5 Crore Tax Audit Limit - Worksheets have become vital tools for different objectives, covering education, business, and individual company. From straightforward arithmetic workouts to intricate organization analyses, worksheets function as structured frameworks that assist in knowing, planning, and decision-making procedures.

What Is A Tax Audit And To Whom Is It Applicable

What Is A Tax Audit And To Whom Is It Applicable

Worksheets are structured papers used to arrange information, info, or tasks systematically. They offer a visual representation of ideas, permitting individuals to input, manipulate, and analyze information efficiently. Whether in the classroom, the conference room, or in your home, worksheets improve procedures and boost efficiency.

Types of Worksheets

Discovering Devices for Kids

Worksheets are highly helpful tools for both instructors and pupils in instructional environments. They encompass a selection of tasks, such as mathematics projects and language tasks, that allow for method, reinforcement, and evaluation.

Business Worksheets

Worksheets in the business ball have numerous purposes, such as budgeting, task administration, and evaluating data. They promote notified decision-making and tracking of objective accomplishment by businesses, covering monetary records and SWOT evaluations.

Individual Task Sheets

Individual worksheets can be a valuable tool for achieving success in various elements of life. They can assist individuals set and function in the direction of goals, handle their time successfully, and check their development in areas such as fitness and money. By giving a clear structure and feeling of accountability, worksheets can help individuals remain on track and achieve their purposes.

Making the most of Discovering: The Benefits of Worksheets

Worksheets use various benefits. They stimulate involved understanding, boost understanding, and nurture analytical reasoning abilities. Furthermore, worksheets support framework, rise effectiveness and enable teamwork in group situations.

