18 percent gst of 40000 The different slabs for GST are 5 12 18 and 28 GST calculation can be explained by a simple illustration If a goods or services is sold at Rs 1 000 and the GST rate applicable is 18 then

Divide the gross price the price including GST by the net price subtract one and then multiply by 100 This will give you the GST rate as a percentage You can check your calculation using the GST GST amount Price x GST Net price Cost of the product GST amount For example if a product or service costs Rs 100 and the GST levied on that is 18 the GST

18 percent gst of 40000

18 percent gst of 40000

https://razorpay.com/learn-content/uploads/2021/07/Screenshot-2021-07-26-at-2.18.36-PM-1024x595.png

Odisha Records 13 Percent GST Growth In July The Statesman

https://www.thestatesman.com/wp-content/uploads/2020/01/iStock-691243938_ED.jpg

Advelsoft GST Amendment From 6 To 0 User Guide May 30 2018

https://cdn1.npcdn.net/userfiles/17994/image/0_percent_GST_600x350.jpg

Calculate GST easily with Tally s free GST calculator Quick accurate and user friendly for all your GST needs Try it now and simplify your finances The simplified GST calculator helps you determine the price for gross or net product depending on the amount and gives you a split of percentage based GST rates

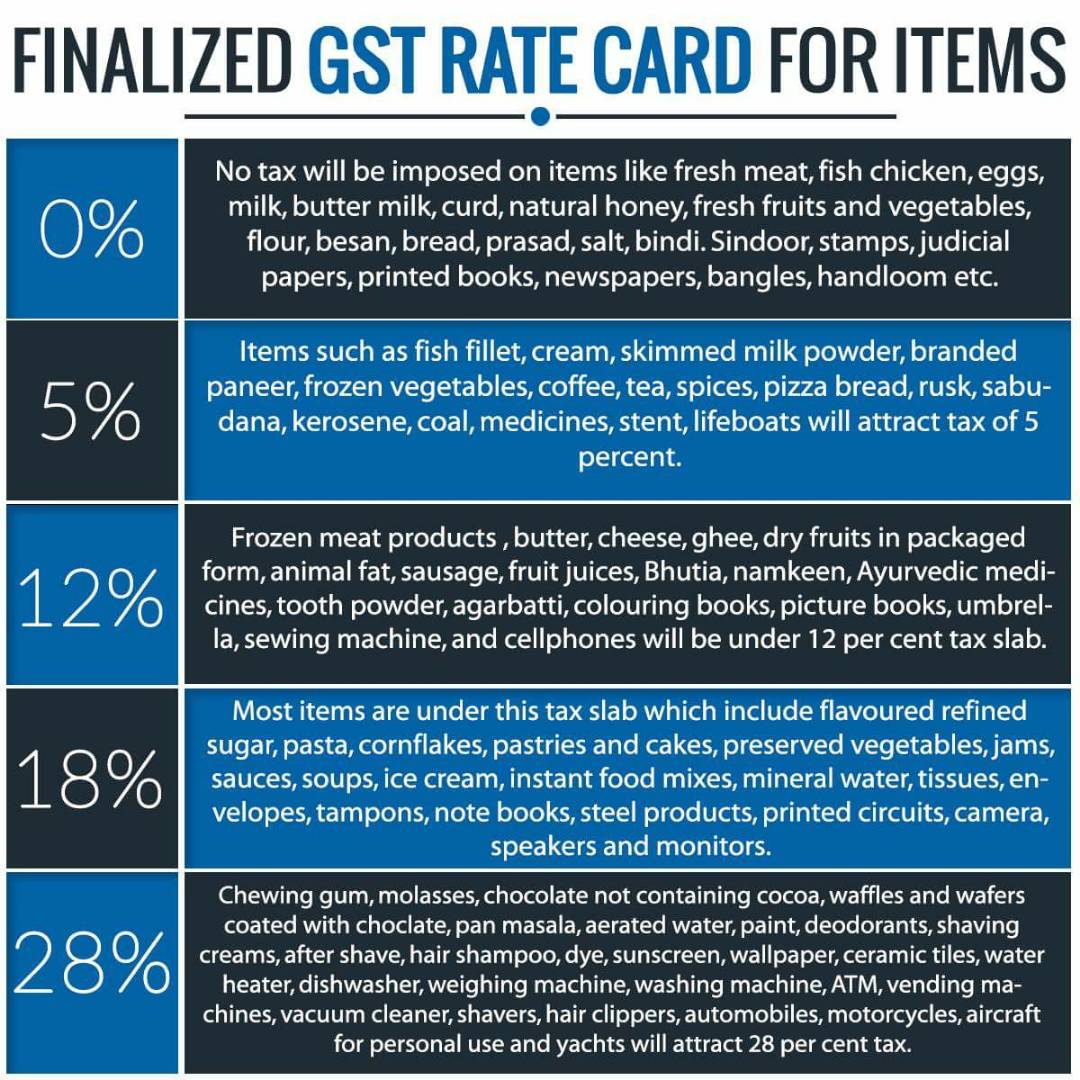

GST is divided into five different tax slabs for collection of tax 0 5 12 18 AND 28 Before GST there was a huge ambiguity on the applicable tax rates on different products however GST has introduced To calculate 18 GST on the total you simply multiply the total amount by 18 or 0 18 For example if the total amount is Rs 1000 the GST amount would be Rs 180 1000 x

More picture related to 18 percent gst of 40000

Round 0 Percent Stamp PSD PSDstamps

https://www.psdstamps.com/wp-content/uploads/2019/11/round-0-percent-stamp-png.png

GST Rates For All Items 0 5 12 18 28 GST Tax Items YouTube

https://i.ytimg.com/vi/GlgBgq5eAws/maxresdefault.jpg

Gst Tax Rate Chart For Fy Ay Goods And Service Hot Sex Picture

https://taxdose.b-cdn.net/wp-content/uploads/2016/09/GST-Easy-Chart.jpg

The simplified GST calculator helps you determine the gross or net product price on percentage based GST rates It helps give the bifurcation of the rate between CGST With the free GST calculator you can calculate the tax amount in three simple steps The tool provides you with three fields that have to be filled and it calculates GST automatically based on what you fill in Enter the

To find out the how GST affects the price of a product or service all that one needs to do is input into the tool the original cost of the product or service and the GST rate applicable Our GST calculator will calculate the amount of GST included in a gross price as well as the amount you should add to a net price

GST Rate Hikes List Of Goods And Services Which Are Expensive Now

https://akm-img-a-in.tosshub.com/indiatoday/images/bodyeditor/202207/gst-gfx-x1200.jpg?9FJEzZ96aRNPzq.f6QohSDTNh_whzjA_

5 GST Rate Items HSN Code For Goods Updated 2023 AUBSP

https://www.aubsp.com/wp-content/uploads/gst-rates-goods-5-percent.jpg

18 percent gst of 40000 - The simplified GST calculator helps you determine the price for gross or net product depending on the amount and gives you a split of percentage based GST rates