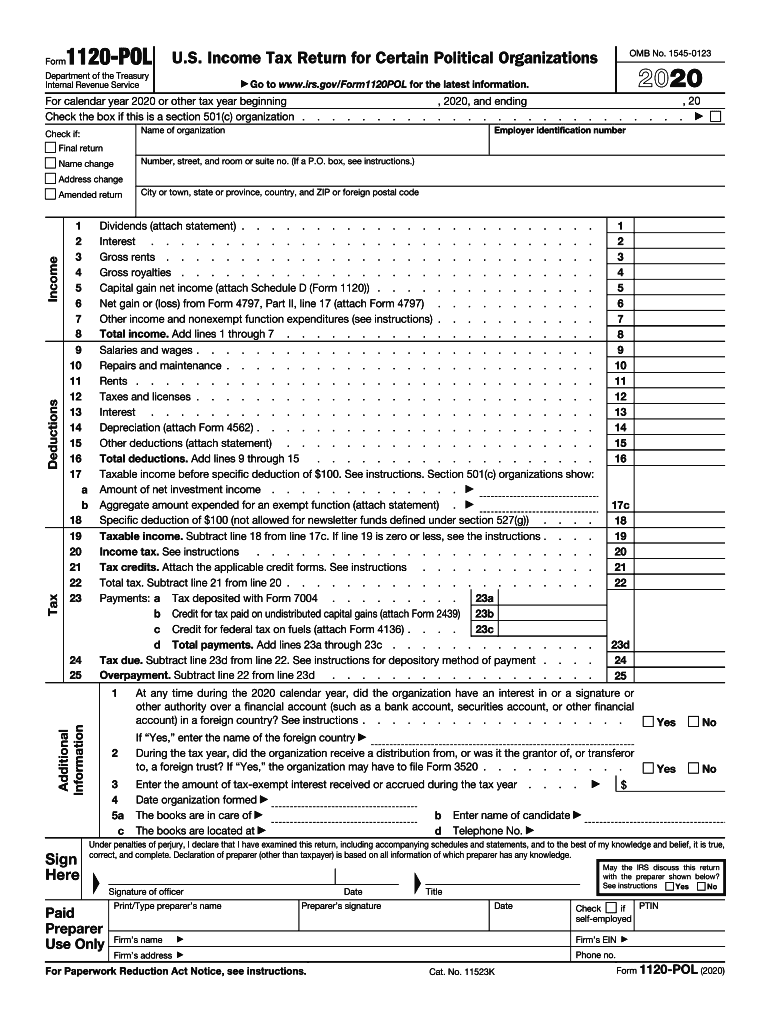

2020 Form IRS 1120 POL Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/530/48/530048917/large.png

1120 Fsc 2023 Blank Sample To Fill Out Online In PDF

https://www.pdffiller.com/preview/458/73/458073463/big.png

Following the detailed Form 1120 H instructions for the 2022 tax year can help homeowners associations properly file their returns and comply with IRS regulations Key Form 1120 H must be submitted on the 15th day of the 4th month following the end of the association s fiscal year However if your fiscal year ends on June 30 Form 1120 H must be submitted by the 15th day of the 3rd month following

Looking for a form 1120 H example We walk through the HOA tax return and point out some of the tips and tricks to stay compliant Let s take a look HOAs have two forms to choose from 1120 and 1120 H Form 1120 is used by C corporations while 1120 H is a tax form specifically designed for qualifying HOAs What makes HOAs unique is the ability to file two different tax returns

