flat tax rate What Is a Flat Tax A flat tax is a single tax rate applied to all taxpayers regardless of income Employing a flat tax means that taxpayers cannot take deductions or exemptions

A flat tax system is a single rate tax applied uniformly to all income levels without considering deductions exemptions or varying tax brackets It simplifies the taxation system making it easier for taxpayers to understand and comply with tax laws Definition A flat tax system levies the same percentage rate on all taxpayers By contrast a progressive tax system increases rates on higher incomes

flat tax rate

flat tax rate

https://www.washingtonpost.com/resizer/Fwu4uryQncdDK8GRea-3NLDsNtQ=/1484x0/arc-anglerfish-washpost-prod-washpost.s3.amazonaws.com/public/7ALLOLCGO46NZCKP55QTL4NQQM.png

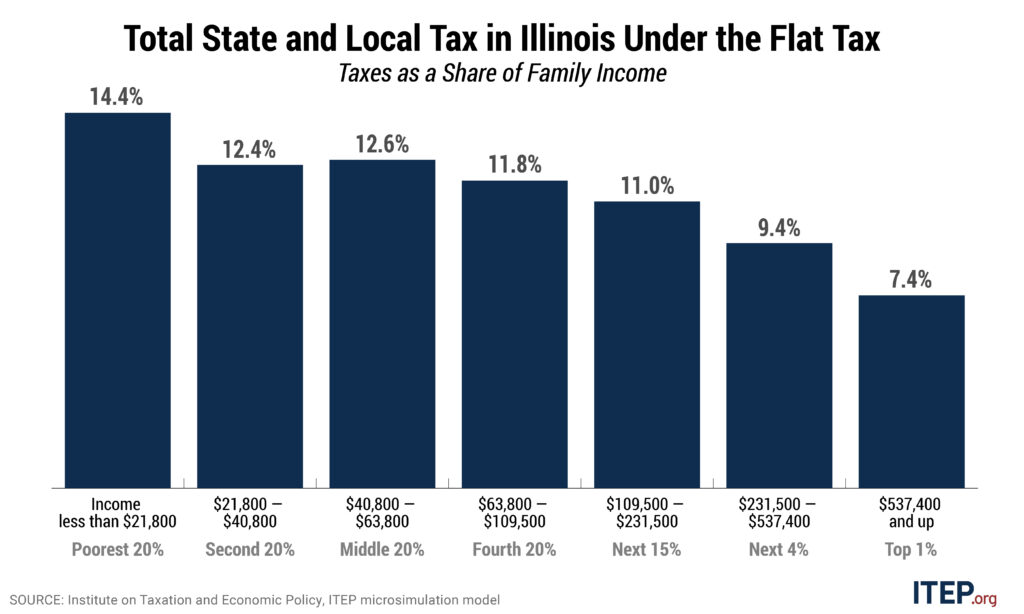

Illinois s Flat Tax Exacerbates Income Inequality And Racial Wealth

https://itep.sfo2.digitaloceanspaces.com/Figure-2-State-and-Local-Tax-under-the-Flat-Tax-1024x614.jpg

Flat Tax Definition Examples Pros Cons Of Flat Income Tax System

https://www.wallstreetmojo.com/wp-content/uploads/2019/08/Flat-Tax.png

A flat tax refers to a tax system where a single tax rate is applied to all levels of income This means that individuals with a low income are taxed at the same rate as individuals with a high income Flat tax refers to the taxation of all income groups at a standard rate by the government It is still prevalent in countries like Russia Ukraine and Georgia Under this taxation system the government doesn t facilitate

A flat tax is a tax system in which everyone pays the same tax rate regardless of their income While countries such as Estonia have seen their economies grow since implementing a A flat income tax is a taxation model that applies the same rate to all taxpayers regardless of their income This concept starkly contrasts with the progressive tax system currently employed by many countries including the United States where tax ratesincrease as taxable income increases

