difference between itr 1 2 3 and 4 Which income tax form applies to you The deadline to file Income Tax Returns ITR for FY 2022 23 is 31st July 2023 Online filing for ITRs 1 and 4 has been enabled Different ITR forms

This guide explains eligibility for ITR 3 and ITR 4 variants for businesses and professionals It also discusses presumptive taxation under Sections 44AD 44ADA and Filing taxes Discover the differences between ITR 3 vs ITR 4 which form to use deadlines and eligibility criteria Simplify your tax filing process

difference between itr 1 2 3 and 4

difference between itr 1 2 3 and 4

https://www.legalraasta.com/blog/wp-content/uploads/2018/08/Untitled-design-28-e1534745605196.png

ITR E Filing ITR 3 Vs ITR 4 Difference Between ITR 4 ITR 3 ITR

https://i.ytimg.com/vi/-lAlflQkyX8/maxresdefault.jpg

Types Of ITR Which ITR Should I File GeeksforGeeks

https://media.geeksforgeeks.org/wp-content/cdn-uploads/20230210110107/TYPES-OF-ITR.png

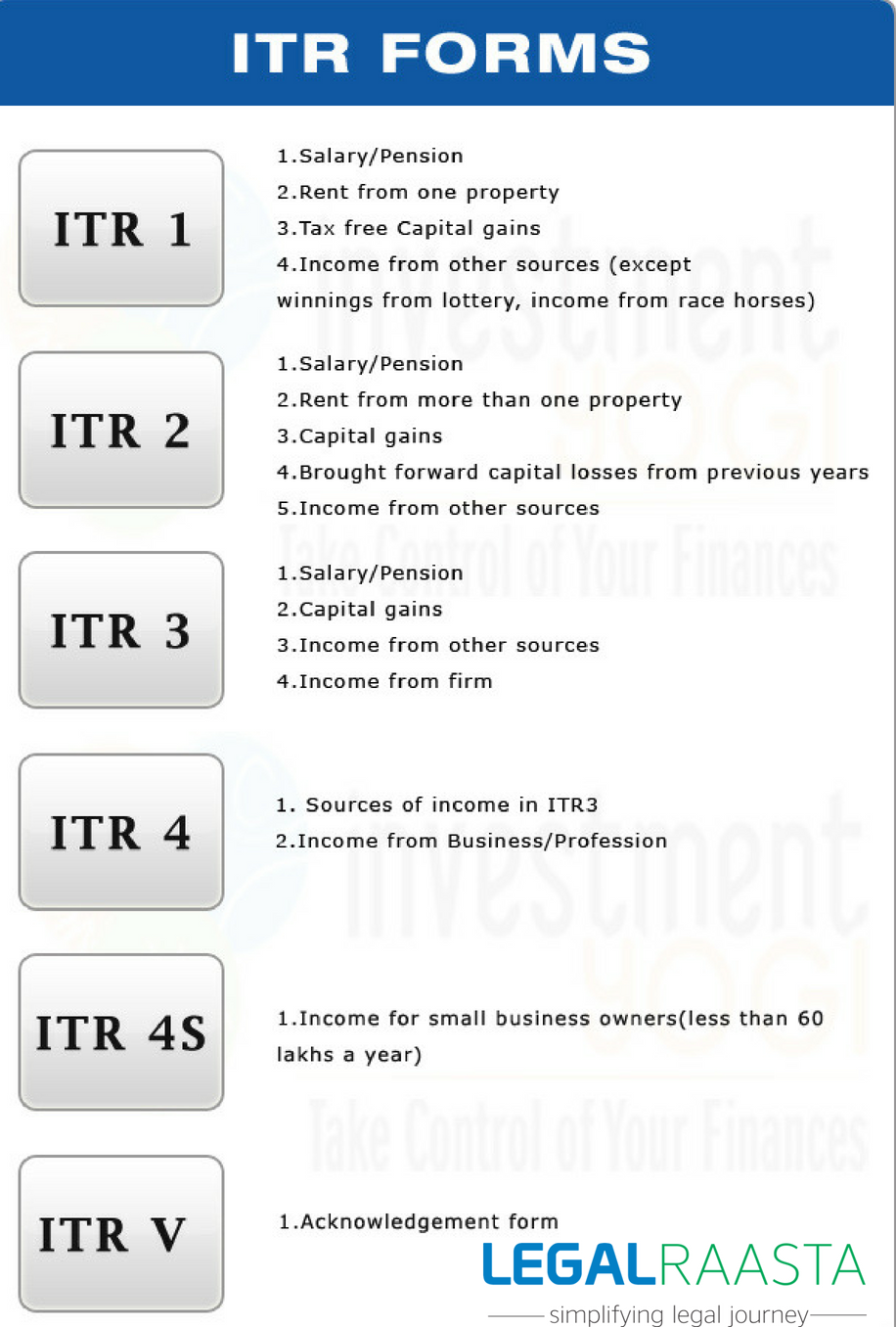

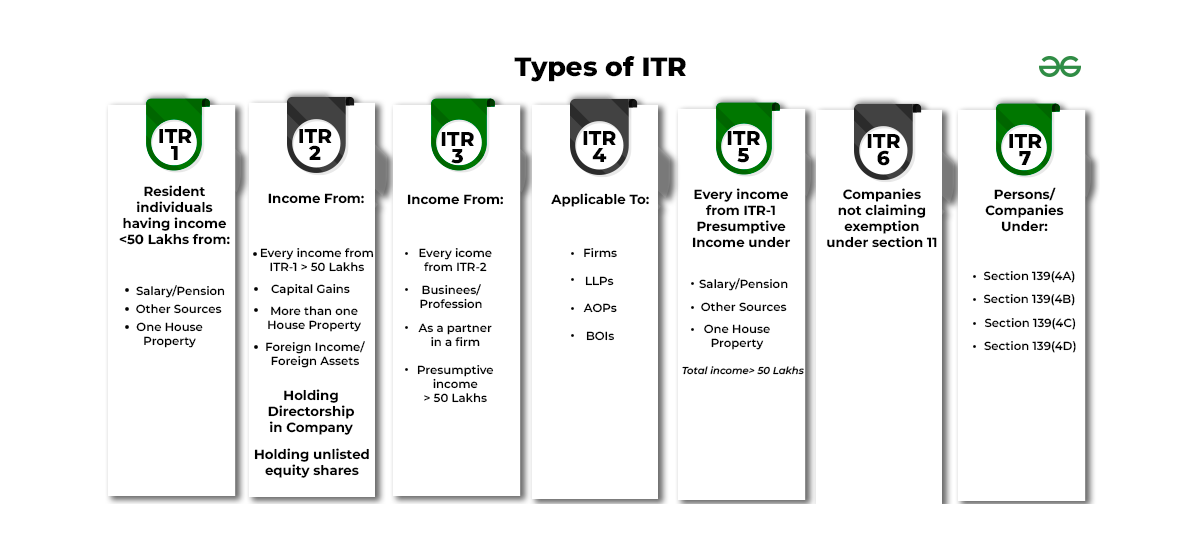

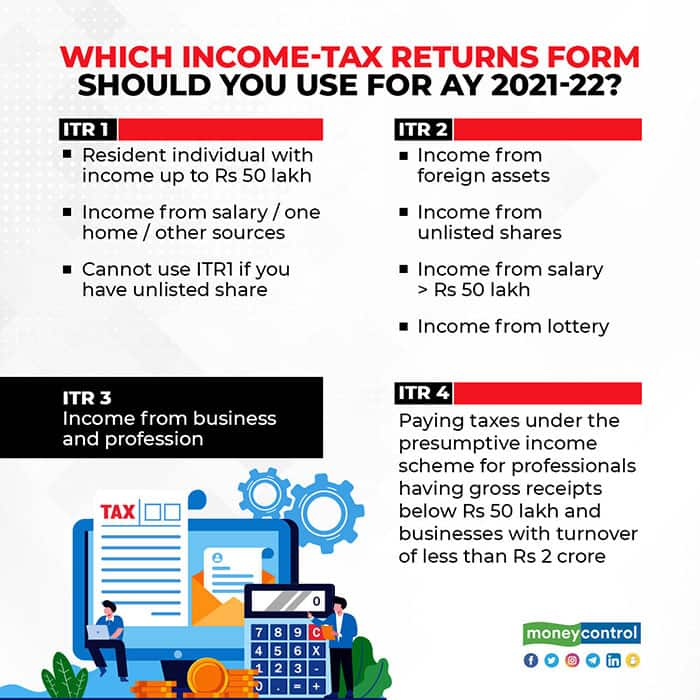

The article explains differences between ITR 1 and ITR 4 forms highlighting eligibility and ineligibility criteria Filing ITR is crucial for nation building loan processing loss A salaried employee with no directorship or foreign income and a salary of

Learn about the differences between ITR 1 and ITR 4 Income Tax Return forms Get expert insights on eligibility reporting requirements and best practices for choosing the What is the difference between ITR 3 and ITR 4 ITR 3 applies to individuals and HUFs having income from business or profession whereas ITR 4 applies to those opting for a