More picture related to form 1120 h 2022

1120s Due Date

https://www.irs.gov/pub/xml_bc/51221535.gif

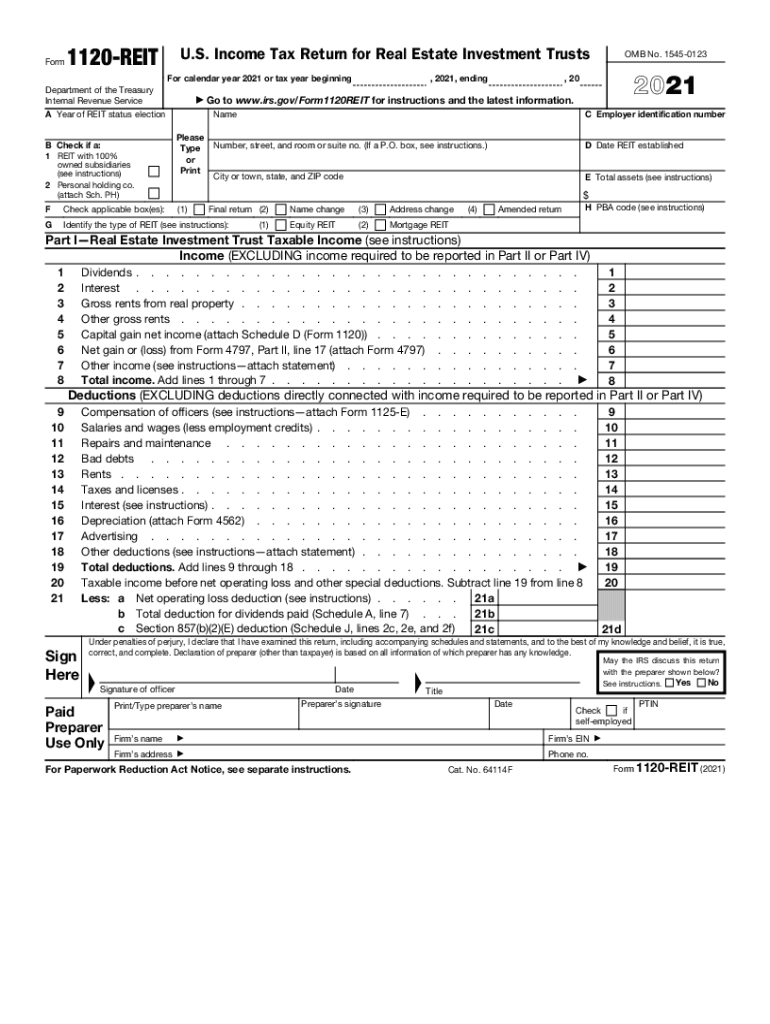

IRS Form 1120 REIT Download Fillable PDF Or Fill Online U S Income Tax

https://data.templateroller.com/pdf_docs_html/2017/20173/2017374/irs-form-1120-reit-u-s-income-tax-return-for-real-estate-investment-trusts_print_big.png

3 11 217 Form 1120S Corporation Income Tax Returns Internal Revenue

https://www.irs.gov/pub/xml_bc/51221503.gif

The Form 1120 H is also known as an U S Income Tax Return for Homeowners Associations Using this form instead of a standard tax return will allow a homeowner s association to take advantage of several tax benefits The 1120H U S Income Tax return for a Homeowners Association cannot be electronically filed It can be generated for paper filing by creating a corporate return going to the first Other

Learn about how homeowners associations can save money on their federal taxes by filing IRS Form 1120 instead of Form 1120 H Full details inside Download or print the 2023 Federal Form 1120 H U S Income Tax Return for Homeowners Associations for FREE from the Federal Internal Revenue Service

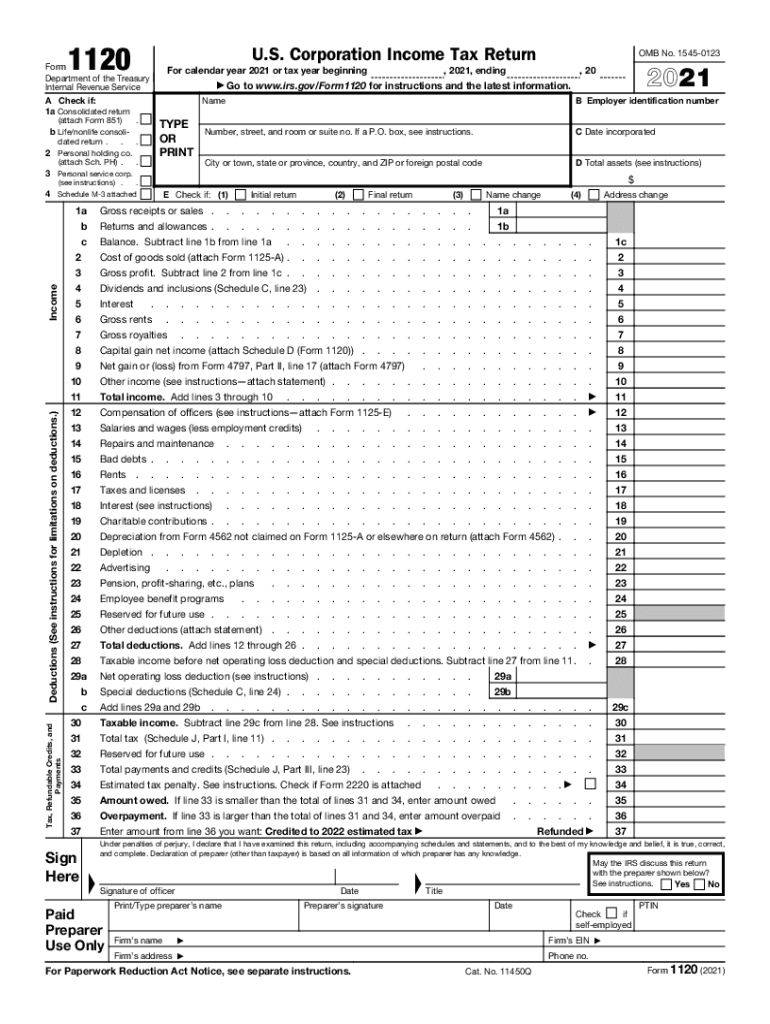

IRS 1120 2021 2022 Fill And Sign Printable Template Online US Legal

https://www.pdffiller.com/preview/579/101/579101667/large.png

8295 2020 2023 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/536/160/536160330/large.png

form 1120 h 2022 - One option is to file form 1120 H which is at the flat tax rate of 30 on net taxable income and is based on IRC Section 528 This is a one page form with minimal tax preparation issues Filing