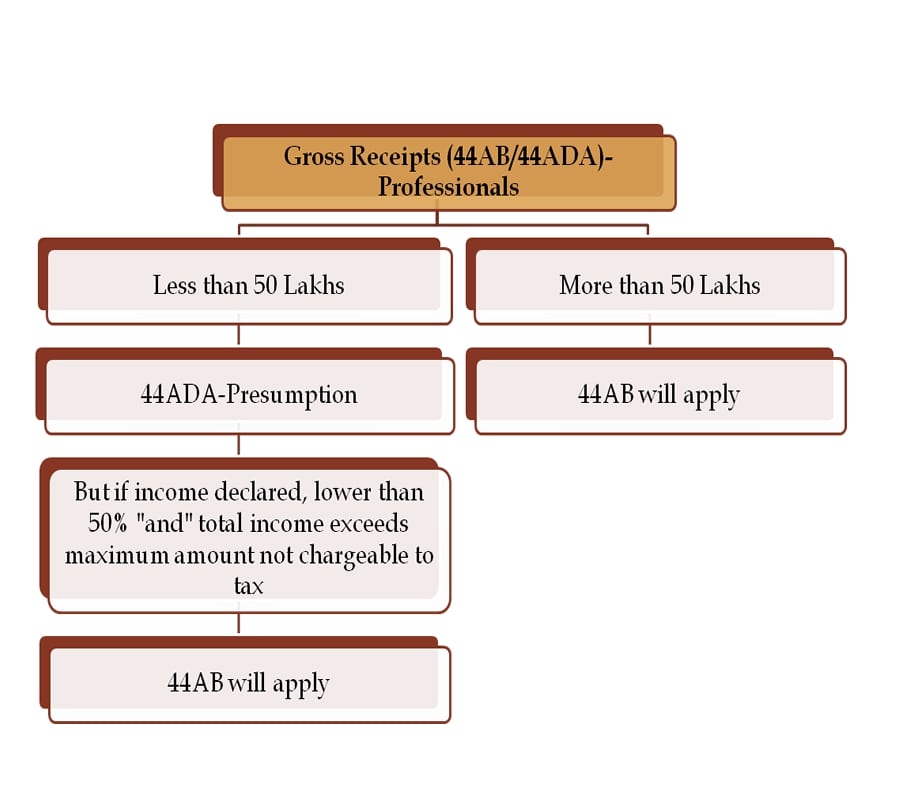

FAQs Introduction Applicability Of Tax Audit A Y 2022 23

What Triggers An IRS Tax Audit Wiggam Law

Taxmann s 75 FAQs On Tax Audit Under Section 44AB For A Y 2022 23 By

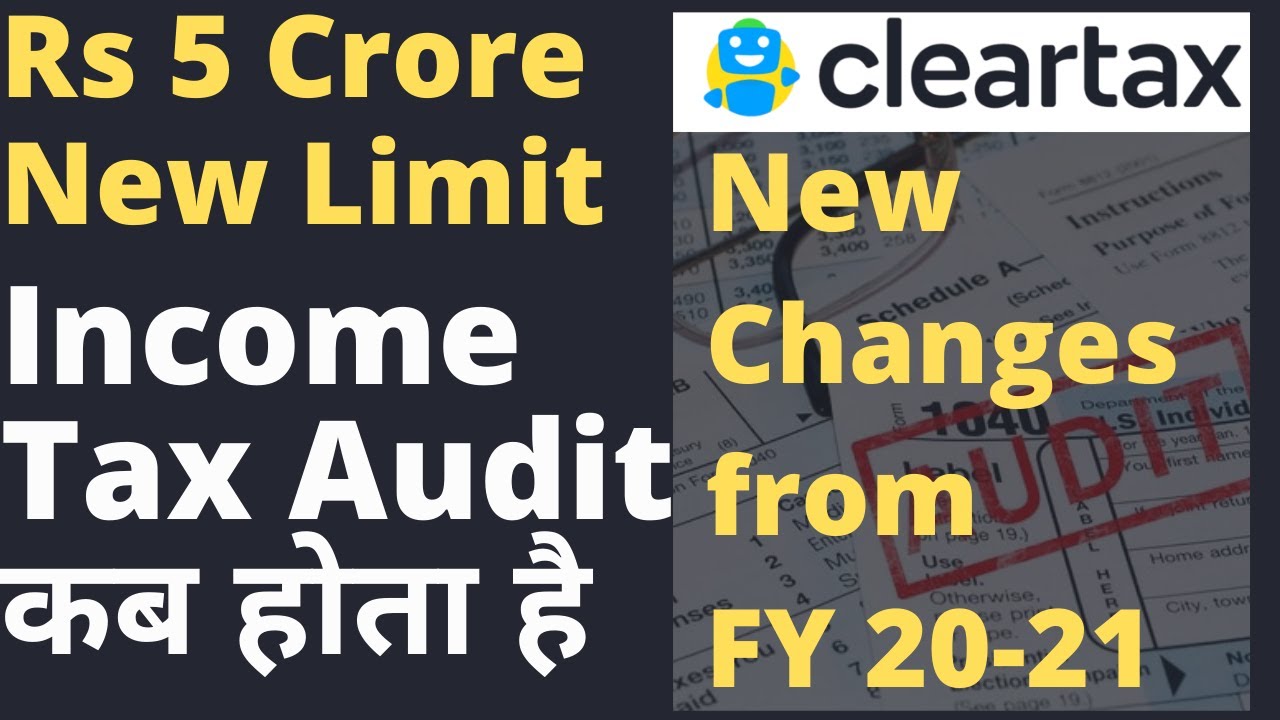

When Income Tax AUDIT Is Required NEW LIMIT Of Rs 5 Crore For Tax

Tax Audit Limit For AY 2023 24 Ft skillvivekawasthi YouTube

Tax Audit Under Section 44AB Limit And Due Date IndiaFilings

What Is Tax Audit Limit For The AY 2022 23 CA Rajput Jain

E Invoicing Limit Reduce E Invoicing For 5 Crore Turnover Under GST

No Proposal To Reduce GST E invoice Threshold Limit To Rs 5 Crore

Comprehensive Analysis Of Tax Audit Academy Tax4wealth