70 20 10 rule money calculator Using the 70 20 10 Calculator is simple and intuitive Begin by inputting the total amount of income or budget into the designated field Upon submission the calculator computes the allocations for essential expenses investments and leisure activities based on the 70 20 10 rule

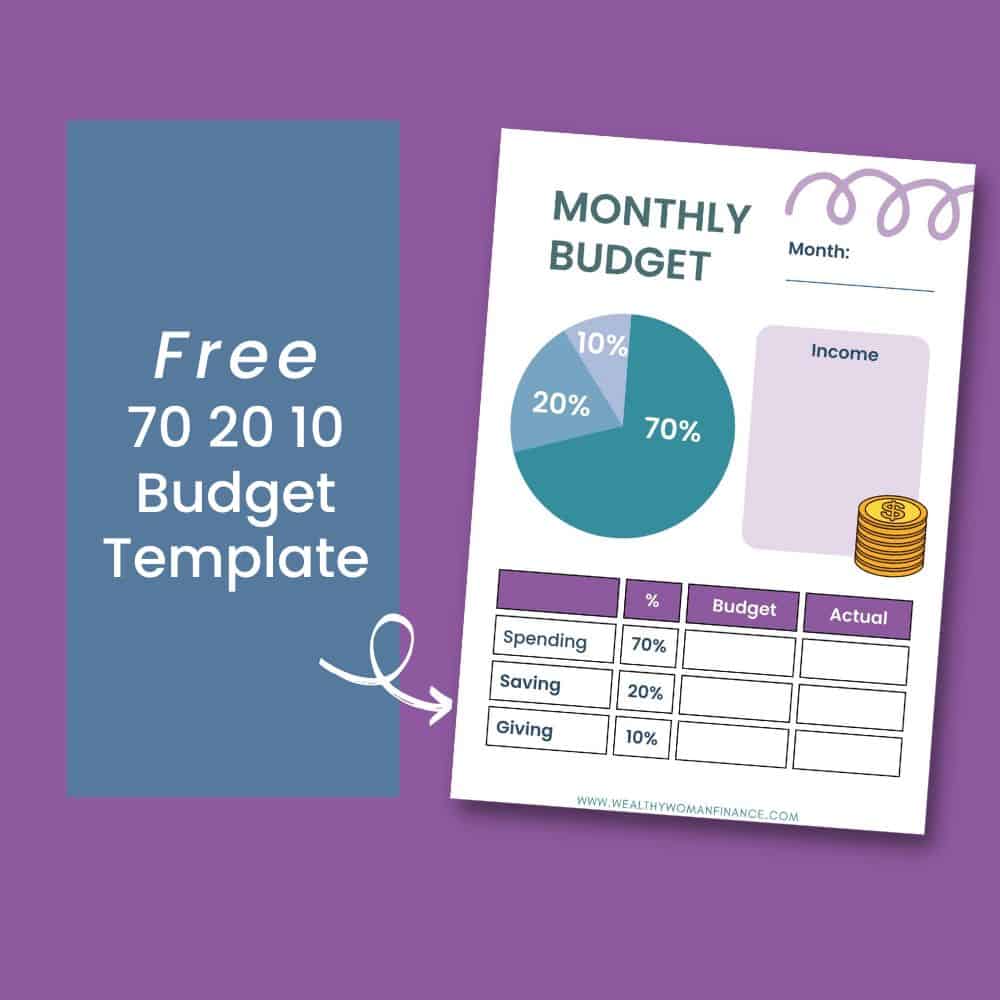

The 70 20 10 budget refers to the percentage of your take home pay that you devote to each of three major categories spending saving and giving That s it If you d like an even more streamlined budget plan you could check out the 80 20 budget and apply it to your budget instead What Is the 70 20 10 Budget Rule The 70 20 10 budget rule is a money management strategy you can use to dictate where you want your income to go It involves separating your take home

70 20 10 rule money calculator

70 20 10 rule money calculator

http://static1.squarespace.com/static/5ec1dd5719eb48129f4a4206/5ec1e026b9557a142782f6d0/61a61c557803d639ad4051af/1638795399466/What-is-the-70-20-10-Rule-money2.jpg?format=1500w

What Is The 70 20 10 Rule Money

https://bridefeed.com/wp-content/uploads/2021/08/What-is-the-70-20-10-Rule-money-3-scaled.jpg

How To Achieve Financial Freedom With The 70 20 10 Money Rule

https://thirtyeightinvesting.com/wp-content/uploads/2020/07/Untitled-design-19.jpg

The 70 20 10 budget is a percentage based money management style that helps you make room for saving investing paying down debt and donating Rather than managing your gross income down to the last penny this simple budget method is just a general guideline that can help you set realistic financial goals With the 70 20 10 budget you re dividing your income into three main spending categories This budgeting method is a twist on the 50 30 20 method but it s a bit more ambitious as less is going to everyday expenses

The 70 20 10 budget formula divides your after tax income into three buckets 70 for living expenses 20 for savings and debt and 10 for additional savings and donations By allocating your available income into these three distinct categories you can better manage your money on a daily basis How to follow the 70 20 10 budget rule You can create a personal budget following the 70 20 10 rule in just 5 simple steps Step 1 Calculate your after tax income The first step is to calculate your monthly take home pay This is your after tax income also known as your net income rather than your gross income

More picture related to 70 20 10 rule money calculator

70 20 10 Rule Budget What Is It How Does It Work

https://wealthywomanfinance.com/wp-content/uploads/2022/10/70-20-10-budget-template-1000-×-1000-px.jpg

Cashflow Quadrants

https://www.bennyma.com/content/images/size/w750/2022/01/702010-rule.png

70 20 10 Rule Budget What Is It How Does It Work

https://wealthywomanfinance.com/wp-content/uploads/2022/10/70-20-10-budget-1.jpg

With the 70 20 10 budget you ll start with your monthly after tax income Then divide the money into 70 for needs and wants 20 for savings and 10 for debt repayment or donations With this rule you ll see exactly where your money goes and if you re overextending in certain areas Calculate your monthly income and track your expenses Determine whether you can comfortably allocate 70 to essential expenses like housing utilities groceries transportation and

[desc-10] [desc-11]

Budget Money Rules 70 20 10 Vs 50 30 20 Which Is BEST YouTube

https://i.ytimg.com/vi/AFOTw6yS-dM/maxresdefault.jpg

70 20 10 Budgeting Rule Planner Worksheet Printable Personal Finance

https://i.etsystatic.com/28932905/r/il/b441a7/3501298422/il_fullxfull.3501298422_ehmk.jpg

70 20 10 rule money calculator - The 70 20 10 budget is a percentage based money management style that helps you make room for saving investing paying down debt and donating Rather than managing your gross income down to the last penny this simple budget method is just a general guideline that can help you set realistic financial goals