More picture related to difference between itr 1 2 3 and 4

Types Of ITR Form And ITR Form Applicability CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/03/type-of-ITR.jpg

ITR 1 ITR 2 What Is The Difference Between ITR 1 And ITR 2

https://img.etimg.com/thumb/msid-93226496,width-1070,height-580,imgsize-681447,overlay-etwealth/photo.jpg

Confused On Which ITR Form To Use Here s Help

https://images.moneycontrol.com/static-mcnews/2021/10/Which-income-tax-returns-form-should-you-use-for-AY-2021-22.jpg

According to income tax laws different classes of taxpayers can file their income tax return ITR using these forms For filing of income tax return the Income Tax Department Briefly stated ITR 2 cannot be used by an Individual or an HUF who have any business or professional income The income here includes loss also and in case you have

First of all identify sources of income by listing them If your income is from salary one house property and any other simple source then ITR 1 is the best option In case of income from The main difference between ITR 3 and ITR 4 is the category of taxpayers who can file these forms ITR 3 is for individuals and HUFs with income from profits and gains from

Which ITR Form To File Types Of ITR ITR1 ITR2 ITR3 ITR4 ITR5 ITR6

https://i.ytimg.com/vi/Lie8SWmuEn0/maxresdefault.jpg

What Is Difference Between ITR 1 And ITR 4 ITR 1 Filling ITR 4

https://i.ytimg.com/vi/8OdbNBIt-ZY/maxresdefault.jpg

difference between itr 1 2 3 and 4 - Learn about the differences between ITR 1 and ITR 4 Income Tax Return forms Get expert insights on eligibility reporting requirements and best practices for choosing the