28000 divided by 12 after tax On a 28 000 salary your take home pay will be 23 371 after tax and National Insurance This equates to 1 947 58 per month and 449 44 per week If you work 5 days per week this is

The Dividends calculator allow you to adjust the split of your 28 000 00 income by using a slider to alter the percentage split you take as salary or via a dividend This tool allows you to Step 1 Enter the expression you want to evaluate The Math Calculator will evaluate your problem down to a final solution You can also add subtraction multiply and divide and

28000 divided by 12 after tax

28000 divided by 12 after tax

https://hi-static.z-dn.net/files/d07/8ed08dc5f36967d4692130c609a56df9.jpg

9235 Divisible By 4 Brainly in

https://hi-static.z-dn.net/files/d43/96e4bf3526eae3ee7e8c9c5ada459d72.jpg

Debt To Income Calculator

https://cdn.document360.io/6ef8bcc1-6489-4486-9ad1-83acff7e5df0/Images/Documentation/2022-08-22_11h48_25.gif

Calculate and visualize your Take Home Pay using the salary calculator considering income tax national insurance and more Updated for 2024 2025 tax year 42 rowsFor the 2022 2023 tax year 28 000 after tax is 22 513 annually and it makes 1 876 net monthly salary This net wage is calculated with the assumption that you are younger than

Use Reed co uk s free and simple salary tax calculator to estimate what you re left with after tax and national insurance are deducted from your 25 000 salary This is 28 000 minus your personal allowance of 12 500 capped at your higher earnings limit of 50 000 Below is your tax breakdown in simplified form On the first 12 500 you earn you

More picture related to 28000 divided by 12 after tax

If X 2 5 Power 1 2 2 5 Power 1 2 And Y 2 5 Power 1 2

https://hi-static.z-dn.net/files/d01/4e700b15dbd3913d401fa801b100803a.jpg

Debt To Income Calculator

https://cdn.document360.io/6ef8bcc1-6489-4486-9ad1-83acff7e5df0/Images/Documentation/2022-08-19_16h18_38.gif

Dividing By 2 digit Divisors With Base 10 Blocks Math Elementary

https://showme0-9071.kxcdn.com/files/677011/pictures/thumbs/1666087/last_thumb1411428666.jpg

How To Use The Hourly Wage Calculator Enter your income and specify whether it is an annual or monthly figure Choose employment status This step is important because it Use Reed co uk s free and simple salary tax calculator to estimate what you re left with after tax and national insurance are deducted from your 22 000 00 salary

28 000 after tax and National Insurance will result in a 1 906 monthly net salary in 2019 leaving you with 22 869 take home pay in a year You will pay a total of 3 086 in tax this What is 28000 Divided by 12 We provide you with the result of the division 28000 by 12 straightaway 28000 divided by 12 2333 3 The result of 28000 12 is a non

