erisa 3 21 vs 3 38 fiduciary The main difference between a 3 21 vs 3 38 fiduciary advisor lies in the duties they perform when working with retirement plan sponsors

ERISA 3 21 investment advice fiduciary Unlike an ERISA 3 21 investment advice fiduciary an ERISA 3 38 investment manager must be formally appointed An investment manager must ERISA 3 38 Fiduciary An Overview An ERISA 3 38 fiduciary on the other hand is granted full discretionary authority to manage the plan s assets This fiduciary assumes responsibility for selecting monitoring and replacing the

erisa 3 21 vs 3 38 fiduciary

erisa 3 21 vs 3 38 fiduciary

https://www.mariettawealth.com/wp-content/uploads/2022/02/feb2022rt1.png

ERISA 3 21 3 38 Investment Advisors

https://blog.multnomahgroup.com/hubfs/Images/Blog_Images/shutterstock_260251187.jpg#keepProtocol

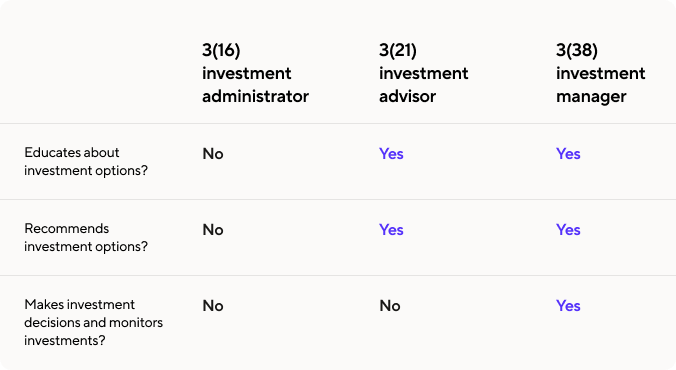

What Is The Difference Between A 3 16 3 21 And 3 38 Fiduciary

https://media.licdn.com/dms/image/C4D12AQFOqSt0D-7aDQ/article-cover_image-shrink_600_2000/0/1520157043670?e=2147483647&v=beta&t=pPYtmoNFHAXZaB2Tuvhzr24rdpbhKJUG-RtZinBuwK8

Hosted by ERISA attorney Ary Rosenbaum and presented by Lyle Himebaugh of Granite Group Advisors it explained the key differences between a 3 21 and 3 38 advisor The most important differences come down to risk and responsibility As Carol points out a 3 21 fiduciary acts as an investment advisor who does some of the work and makes recommendations By contrast a 3 38 is an investment

ERISA section 3 21 defines the term fiduciary and section 3 38 sets forth the requirements for serving as an investment manager to a qualified retirement plan Anyone can call himself or herself a fiduciary but a fiduciary is determined not only by title but by actions as well Both 3 21 and 3 38 advisors accept fiduciary

More picture related to erisa 3 21 vs 3 38 fiduciary

Why You NEED A 3 38 Fiduciary Advanced Business Solutions

https://www.abs-core.com/wp-content/uploads/2022/06/kenny-eliason-AOJGuIJkoBc-unsplash-1030x687.jpg

Employer Liability 3 38 Financial Planning Tucson Wellspring

http://wellspringfinancialpartners.com/wp-content/uploads/2016/05/fiduciary-1024x452.png

Managing Retirement With A 3 38 Fiduciary Guideline

https://www.guideline.com/blog/content/images/2023/05/3-38-Fiduciary-Chart---20230505.png

Some employers the fiduciary duties of their 401 k plan In turn they can hire a 3 38 3 21 or 3 16 fiduciary Here s how they differ A 3 21 investment adviser is a co fiduciary role whereby an adviser provides advice to an employer with respect to funds on a 401 k investment menu and the employer

What are the 3 16 3 21 and 3 38 fiduciary roles The 3 in 3 16 3 21 and 3 38 comes from Section 3 of ERISA which contains the rules and defines fiduciary roles into three separate sections A 3 38 fiduciary has discretionary control of a plan s investment assets Here is how it works and how it differs from a 3 21

_vs_ERISA_3(21)_vs_ERISA_3(16).png?width=960&height=652&name=ERISA_3(38)_vs_ERISA_3(21)_vs_ERISA_3(16).png)

What Employers Need An ERISA 3 38 Fiduciary Advisor

https://www.carboncollective.co/hs-fs/hubfs/ERISA_3(38)_vs_ERISA_3(21)_vs_ERISA_3(16).png?width=960&height=652&name=ERISA_3(38)_vs_ERISA_3(21)_vs_ERISA_3(16).png

Understanding Fiduciary Roles 3 21 Vs 3 38 PlanPILOT Retirement

https://planpilot.com/wp-content/uploads/2018/09/fiduciary-roles-responsibilities-768x384.jpeg

erisa 3 21 vs 3 38 fiduciary - Anyone can call himself or herself a fiduciary but a fiduciary is determined not only by title but by actions as well Both 3 21 and 3 38 advisors accept fiduciary