are setup fees taxable Incorporation expenses can not be deducted as startup costs However they may be deductible as incorporation expenses Startup expenditures for interest real estate taxes

Setup fee creating screen calibrating lasers etc Totally separate from an artwork fee Unless it s a digital imprint multiple colors will Generally an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject to tax

are setup fees taxable

are setup fees taxable

https://setup.teamxray.com/data/images/sheets/xt8-22/9q80g_thumb.jpg

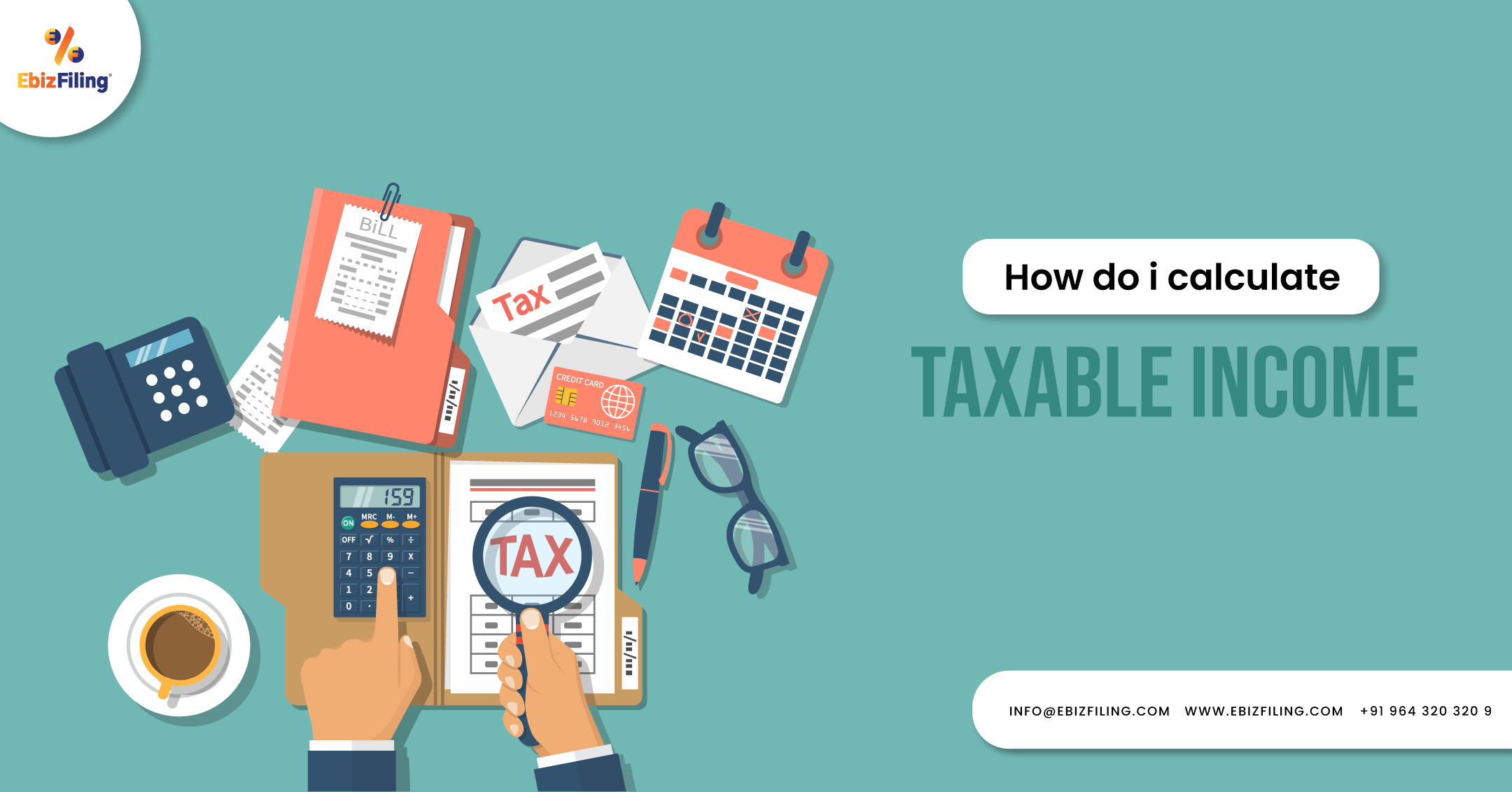