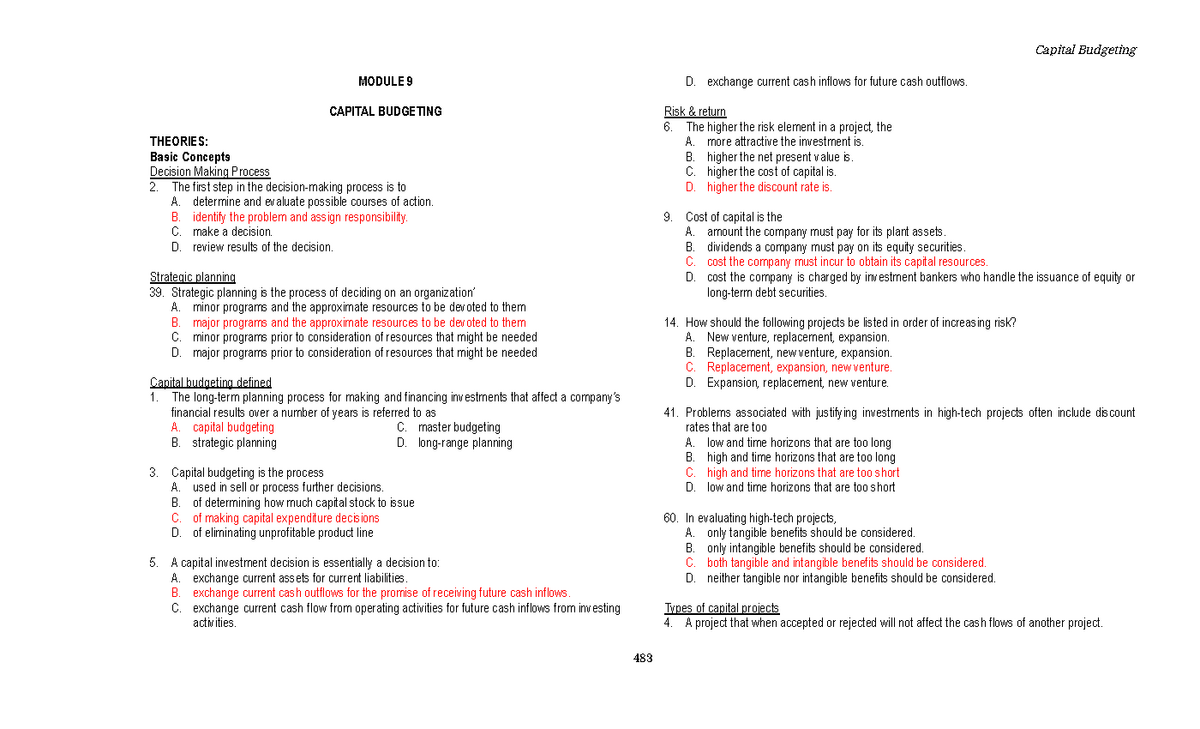

33097 TESTBANKS MODULE 9 CAPITAL BUDGETING THEORIES Basic Concepts

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/0a69ba779c1084532103d51649bd3cde/thumb_1200_729.png

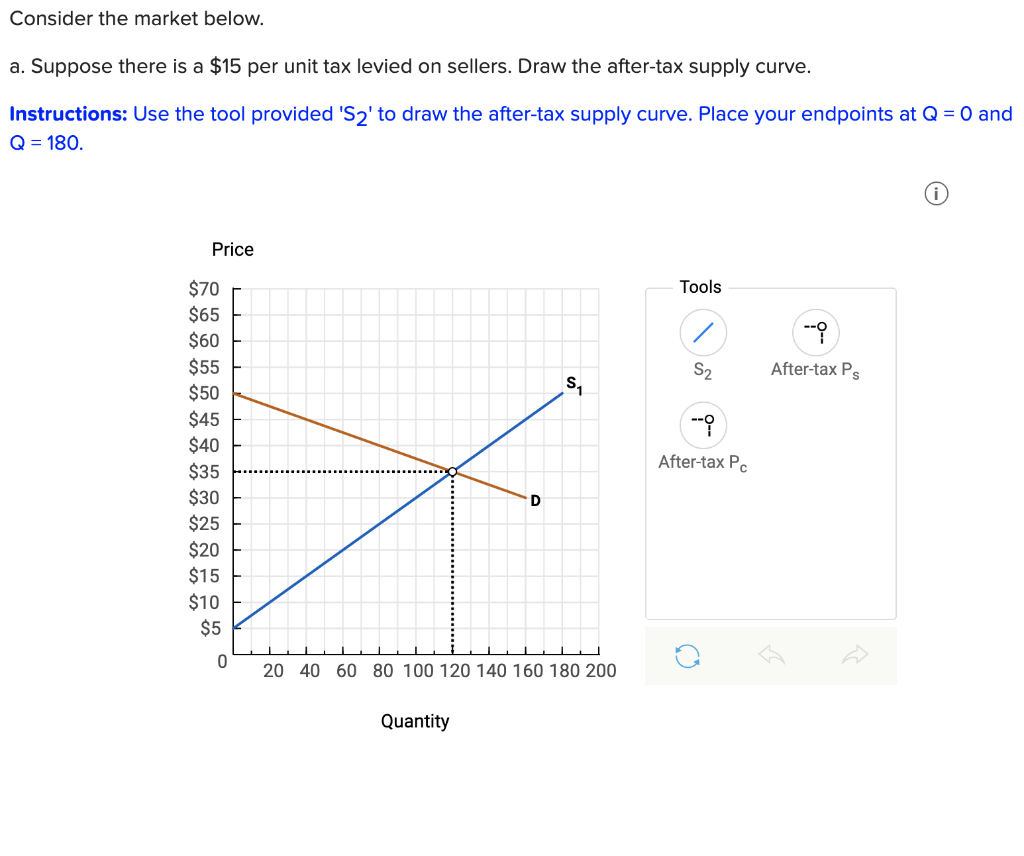

Solved Consider The Market Below A Suppose There Is A 15 Chegg

https://media.cheggcdn.com/media/1f2/1f254e75-44fa-4424-aa15-eebed28e4f24/phpezHNsR

28000 divided by 12 after tax - 42 rowsFor the 2022 2023 tax year 28 000 after tax is 22 513 annually and it makes 1 876 net monthly salary This net wage is calculated with the assumption that you are younger than