does uber send 1099 Learn about the types of tax documents you could receive from Uber including 1099 K 1099 NEC and 1099 MISC Find out how to access your tax documents file your

Not all drivers and delivery people will receive 1099s For more information please review What is the 1099 K What is the 1099 NEC and What is the 1099 MISC questions below or at Uber drivers can download their 1099 tax forms from drivers uber or the Driver App after January 31st If they opted for a physical copy they should receive it in the mail after February

does uber send 1099

does uber send 1099

https://1099.expert/wp-content/uploads/2023/12/image-title-Generate-high-resolution-30140.png

Irs 1099 Nec Printable Form

https://free-printable-az.com/wp-content/uploads/2019/07/irs-form-1099-reporting-for-small-business-owners-free-printable-1099-misc-forms.png

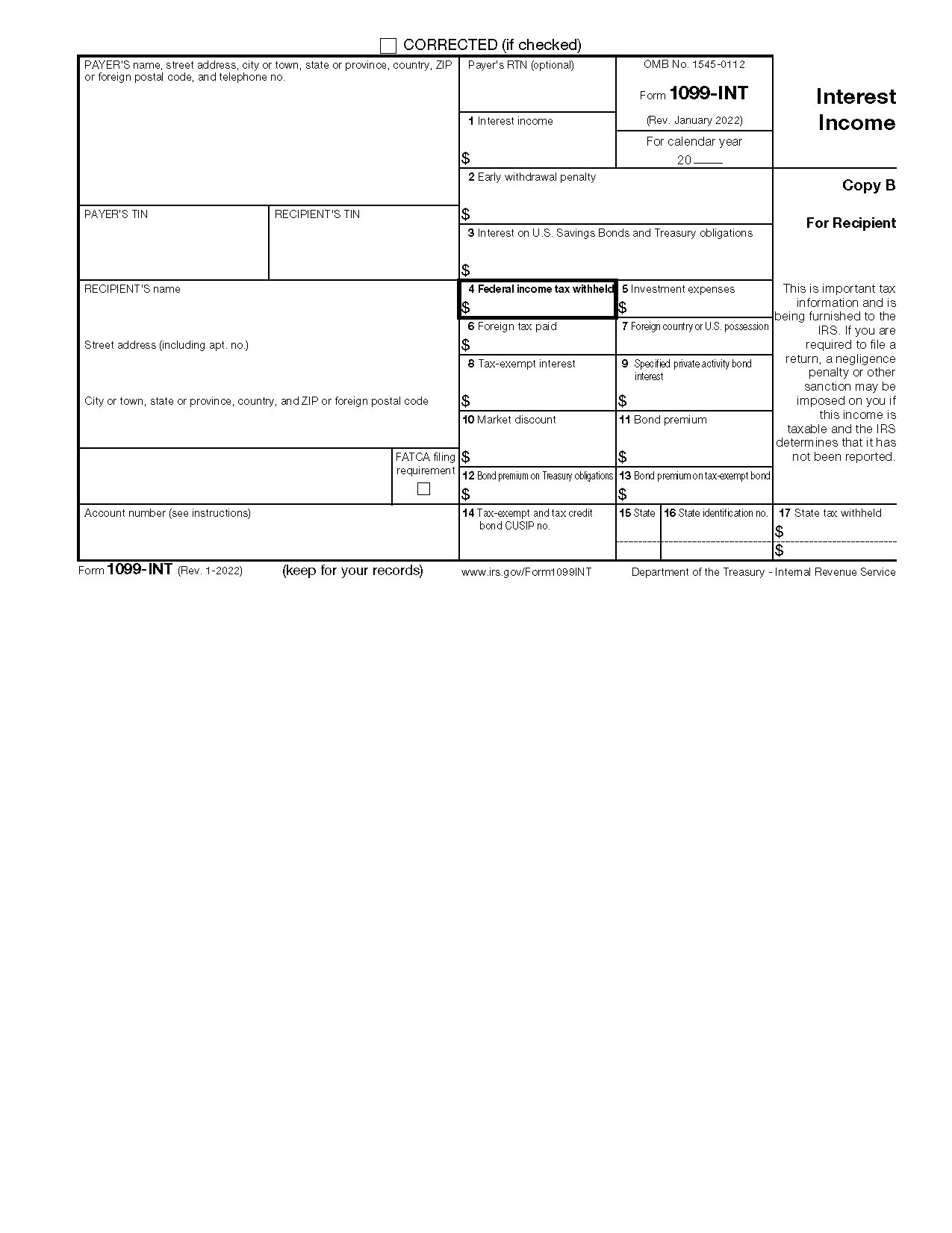

Free IRS Form 1099 INT PDF EForms

https://eforms.com/images/2023/10/IRS-Form-1099-INT.png

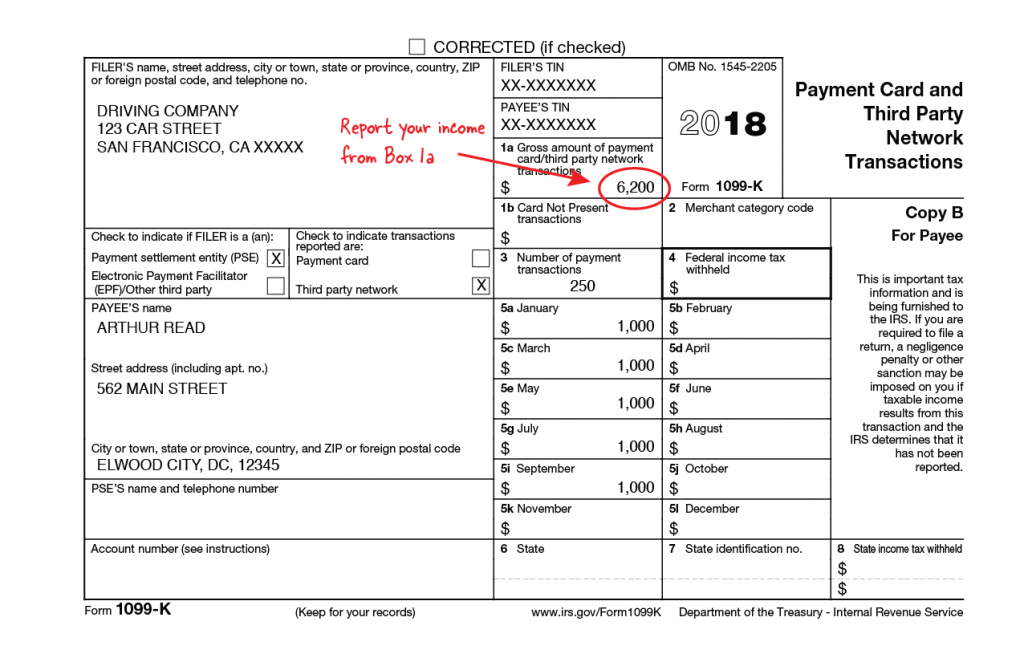

Uber will report your earnings on 1099 NEC 1099 MISC and 1099 K forms which you ll use to file Schedule C and Schedule SE for self employment tax Learn how t Yes Uber does report taxes to the IRS under certain circumstances Specifically Uber is required to issue a 1099 K form to drivers who have earned more than 20 000 in gross ride receipts

As an Uber independent contractor you may get one or both of the following tax forms 1099 K form If you ve earned over 600 in gross unadjusted earnings from rides and deliveries 1099 Starting in 2021 the 1099 NEC replaced the 1099 MISC for reporting specific tax information From 2022 most people won t get a 1099 MISC Only those who qualify and earned 600 or