What Is Taxable Income And How To Calculate Taxable Income

https://ebizfiling.com/wp-content/uploads/2022/04/Taxable-Income.png

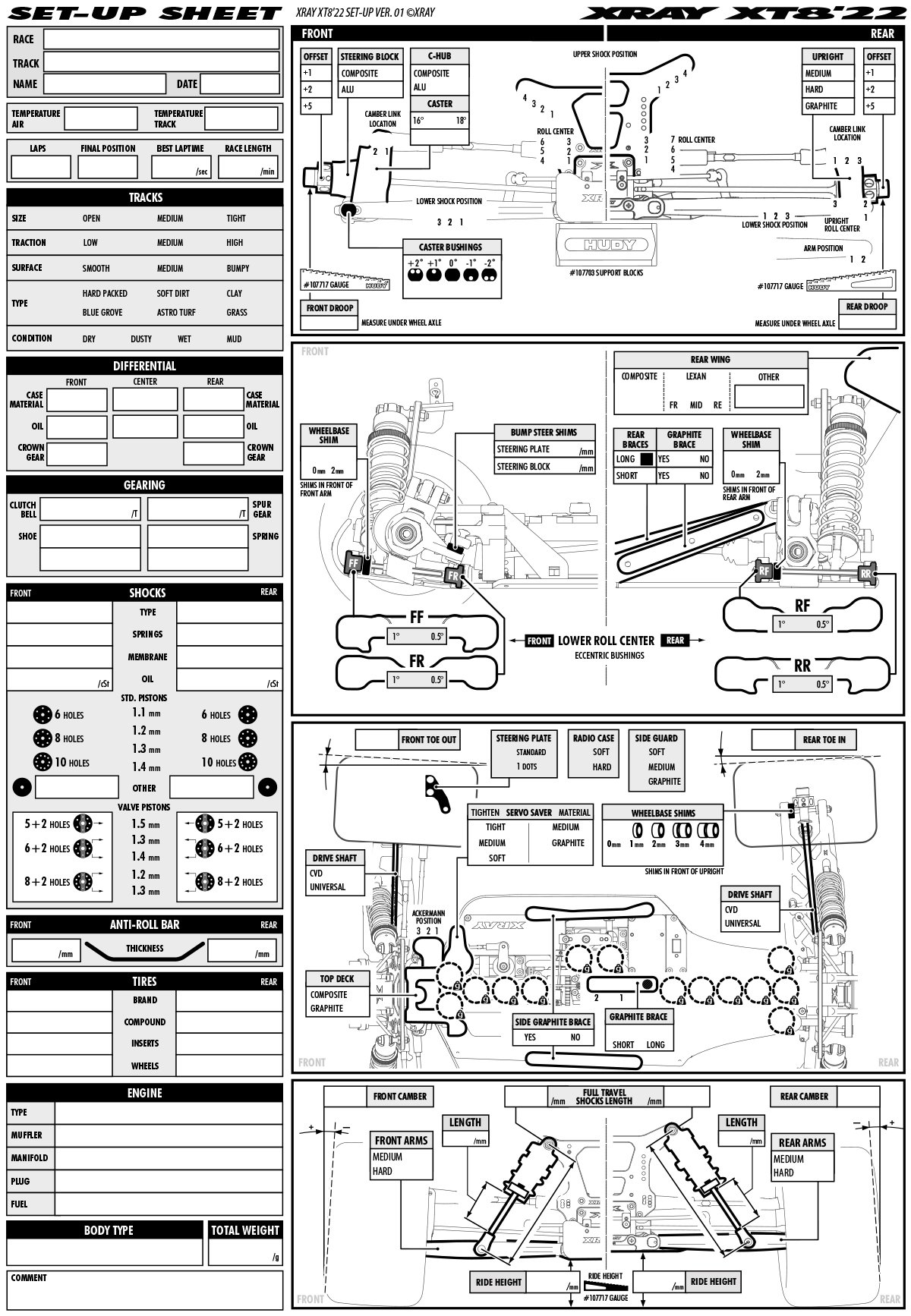

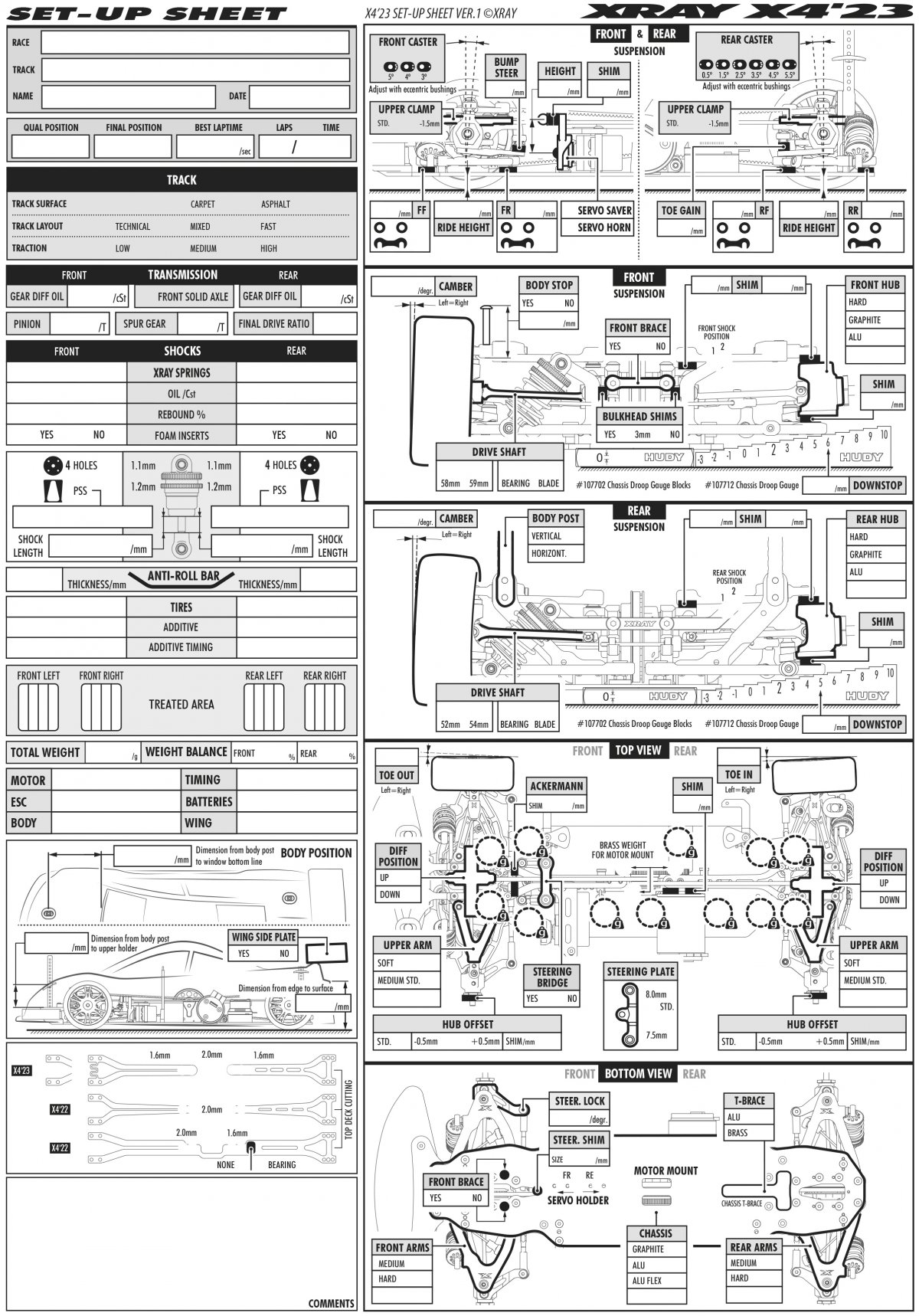

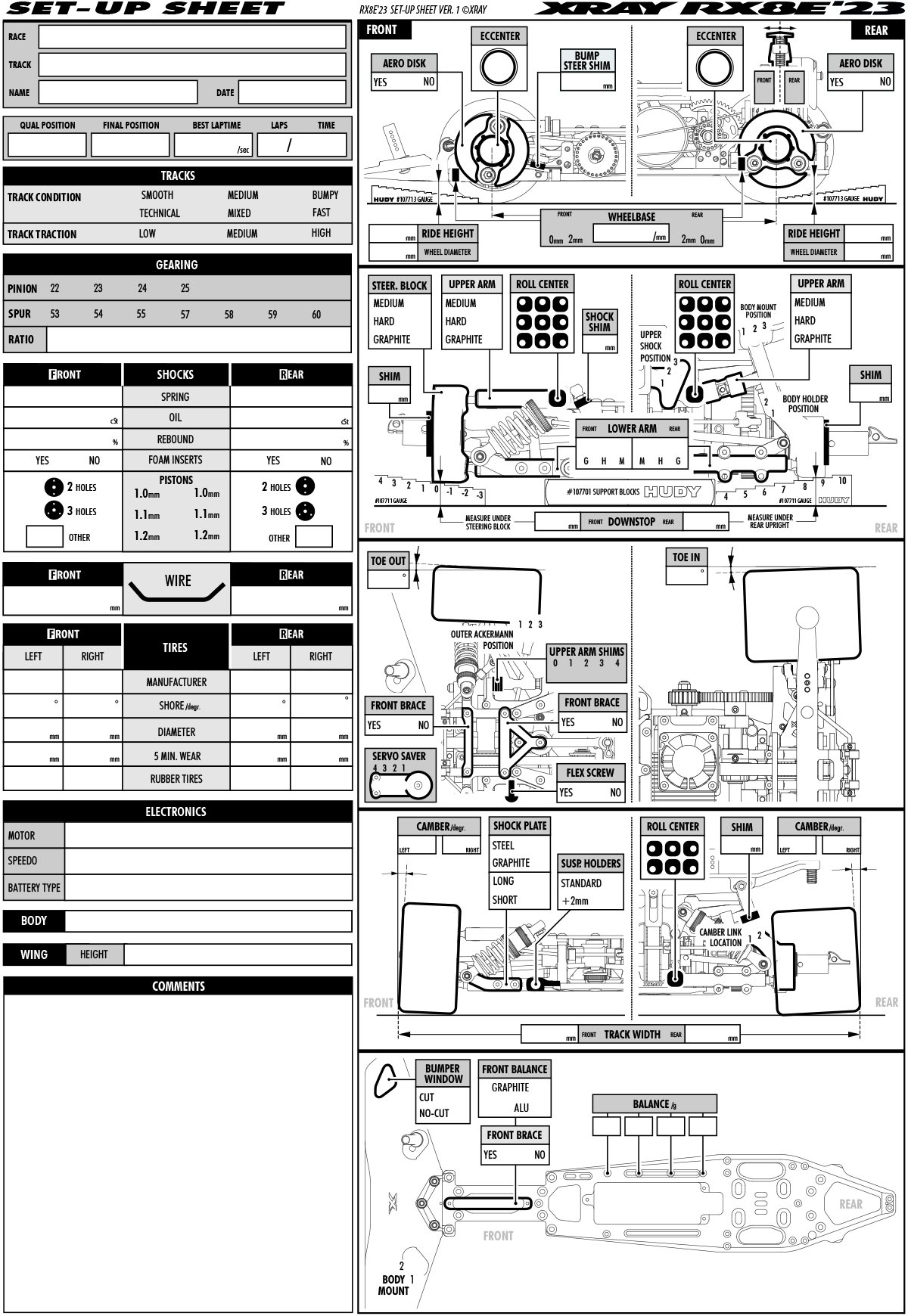

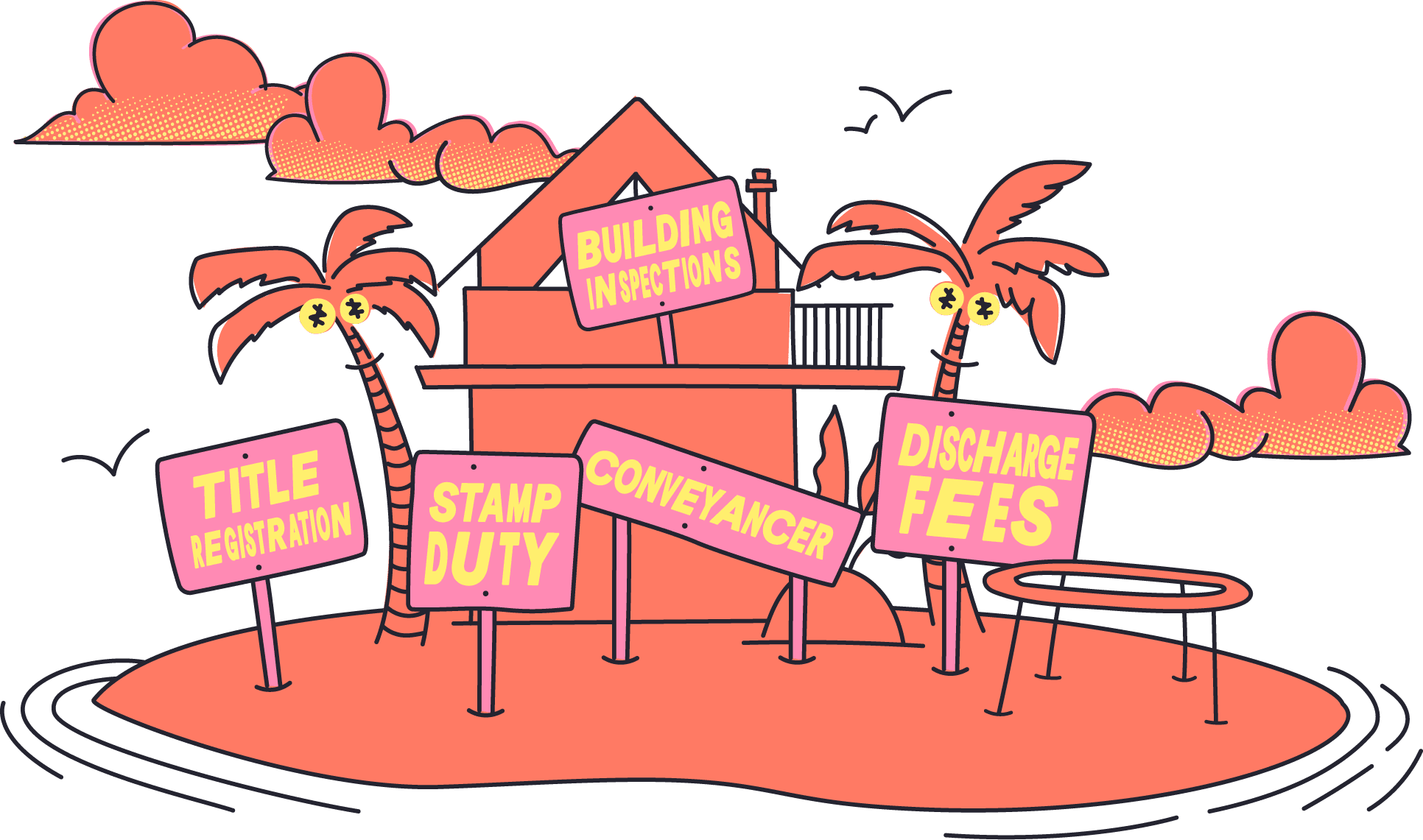

Setup Sheets

https://setup.teamxray.com/data/images/sheets/x4-23/kew5j_thumb.jpg

Business startup costs include costs for startup and for setting up your business legal type These costs are part of your investment in your business and they must be deducted over several years using a process Most company startup costs are