40 40 20 rule finance What is the 40 40 20 Budget The 40 40 20 budget is a straightforward budgeting method that allocates your income into three main categories needs wants

The 40 40 20 Budget Rule divides your income into 40 for essentials 40 for savings and debt repayment and 20 for wants offering a structured yet flexible The idea is you d aim to spend 50 of your income on needs essential living expenses such as rent mortgage bills food and transport to work 30 on wants discretionary spending such as eating out shopping

40 40 20 rule finance

40 40 20 rule finance

https://dynamicard.com/wp-content/uploads/2022/02/404020.jpg

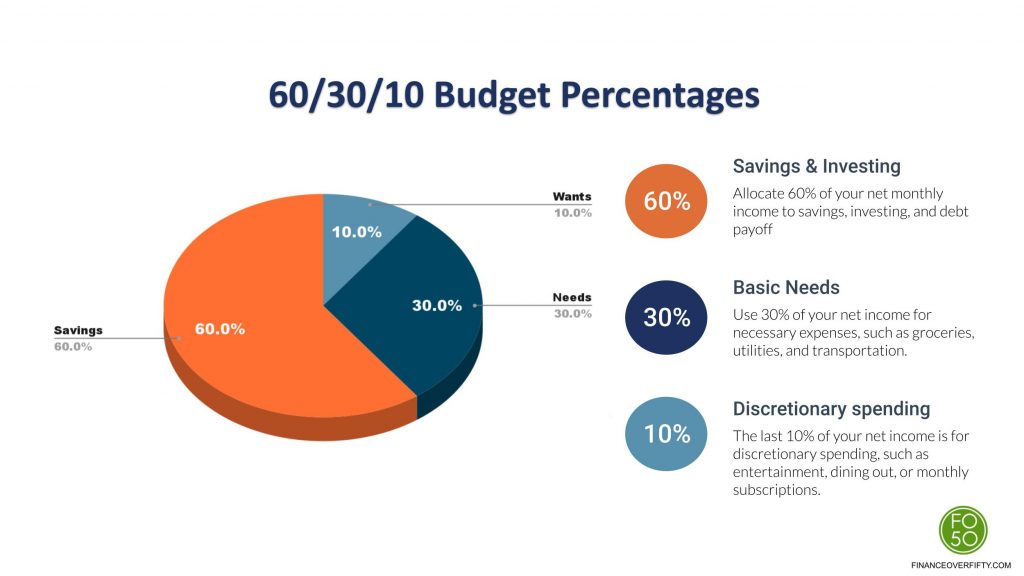

How To Use The 60 30 10 Rule Budget And Crush Your Money Goals

https://financeoverfifty.com/wp-content/uploads/2022/11/60-30-10-Pie-Chart-1-1024x576.jpg

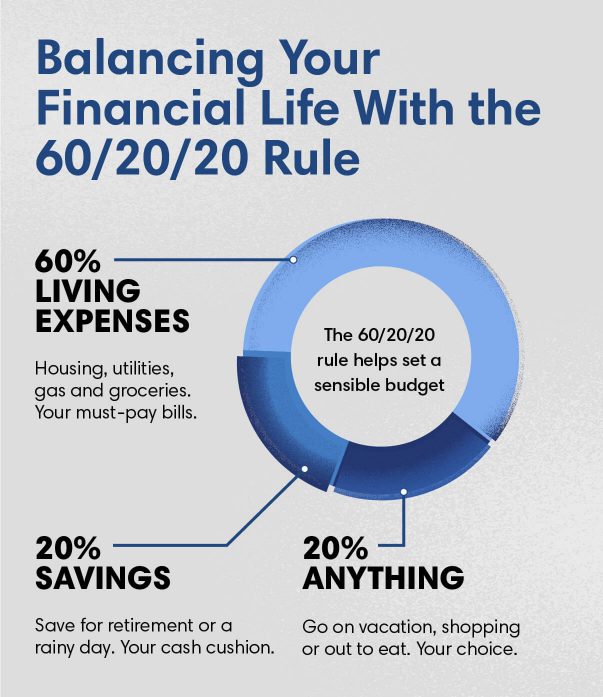

60 20 20 Rule Budget What Is It How Does It Work

https://wealthywomanfinance.com/wp-content/uploads/2022/11/60-20-20-rule-budget-1-600x400.jpg