More picture related to flat tax rate

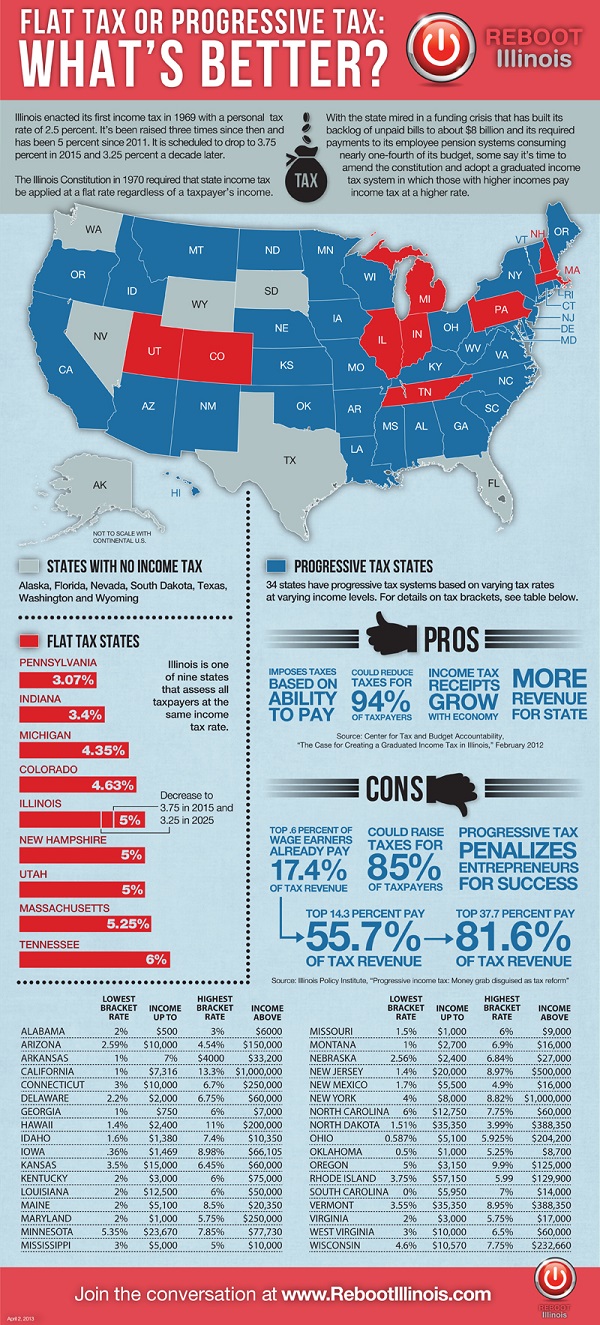

Flat Income Tax Progressive Tax No State Income Tax A Nationwide

http://images.huffingtonpost.com/2013-07-19-FlatorProgressiveTax.jpg

Most Tax Friendly States To Enjoy Your Hard Earned Dollars

https://www.creditloan.com/media/flat-tax-states-rates-2018-4.png

What Is A Flat Tax On Income Credit Karma

https://creditkarma-cms.imgix.net/wp-content/uploads/2019/06/what-is-flat-tax-on-income_986674576.jpg

The flat tax can be split into two parts the business tax and the individual tax Firms would be responsible for paying taxes at a flat rate on sales after they have deducted wages pensions material costs and capital investments The reforms include A flat tax An income tax is referred to as a flat tax when all taxable income is subject to the same tax rate regardless of income level or assets of 20 percent on individual income combined with a generous family allowance to protect low income households

[desc-10] [desc-11]

4 Reasons Why Pritzker Should Abandon His Progressive Tax Plan Wirepoints

https://wirepoints.org/wp-content/uploads/2019/02/4-of-Illinois-neighbors-have-a-flat-tax.png

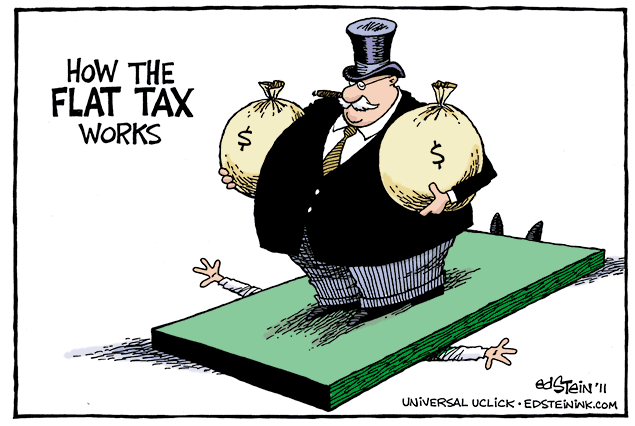

The Flat Tax Visualized Comic

http://www.prosebeforehos.com/wordpress/wp-content/uploads/2011/12/flat-tax-visualized.png

flat tax rate - A flat income tax is a taxation model that applies the same rate to all taxpayers regardless of their income This concept starkly contrasts with the progressive tax system currently employed by many countries including the United States where tax ratesincrease as taxable income increases