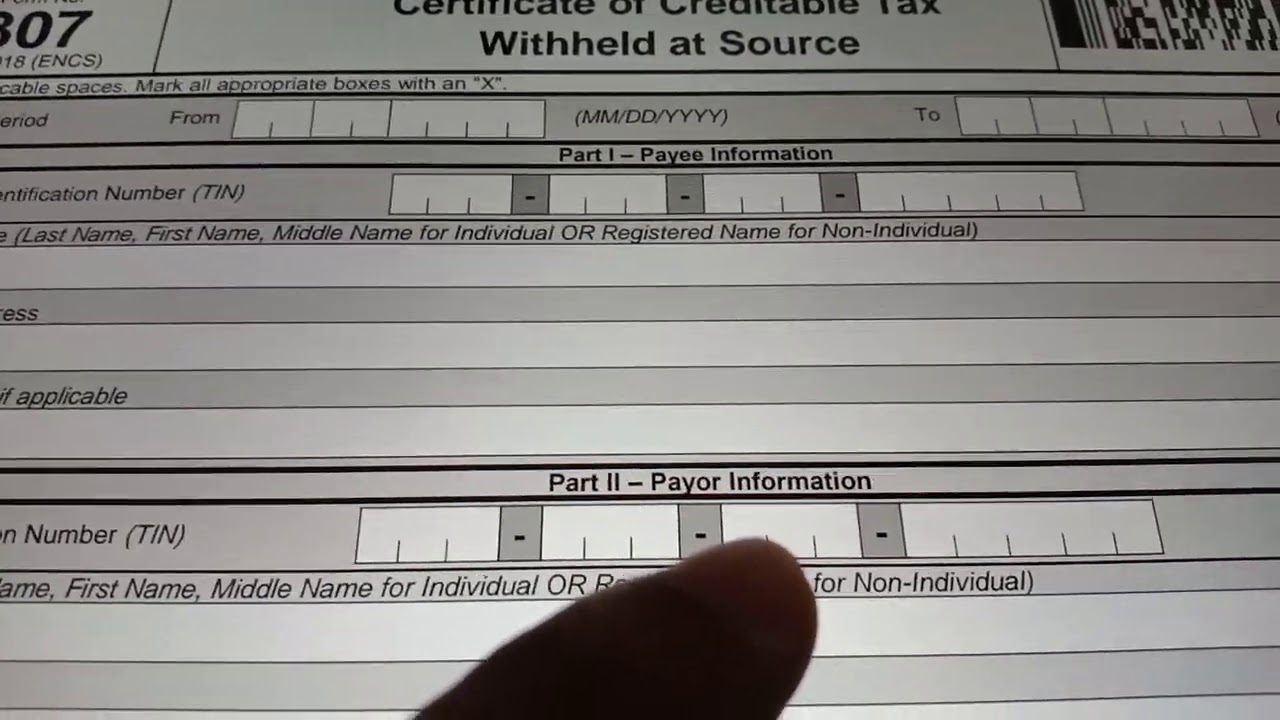

difference between 2307 and 2306 Table of Contents The BIR Form 2307 known as the Certificate of Creditable Tax Withheld at Source is a certificate that is accomplished and issued to recipients of income subject to expanded withholding tax It s one of the most common BIR forms used by businesses of all sizes from multinational corporations to freelancers

0 00 1 51 55 TaxTrainingByElsaMCaneteLive Stream Topics 1 Difference between 2306 and 2307 2 Final Withholding Tax and Creditable Withholding Tax and 3 Question an BIR Form No 2306 Certificate of Final Tax Withheld at Source shall no longer be issued for this purpose The BIR Form 2307 shall be used by the VAT taxpayers as proof of claiming VAT credit in monthly and quarterly VAT declarations

difference between 2307 and 2306

difference between 2307 and 2306

https://i.ytimg.com/vi/eYUR7tAWAPg/maxresdefault.jpg

Calam o 2307

https://p.calameoassets.com/200609203030-ad7439b537a1f6ce946d368fc6aee982/p1.jpg

New And Revised BIR Forms 2306 And 2307 YouTube

https://i.ytimg.com/vi/sFZXCR6y_Vc/maxresdefault.jpg

Commonly referred to as the Certificate of Creditable Tax Withheld At Source the BIR Form 2307 presents the income that s subjected to Expanded Withholding Tax EWT paid by the withholding agent In the accounting books of the taxpayer it is included under the assets section as Form 2307 is reflected as income tax pre payments BIR FORM NO 2306 Certificate of Final Tax Withheld at Source BIR FORM NO 2307 Certificate of Creditable Tax Withheld at Source BIR FORM NO 2316 Certificate of Compensation Payment Tax Withheld

0613 Payment Form Under Tax Compliance Verification Drive Tax Mapping 0619 E Monthly Remittance Form for Creditable Income Taxes Withheld Expanded 0619 F Monthly Remittance Form for Final Income Taxes Withheld 0620 Monthly Remittance Form of Tax Withheld on the Amount Withdrawn from the Decedent s Deposit Account The BIR Form 2307 is more commonly referred to as the Certificate of Creditable Tax Withheld at Source This certificate exhibits the income that is subjugated to Expanded Withholding Tax EWT that is paid by a withholding agent In accounting books the form is included under assets

More picture related to difference between 2307 and 2306

IMG 2307 YouTube

https://i.ytimg.com/vi/3Knwqtzyl8M/maxresdefault.jpg

IMG 2307 YouTube

https://i.ytimg.com/vi/yGkURi5QyaY/maxresdefault.jpg

2307 All YouTube

https://i.ytimg.com/vi/aSvcsg_Yv4E/maxresdefault.jpg

Form 2306 Certificate of Final Tax Withheld at Source Form 2307 Certificate of Creditable Tax Withheld at Source Form 2316 Certificate of Compensation Payment Tax Withheld To learn more about the policies and guidelines you BIR s RMC 73 74 A Deeper Look of Recent Form Changes Creating Creditable Certificates 2306 and 2307 BIR Form 2306 is a tax certificate which needs to be accomplished by a withholding agent to a specific recipient whose

BIR Form No 2306 Download Certificate of Final Tax Withheld at Source Description A Certificate to be accomplished and issued by a Payor WA to each recipient of income subjected to final tax The column amount of payment should indicate the total amount paid and the total taxes withheld and remitted during the period Filing Date Jeffrey Salazar May 5 2022 3 minute read Table of Contents Hide What are the different BIR forms used for BIR Forms that start with Code 19 Application Forms BIR Forms that start with Code 17 Forms relating to Income Tax BIR Forms that start with Code 18 Forms relating to Estate and Gift Taxes

Denon AVR 2307 Audio HiFi TV Audio fi

https://www.tv-audio.fi/wp-content/uploads/2020/09/DSC09378-scaled.jpg

Snow 2307

https://www.pukkainc.com/media/19985/show_2307_large.jpg

difference between 2307 and 2306 - 0613 Payment Form Under Tax Compliance Verification Drive Tax Mapping 0619 E Monthly Remittance Form for Creditable Income Taxes Withheld Expanded 0619 F Monthly Remittance Form for Final Income Taxes Withheld 0620 Monthly Remittance Form of Tax Withheld on the Amount Withdrawn from the Decedent s Deposit Account