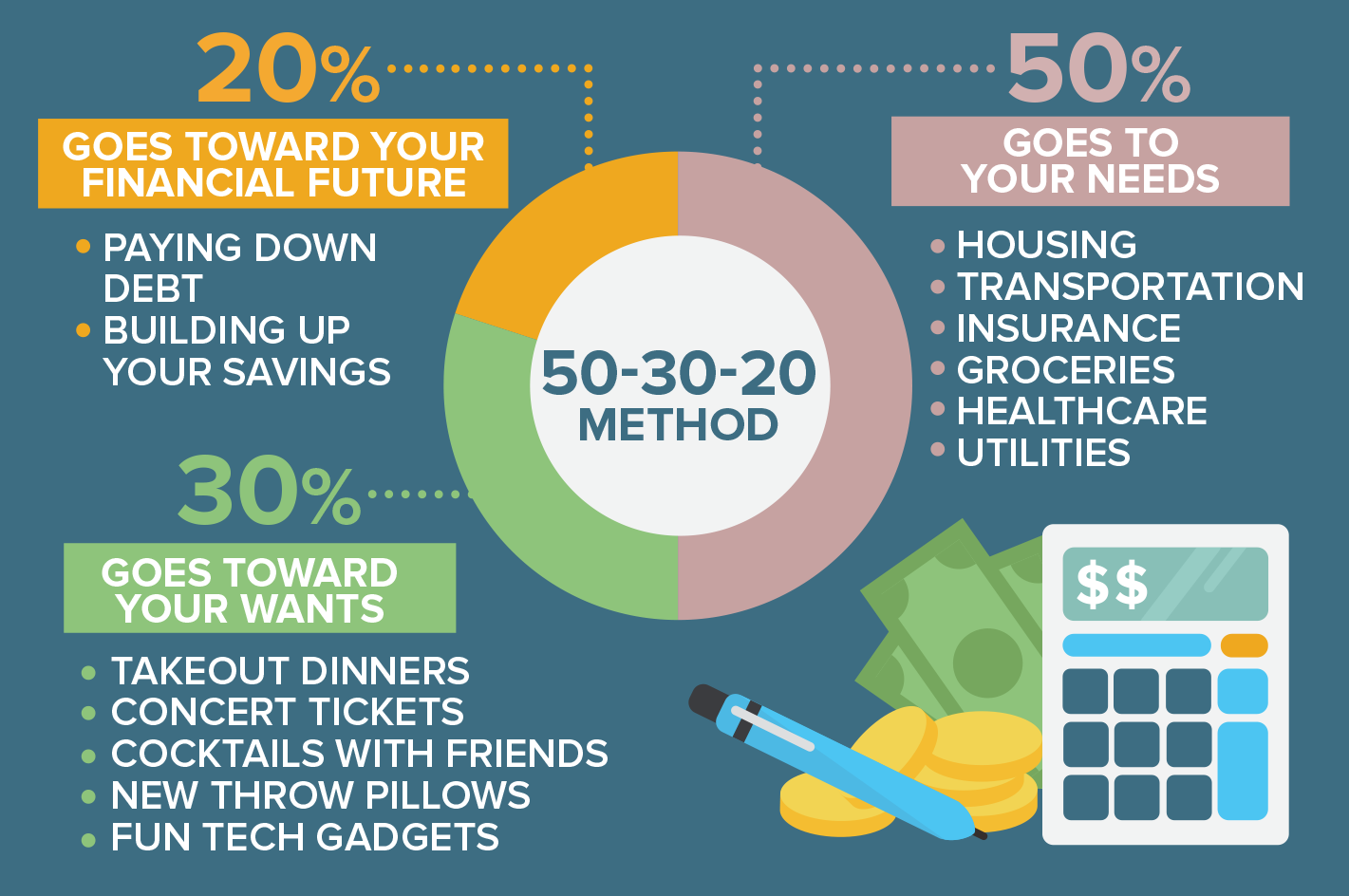

The 50 30 20 rule of thumb is a guideline for allocating your budget accordingly 50 to needs 30 to wants and 20 to your financial goals The rule The 50 30 20 rule is an easy budgeting method that can help you to manage your money effectively simply and sustainably The basic rule of thumb is to divide your monthly after tax income into three spending

The 50 30 20 rule is a popular budgeting strategy that suggests dividing your income into three categories 50 for needs 30 for wants and 20 for savings Our 50 30 20 calculator divides your take home income into suggested spending in three categories 50 of net pay for needs 30 for wants and 20 for savings and debt repayment

More picture related to 40 40 20 rule finance

Balancing Your Financial Life With The 60 20 20 Rule First Citizens Bank

https://www.firstcitizens.com/content/dam/firstcitizens/images/resources/personal/budgeting/[email protected]/image-scaled-2x-to-1x/image.20220829.jpeg

Understanding The 50 30 20 Rule To Help You Save MagnifyMoney

https://www.magnifymoney.com/wp-content/uploads/2019/06/Graphic-1-1568x1568.png

50 30 20 Rule Of Budgeting Explained Mudrex Blog

https://mudrex.com/blog/wp-content/uploads/2022/10/Blog-46.png

The 40 40 20 budget rule is a structured yet flexible approach to managing your income and expenditures It s designed to help you allocate your after tax income The 50 30 20 rule is a budgeting technique that involves dividing your money into three primary categories based on your after tax income i e your take home pay 50 to needs 30

Using the 50 30 20 rule calculator is entirely easy all you need to do is enter your monthly after tax income Then the calculator will tell you how to distribute your As the 50 30 20 rule dictates 20 percent of your post tax income must be saved and then utilized through investments Please note unlike needs and wants savings should be

How 50 20 30 Rule Will Change Your Life Finance Expert

https://bankonus.com/finance-expert/wp-content/uploads/2018/11/d4b56bad34702ffb869c6e9628f996f6-1.png

Why The 40 40 20 Rule Adds Up To Better Fundraising For Small Nonprofits

https://eleoonline.com/wp-content/uploads/2020/12/40-40-20-for-nonprofits.png

40 40 20 rule finance - The 50 30 20 rule is an easy budgeting method that can help you to manage your money effectively simply and sustainably The basic rule of thumb is to divide your monthly after tax income into three spending