tax deductible but the cost of company formation itself cannot be claimed against Corporation Tax The fee for setting up a limited company is classed as a one off capital expense so you can t claim tax relief

Generally business owners have been able to deduct these types of capital costs over a five year time period on a straight line basis 20 for the first five years In order to claim these The IRS s Large Business and International Division released Examining a Transaction Costs Issue regarding the treatment of transaction costs incurred in certain business transactions

More picture related to are setup fees taxable

How To Set Taxable Amount For All Merge Fees Dotstore Help Center

https://d33v4339jhl8k0.cloudfront.net/docs/assets/5ad9db7c042863075092a2a2/images/618273fb2b380503dfe00f97/file-meuDKFahqi.png

Setup Sheets

https://setup.teamxray.com/data/images/sheets/rx8e-23/xph6u_thumb.jpg

Is Gratuity Taxable On Superannuation

https://www.outlookindia.com/outlookmoney/public/uploads/article/gallery/10e04aed70ffdea625c5e29b3b00bedd.jpg

The setup fee does not go toward art and graphics services like creating the perfect proof because at Crestline those services are provided for free Setup charges depend on the items being ordered Several factors go What should you know to best understand when a sale is taxable or exempt And what should you know to ensure that a customer or you can claim an exemption Ask these

Hello I setup my company in the latter half 2019 I had initial setup costs of 1600 These were the costs incurred to establish the company and all associated accounting and The short answer is It depends Each state makes its own regulations as the examples of taxable services listed below demonstrate Five U S states Alaska Delaware Montana New

