18 percent gst of 30000 If a goods or services is sold at Rs 1 000 and the GST rate applicable is 18 then the net price calculated will be 1 000 1 000X 18 100 1 000 180 Rs 1 180 GST Calculation Formula

Divide the gross price the price including GST by the net price subtract one and then multiply by 100 This will give you the GST rate as a percentage You can check your calculation using the GST To figure out how much GST was included in the price you have to divide the price by 11 110 11 10 To work out the price without GST you have to divide the amount by 1 1

18 percent gst of 30000

18 percent gst of 30000

https://razorpay.com/learn-content/uploads/2021/07/Screenshot-2021-07-26-at-2.18.36-PM-1024x595.png

Odisha Records 13 Percent GST Growth In July The Statesman

https://www.thestatesman.com/wp-content/uploads/2020/01/iStock-691243938_ED.jpg

Round 0 Percent Stamp PSD PSDstamps

https://www.psdstamps.com/wp-content/uploads/2019/11/round-0-percent-stamp-png.png

You can easily use the GST calculator online by following the steps mentioned below Enter the net price of a service or good and the GST slabs such as 5 12 18 and Enter the cost of production cost of goods profit ratio percentage and rate of GST It will show the total cost of production CGST SGST and total tax What are the

Mr A who lives in Raipur C G purchased a Good from a local dealer worth Rs 100 Now Rs 100 is the taxable value and we have to charge GST on this value Suppose this Based on this data the calculator will show how much one would need to pay as GST for a product or service The formula for GST calculation is as under GST Amount GST x

More picture related to 18 percent gst of 30000

Advelsoft GST Amendment From 6 To 0 User Guide May 30 2018

https://cdn1.npcdn.net/userfiles/17994/image/0_percent_GST_600x350.jpg

What Are GST Slab Rates GST Percentage Rate List In India

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/gst-rate-slab.jpg

GST Revised Rates Come Into Effect From Today Here s What Gets

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202207/gst-gfx.jpg?itok=UukrRu3d

The online GST calculator helps you to calculate the price of a gross or net product It is based on the quantity and provides a breakdown of percentage based GST rates and Use this calculator to find percentages Just type in any box and the result will be calculated automatically Calculator 1 Calculate the percentage of a number For

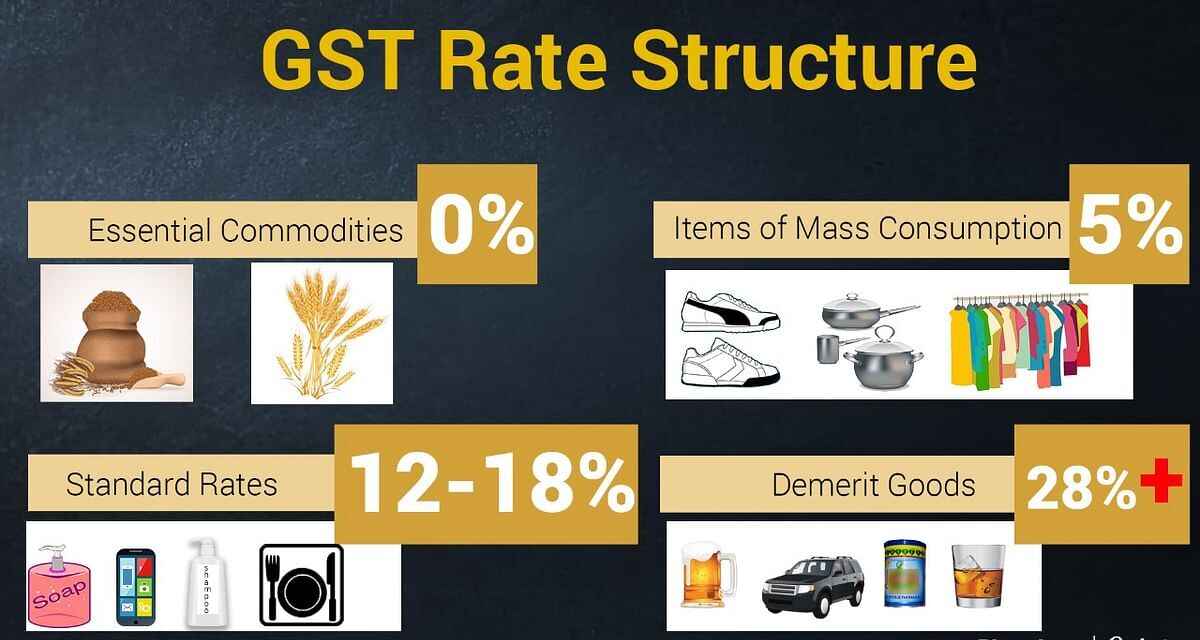

1 Mention the Net Price of the Goods and Services 2 Along with this mention the GST rate slab 0 5 12 18 28 accordingly 3 Submit after entering the details and get Home GST Payments and Refunds GST Calculator to Calculate Your GST Amount Online under Different Tax Slabs Complete GST lifecycle on one platform Hyper automation

GST Rates For All Items 0 5 12 18 28 GST Tax Items YouTube

https://i.ytimg.com/vi/GlgBgq5eAws/maxresdefault.jpg

5 GST Rate Items HSN Code For Goods Updated 2023 AUBSP

https://www.aubsp.com/wp-content/uploads/gst-rates-goods-5-percent.jpg

18 percent gst of 30000 - Enter the cost of production cost of goods profit ratio percentage and rate of GST It will show the total cost of production CGST SGST and total tax What are the