5329 codes Use Form 5329 to report additional taxes on IRAs Other qualified retirement plans Modified endowment contracts Coverdell ESAs QTPs Archer MSAs HSAs

Exception Code Description 01 Qualified retirement plan distributions doesn t apply to IRAs you receive after separation from service when the separation from service The official title for IRS Form 5329 is Additional Taxes on Qualified Plans including IRAs and Other Tax Favored Accounts It s

5329 codes

5329 codes

https://i.ytimg.com/vi/ZsP05mpGWYQ/maxresdefault.jpg

IRS Form 5329 For Retirement Savings And More Tax Relief Center

https://eqp5jgfqqvh.exactdn.com/wp-content/uploads/2018/04/portrait-concentrated-businessman-glasses-laptop-reading-form-5329-ss-768x513.jpg?strip=all&lossy=1&ssl=1

I 5329 YouTube

https://i.ytimg.com/vi/YyHWPFXGfg8/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AZoEgALQBYoCDAgAEAEYZSBlKGUwDw==&rs=AOn4CLAM8diO1NxrfPQwGlqkQebbchYFYw

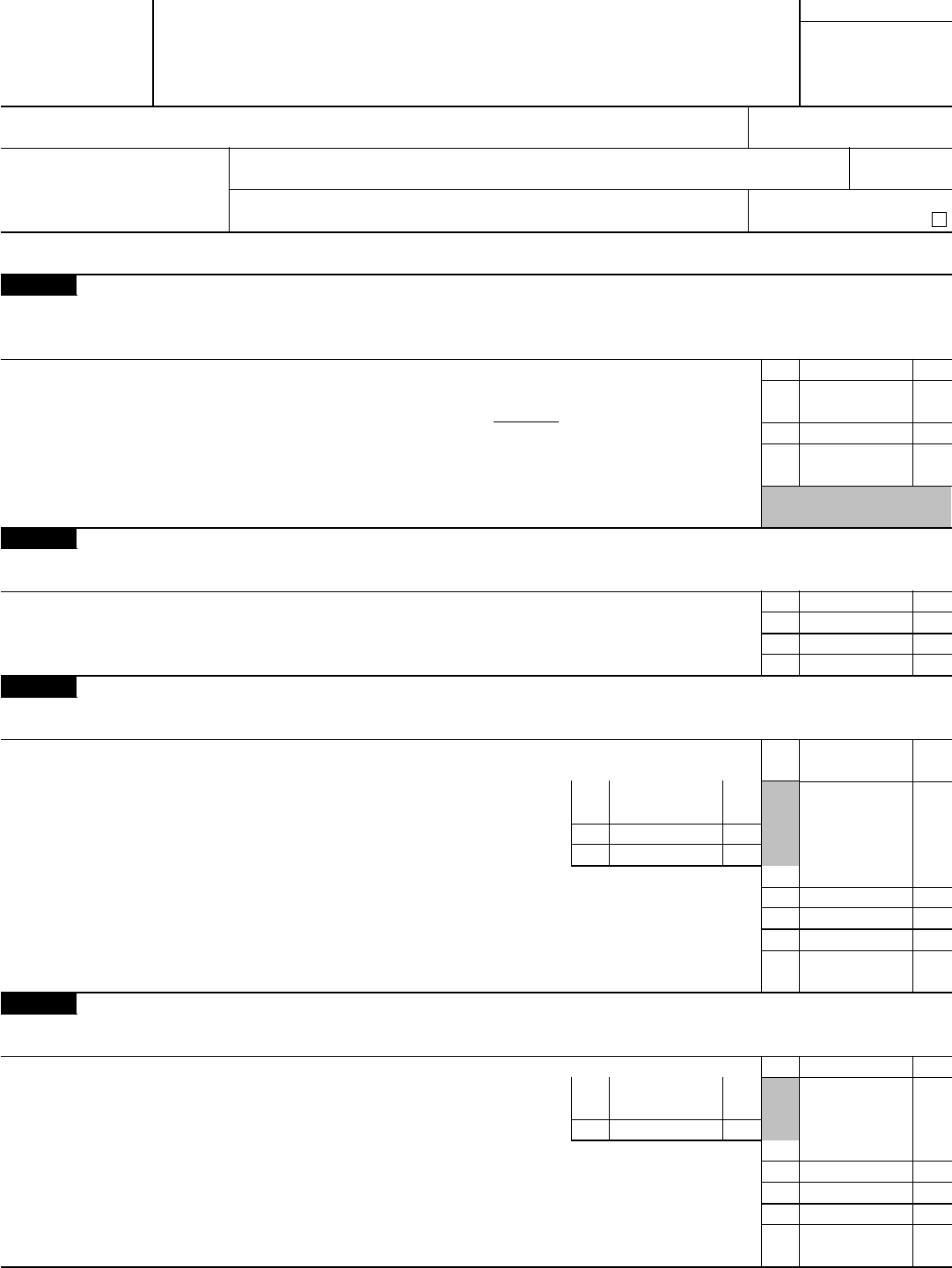

This table explains exceptions to Form 5329 Additional Tax on Early Distributions to assist you with entering this information in ProSeries Refer to the IRS There are some exceptions to early withdrawal penalty codes on Form 5329 Use the corresponding number to indicate which exception you are claiming 01 Distributions

Form 5329 exceptions to early withdrawal penalty codes are 01 Distributions from a qualified retirement plan not an IRA after separation from employment and after 11 rowsForm 5329 Exceptions to Early Withdrawal Penalty If your Form 1099 R distribution was for any of the reasons listed below it is generally exempt from additional

More picture related to 5329 codes

Dunn Edwards Parchment Paper DE 5329 Paint Color Codes Similar

https://www.colorxs.com/img/color/name/de-parchment-paper-de-5329.png

Vsp Qr Codes Shake Coding Video Smoothie Programming

https://i.pinimg.com/originals/19/81/31/198131f33ab1180d05235cd365b744fa.jpg

IMG 5329 1 jpg WorldWaterSkiers

https://worldwaterskiers.com/wp-content/uploads/2020/08/IMG_5329-1-scaled.jpg

Form 5329 is the tax form used to calculate possibly IRS penalties from the situations listed above and possibly request a Instructions for Form 5329 Additional Taxes on Qualified Plans Including IRAs and Other Tax Favored Accounts Rev February 2021 Department of the Treasury Internal

Form 5329 Additional Taxes on Qualified Retirement Plans including IRAs and Other Tax Favored Accounts is a tax form filed by taxpayers to indicate whether they owe the Internal Revenue 5329 Exception Codes Exception Codes for Additional Tax on Early Distributions Revised 10 2018 Other Distributions incorrectly indicated as early distributions by code 1 J or

2011 Form 5329 Edit Fill Sign Online Handypdf

https://handypdf.com/resources/formfile/htmls/gov1218/2011-form-5329/bg1.png

Mythical Pet Simulator X Codes 2021 Big Answer

https://i2.wp.com/cdn.gamerjournalist.com/primary/2021/12/How-to-Redeem-Merch-Codes-in-Pet-Simulator-X.png

5329 codes - This table explains exceptions to Form 5329 Additional Tax on Early Distributions to assist you with entering this information in ProSeries Refer to the IRS