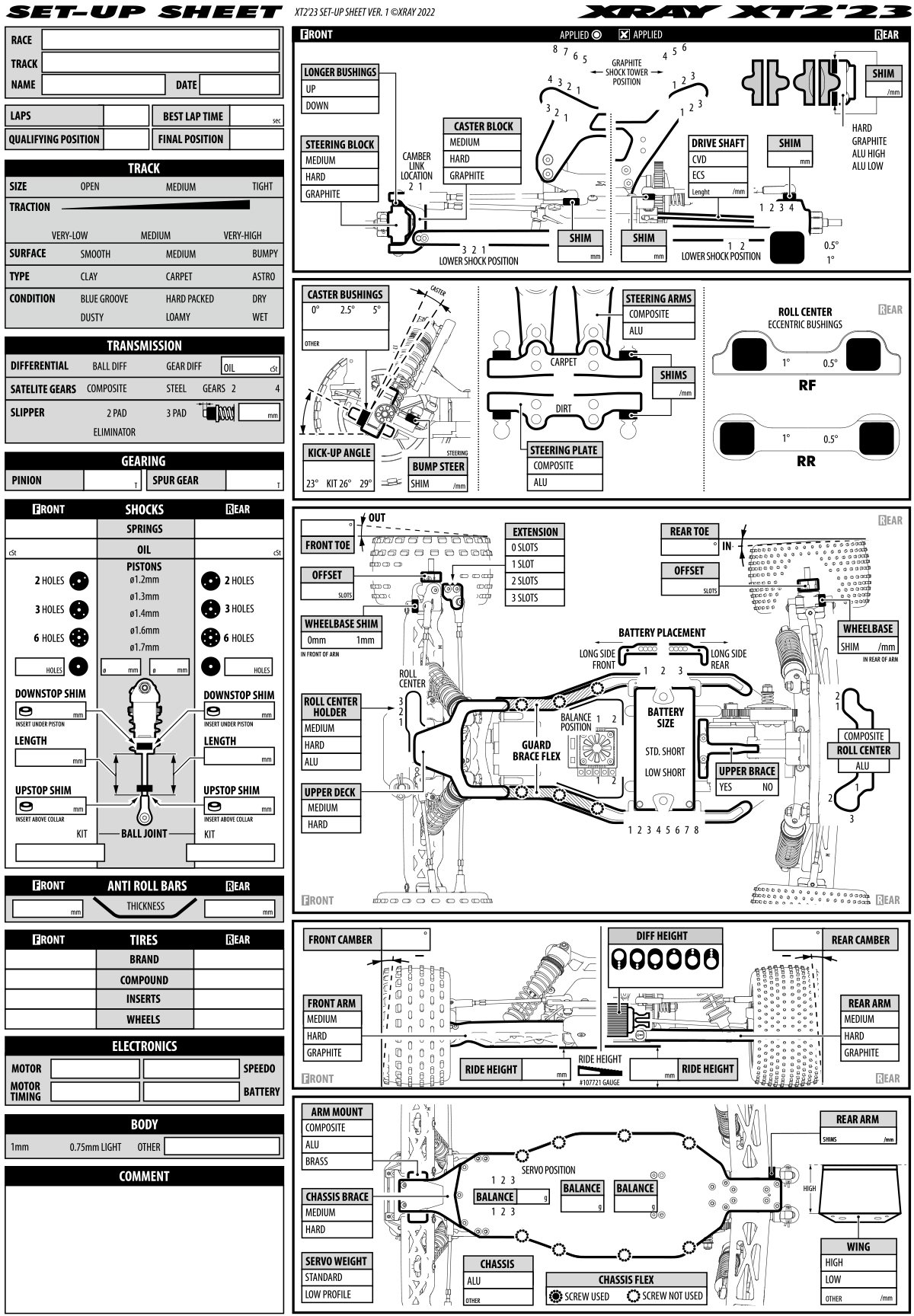

Fees And Rates Summary

https://up.com.au/static/home-loan-fees-74262083fb710740bf31b4b48b3e98fc.png

Setup Sheets

https://setup.teamxray.com/data/images/sheets/xt2-23/6iclw_thumb.jpg

are setup fees taxable - Most company startup costs are tax deductible but the cost of company formation itself cannot be claimed against Corporation Tax The fee for setting up a limited company is classed as a one off capital expense so you can t claim tax relief