More picture related to does uber send 1099

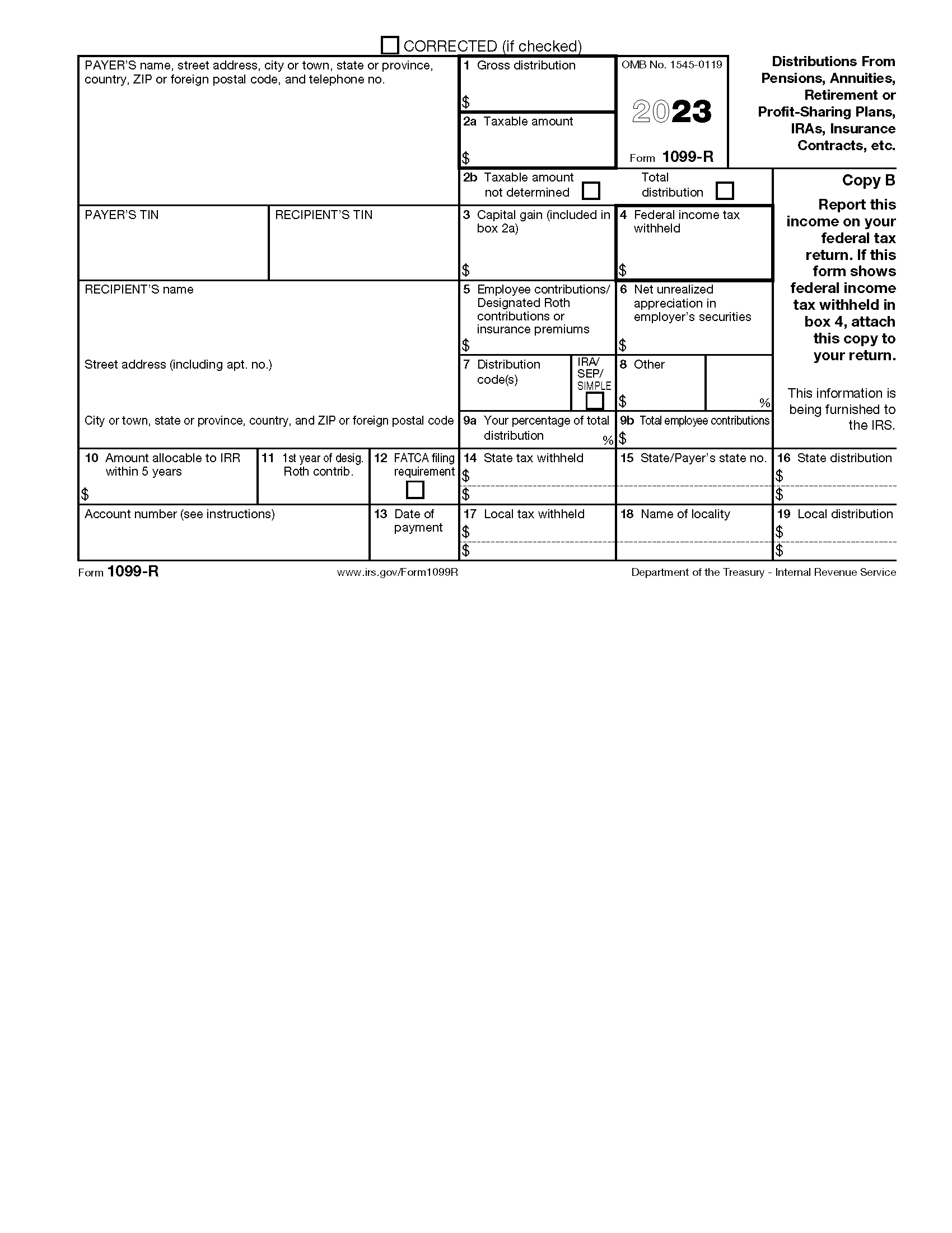

Free IRS 1099 R PDF EForms

https://eforms.com/images/2023/10/IRS-Form-1099-R.png

What Is A 1099 K Stride Blog

https://images.squarespace-cdn.com/content/v1/56f9ad715f43a6d77cb2536a/1553024571137-QUSFDUJQ2E8F664XHMR7/what+is+a+1099-k%3F

Uber Taxes Explained How To File Taxes For Uber Lyft Drivers YouTube

https://i.ytimg.com/vi/uAOx88rzHCM/maxresdefault.jpg

Uber will send you a 1099 MISC or NEC showing what you earned while driving for them as well as the number of miles so you can calculate the mileage deduction if you choose to Uber drivers must self report their income and expenses on a 1099 K and a 1099 MISC Learn how to read record and report your Uber 1099s with QuickBooks software and tools

Uber doesn t withhold taxes from your earnings as an independent contractor You may receive a 1099 K or 1099 NEC form depending on your annual gross earnings and email addresses Uber not unlike every other US company that has independent contractors to pay is required to submit all 1099 forms for non employed compensation and W 2 forms for employees The

Uber Taxes Explained How To File Taxes For Uber Lyft Drivers

https://i.ytimg.com/vi/69fczJQw9T4/maxresdefault.jpg

1099 Unemployment Tax Calculator AnaliseTymon

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/618c3ceee20d2e2d2d1a7ddd_doordash-1099-taxes-form-1099-nec.png

does uber send 1099 - If you re a self employed worker with Uber you ll file your taxes using your 1099 form Here s where to find it so you re ready to go when tax season arrives