examples of credit cards Revolving credit is a line of credit that can be borrowed and repaid as needed with interest rates that vary with the Federal Reserve Learn how revolving credit works why it matters and what factors affect its approval and cost

Learn what a credit limit is and how it works for credit cards and loans Find out how factors like credit score income and job stability affect your credit limit and why it matters A charge card is a plastic card that allows the user to borrow funds from a financial institution and pay the balance in full each month Learn the difference between charge cards and credit cards the benefits and risks of using charge cards and

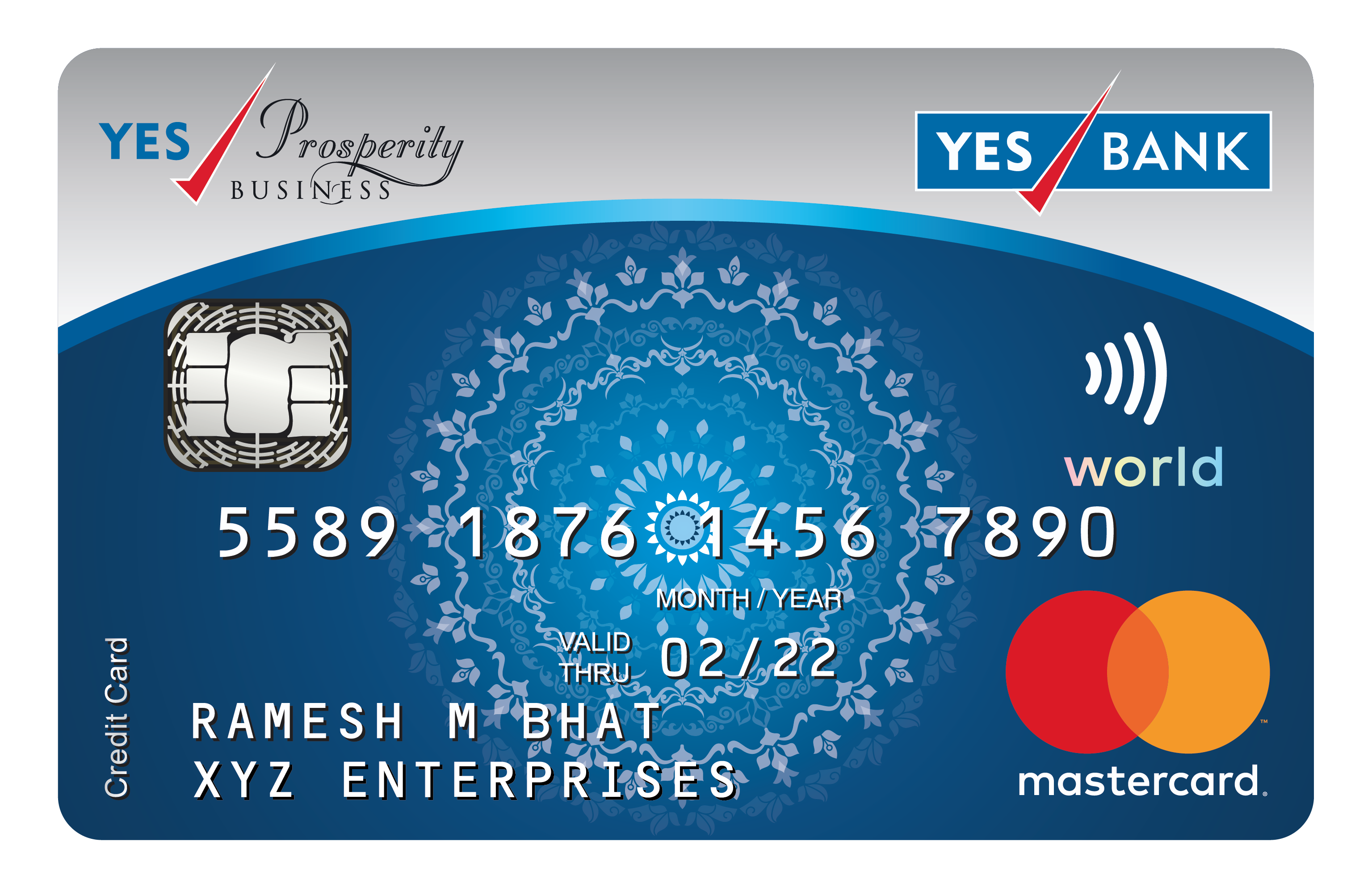

examples of credit cards

examples of credit cards

https://www.betterloanchoice.com/articles/wp-content/uploads/2013/08/credit.jpg

20 Amazing Facts About Credit Cards You Didn t Know Yet Paymaxx Pro

http://paymaxxpro.com/wp-content/uploads/2017/04/creditcards.jpg

Credit Card PNG

https://pngimg.com/uploads/credit_card/credit_card_PNG236.png

Near money is a term for highly liquid assets that are quickly and easily converted into cash Learn how near money works in liquidity analysis money supply personal wealth management and corporate finance Ensure that you re paying all your loans and credit cards back on time even if it s the minimum payment amount If you keep doing this consistently you should see your score go up Avoid applying for new credit Having too many recent applications may show lenders you re stretched thin financially and relying on credit too much potentially

If you divide that number by the number of Americans with credit cards 50 2 million it means the average American has an astounding 15 799 in credit card debt The number keeps on growing because even with legislation aimed at protecting consumers from credit card debt the system is stacked against consumers Credit Card Debt s Downward Spiral A fleet card is a payment card for vehicle related expenses issued to employees by a company Learn how fleet cards work their benefits and how they differ from corporate credit cards

More picture related to examples of credit cards

What Are The Different Types Of Credit Cards

https://www.usatoday.com/money/blueprint/images/uploads/2023/09/20043411/GettyImages-1072350908-scaled-e1695198888445.jpg

Credit Card Umemployed Or Self employed Here s How You Can Get A

https://imgk.timesnownews.com/story/1569653930-Credit_Card.jpg

Credit Card Britannica

https://cdn.britannica.com/02/160902-050-B58BAD84/Credit-cards.jpg

Equity financing is when a company sells part of its ownership to investors in exchange for cash Learn about the common types of equity financing such as angel investors venture capital IPOs and crowdfunding and how they differ from debt financing A finance charge is the fee charged to a borrower for the use of credit extended by the lender It can include interest fees and other costs and vary depending on the type of loan and the borrower s creditworthiness

[desc-10] [desc-11]

Best Credit Cards For Every Type Of Purchase Reader s Digest

https://www.rd.com/wp-content/uploads/2018/04/creditcard-2.jpg

Whom Do Credit Card Rewards Programs Really Reward The New Yorker

https://media.newyorker.com/photos/639a3abffa4ffde83ca42fad/master/w_2560%2Cc_limit/Lardner-Credit-Card-Final-2.jpg

examples of credit cards - If you divide that number by the number of Americans with credit cards 50 2 million it means the average American has an astounding 15 799 in credit card debt The number keeps on growing because even with legislation aimed at protecting consumers from credit card debt the system is stacked against consumers Credit Card Debt s Downward Spiral