does square send 1099 If you are a Square seller and have an account with 600 or more in gross sales from goods or services in the 2022 tax year you may qualify for a Form 1099 K Qualifications

If you are eligible your 1099 INT tax form will be available to download on your Square Dashboard by January 31 You can find additional instructions for filing with your Forms 1099 How does a 1099 K from Square factor into your taxes And how do you go about getting the form in the first place This article answers those questions and provides tips for saving money on your 1099 taxes

does square send 1099

does square send 1099

https://free-printablehq.com/wp-content/uploads/2019/07/irs-form-1099-reporting-for-small-business-owners-free-printable-1099-form.png

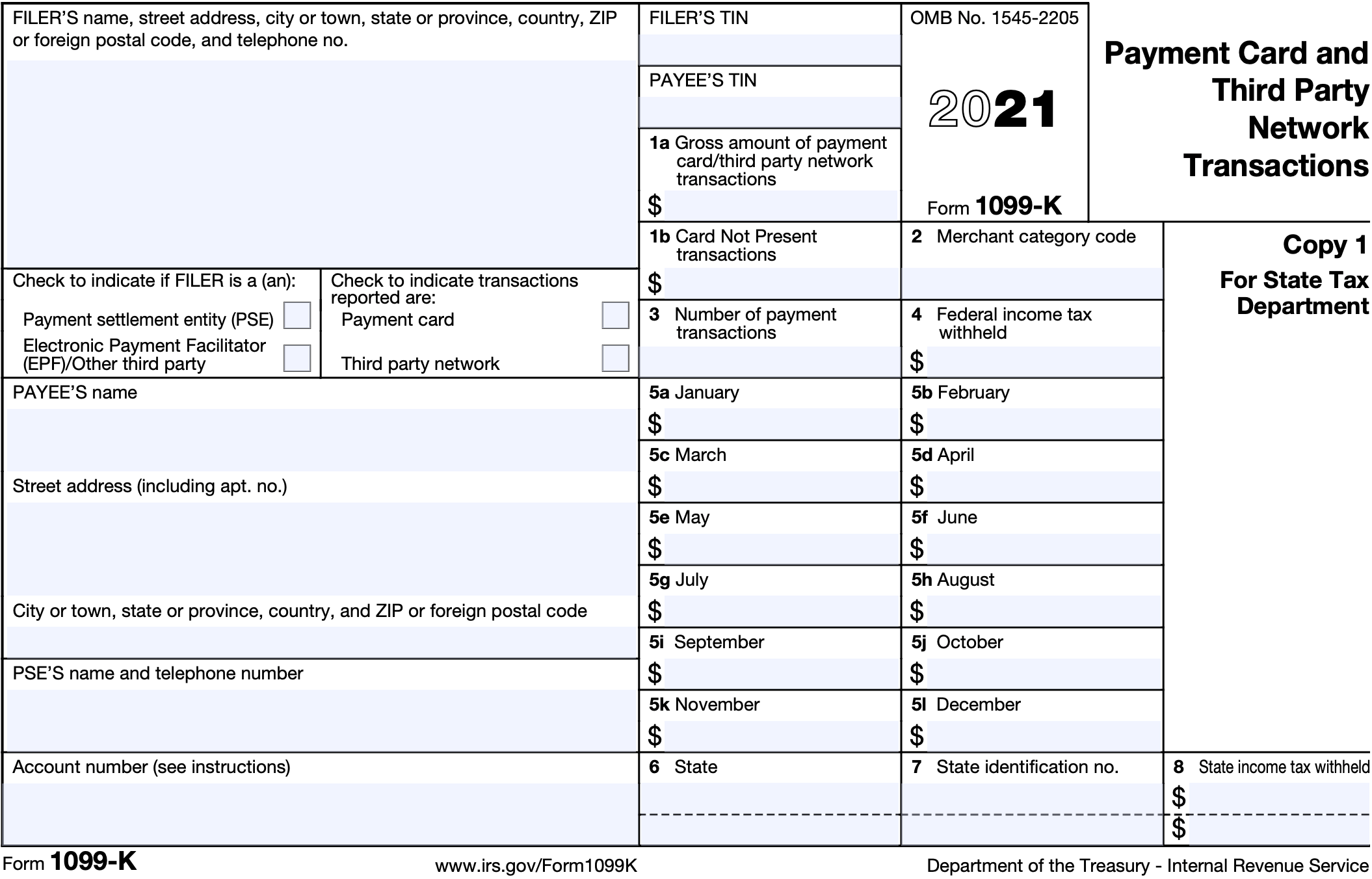

Payment Card And Third Party Network Transactions 1099 K Crippen

https://crippencpa.com/wp-content/uploads/2022/07/1099-K-form.png

How To File A 1099 Form For Vendors Contractors And Freelancers

https://assets-global.website-files.com/60a6b551be6130e4e5b19b98/62febbe85290864275ec05d3_Blog_Hero_1099.png

Generally if you exceed 20 000 in transactions for goods and services and have more than 200 business transactions in a year you will likely receive a Form 1099 K by the end of January or In most states Square has to send a Form 1099 K to the IRS for accounts that meet both of the following criteria More than 20 000 in income from products or offerings all throughout the year And more than 200 deals in

Square Tax Reporting and Form 1099 K Overview Read article Update Form 1099 K Read article 1099 K Topics Form 1099 K Tax Reporting Information Form 1099 K Qualifications As a payment processor Square is required by law to report to the IRS all earnings processed through its platform This includes 1099 K forms which are sent to both the IRS and the seller detailing the total gross payment

More picture related to does square send 1099

How To Read Your 1099 R And 5498 Robinhood

https://images.ctfassets.net/fomw95h5b4ty/750v6J4OcVJ4qgG92KAfQj/548cbf16b32045a5733b44426b765446/example-1099-r.png

Your Free Guide To The 1099 Tax Form OPG Guides

https://cdn.opgguides.com/wp-content/uploads/sites/239/2022/04/Cover_1099-Tax-Form.jpg

Does Crypto Send A 1099

https://watcher.guru/news/wp-content/uploads/2023/04/1099.jpg

If you ve received payments on Square as a self employed individual or a freelancer you may have received a 1099 K Form from Square at the end of the year If you re a sole proprietor You are required to provide your team members with a physical copy of their Form W 2 or Form 1099 NEC unless they consent to electronic only delivery Alternatively you can

This guide covers information about Square Tax Reporting and the Form 1099 K including qualification standards IRS rules and how to update the Federal Business Tax ID Yes Square reports to IRS all the account transactions which qualify for the Form 1099 K criteria IRS or the Internal Revenue Service requires payment service providers to

How To Use The New 1099 NEC Form For 2020 SWK Technologies Inc

https://www.dynamictechservices.com/wp-content/uploads/2020/11/1099-NEC-blog-header-Final.png

IMG 1099 Retrohen

https://retro-hen.com/wp-content/uploads/2019/01/IMG_1099.jpeg

does square send 1099 - Generally if you exceed 20 000 in transactions for goods and services and have more than 200 business transactions in a year you will likely receive a Form 1099 K by the end of January or